This week's five highlights

When And How Will the U.S. Government Shutdown End

U.S.-Canada's Fragile Relationship

Firm but a little less so in core rate for U.S. September CPI

A Final and Lower Than Expected UK CPI

New Japan PM Elected

The US government shutdown is now entering its fourth week and there are no signs of an imminent solution, though once progress starts, it could gain momentum quickly. It looks likely that pressure to reach a solution will start to build in early November, though the nature of the eventual settlement remains far from clear.

Pressure to end the shutdown has so far been limited, with political focus more on progress towards peace in Gaza and the increasing use of the military in US cities. The public has been less focused on the shutdown, with many on each side having partisan opinions on who is to blame, and many others cynically resigned to government dysfunction. However, opinion polls do show the public more inclined to blame the Republicans than the Democrats. This will strengthen the willingness of the Democrats to stick to their position, which the Democratic base is demanding.

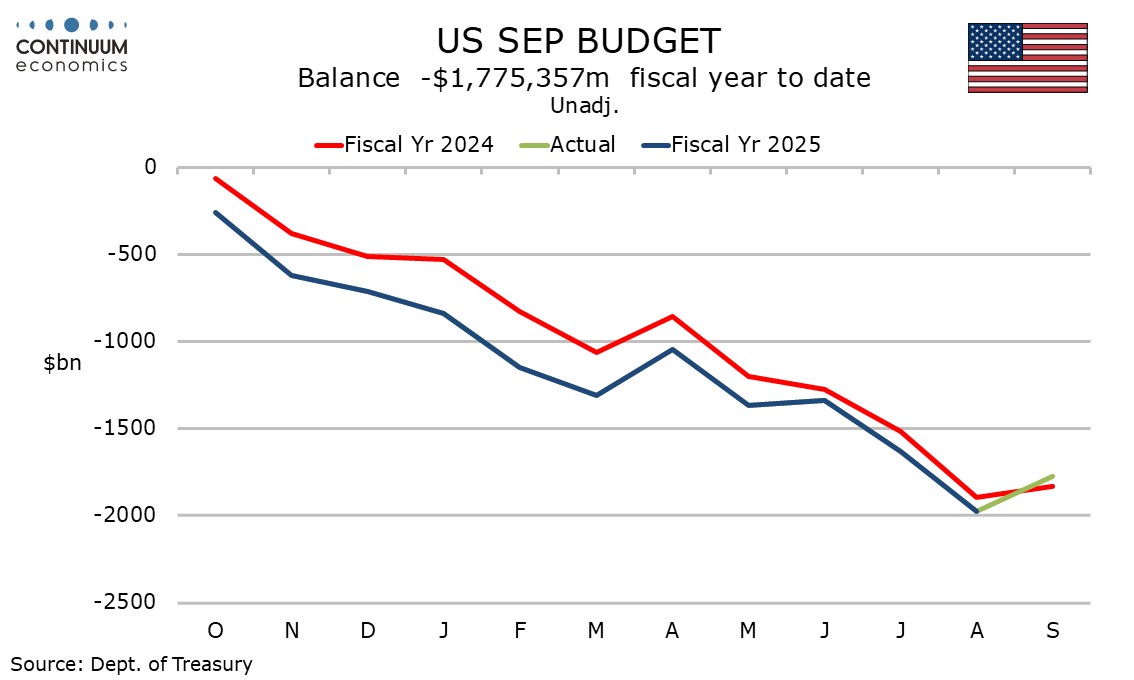

Pressure to reach a settlement is however likely to build with government workers soon set to miss their first full paycheck, though Trump is attempting to get military personnel paid. November 1 will start to see open enrollment for health insurance under the Affordable Care Act, which will see some hit by significant hikes in premiums. Democrats have chosen to make the removal of health spending cuts their central demand as these will hit many Trump voters. The cuts are of more importance to traditional Republicans worried about the budget deficit than the Trump base. It is likely the Republicans will feel some pressure to back down, but a full climb down will be too costly for them to accept, over $1 trillion over 10 years. Republicans will be unwilling to compromise on tax cuts to offset any compromises on health spending, so any settlement will probably add to the budget deficit. Eventually both sides are unlikely to get all that they want, keeping the boost to the budget deficit modest, though the deficit is already unsustainably large.

