Preview: Due January 25 - U.S. Q4 GDP - Slower but resilient, with Core PCE Prices consistent with target

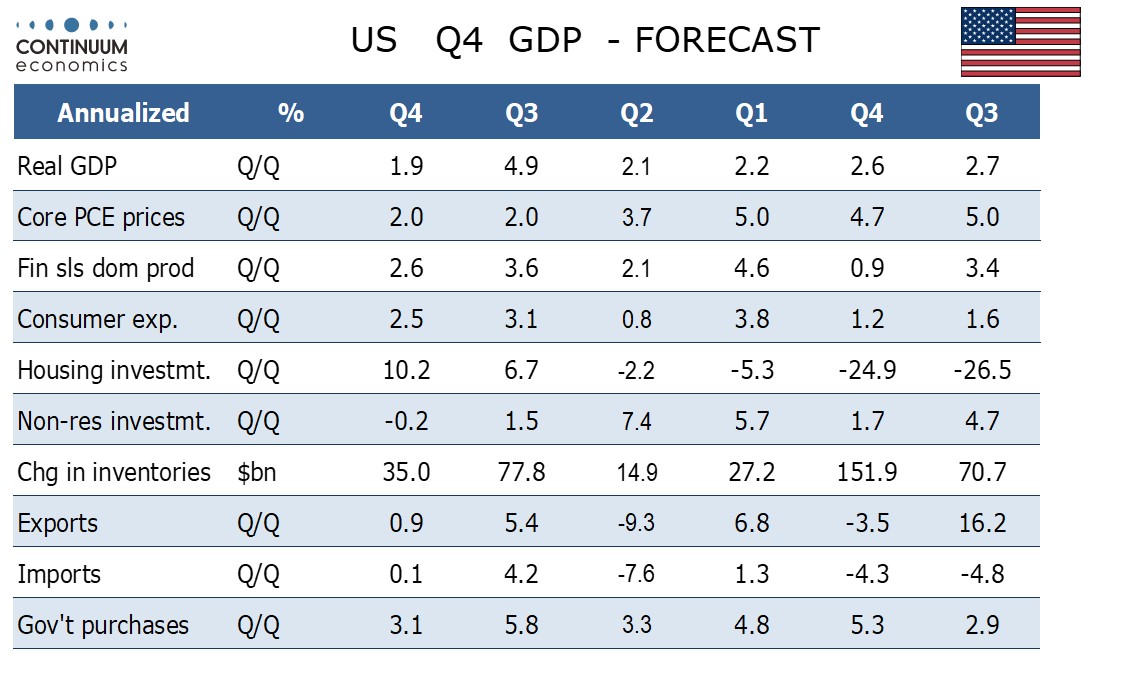

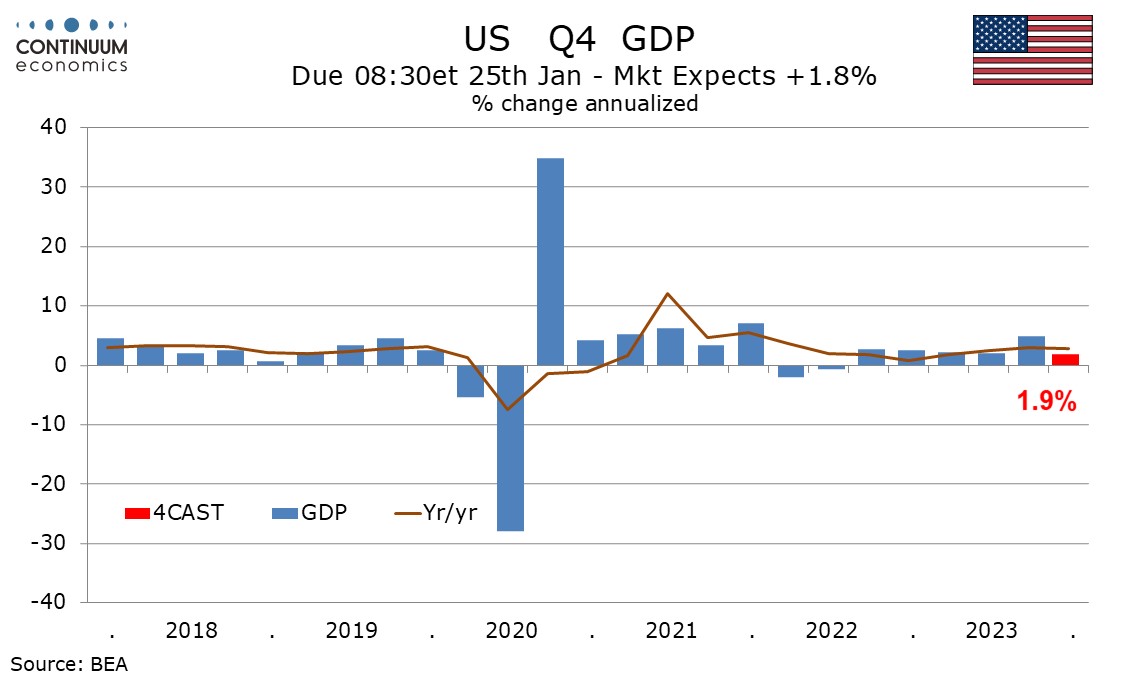

We expect a 1.9% annualized increase in Q4 GDP. While this would be the slowest since Q2 2022 saw a decline it would maintain a respectable pace and exceed our expectations at the start of the quarter.

