FX Weekly Strategy: Oct 27th-31st

FOMC a focus, but may well be a damp squib

BoC meeting potentially CAD positive

BoJ unlikely to hike rates, but JPY reaction likely either way

CHF strength continues to look excessive

Strategy for the week ahead

While Wednesday’s FOMC meeting will be a focus this week, it’s hard to see it producing any real surprises, as a 25bp easing is fully priced in, there are no updates to the dots, and the Fed have limited information to go on since the last meeting due to the lack of data released because of the government shutdown. More interesting will be the BoC meeting on the same day, which is more in the balance, and the BoJ meeting on Thursday, with Thursday’s ECB meeting also looking unlikely to be market-moving.

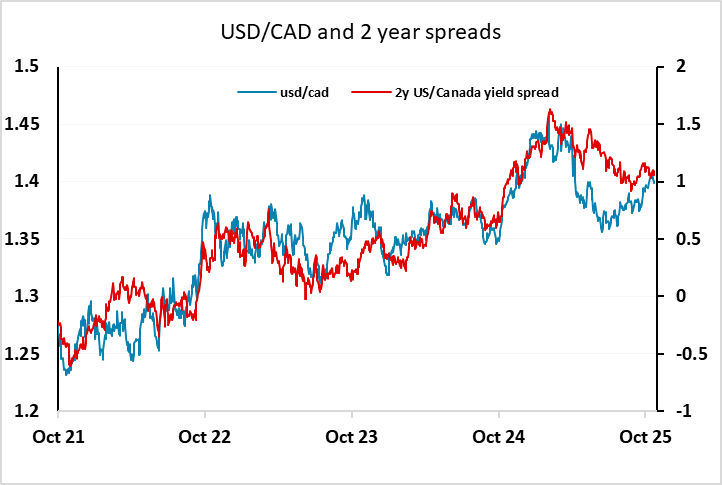

While we do not believe the Bank of Canada is done with easing, we expect the October 29 meeting to see rates left on hold at 2.50% given that most recent data have been on the firm side of expectations, though not strong enough to rule out a move. A pause in October would follow easing in September, which was the first easing since March after pauses in June and July. As it stands, the market is pricing a 25bp easing as an 82% chance, so our call for no change could be expected to trigger a significant CAD rally, even though we see it is a cut delayed rather than cancelled. If rates are left on hold, we would expect USD/CAD to break below the 1.40 level, although it will still be hard to generate much downside momentum if the BoC give the impression that they are likely to cut at the December meeting. There are only 40bps of cuts priced by the end of 2026, so whether the first 25bps comes in October or December is of limited significance.

