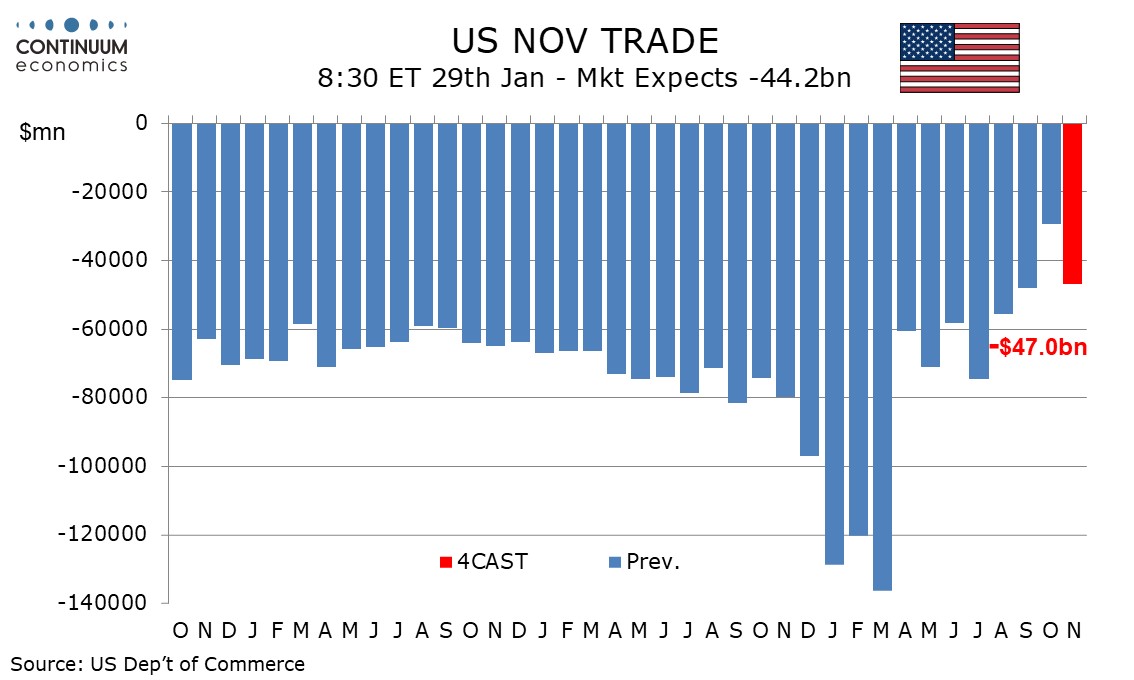

Preview: Due January 29 - U.S. November Trade Balance - Narrower October deficit looks unsustainable

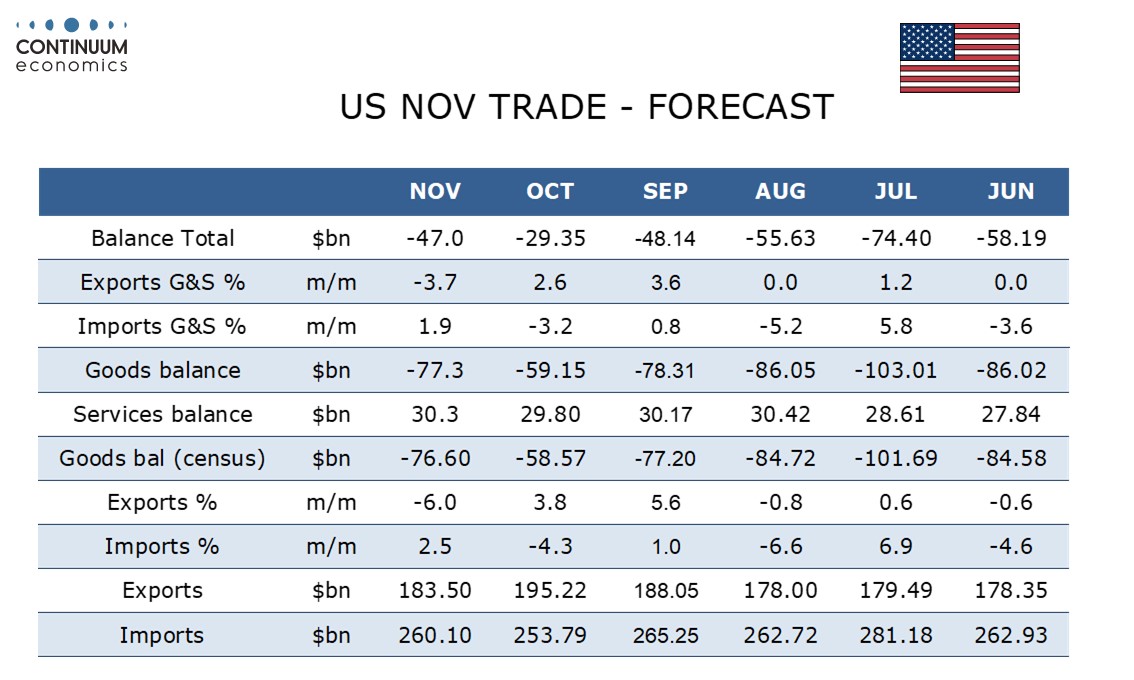

We expect a November trade deficit of $47.0bn, up from October’s $29.35bn which was the lowest since June 2009 and which looks unsustainably low, but still slightly narrower than September’s $48.14bn, which was itself the narrowest since March 2020.

The sharp narrowing in October’s deficit came largely from a second straight sharp rise in exports of nonmonetary gold, and a sharp fall in imports of pharmaceutical preparations which more than fully reversed a strong rise in September. While it is far from certain that data will return to underlying trend as soon as November, such a move would see a sharp fall in goods exports reversing most of the September and October gains, and goods imports somewhere between the levels of September and October.

We expect goods exports to fall by 6.0% after gains of 5.6% in September and 3.8% in October while goods imports rise by 2.5% after a 4.3% fall in October that followed a 1.0% increase in September. Price gains will contribute around 0.5% to the November gains in each series. We expect service exports to rise by 0.5% after a 0.7% October gain while service imports rise by 0.1% after bouncing by 1.4% in October, leaving overall exports down by 3.7% and overall imports up by 1.9%.

It will be some time before the underlying trade picture becomes clear given continuing volatility in policy but it is likely that the deficit remains below underlying trend after surging in Q1 ahead of the tariffs. The average deficit in the first 10 months of 2025 is $78.3bn, not far from an average monthly deficit of $75.3bn in 2024.