GDP would be up a healthy 2.8% yr/yr in Q4, similar to Q3’s 2.9% while 2023 as a whole would be up by 2.4% from 2022, outpacing 2022’s 1.9% increase.

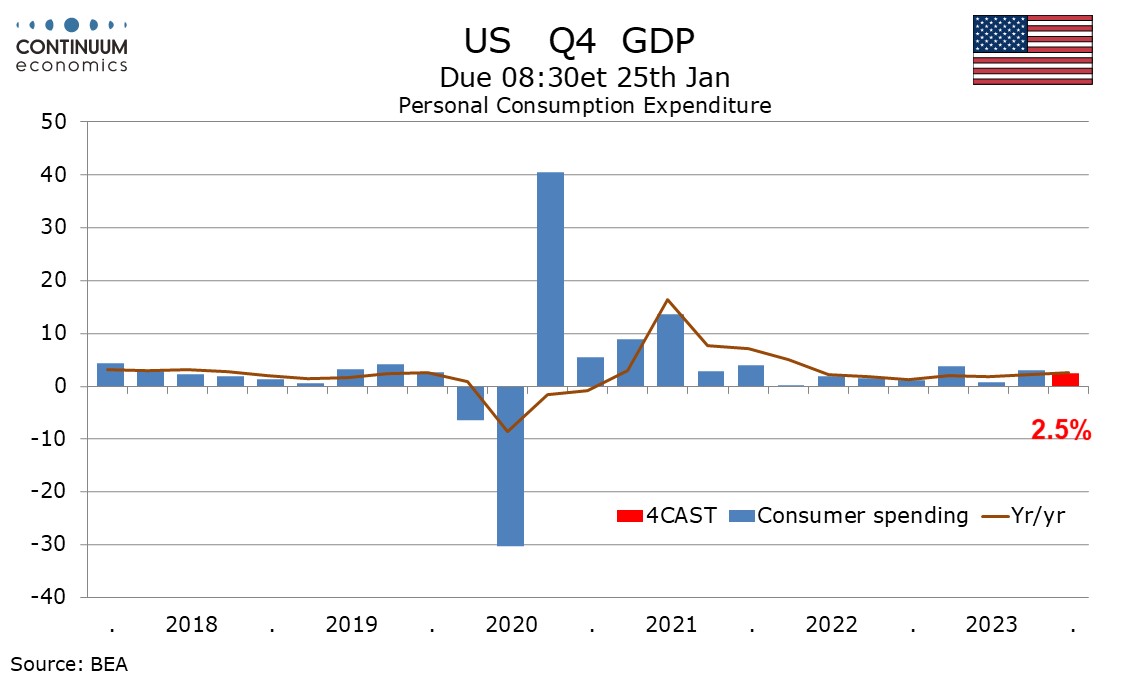

Consumer spending remains resilient after a healthy December retail sales report and we expect a 2.5% increase in Q4, only modestly slower than a 3.1% increase in Q3.

