JPY, NZD, EUR, SEK flows: JPY and NZD down sharply, EUR resilient

JPY extends weakness on weak wage data, NZD drops sharply on 50 bp RBNZ cut. EUR resilient despite likely erratically weak German production data

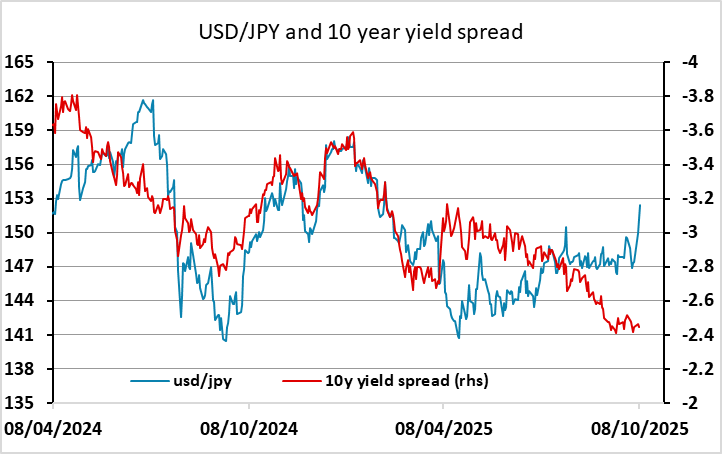

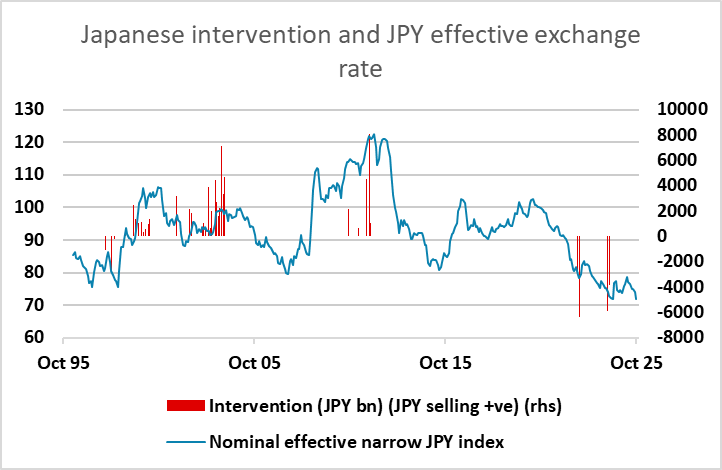

Plenty of volatility overnight, with USD/JPY getting another leg up from weaker than expected wage data, which further reduces the chances of a BoJ rate hike at the end of October meeting. However, the weakness of the JPY to some extent counterbalances this, as the sharp decline seen in the last few days may convince the BoJ of the need for some action if we don’t see a turn. Indeed, these look like conditions that could attract FX intervention if we don’t see some stabilisation in the near future.

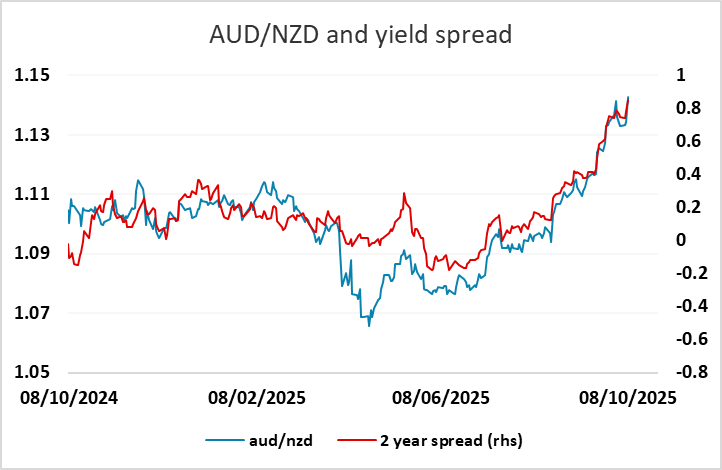

The NZD also fell sharply after the RBNZ cut rates 50bps. The market was split between a 25bp and a 50bp cut, so a reaction was likely ither way, but the RBNZ statement was still dovish, so significant NZD weakness ensued. AUD/NZD continues to follow the 2 year yield spread higher, but may pause below 1.15.

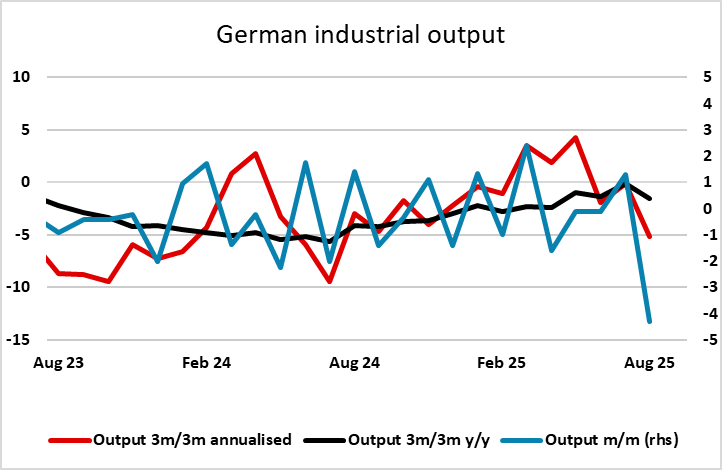

The European data this morning sees a much weaker than expected reading on German industrial production, following the weak orders data yesterday. While this is likely due mainly to seasonal car plant closures, it still paints the picture of weakening German and European growth which may weigh on the EUR, although EURUSD is initially not much changed after an initial dip.

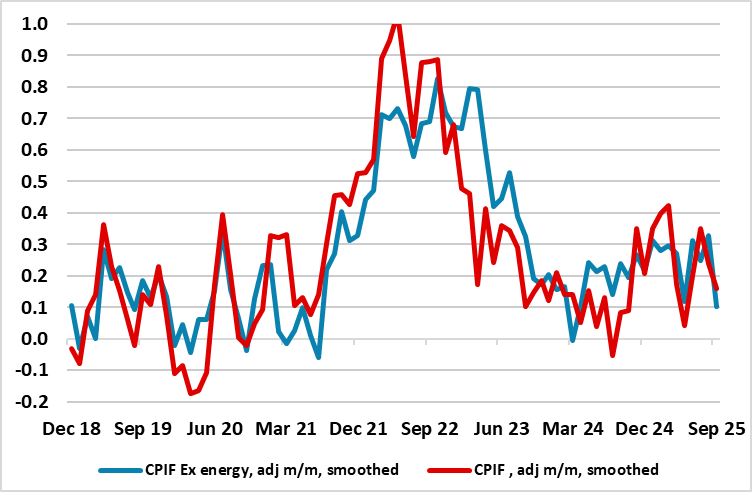

Swedish CPI data was also on the soft side of consensus, but only modestly, and the market remains comfortable with the Riksbank now being on hold for the foreseeable future. EUR/SEK is steady

Swedish CPI