Preview: Due January 22 - U.S. October and November Personal Income and Spending - Heading for annualized Q4 gains a little above 2.0%

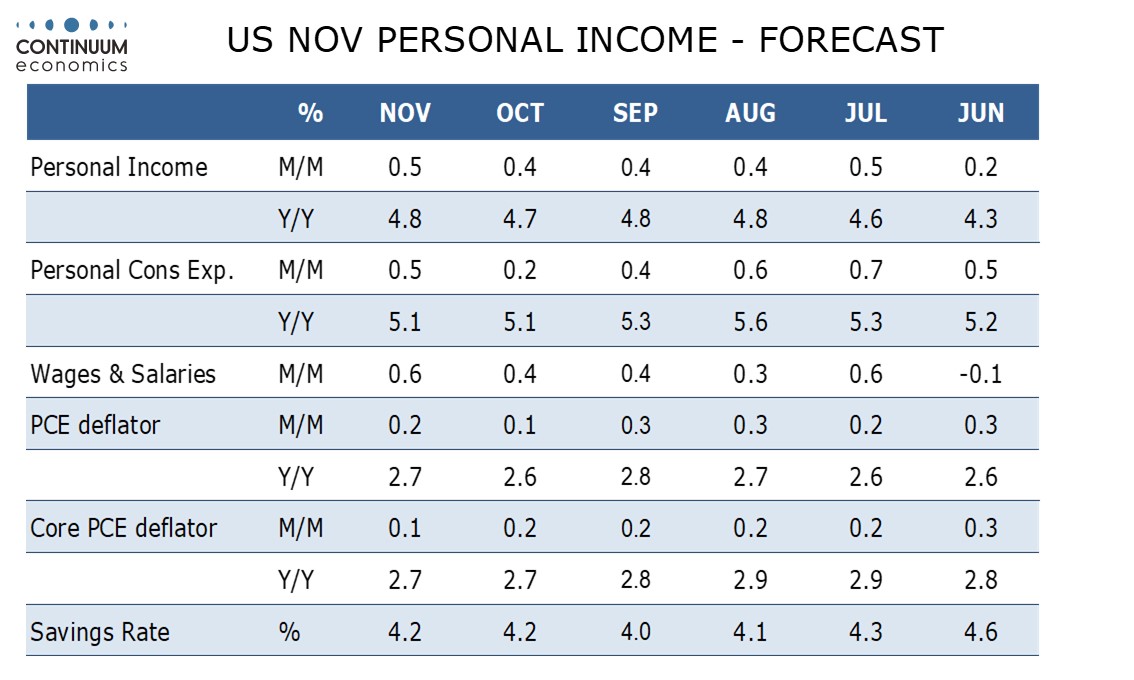

January 22 will see a personal income and spending report for both October and November. We expect personal income to rise by 0.4% in October and 0.5% in November and personal spending to rise by 0.2% in October and 0.5% in November. For core PCE prices, we expect gains of 0.2% in October and 0.1% in November. For Q4, gains slightly above 2.0% for real disposable income, real personal spending and core PCE prices all look likely.

