EUR, USD, JPY flows: USD holding firm but may be stretched

Lower yields across the board but spreads suggest USD is stretched

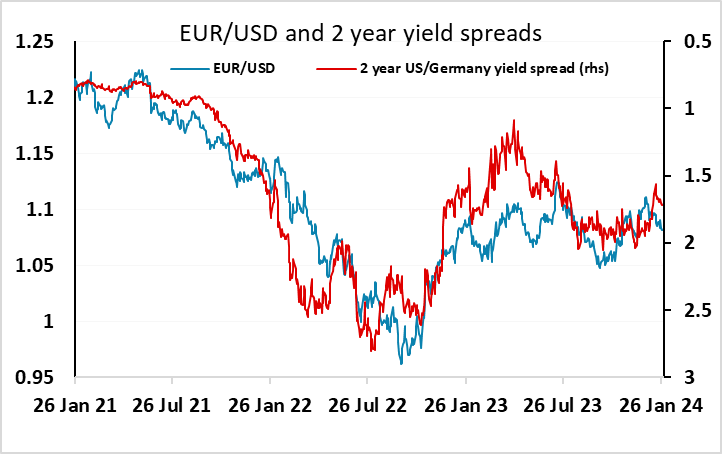

The USD has retained a firm tone overnight, even though US yields continued to slip lower. Yields elsewhere have generally followed, so there hasn’t been much change in spreads, but USD gains look a little stretched based on current spreads.

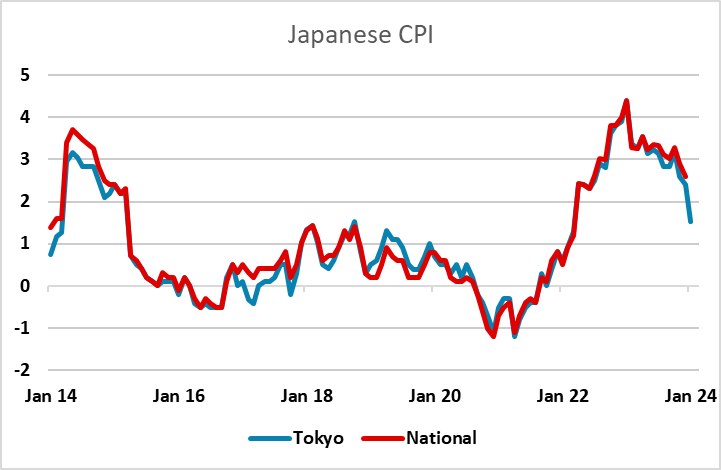

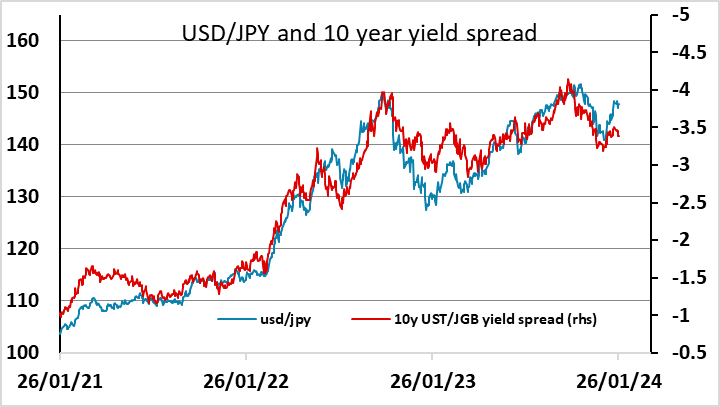

USD/JPY has risen helped by weak Tokyo CPI data for January released overnight. This came in a lot weaker than expected at 1.6% y/y for both headline and core, and will have reduced expectations of near term BoJ tightening. However, from a yield perspective there is very limited scope for impact, as the market is only pricing a 10 bp rise in the policy rate by June, and 20 bp over the whole year. While the BoJ may not feel the need to tighten, the impact on JGB yields is likely to be small, and if inflation falls due to global pressures, the JPY may benefit from sharper yield declines elsewhere. In any case, current spreads still suggest USD/JPY has scope to fall.

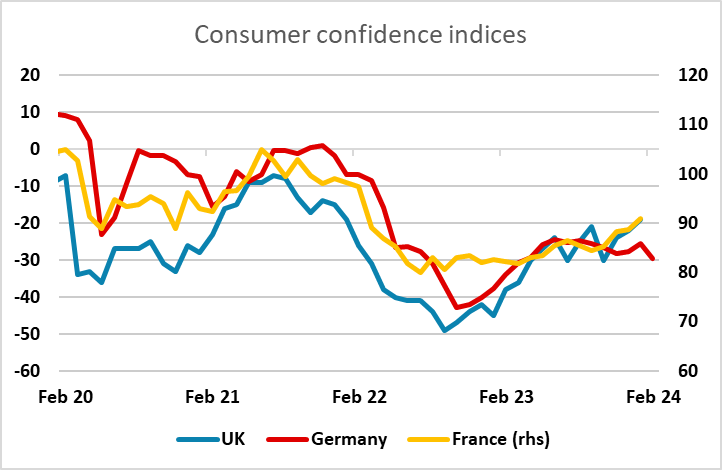

For the EUR, yesterday’s ECB statement and press conference has been seen as mildly dovish, mainly due to Lagarde’s admission that inflation had continued to moderate. However, her indication that there was some evidence of stabilisation in the economy, citing the PMIs, is being challenged by the German data. Yesterday’s IFO was the weakest since the pandemic, and German consumer confidence this morning has dipped, reversing the recent recovery trend. This may be a German rather than a Eurozone phenomenon, but is likely to keep the EUR on the back foot near term. Having said that, the losses on Thursday look excessive relative to yield moves, so for now we would expect to see support at 1.08.