Bank of Canada Minutes Show Strong Consensus For Larger 50bps Move

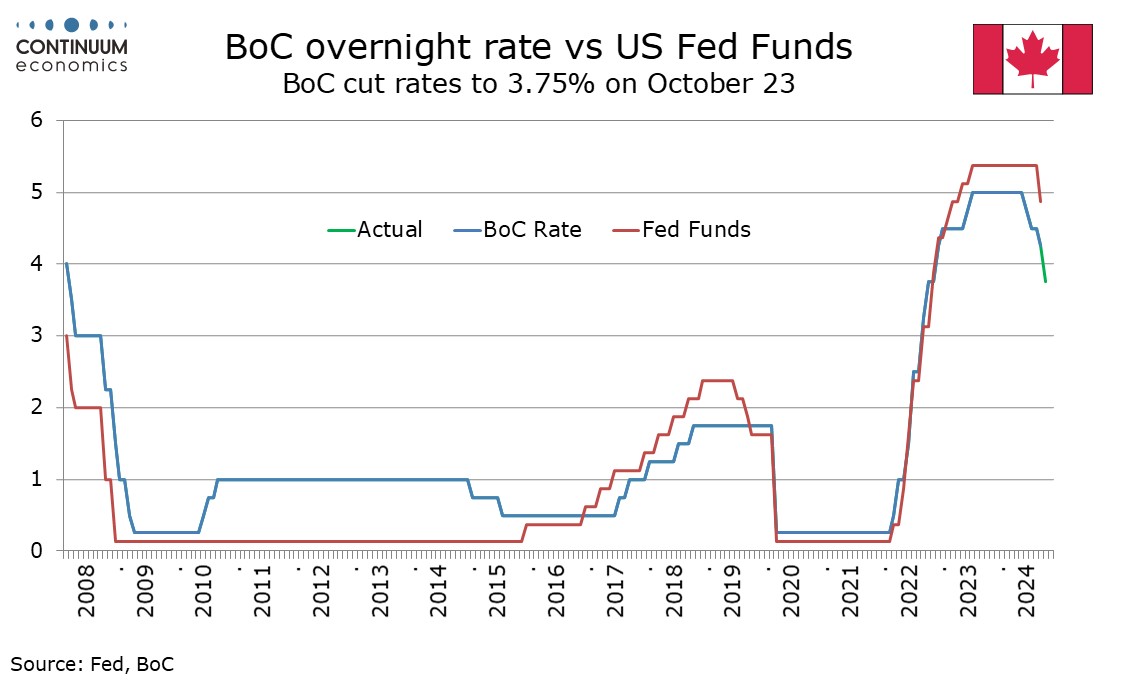

The Bank of Canada has released minutes from its meeting on October 23, which accelerated the pace of easing to 50bps, to 3.75%, after three straight meetings in which the rate was eased by 25bps. While members considered another 25bps move, there was a strong consensus for taking a larger step.

Factors given to support the decision were increasing confidence that upside pressures on inflation would continue to decline, ongoing softness in the labor market and the need for stronger growth to absorb excess supply. Further easing as anticipated if the economy continues to evolve roughly as expected. Some expressed concern that a 50bps move might be seen as a sign of trouble, but members wanted to convey that a larger step was appropriate given data since July. They continued to expect the economy to grow with inflation close to target.

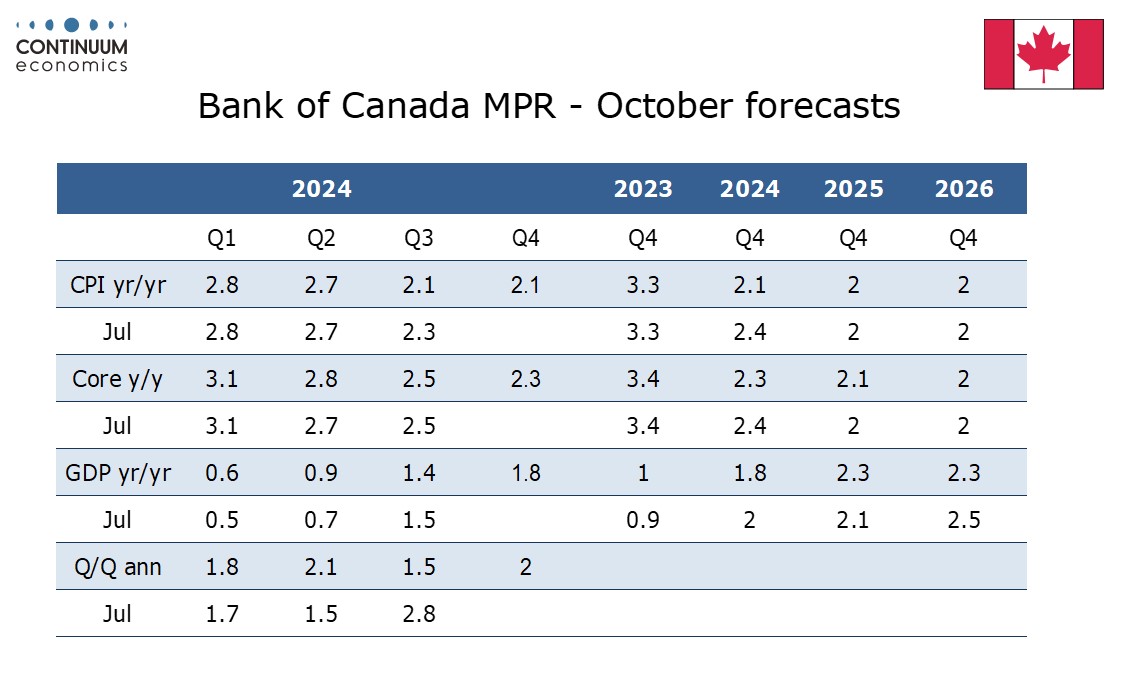

Members agreed that they should be equally concerned about inflation coming in higher or lower than expected. There was more confidence that sources of upward inflationary pressure, particularly shelter costs, would ease, but the possibility the housing market could pick up more quickly than expected was noted, as was the risk of more persistent wage pressure than expected. Excess supply was seen as putting downward pressure on inflation, and the timing of an expected pick-up in growth was uncertain. GDP growth was seen slightly below 2% in the second half of 2024 after rising by roughly 2% in the first half. It was concluded that the labor market remained soft.

The minutes have a dovish tone, though this should not come as a surprise given the decision to accelerate the pace of easing. We continue to expect another a 50bps move in December, before three 25bps moves in 2025. That would take the rate to 2.5%, in the lower half of the 2.25-3.25% range the Bank of Canada sees as neutral.