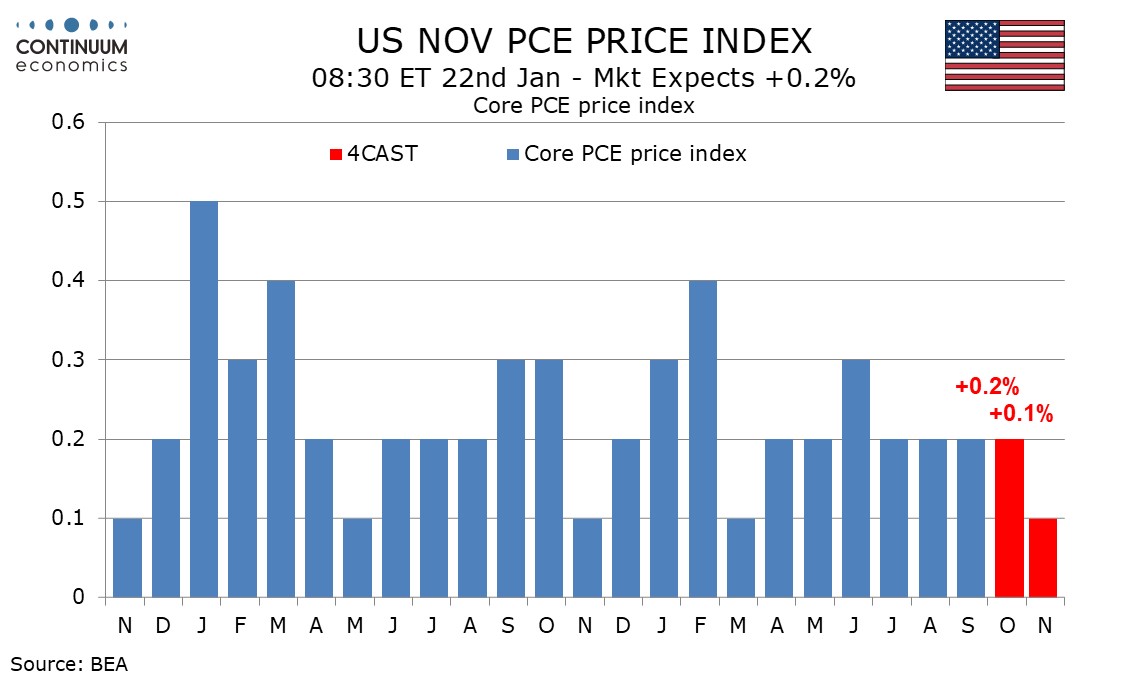

CPI data was not collected for October but it is known that CPI, both overall and ex food and energy, rose by only 0.2% over the two months. We do not expect PCE prices to be quite as soft as that, each rising by 0.3% over the two months. The breakdown by month of the core rate is hard to predict but it is known that gasoline prices fell in October and rebounded in November. We thus expect a smaller 0.1% rise in overall PCE prices in October while the core rises by 0.2%, but November to see overall PCE prices up by 0.2% even with a slower 0.1% increase in the core. We see yr/yr growth in overall PCE prices at 2.7% in November, up from 2.6% in October but below September’s 2.8%, with core PCE prices at 2.7% yr/yr in both October and November, down from 2.8% in September.

