This week's five highlights

Trump Tougher Posture with Russia

And His Barrage of New Tariffs

Are Dragging the DXY Lower

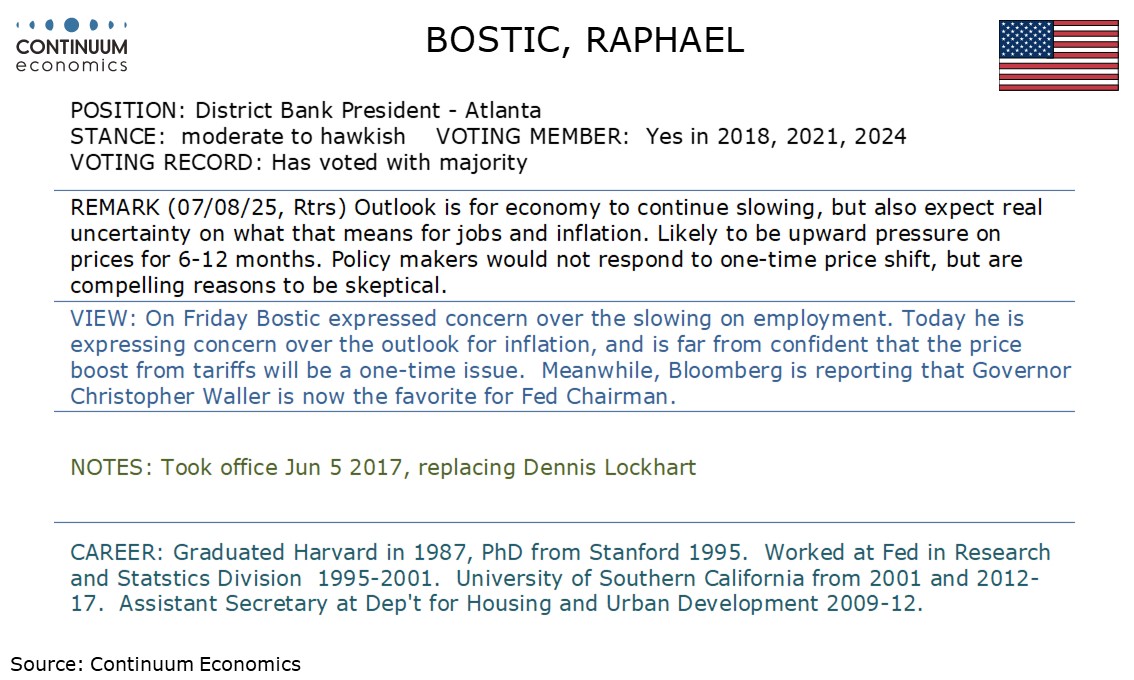

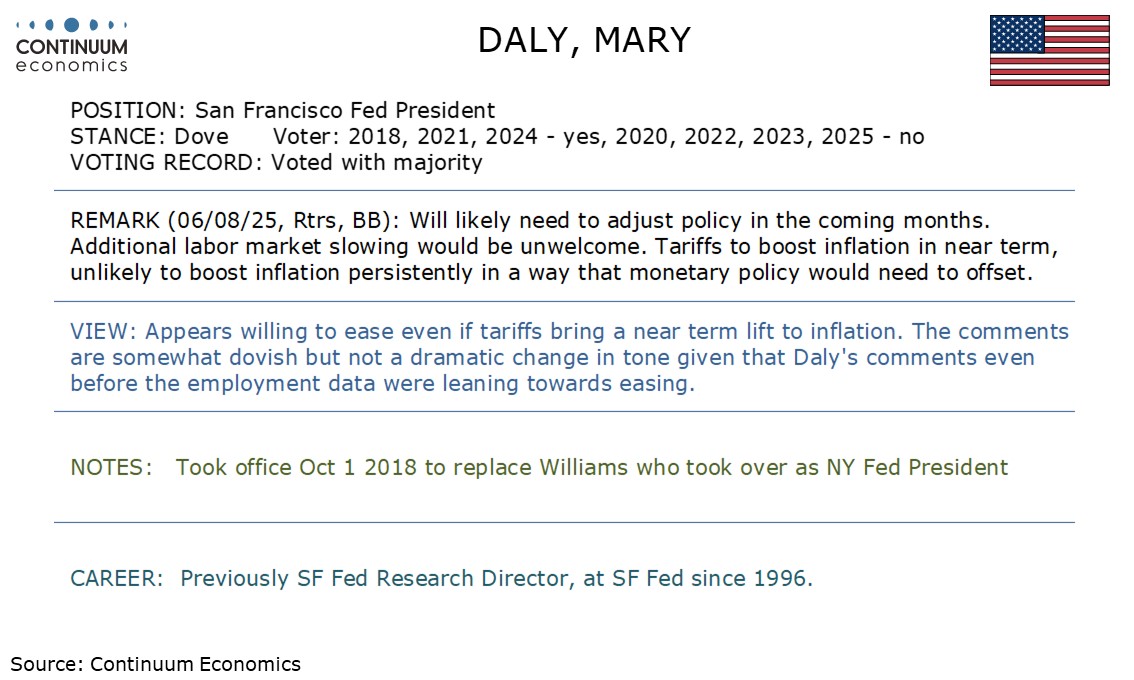

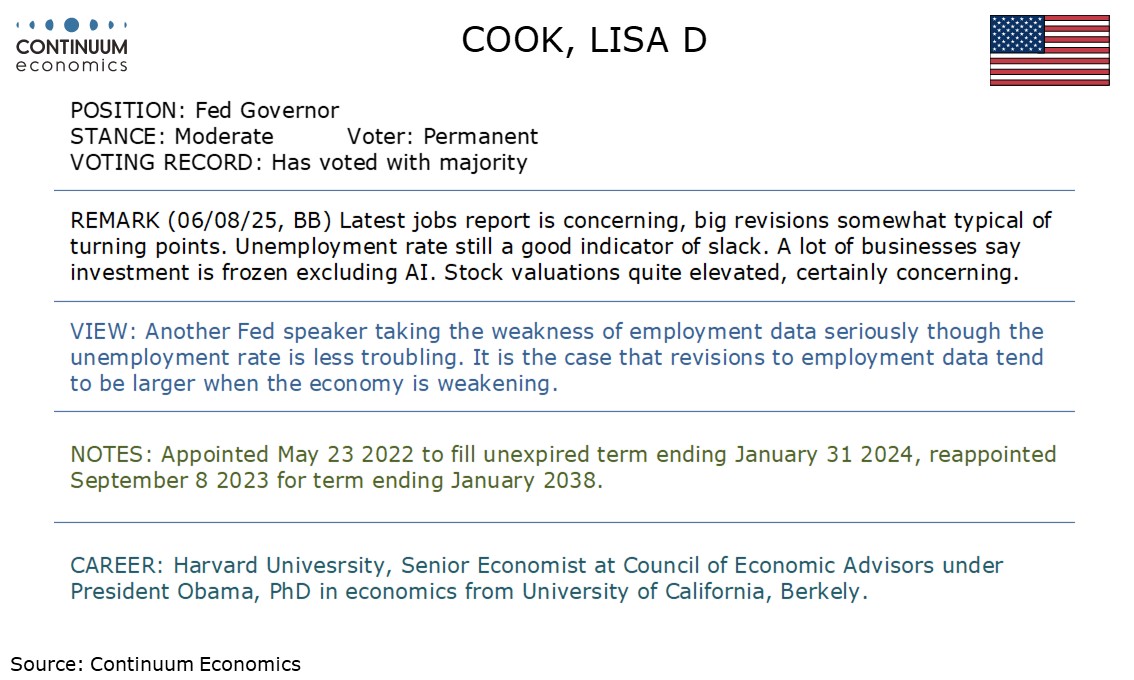

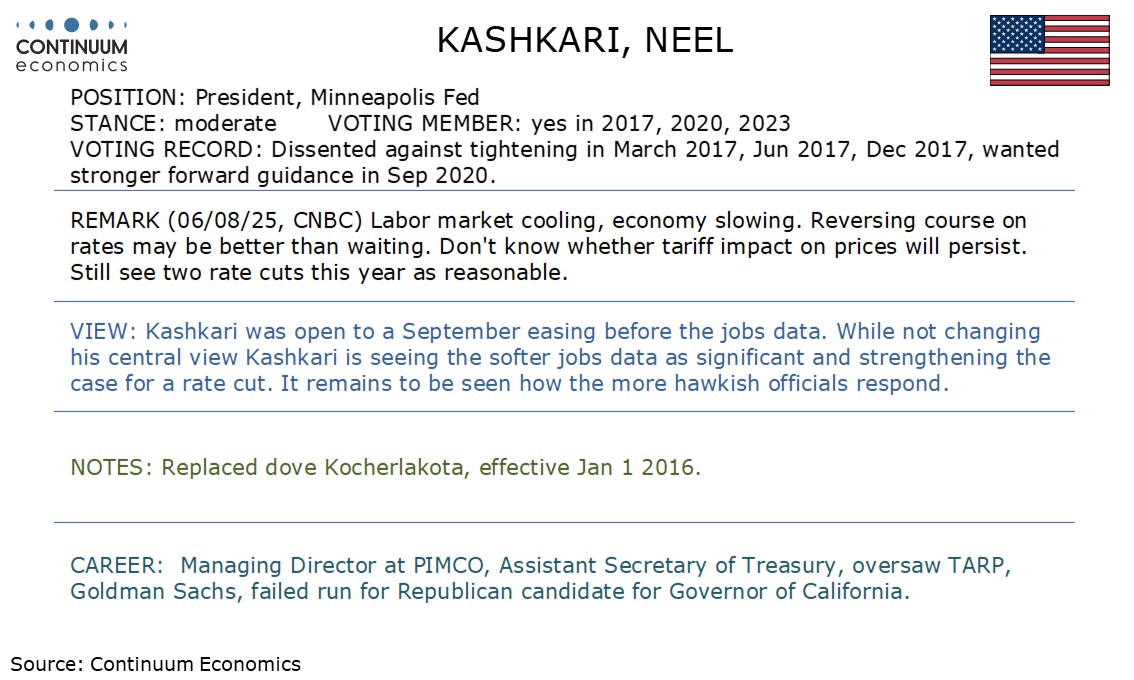

This Week's Fed Speakers

Trump Tougher Posture with Russia

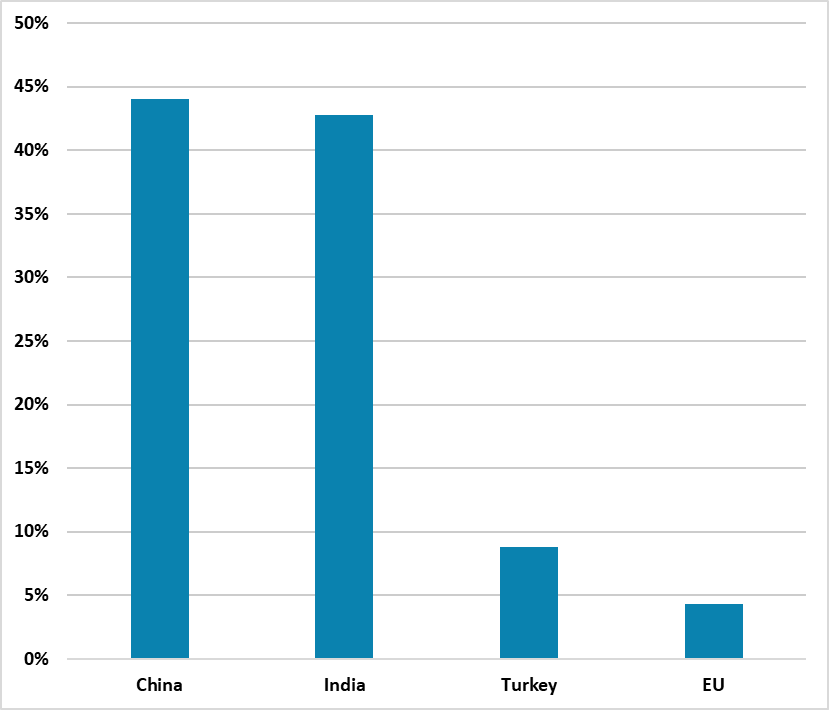

Figure: Russian Crude Oil Exports (%)

We suspect that Trump will not follow-through with an across the board secondary sanction on importers of Russia oil, as it would freeze U.S./China trade again and could boost U.S. gasoline prices – high inflation is one main reason for Trump’s softer approval rating. Trump could agree a face saving set of new peace talks or more