FOMC Minutes from March 19 - Concerns inflation could prove persistent

FOMC minutes from March 19 contained no major surprises, though showed a significant degree of concern over inflation which justifies caution towards easing, with the inflationary concerns led by the prospect of tariffs. Even with Trump’s recent partial climbdown, the risks have probably gone up since the meeting took place.

Participants saw increased downside risks to employment and activity and increased upside risk to inflation, with high uncertainty. Inflation data in the first two months of the year had been higher than expected with core non-housing services remaining high. Several noted announced or planned tariffs were larger than expected, contacts were already reporting increases in costs and had indicated willingness to pass them onto consumers. Dovish offsets to this were cited by only a couple of participants, depletion of excess savings, lower immigration reducing pressures in housing and a balanced labor market. A couple also noted that distinguishing between temporary and more persistent changes in inflation may serve especially difficult. Almost all agreed near term inflationary expectations had risen but the longer term remained well anchored. Available data suggested the economy continued to grow at a solid pace but there were some indications that consumer spending may be moderating.

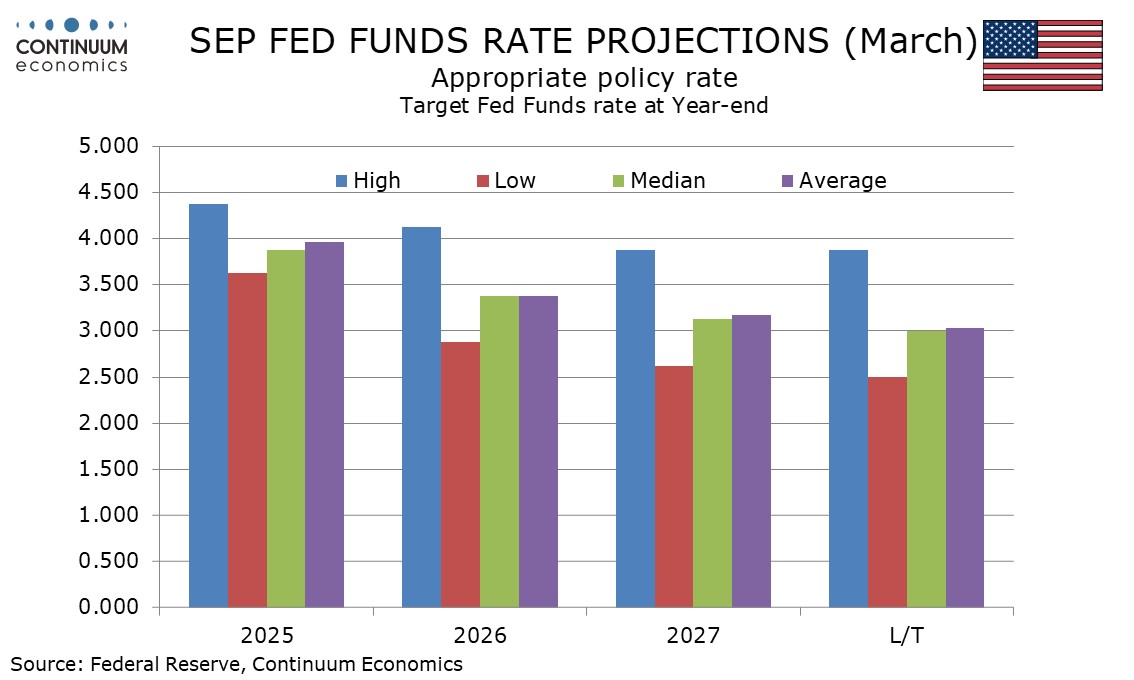

All participants viewed it as appropriate to hold rates at 4.25-4.50% with almost all seeing inflation risks as tilted to the upside and employment risks as tilted to the downside. Several emphasized that elevated inflation could prove more persistent that expected, and this could lead to difficult tradeoffs. Almost all participants supported slowing the pace of balance sheet runoff, while noting the importance of communicating this had no implications from the policy stance. On this Governor Waller, as was already known, dissented in favor of maintaining the existing pace of runoff.