USD, EUR, JPY, NOK flows: USD firmer after Fed, JPY soft, NOK could slip on Norges Bank

USD firmer after Fed despite larger than expected 2025 rate cuts in the dots. JPY continues to underperform. NOK can slip on Norges Bank

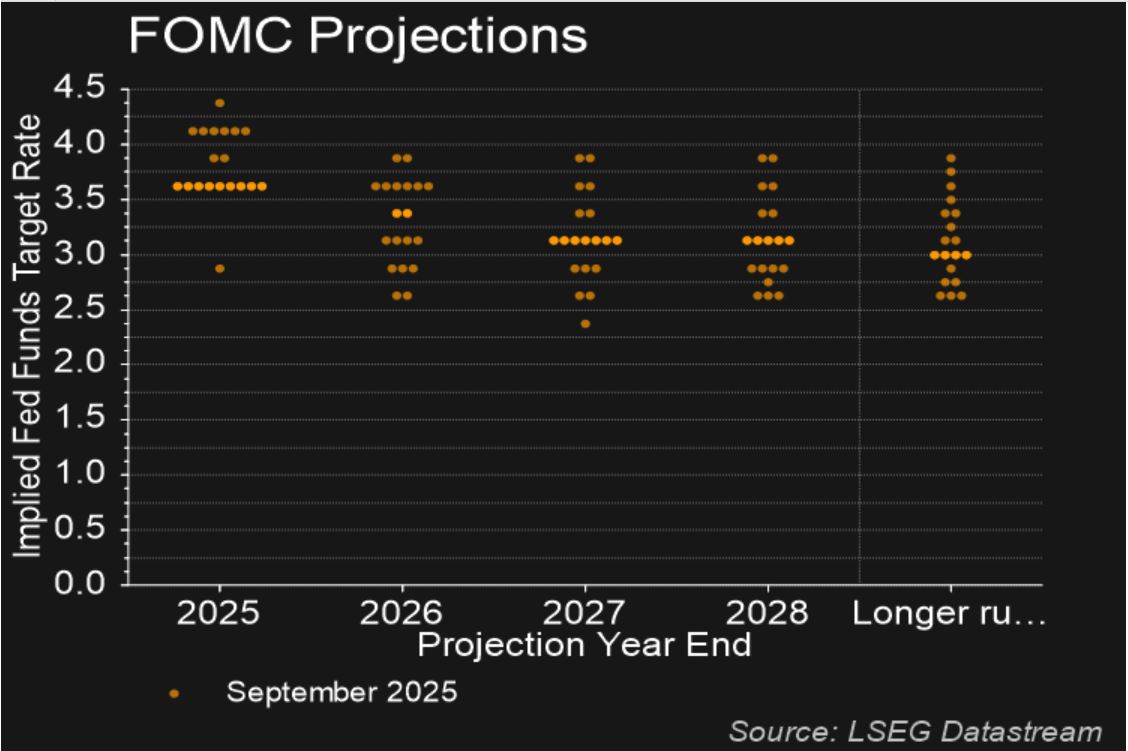

The net impact of the FOMC meeting has left the USD slightly higher and the JPY slightly lower on the crosses, although the initial USD move was lower as the Fed dots indicated two more moves were expected this year rather than the one most anticipated. However, the USD recovered quickly and extended gains through the Asian session. US yields were net little changed after edging up into the FOMC. Most of the USD move can be attributed to positioning, as the USD was under pressure in the week ahead of the meeting. Objectively, the dots suggests a slightly more dovish Fed position than anticipated, although they only move the Fed into line with hat the market is already pricing in for this year, and the Fed dots remain some way short of the easing priced into the market for 2026. The market prices in 120bps of further easing by the end 2026, while the dots only have 75bps of easing with only one cut in 2026 after two in the remainder of this year. This may reflect a market belief that things will change when Powell’s term ends in March, but still suggests there is quite limited downside for US front end yields from here in the absence of significantly weak data.

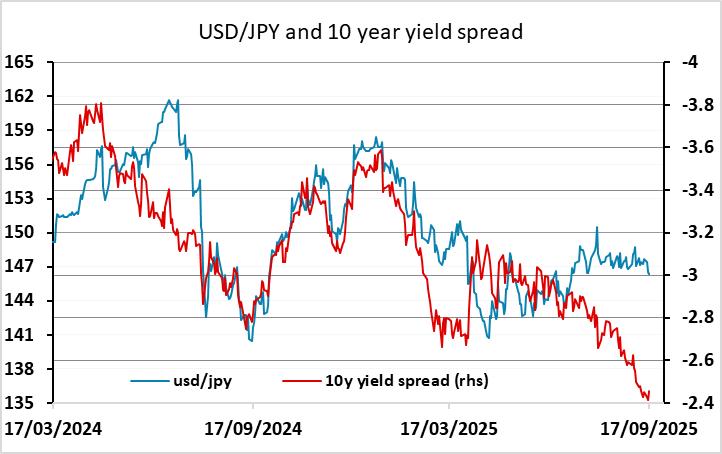

This suggests the USD may manage a further recovery from here, with scope for yields to edge a little higher. However, the USD sensitivity to yields and yields spreads remains quite low across a range of currencies, notably against the JPY, where the sharp decline in yield spreads in the last two months has failed to trigger any decline in USD/JPY. EUR/USD is showing a better yield spread correlation once the one off rise in April following the initial reciprocal tariff announcement is discounted, but the limited downside for US yields from here suggests it will be difficult to extend above 1.20.

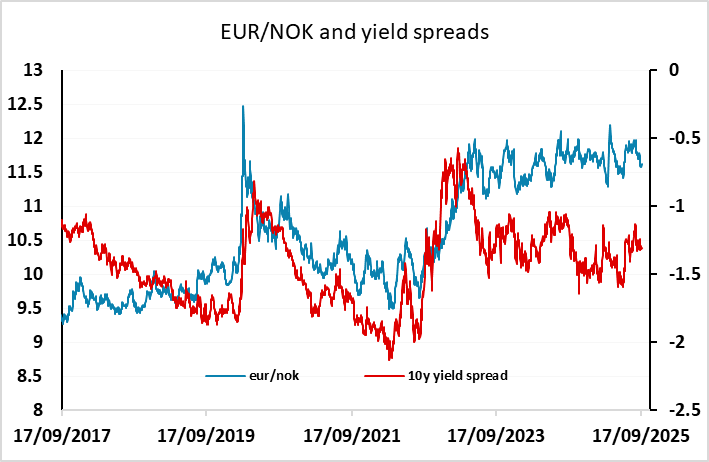

For today, the focus shifts to central bank meetings in Norway, were a 25bp rate cut is expected, and the UK, where the market expects no change. There is greater uncertainty around the Norges Bank decision, where 75% of forecasters are looking for a cut, but the market is pricing a cut as only around a 40% chance. We expect to see a Norges Bank cut, which suggests upside risks for EUR/NOK today.