moderate tariffs directly on Russia. An extra trade tax on India is possible, but not certain. Trump has effectively set a deadline of August 8 for Russia to agree a ceasefire with Ukraine, which is highly unlikely to happen given President Putin reluctance. It is still possible that Putin could launch new peace talks that provide an opportunity for Trump to claim success and de-escalation then occurs over the remainder of August. Reports suggest that U.S. special envoy Witkoff may travel to Moscow to meet Putin August 6 or 7. We would view the shifting of two U.S. nuclear submarines as posturing.

However, Trump could decide that he needs to act tough with Russia and impose new sanctions on Russia. One option is reciprocal tariffs, which has not yet been imposed on Russia. However, this would be largely symbolic, given the small direct U.S. trade with Russia. An aggressive approach would be to impose secondary sanctions of all goods from countries that buy Russia oil (Figure) at a supplementary rate of say 25% or 50%. This is disruptive if it includes China as it would go back to the April freeze in U.S./China trade and the reduction in China rare earth minerals exports from China. Trump and his team have also been signaling a desire to do a trade deal with China and extend the August 12 deadline. The EU oil purchases are solely Hungary and Slovakia and Trump is friendly with their leaders. Turkey is the 3rd main purchaser of Russian crude oil, but Trump has a good and close relationship with Turkey’s president.

