JPY, AUD, EUR flows: USD firm early in Europe, AUD has upside potential

USD positive and risk positive tone as China eases. AUD has upside scope

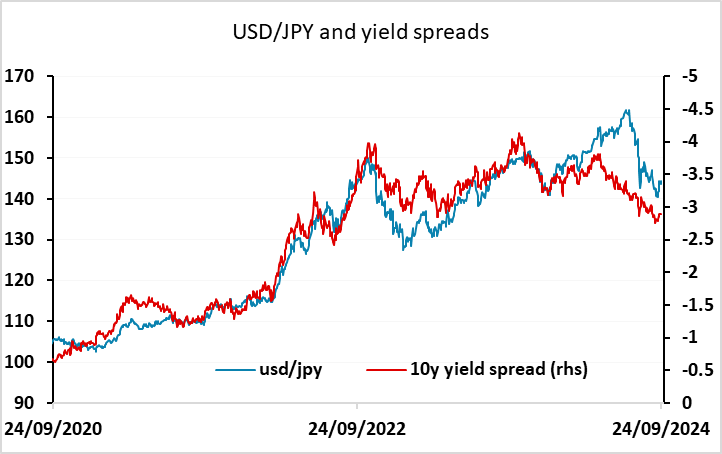

The JPY is starting the European morning on the back foot after the speech from BoJ governor Ueda which the market has seen as being on the dovish side. However, in reality Ueda’s comments were in line with the statement after the BoJ meeting, indicating that rates were likely to rise again if the BoJ’s forecasts were correct, but that there was less urgency now than in July in part because the JPY had recovered. In his post-BoJ meeting press conference, he focused on the likelihood of further wage increases, and was focused on the impact on service prices in October. This suggests that an October hike is unlikely, but that evidence that wage gains are feeding through to prices in October would set the scene for a December rate hike.

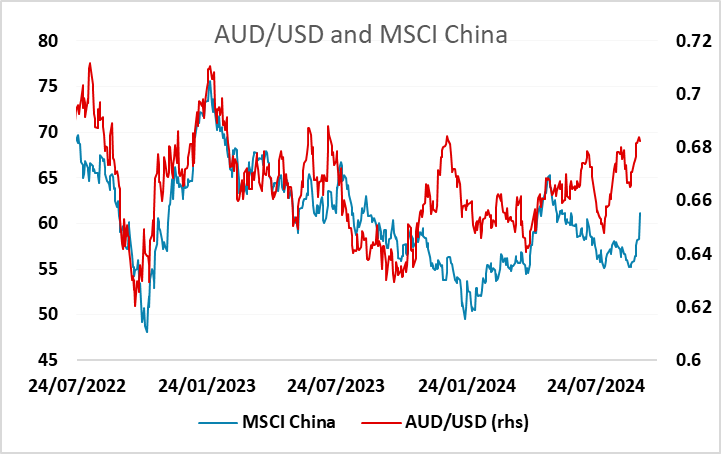

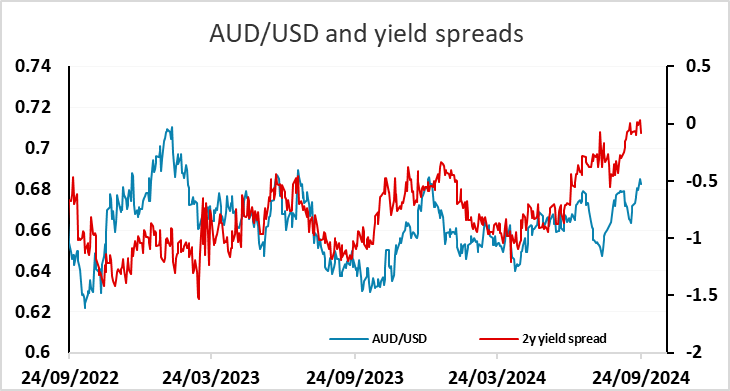

JPY weakness is also a function of a more risk positive market tone, notably in Asia, where Chinese equities have rallied strongly helped by China announcing more stimulus. However, after breaking to new highs for the year overnight, AUD/USD has reversed gains early in Europe as the USD has shown some general strength. The EUR held up relatively well to the weak PMI data yesterday, but the data does seem to have capped EUR gains for the moment, and the IFO survey today represents a risk of renewed losses. Despite its early losses this morning, we would favour the AUD in the current market as yield spreads are favourable even though front end yields fell slightly after the RBA meeting overnight, and the Chinese equity market weakness that has held it back for much of the year looks to have abated for now.