FX Weekly Strategy: APAC, August 11th-15th

Impact of US CPI less clear than in the past

Any USD gains on stronger inflation data would likely be temporary

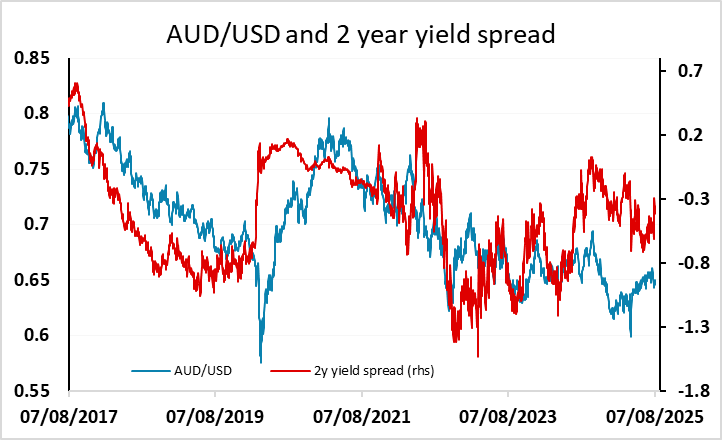

AUD range bound for now but RBA could threaten a breakout

GBP downside risks on labour market data

Strategy for the week ahead

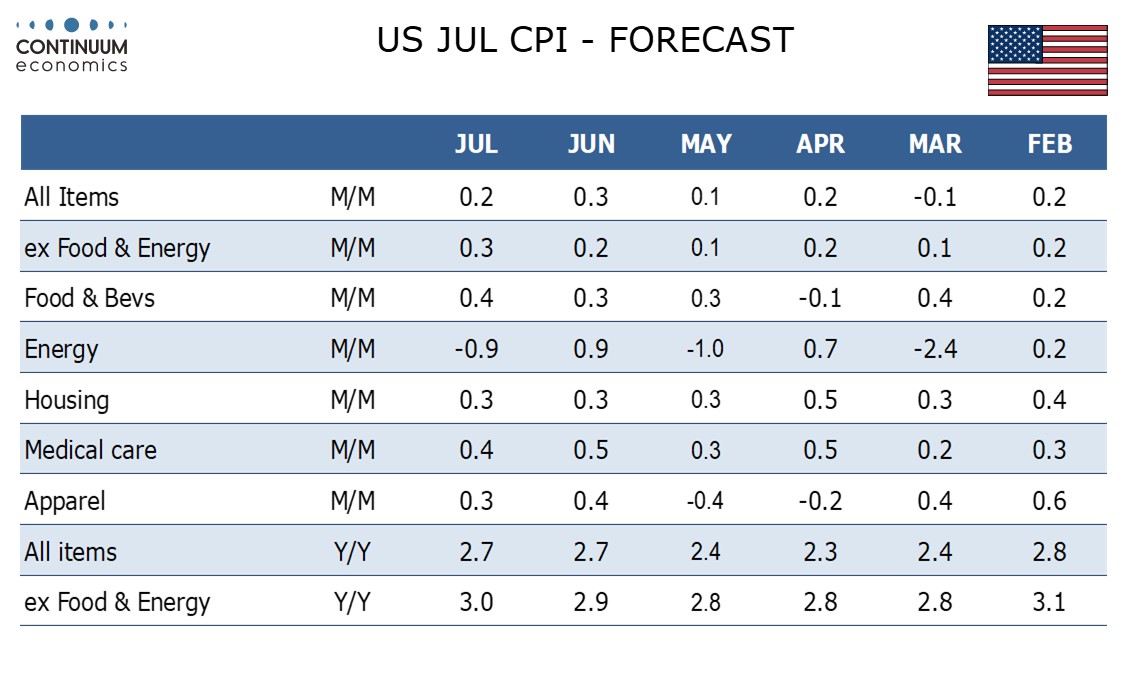

US CPI is the main data focus of the week, and the scrutiny will increase over the next few months as the impact of tariffs is assessed. Our forecasts of a 0.2% headline, 0.3% core is in line with consensus, but will mean a mild uptick in y/y rates of inflation to 2.8% headline and 3.0% core. More of this is likely in the coming months, and could damage hopes of more aggressive Fed easing that have emerged since the employment report. US 2 year yields are down 20bps since the employment report, but more aggressive easing against a background of higher inflation is unlikely unless there is more evidence of economic weakness. Further down the road, if Trump appoints a dovish Fed chair, more aggressive easing is possible, but for now, with a September rate cut near fully priced and two cuts more than fully priced for December, it’s hard to argue for much lower front end US yields.

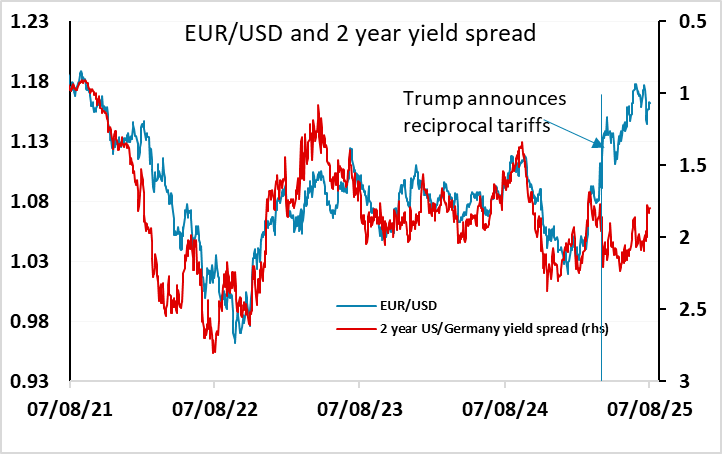

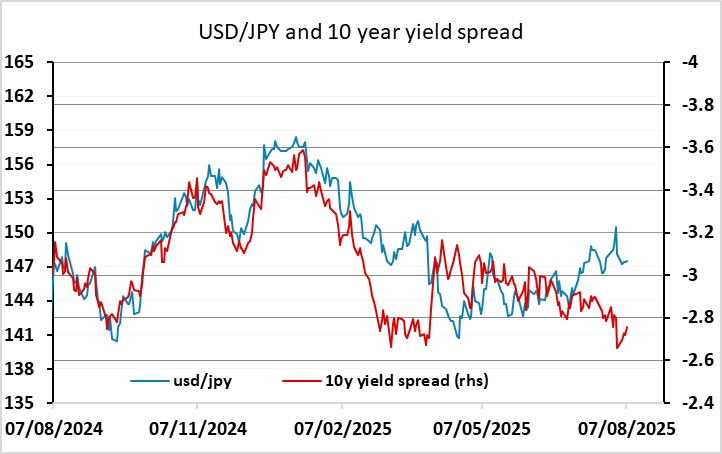

Even so, it’s not 100% clear that higher US yields would necessarily result from higher CPI, given the risks that this would mean weaker real growth, although it does seem likely that this would be the initial reaction. Whether this would be USD positive at this stage is, however, also unclear. EUR/USD correlation with yield spreads has weakened significantly, and EUR/USD direction now looks to be more conditioned on confidence in the US economy. Higher inflation might therefore conceivably prove USD negative against the EUR, but in truth the reaction is unclear. Even against the JPY, while higher US yields tend to be supportive, if higher inflation led to lower equities (in part due to higher yields), JPY downside would also look quite limited. So reactions to the CPI data are less clear than they have been for some time. On balance, we would tend to favour a stronger USD if the numbers are at or above consensus, but probably only in the very short run.

Other than US CPI, we have the RBA meeting on Tuesday, with a 25bp rate cut now fully priced in after softer recent inflation data. The AUD has already fallen back a little due to a more dovish RBA outlook, and looks more at risk than it has for some time due to declining AUD yields and increasing downside risks for equity markets. The short term range of 0.64-0.66 looks unlikely to be broken, but the downside will become more at risk if the RBA encourage expectations of more aggressive easing.