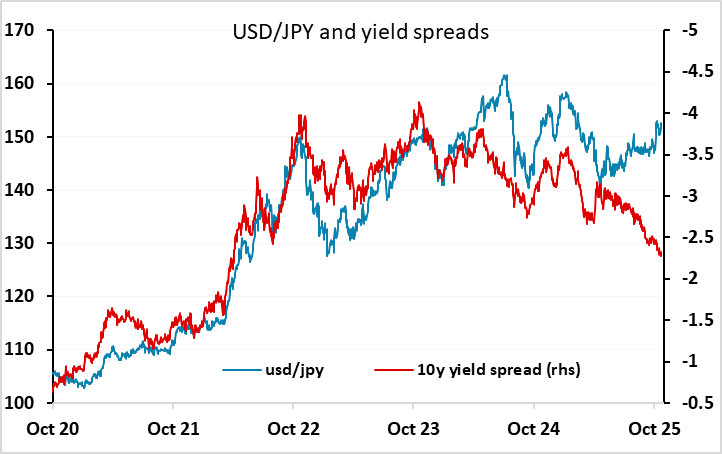

The BoJ is potentially even more interesting, as there has been substantial speculation about their policy stance under the new PM Takaichi. The BoJ is legally independent, so has no obligation to follow the desires of the new PM. However, there has been a general expectation that they will leave rates on hold at this meeting in part to avoid immediate conflict with a government that is perceived to want easy monetary policy, in part to wait to see what new fiscal policies are going to be implemented. The government’s policy on the JPY is also potentially significant. We wouldn’t rule out the possibility of a BoJ hike, in part because the JPY has been so weak since Takaichi became LDP leader, increasing inflationary pressure. The expectation of easy fiscal policy also suggests there is scope for tighter monetary policy. But in all probability rates will be left unchanged as BoJ governor Ueda has indicated he doesn’t see much downside to delaying rate hikes, although that view could have been challenged by the recent weakness of the JPY. Nevertheless, any comments from Ueda on future policy will potentially be significant. Coming into the meeting, there might be some paring back of short JPY positioning due to the risk of a sharp JPY rally if rates are hiked, but if rates are left unchanged as expected USD/JPY could press on towards the retracement target at 154.40.

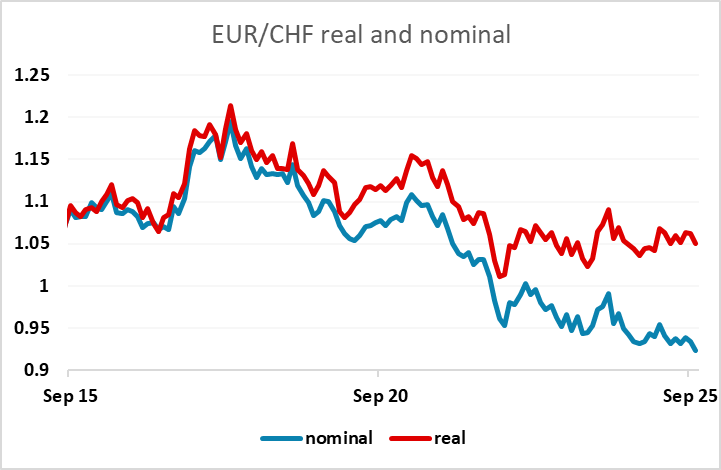

For most European currencies the picture looks more neutral. Risk sentiment remains reasonably positive, with the PMIs last week suggesting some improvement in growth prospects, even though the divergence between French and German PMIs is a mild cause for concern. The USD index continues to broadly follow the path seen under the first Trump administration, and this suggests we could see a rangy picture in EUR/USD until the end of the year. The CHF stands out as the strongest of the European currencies, having tested the lows just above 0.92 that have market the bottom for EUR/CHF over the past year. The November low of 0.9204 is the all time low if the 2015 spike low is excluded. While the CHF is slightly less strong than this suggests in real terms, it is nevertheless by some way the strongest currency in the G10 world relative to PPP, despite zero rates and a generally risk positive environment. Divergence within the Eurozone between French and German growth could be seen as a CHF positive factor, as there is some correlation between EUR/CHF and intra-Eurozone yield spreads. But it’s hard to see the case for a break to effective new all time lows at this stage, so EUR/CHF should be near a bottom.

Data and events for the week ahead

USA

The key event in the US is Wednesday’s FOMC meeting. A 25bps easing looks likely despite continued inflationary concerns and uncertainty on the extent of the downside economic risks given the absence of key economic data. The statement is unlikely to give much forward guidance and the dots will not be updated at this meeting. Fed’s Logan will speak on Thursday while Logan, Hammack and Bostic will speak on Friday.

Private sector data that will be released include manufacturing surveys from the Dallas Fed on Monday and the Richmond Fed on Tuesday, October consumer confidence on Tuesday and September pending home sales on Wednesday. Should the government shutdown be resolved one of the first delayed releases likely to appear will be September’s non-farm payroll. Despite a negative ADP report, we continue to expect a modest increase of 45k. Before the shutdown, this week’s data highlight would have been Q3 GDP on Thursday, but even if there is a resolution that release is highly unlikely to be released on schedule, with several key inputs still needed.