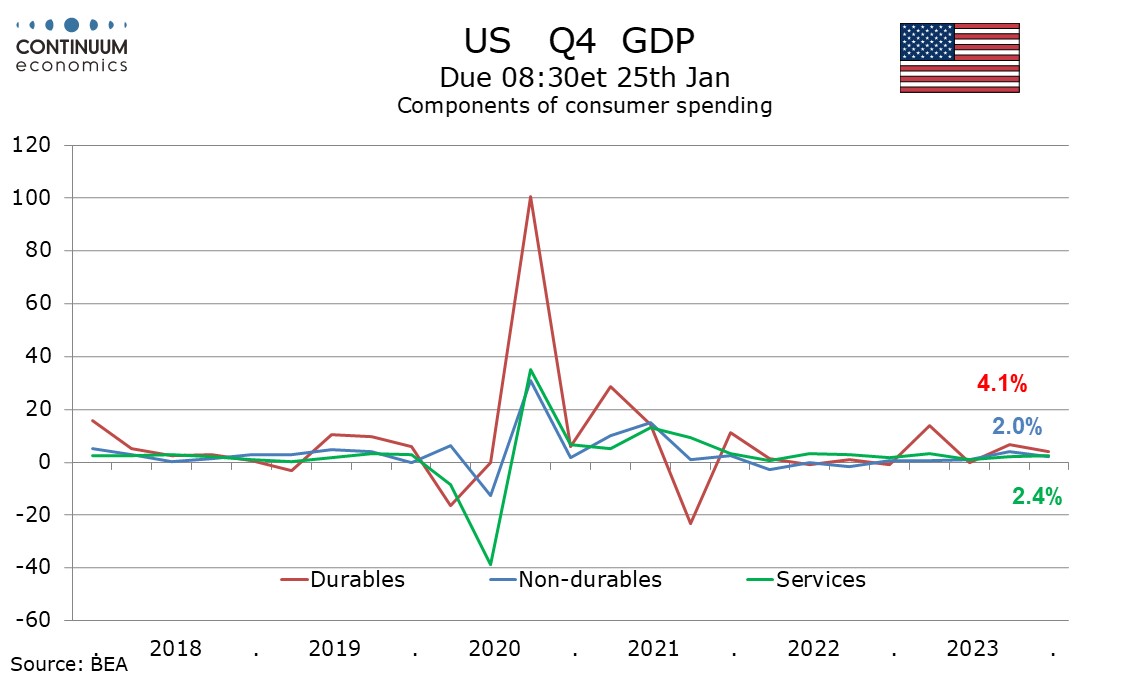

Durables with a 4.1% increase would lead the gain in consumer spending with non-durables at 2.0% and services at 2.4%. Spending would be similar to a 2.3% increase in real disposable income.