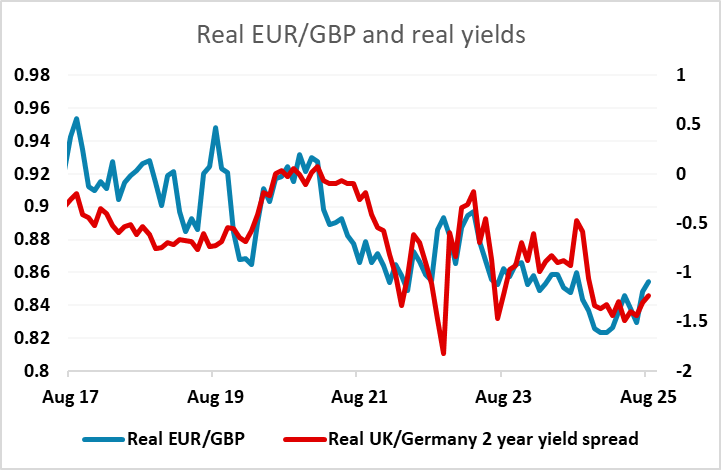

GBP benefited from a less dovish than expected BoE presentation of their decision to cut rates last week, with Bank concerns about near term inflation risks rising. Many of these risks are short term, but Bank concerns about a feedthrough to wages remain. This week’s labour market data is consequently all the more important. Recent evidence of weakening wage growth was part of the story behind the BoE rate cut, and further evidence along these lines might restore some rate cut hopes. In any case. We feel that the GBP rise since the decision is overdone, in part because the Bank is likely to downgrade growth and inflation forecasts later in the year once the government addresses the current big budgetary shortfall, most likely with higher taxes. GBP risks should consequently be on the downside.