As we all know, the tariff man does not sleep. This week we have potentially new tariffs on chip, semiconductor, gold and Russian oil. Neither of them are going to have a minor impact towards the broader market. We will have to wait for more clarification from the man himself. On the other hand, it is clarified all items from Japan will be subject to the 15% tariff only, contrary to previous report that the 15% tariff is additional. While India has responded firmly to US tariff escalation, defending its strategic autonomy on Russian oil and domestic market protections. The economic hit is manageable, but the geopolitical signal is clear: India won’t yield under pressure. Talks will continue, but New Delhi won’t trade core interests for lower duties.

The India–US trade relationship has entered its most challenging phase in recent memory. The imposition of a sweeping 25% tariff on Indian exports to the US by President Donald Trump, effective August 1, 2025, marks a significant escalation in bilateral economic tensions. But beneath the trade spat lies a deeper geopolitical gambit—one that India is increasingly unwilling to play by Washington’s rules. At the centre of the conflict are two flashpoints: India’s imports of discounted Russian crude and its refusal to grant the US broader access to its agriculture and dairy markets. Both issues have long rankled Washington, but Trump’s decision to wrap them into punitive trade measures reflects a new, more coercive posture. He declared the tariffs were a response not just to India’s “high tariffs and non-monetary trade barriers,” but also to its continued military and energy engagements with Russia, despite the war in Ukraine.