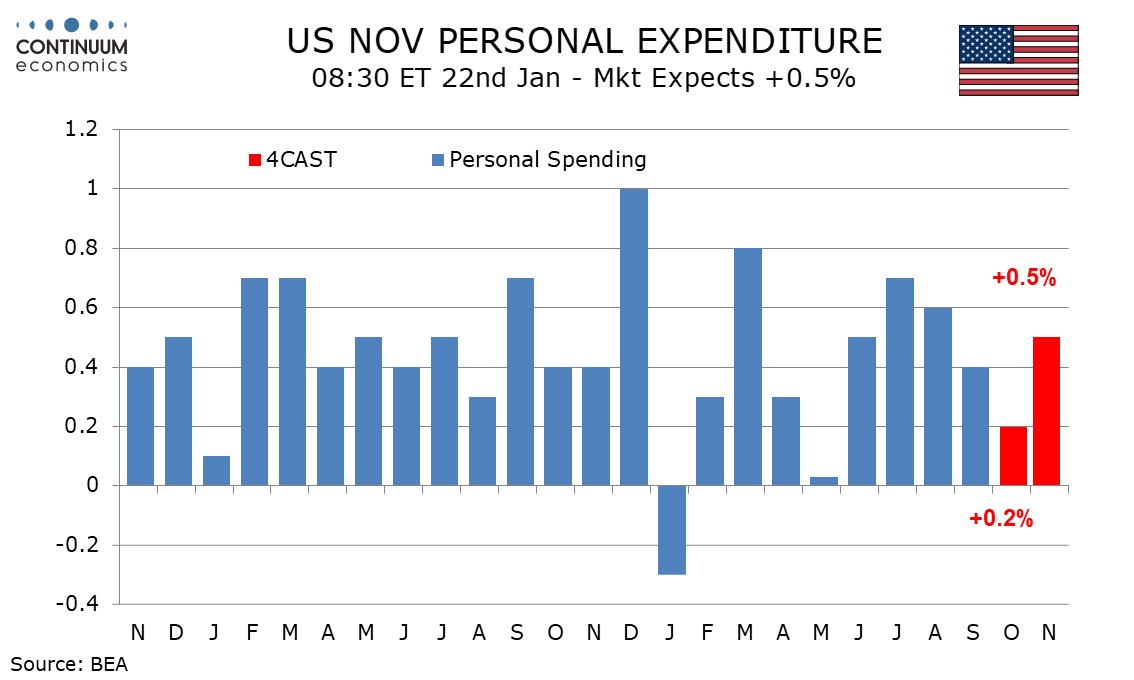

Retail sales regained momentum in November after a subdued October, with autos recovering from a dip in October as did gasoline in response to prices. We expect services to rise by 0.4% in both October and November, slower than in each month 0f Q3. This would leave overall consumer spending up by 0.5% in November after a 0.2% increase in October.

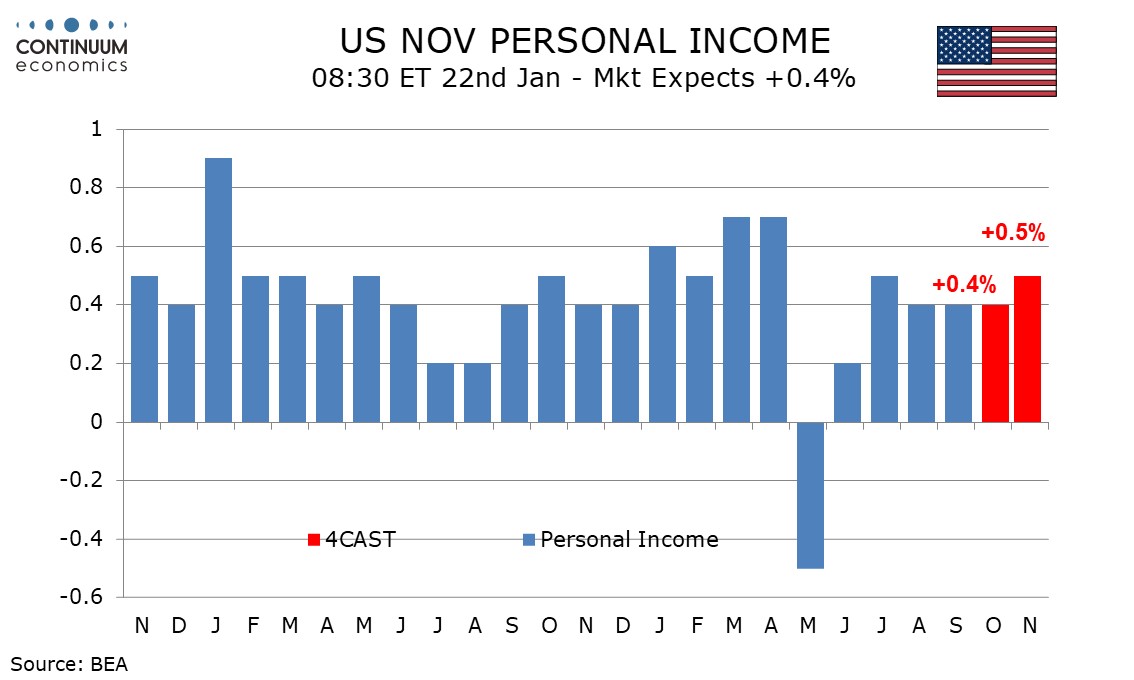

The non-farm payroll details, considering, payrolls, average hourly earnings and the workweek, suggest gains in wages and salaries of 0.4% in October and 0.6% in November. Wages and salaries are trending slightly stronger than the rest of personal income, and we expect overall personal income to rise by 0.4% in October and 0.5% in November. There is scope for a bounce in Social Security income in October, after a weak September, weighing against government shutdown risks.

We can make provisional estimates for December. A subdued non-farm payroll suggests a rise of only 0.3% in personal income, but stronger auto industry sales suggest a 0.6% rise in personal spending. The CPI hints at a 0.3% rise in PCE prices, with a 0.2% increase ex food and energy. That would leave annualized Q4 gains of 2.2% in real disposable income, up from an unchanged Q3, and 2.3% in personal spending, slowing from a 3.5% increase in Q3. Core PCE prices would be up by 2.2% annualized, with overall PCE prices at 2.4%, significantly slower that respective gains of 2.9% and 2.8% in Q3, but not quite consistent with the Fed’s 2.0% target.