Data and events for the week ahead

USA

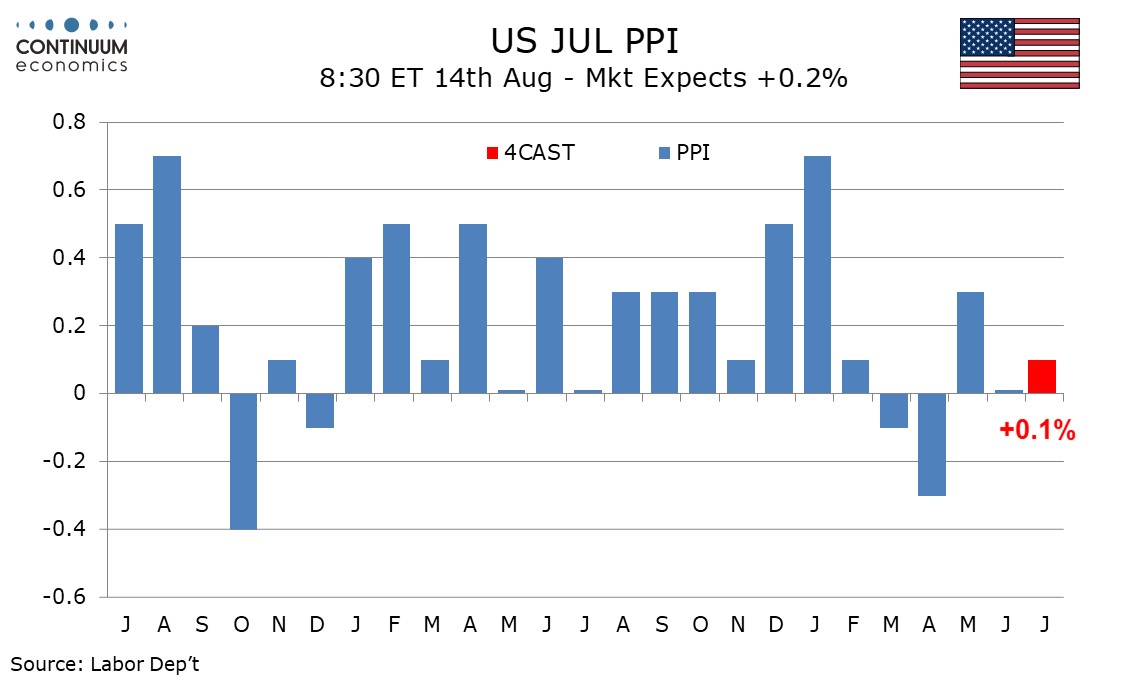

US data focus will be on inflation. On Tuesday we expect July CPI to rise by a slightly slower 0.2% overall but with a slightly stronger 0.3% ex food and energy as the impact of tariffs gradually feeds through. On Thursday we expect July PPI to be subdued on the month, with gains of 0.1% overall and ex food and energy, but most recent months have seen subdued outcomes offset by upward back month revisions. Other releases on Tuesday are July’s NFIB small business survey and July’s budget. Thursday also sees weekly jobless claims. Fed’s Barkin will speak on Tuesday, Wednesday and Thursday. Fed’s Goolsbee and Bostic speak on Wednesday.

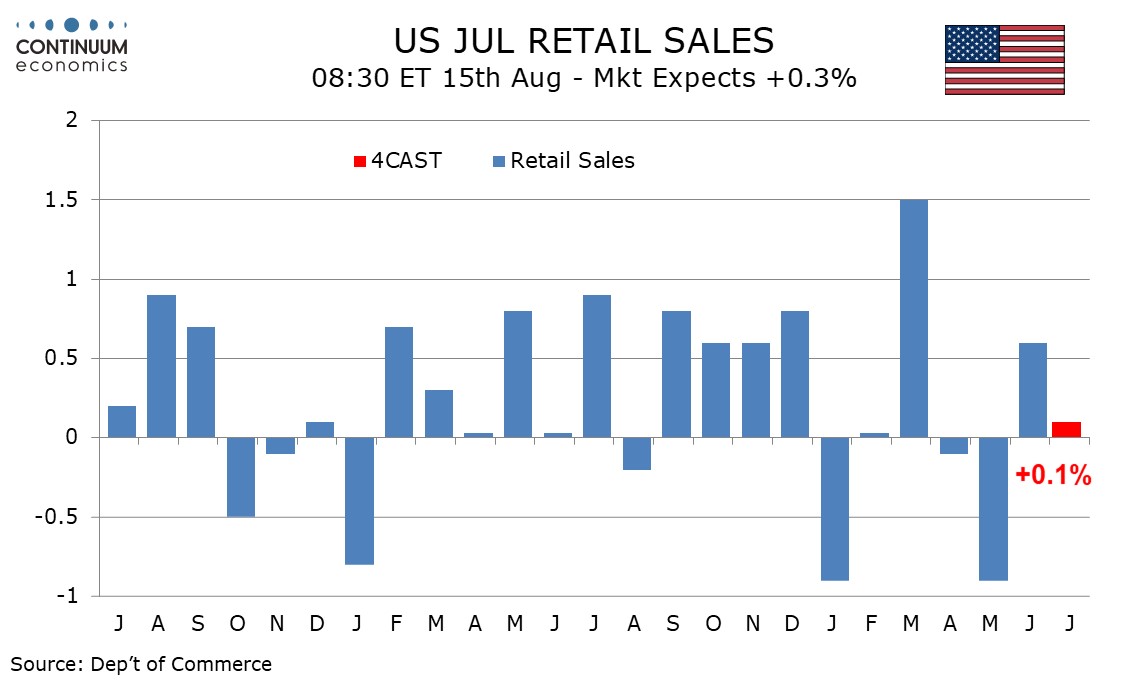

Friday has a busy data calendar. We expect a subdued July retail sales report, with a 0.1% rise overall, 0.1% decline ex autos and an unchanged outcome ex autos and gasoline. July import prices and August’s Empire State manufacturing survey will be released with the retail sales report. July industrial production follows, where we expect a 0.3% rise overall with manufacturing u by 0.1%. Later we will see the preliminary August Michigan CSI, where inflation expectations will be closely watched, and June business inventories, for which existing data suggests a rise of 0.2%

Canada

Canada releases June building permits on Tuesday. Friday sees June manufacturing shipments and wholesale sales, for which preliminary estimates were for respective gains of 0.4% and 0.7%. July existing home sales are also due.