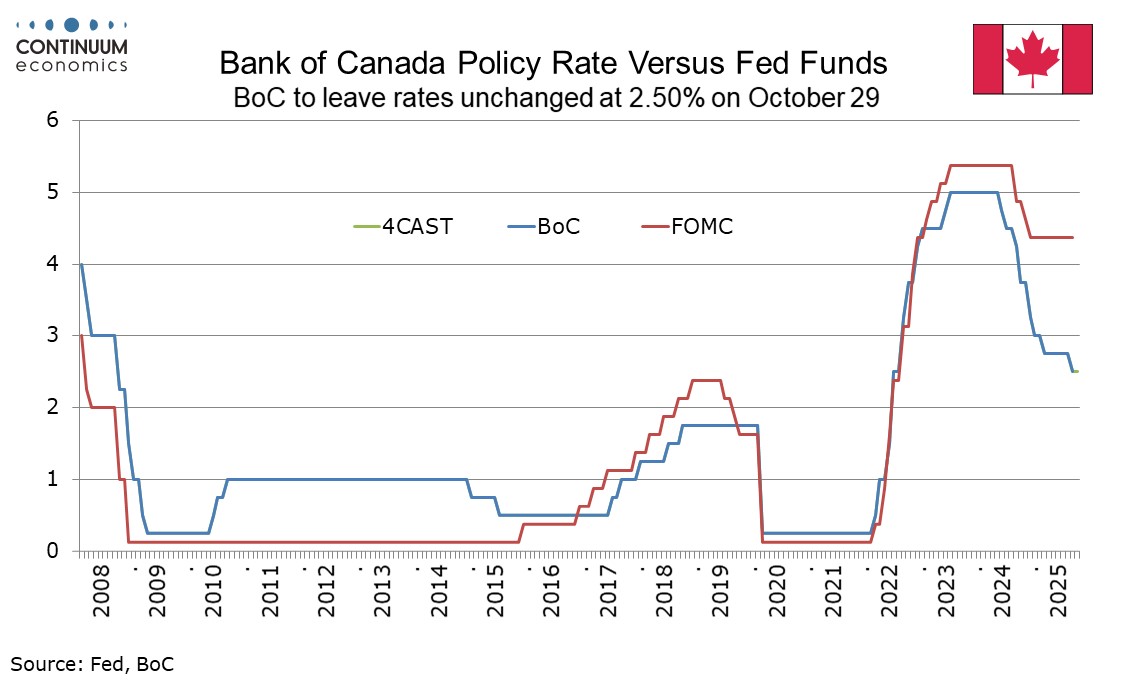

This time Canada has their elbows up by reducing tariff free quota for two U.S. carmakers. Rather than retaliation against U.S. tariffs, it seems more like a punishment as both companies have received massive government subsidy to conduct business in Canada, where they have migrated to the U.S. on tariff concern.

Nevertheless, Trump took it personally and put a stop to all trade negotiations with Canada, citing a false advertisement using Reagan's voice. Canada has failed to secure a good trading relationship with Trump in the past months and it looks like they are going downhill. Trump may not have the time to entertain Carney as he is heading to China.