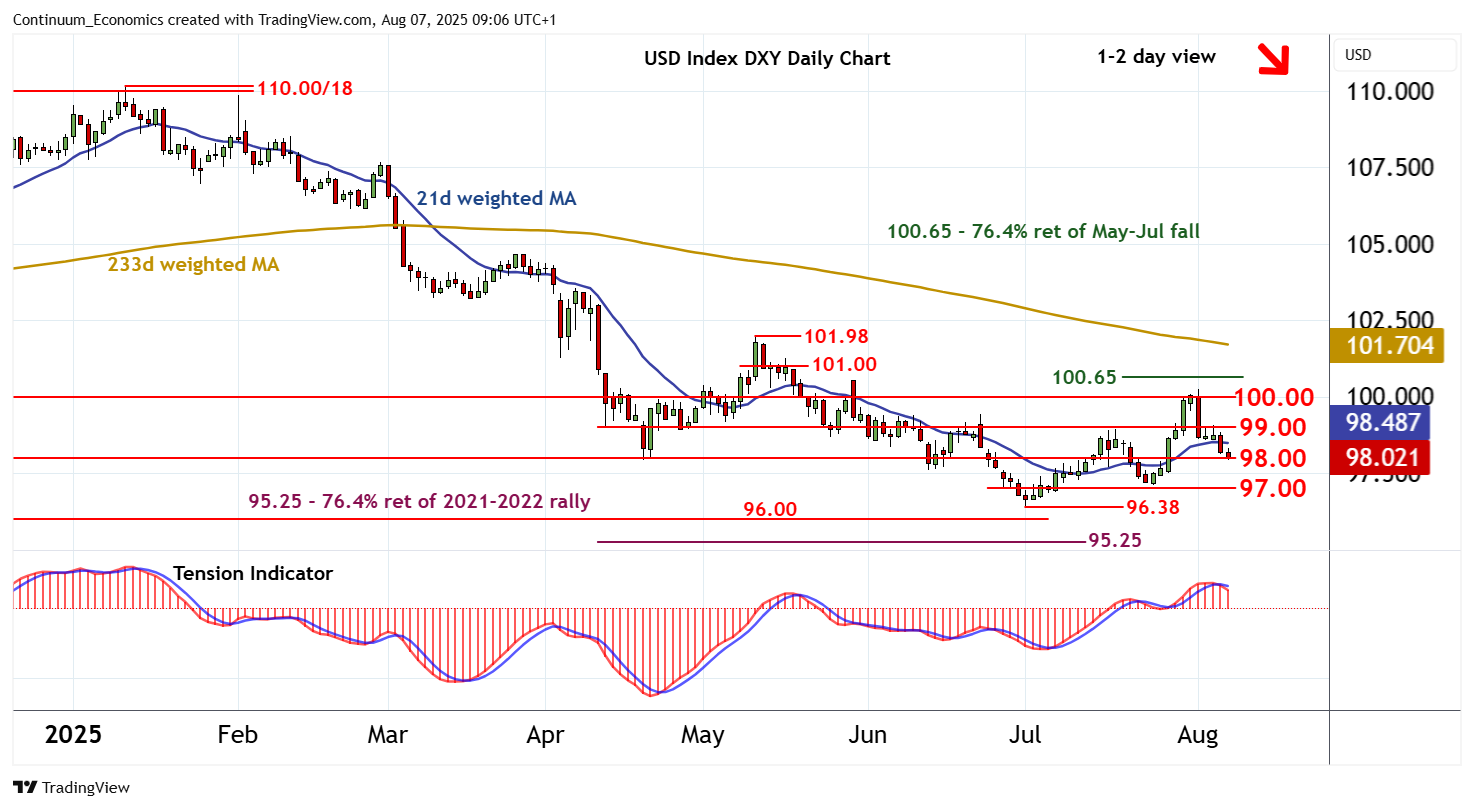

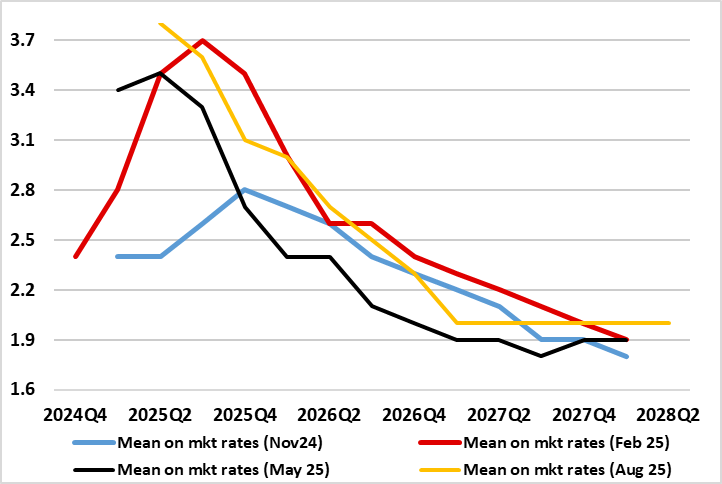

Trump's tariff policy has been dragging the USD lower, along with his frequent comment to undermine the power of Fed chair Powell. The DXY has been on a solid downtrend since the beginning of the year and looks set to continue. Occasional dead cat bounce is quickly dissipated by Trump's call of lower rate. With the next cut almost locked in, what will be the next leg in the greenback will likely be forward guidance along the next cut. CPI in the meantime will also be critical, as market is hrad to forecast inflationary pressure from all kinds of tariff Trump is creating and dissolving.

On the chart, cautious trade is giving way to a drift lower, as intraday studies turn down, with prices currently pressuring congestion support at 98.00. Daily readings have turned down and overbought weekly stochastics are also under pressure, highlighting a deterioration in sentiment and room for further losses in the coming sessions. A break below 98.00 will open up congestion around 97.00. But by-then oversold daily stochastics should limit any initial break in consolidation/short-covering above critical support at the 96.38 current year low of 1 July. Meanwhile, resistance remains at 99.00. An unexpected close above here will help to stabilise price action and prompt consolidation beneath congestion around 100.00.

Figure: BoE Projections No Longer Suggest Inflation Below Target

The widely expected 25 bp Bank Rate cut (to 4% and the fifth in the current cycle) duly arrived although the anticipated three-way split on the MPC was not quite as expected. It is puzzling how policy makers, faced obviously with both the same array of data and the same remit, can think so relatively disparately. This partly reflects the alternative scenario building that now lies at the heart of policy thinking and which effectively demotes the baseline inflation projection’s importance. This very much complicates the policy outlook. Admittedly, familiar policy guidance (policy to be framed carefully as well as gradually) was offered but this surely masks similar divides that led to the dissents. More notably, the policy outlook is clouded even more than normal as the updated and somewhat higher CPI forecast (Figure) cannot encompass several likely downside risks, most notably a likely fiscal tightening of almost 2% of GDP looming. Thus, the message from those projections, may be far from authoritative, if not outright misleading but what we consider to be (still) too optimistic on growth.

After what was widely considered to be a dovish hold at the last (June) MPC meeting, many will regard this to be hawkish cut. In a notable quirk, there were four dissents in favor of no move – MPC member Taylor preferred a 50 bp cut but shifted to 25 bp in order to reach the eventual 5:4 majority. As for assessment, in what was a real activity picture that has changed little in the last three months, there was seemingly little heed paid to much weaker labor market data late (especially outside of the official numbers) and also ever weaker consumer signs that question the BoE’s assertion about high household savings.