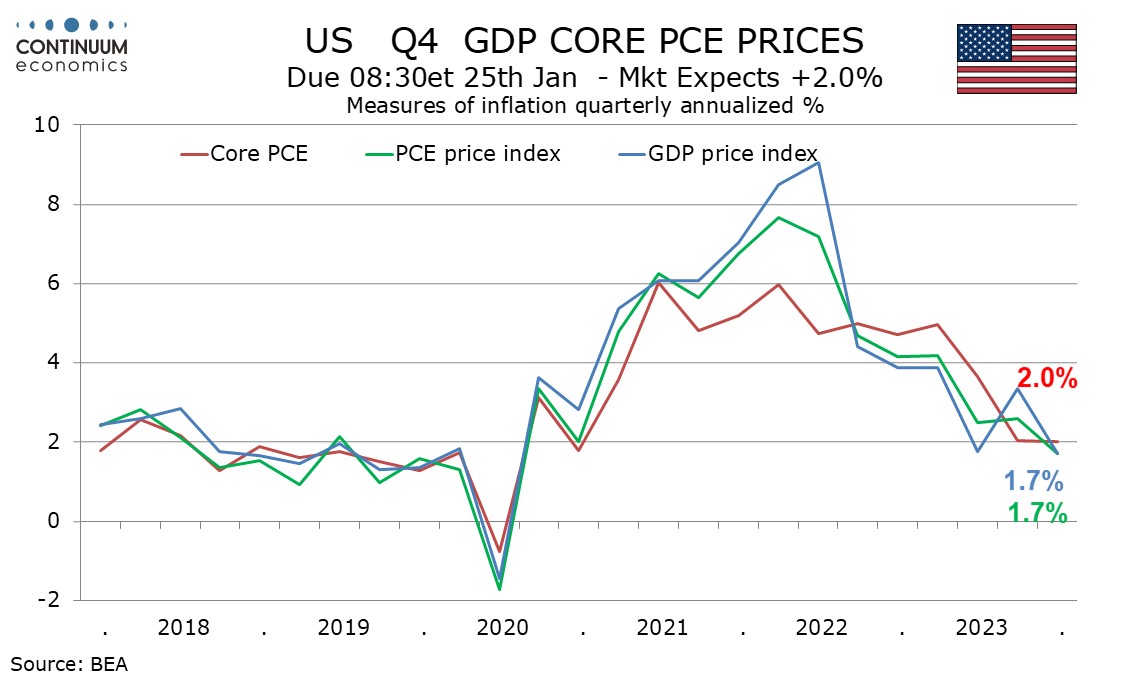

Slower price gains are supportive for real disposable income. We expect gains of 1.7% in the price induces for GDP and PCE, with core PCE at 2.0% consistent with the Fed’s target for a second straight quarter.

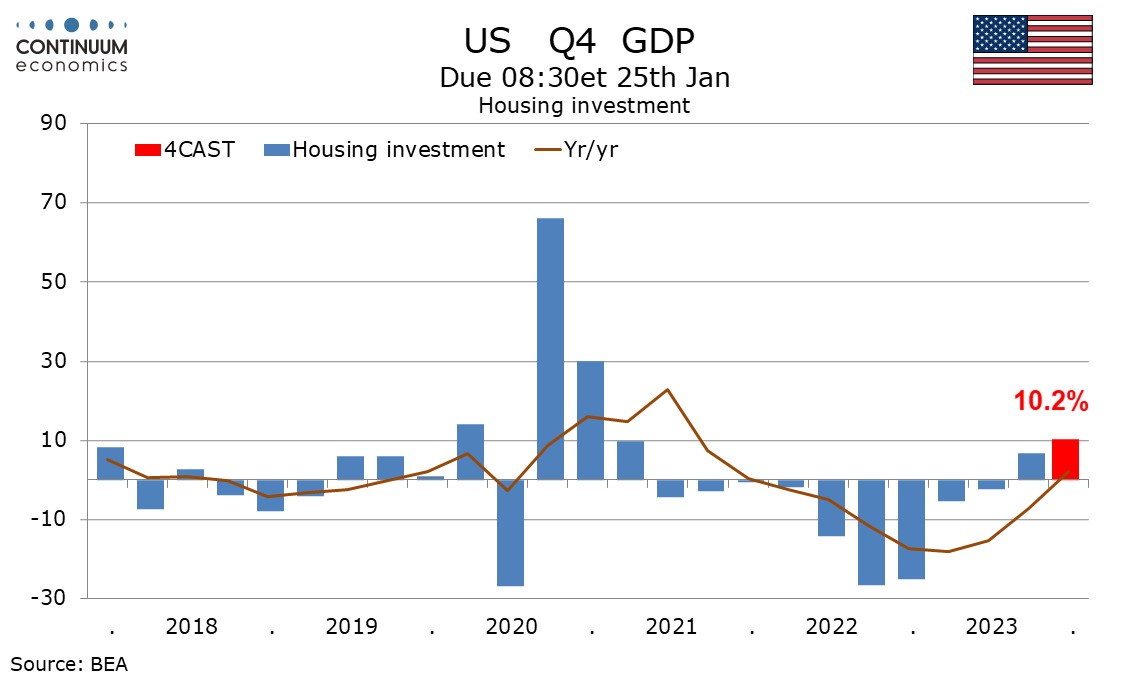

We expect housing investment to record a second straight gain, and a strong one at 10.2%. Despite weakness in home sales data on residential construction has been robust.