UK

Tuesday sees ever-more important labor market numbers where apparent wage resilience has perturbed some MPC members. But this data release, now encompassing updates not just from the long-standing ONS but also real time figures from the HMRC (which we suggest are more authoritative data) is likely to see further clear drops in the official earnings data of up to 0.3 ppt at least for overall pay – a smaller drop for regular earnings. Otherwise, the HMRC numbers are likely to show that employment is continuing to contract and maybe more broadly so, such data possibly taking greater precedence than CPI numbers for most MPC members. Moreover, REC labor market survey data (Mon) may add to signs that the sector is loosening fast, having last month pointed to not only weaker pay pressures, falling job rolls and also a steep rise in those looking for work!

As for other data, Thursday sees monthly and quarterly GDP figures. There are some better signs as far as June GDP is concerned, not least it having been the warmest even such month in England. But we see only a 0.1% m/m rise, even with slightly better property and retail signals for the month. However, such an outcome, while a contrast to the two successive declines in the previous months, hardly alters what is at best a feeble real activity backdrop that may actually be weaker than the near flat underlying picture seen by the BoE. Such a June result would mean Q2 GDP at around 0.1% q/q, higher than we thought a month ago, but less than half of current BoE thinking. The same data sees RICS housing market survey data, the question being whether this add to gloomier signs for the sector.

Eurozone

No ECB updates arrive as Council members attend beaches instead. Datawise, after Thursday’s Q2 GDP update, alongside there is an important update on industrial production likely to be quite solid. Otherwise German ZEW data (Wed) may move improve further, but may be one of the first insights into how the recent EU trade deal is being considered.

Rest of Western Europe

There are key events in Sweden, including Thursday’s final CPI data that help explain the upside surprise seen in the flash numbers. In Norway, although surprised, we thought the Norges Bank’s unexpected easing in June was very much warranted, as are the further cuts being flagged in the Monetary Policy Report (MPR) that came alongside – ie two more such moves by end year. We accept that the Board is unlikely to surprise markets again with a cut at the looming policy verdict on next Thursday, especially given the fresh weakness in the currency since that surprise cut. This is in spite of more downside inflation surprises. As for the latter, July CPI data arrive on Monday and we see the CPI-ATE measure dropping a notch from June’s 3.1%. Finally, on Friday, Switzerland sees flash (sport adjusted) Q2 GDP which we see being flat q/q.

Japan

Preliminary Q2 GDP will be released in early Friday. It is widely expected that the Japanese economy will return to growth in Q2, despite U.S. tariff threats. Yet, the growth is likely very modest given real wage staying negative, dragging the recovery in consumption. A surprise contraction may keep BoJ’s hike at bay in the coming meeting. Else, we have PPI on Wednesday and we forecast a continual read above 2% y/y.

Australia

The RBA interest rate decision will be announced on Tuesday. We forecast the RBA to cut by 25 bps given the current inflationary dynamics. RBA has signalled they are taking it easy on rate cut to assess the cumulative effect of easing. But with trimmed mean CPI also edging closing to the mid point of target range, the RBA would be more comfortable in rate hike. It would be a hawkish surprise if the RBA does not cut or indicate they do not see another cut till 2026. On Wednesday, we will have the wage price index, which is more important than the employment data on Thursday. Australian labor market has been choppy but remain solid, and the crucial wage/employment dynamic has not been perfect for the past year.

NZ

Business PMI and food price index on early Friday. Mostly tier two release.