EUR/GBP flows: GBP down on weak UK GDP but can fall further

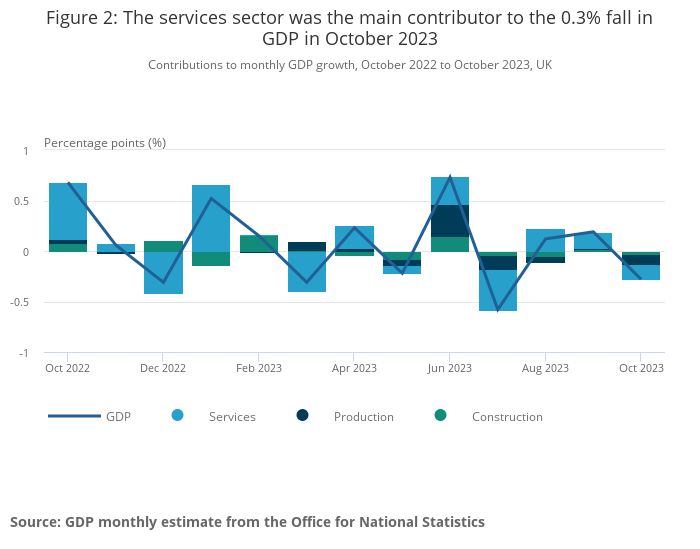

UK October GDP was much weaker than expected at -0.3% m/m, and suggests more substantial EUR/GBP gains may be seen

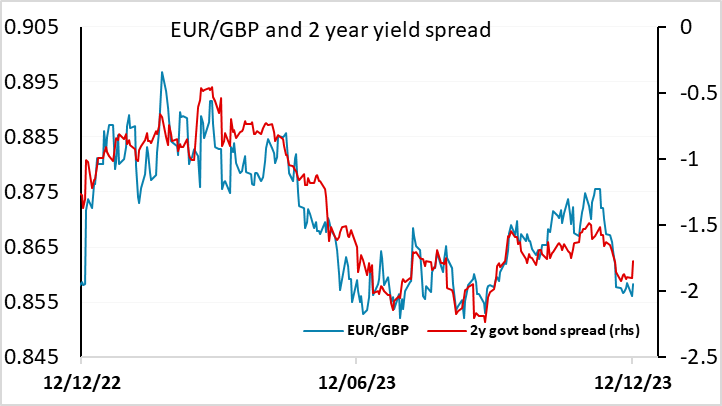

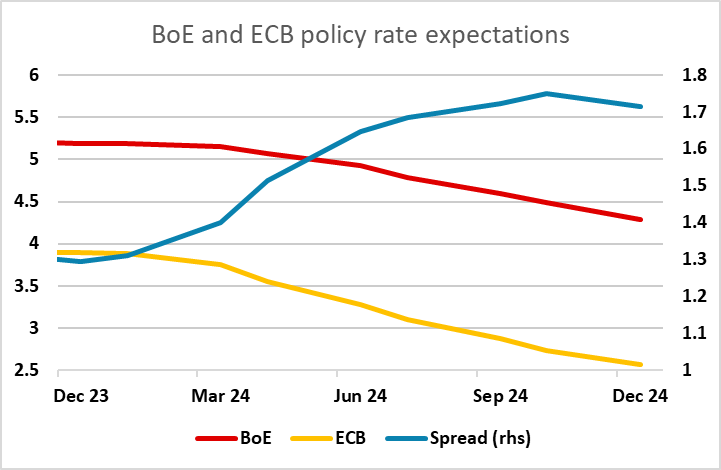

Much weaker than expected UK GDP in October has sent GBP lower, although the initial reaction has been quite modest. EUR/GBP has popped above 0.86, but we suspect there are more gains to come as the 0.3% decline in GDP is likely to impact expectations of Q4 GDP as a whole and convince at least one of the three hawkish dissenters on the MPC to switch their vote to no change at tomorrow’s meeting. EUR/GBP is already slightly on the low side relative to the recent yield spread correlation, and with the market pricing almost 50bps more cuts from the ECB in the next year relative to the BoE, there is scope for the yield spread to narrow in the EUR’s favour.

The data itself was clearly on the weak side, with services, industrial production and construction all falling in October. The market may be taking some comfort from the strength of the November PMIs which suggests there could be some rebound next month, but the decline in October sets a base that will make it hard for Q4 to show positive growth.