Canada

The Bank of Canada meets on Wednesday and while it is a close call, we expect recent stronger than expected, if far from strong, data will see the BoC keeping rates on hold at this meeting, following a 25bps easing to 2.5% in September, though we do not believe that September’s easing will be the last. The BoC will update its economic forecasts at the meeting. The most significant economic release will be August GDP on Friday, which we expect to be unchanged, in line with a preliminary estimate made with July’s data, which rose by 0.2% after three straight declines through Q2.

UK

The week ahead has little interesting data wise albeit including BoE money and credit data (Wed) where housing market volatility and distortions may again be the order of the day but with further signs of an underlying weakening as may be evident in Nationwide house price data due later in the week.

Eurozone

Several important updates are due this week. The main focus will be the ECB verdict on Thursday. As with recent Council meetings, what is important when the ECB gives its (almost certain) stable verdict, is not what it says. Instead, in particular, it is how much the impression is left that the easing window has not closed. The ECB is clearly split about whether policy has troughed or not, this mainly a result of differences within the Council as to where inflation risks lie. But we feel that even if our call that a further rate cut may occur at the final Council meeting this year (Dec 17-18) proves wrong then this merely defers what we still see up to 50 bp of easing through H2 next year. Moreover, the ECB will be loath to suggest that the next move is more likely to be hike, not least as it may be reassessing an economic picture that it not as resilient as it has widely suggested and be wary that any such hints could turn current budget worries into a genuine fiscal crisis in parts of the EZ.

In this regard, the October ECB meeting will be influenced by a series of economic released due in the immediate period ahead. First, Tuesday’s updated bank lending survey will play an important role in shaping ECB thinking this month, not least as it suggested in the last two assessments that for firms with perceived risks related to the economic outlook continued to contribute to a tightening of credit standards. And importantly, any such concerns raised by banks may already be having a tangible negative impact. Indeed, while official credit growth data showed adjusted credit growth stable at 2.8% y/y, this masked a clear m/m softening, in both households but particularly non-financial company credit and it will be interesting whether the September money and credit data (Mon) continues this weaker trend. This help explains the still weak and likely even weaker economic backdrop to come, something that the third piece of important data next week may see, namely Q3 GDP (Wed-Thu). We see a flat q/q outcome for the EZ with the usual divergences among the member states.

Otherwise, there is more survey data from the ECB on consumer expectation and the German IFO update (both Mon) and the European Commission (Thu) and what may be another rise in the jobless rate due the same day. More labor costs data arrives on Tuesday in the form of ECB compiled negotiated wages. And the week end with flash EZ HICP on Friday, preceded by German numbers (Thu) where we see a drop back in these October numbers to 2.2%. As for the EZ HICP we see it falling back to 2.0%, if not a notch below and partly driven by lower services inflation to fresh cycle low of 3.0%!

Rest of Western Europe

There are a few key events in Sweden, most notably the GDP monthly indicator (Wed) and then the Economic Tendency Survey (Thu), the latter likely to remain below par. Tuesday also sees The Riksbank's Business Survey. Otherwise, in Switzerland, Wednesday sees what may still be soft KOF figures for October. Friday sees Norway release more labor market data.

Japan

The BoJ interest rate decision will be announced on Thursday. We do not expect an imminent hike from the BoJ, given the latest political uncertainty. We also expect their will be no change to any forward guidance. However, we see the current inflationary picture and price/wage dynamics supportive for a rate hike. It will be a hawkish surprise if they do so on Thursday as market have not priced in such prospect. Tokyo CPI on Friday will be of less importance this time before any political uncertainty. It is likely headline CPI to moderate further but core-core is likely more stubborn. There are also unemployment rate and retail sales on Friday.

Australia

We have the Q3 CPI for Australia on Wednesday. The monthly CPI has reached 3% in August and should drive quarterly CPI back towards the mid point of inflation target range. RBA trimmed mean may carry more weight as market believe there will be another rate cut coming, though not imminent.

NZ

Business outlook & confidence on Thursday and consumer confidence on Friday. Both tier two data.