USD flows: USD stays firm after ISM

A strong non-manufacturing ISM sustains US uptrend

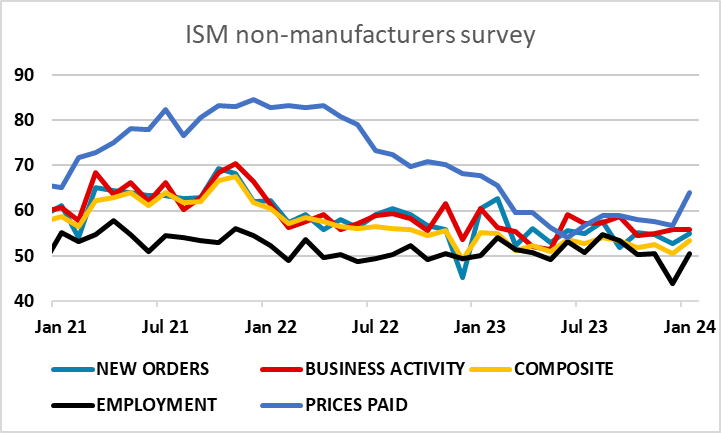

Another strong ISM number, with the price index of the non-manufacturing ISM showing particular strength, but the other components all generally up on the month in January and higher than expected. The data has triggered more USD gains, particularly against the riskier currencies, with the JPY the most resilient and the EUR making gains against GBP and the AUD with equities falling back as US yields rise. The market is still pricing in around 4 ½ rate cuts this year, and Powell’s comments suggest that the Fed is looking at around 3 cuts, as suggested by the dots at the December meeting, so if the data remains strong there may still be some further upside for US yields.

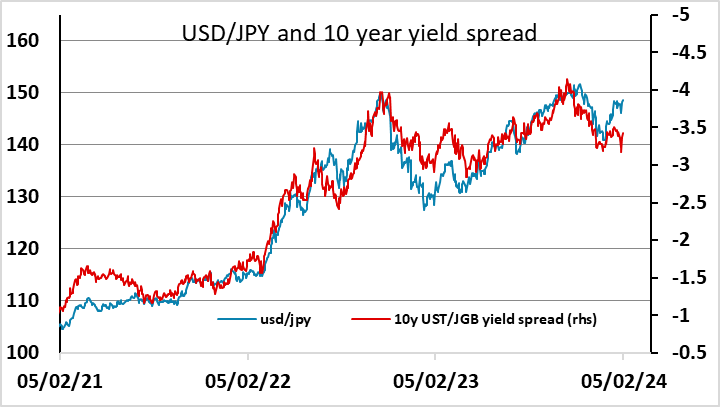

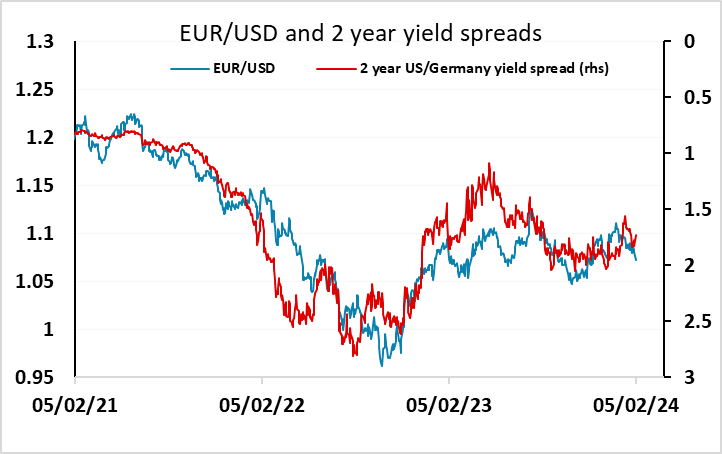

This being the case, USD strength is hard to oppose, especially against the higher yielders if equities fall back in response to higher yields. USD/JPY still looks expensive relative to the usual yield spread correlation, so may have less upside, especially in more risk negative markets, although as long as equities are reasonably resilient, JPY crosses are unlikely to fall far given the correlation to US equity risk premia.