FOMC Minutes from January 29 - No rush to ease, but not hawkish

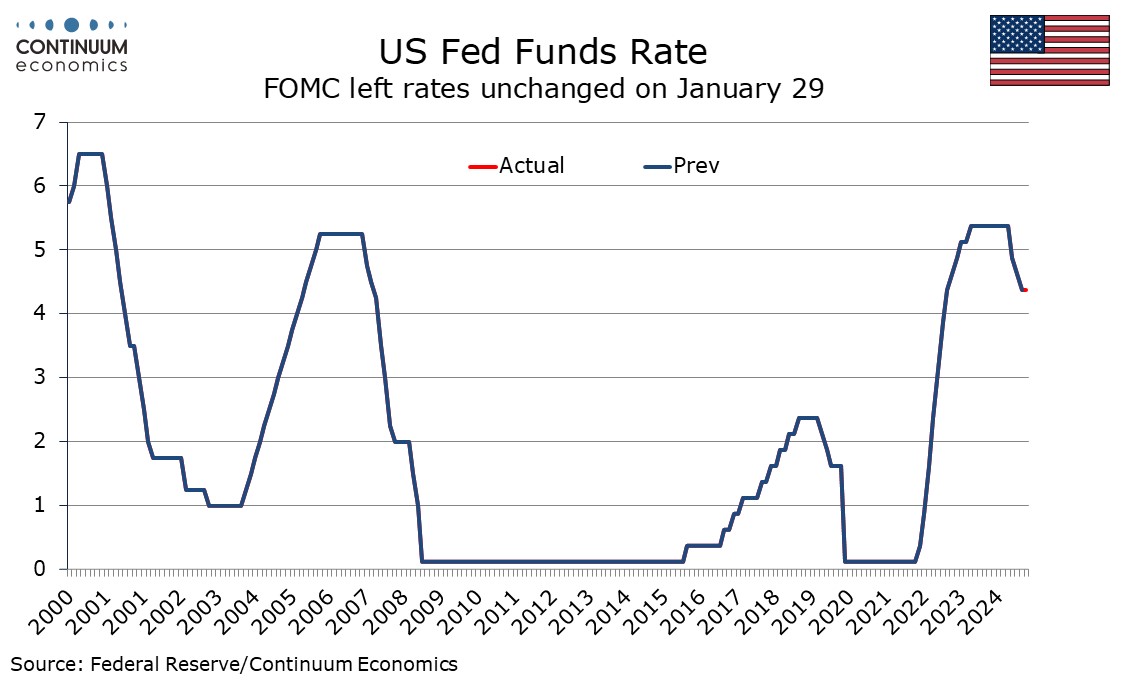

FOMC minutes from January 29 showed agreement to hold policy steady, and that further progress was needed before additional policy adjustments were made. High uncertainty was seen as making a careful approach appropriate, but the minutes contained few shocks, in a market that appeared to be braced for a more hawkish message.

Staff forecasts for inflation and activity were not much changed from December. Optimism still persisted on inflation, with inflation seen continuing to progress toward 2% though progress could remain uneven. November and December data was seen exhibiting notable progress. Some felt that inflation at the beginning of the year was harder than usual to interpret, which suggests the strong January CPI will be treated cautiously, particularly if as expected core PCE prices prove less alarming. Still, upside risk was seen on potential trade and immigration policies, as well as strong consumer demand, and business contacts indicated that firms would attempt to pass on the costs of tariffs.

The minutes noted that most recent activity data, consumer spending in particular, was stronger than expected, and appeared positive on business investment, with many contacts optimistic over potential tax and regulatory changes but only some worrying about increased uncertainty. Still, the vast majority of participants saw risks to the dual mandate as roughly in balance, if with a couple seeing an upside skew.

Echoing remarks made by Chairman Powell in his recent testimonies to Congress, many noted that policy could be kept restrictive if the economy remained strong and inflation remained elevated, while several remarked policy could be eased if labor market conditions deteriorated, activity faltered or inflation returned to 2% more quickly than anticipated. That steady policy requires firm activity and inflation, but easier policy can come if either activity or inflation loses momentum hints at a dovish leaning even if there is no urgency to ease now. Potential Trump policies were discussed in terms of how they would impact the economy, with any monetary policy implications left implicit. There were also suggestions that balance sheet runoff could be paused until a potential coming standoff on the debt ceiling is resolved.