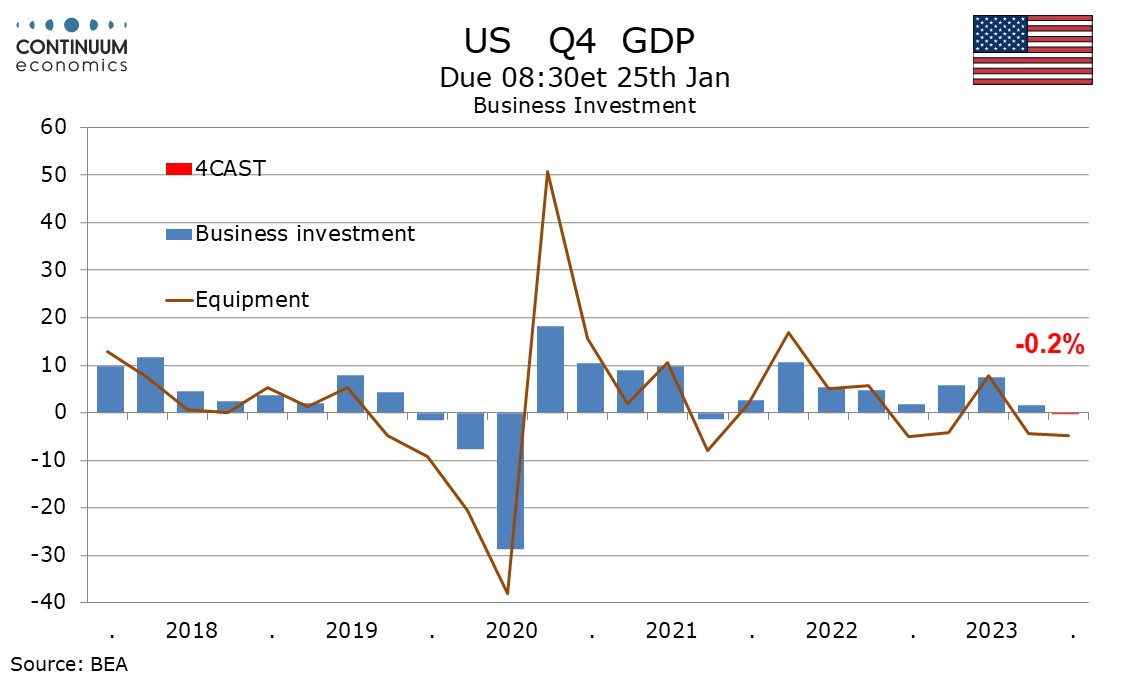

Business investment at -0.2% is likely to be an area of relative weakness, as slippage in equipment outweighs modest gains in structures and intellectual property.

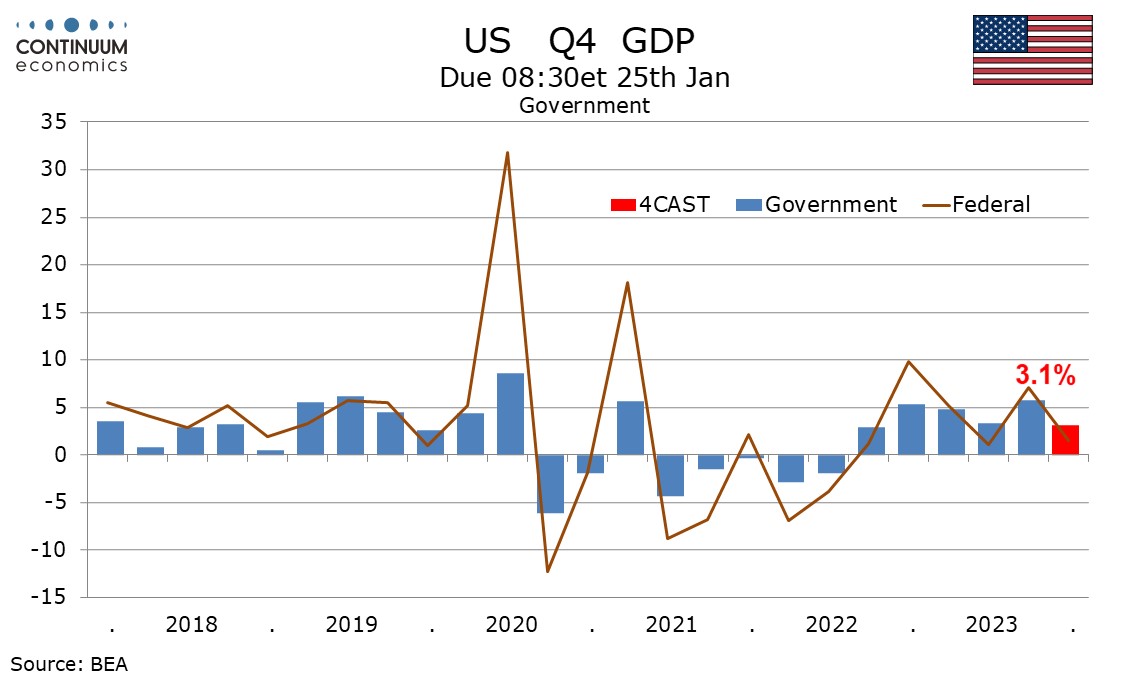

Government with a 3.1% increase is likely to remain firm, of slower than Q3’s 5.8% that saw a particularly strong rise in defense.

