GBP flows: GBP downside risks after weak GDP

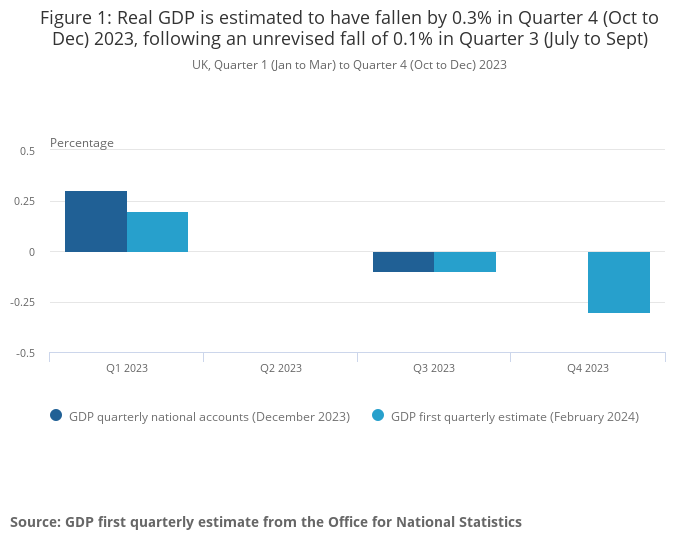

Revisions lead to lager than expected 0.3% decline in UK Q4 GDP, suggesting downside risks for GBP

While UK December GDP was less weak than expected, falling 0.1% m/m, Q4 GDP was weaker than expected at -0.3% q/q due to back revisions, confirming a UK recession in H2 2023. This makes the strength of the UK PMI data in the last few months look rather misleading, and the strength of the pound this year similarly.

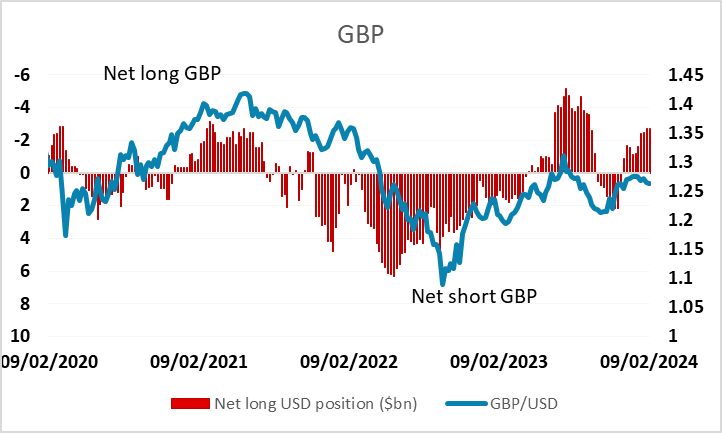

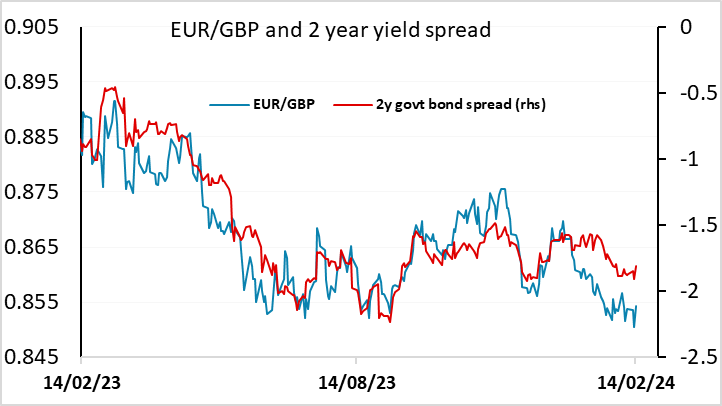

EUR/GBP has so far only risen modestly in response, but given the starting point, which was a little low relative to the recent correlation with yield spreads, and the net long positioning evident in the CFTC data, the risks look to be towards further GBP losses. While the BoE MPC may not be much swayed by the GDP data, focusing more on inflation prospects, the weaker than expected CPI data yesterday and the evidence in the labour market data that earnings are stabilising suggests there is likely to be a more dovish take at the next meeting in March, preparing for a potential May rate cut.

CFTC net speculative positioning