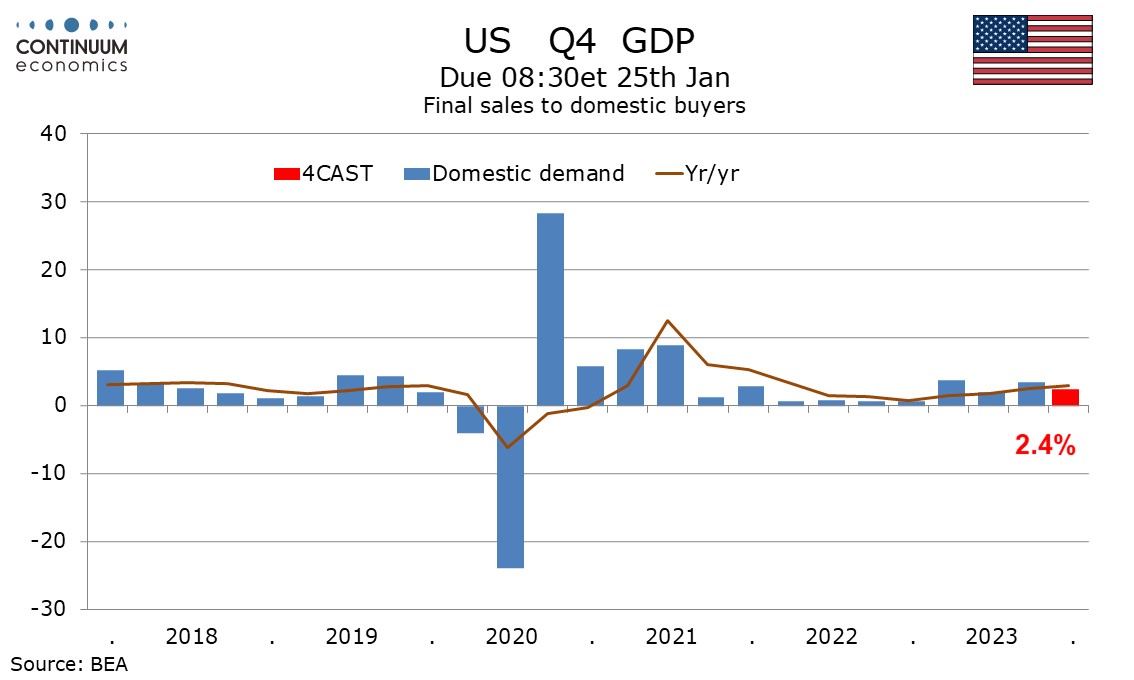

This will leave final sales to domestic buyers (GDP less inventories and net exports) up by 2.4%.

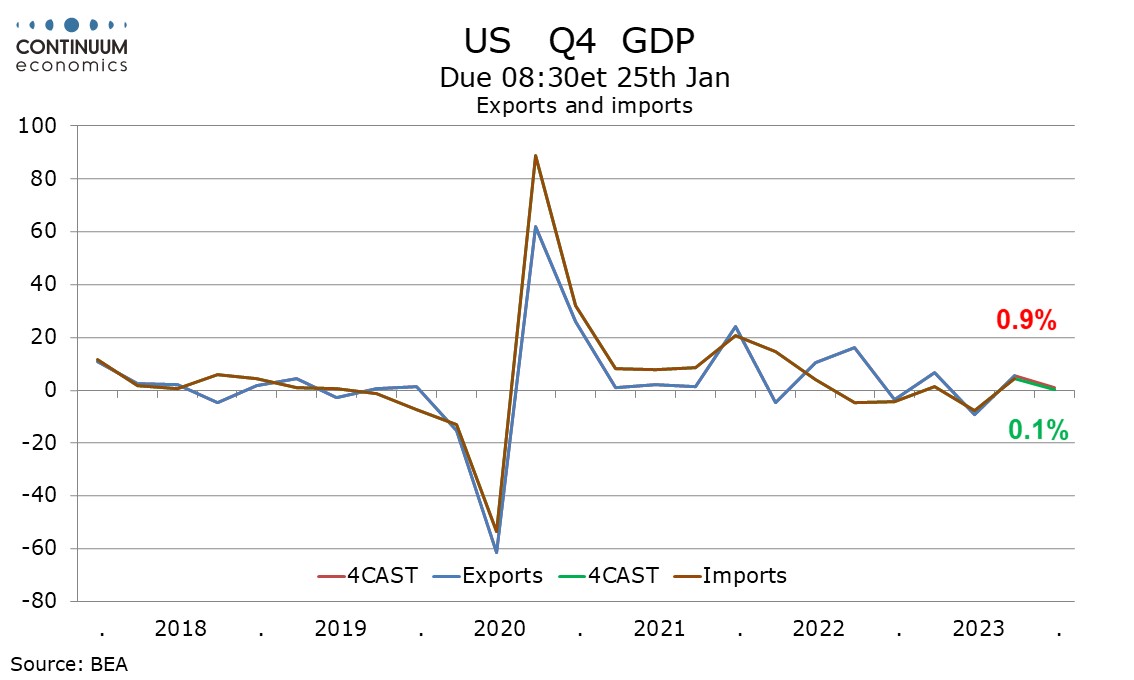

Final sales (GDP less inventories) are seen at 2.6%, meaning a marginal positive from net exports.

Neither exports nor imports are likely to see much change, with exports up by 0.9% and imports up by 0.1%.

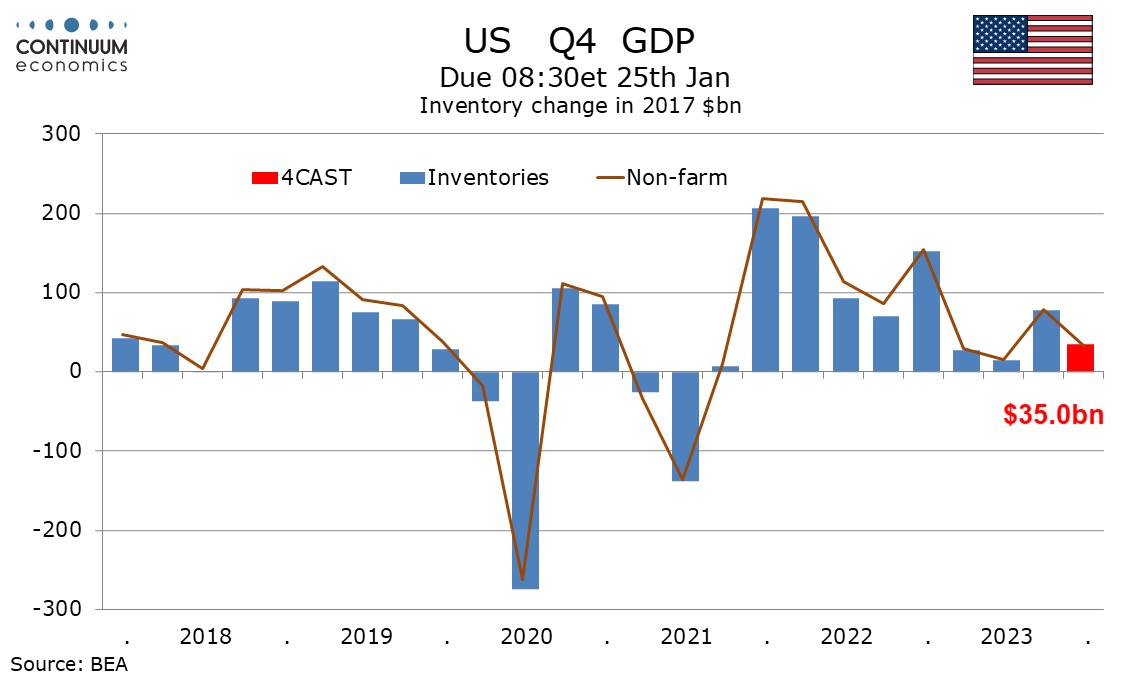

Inventories will make a negative contribution to correct a positive in Q3. October’s auto strikes may be in part responsible for slower Q4 inventory growth.