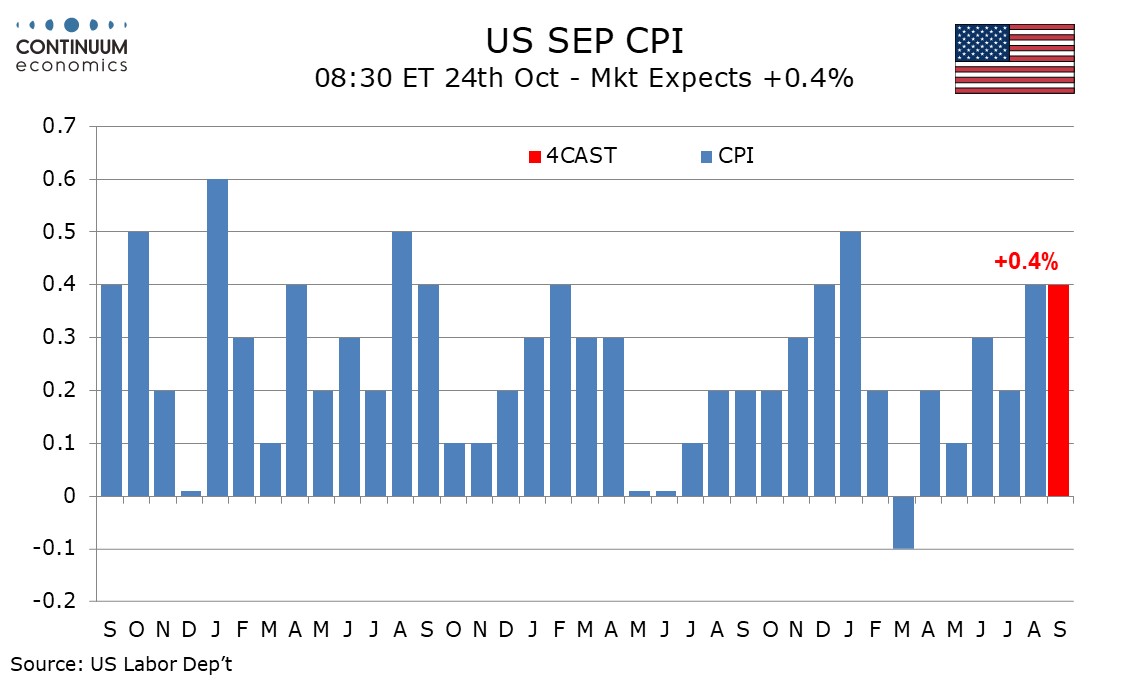

While the government shutdown continues with no sign of a near term deal, September’s US CPI, originally scheduled for October 15, will be released on October 24. The release was considered essential as it is needed for annual cost of living adjustments to Social Security benefits. It is however possible the shutdown will compromise accuracy of the release. Even before the shutdown, recent CPI releases had seen increasing numbers of inputs estimated to reduced staffing.

We expect a 0.4% increase overall in September CPI with a 0.3% rise ex food and energy, matching August’s outcomes after rounding, though before rounding we expect overall CPI to be rounded down from 0.425%, and the core rate to be rounded up from 0.28%, contrasting August data when headline CPI was rounded up from 0.38% and the core rate was only marginally below 0.35% before rounding.

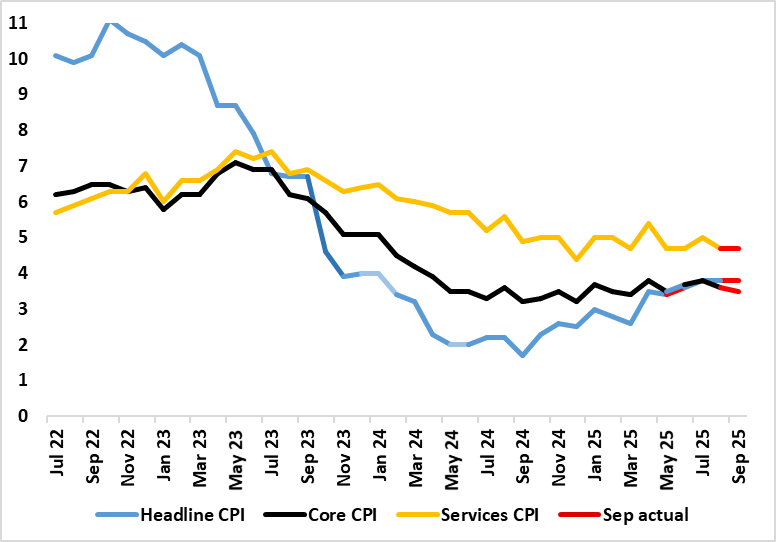

Figure: Headline and Core Nudge Lower

After the upside (and broad) June CPI surprise, CPI inflation rose further, up another 0.2 ppt to 3.8% in July, higher than the consensus but matching BoE thinking. Despite adverse rounding and fuel costs, the headline stayed there in the August figure, and did so again in September in what was a lower-than-expected outcome in what we (and the BoE) think will be the inflation peak. This September data saw the core rate drop 0.1 ppt to a four-month low of 3.5% (Figure), tempered by a belated fall in food inflation. After some further aberrant factors, services inflation in September stayed at 4.7% bolstered again by airfares. Notably, in adjusted terms of late, the recent rise in headline inflation driven more by goods but where pay deals ahead look to be much lower.

Changes in taxes and administered prices have raised headline inflation this year but are unlikely to be repeated next thereby creating favourable bae effect through 2026. This is one reason why shorter-term but adjusted m/m data are useful as they to not encompass price rises that took place months before and are unlikely to be repeated – shows a more reassuring picture for core inflation in this regard.

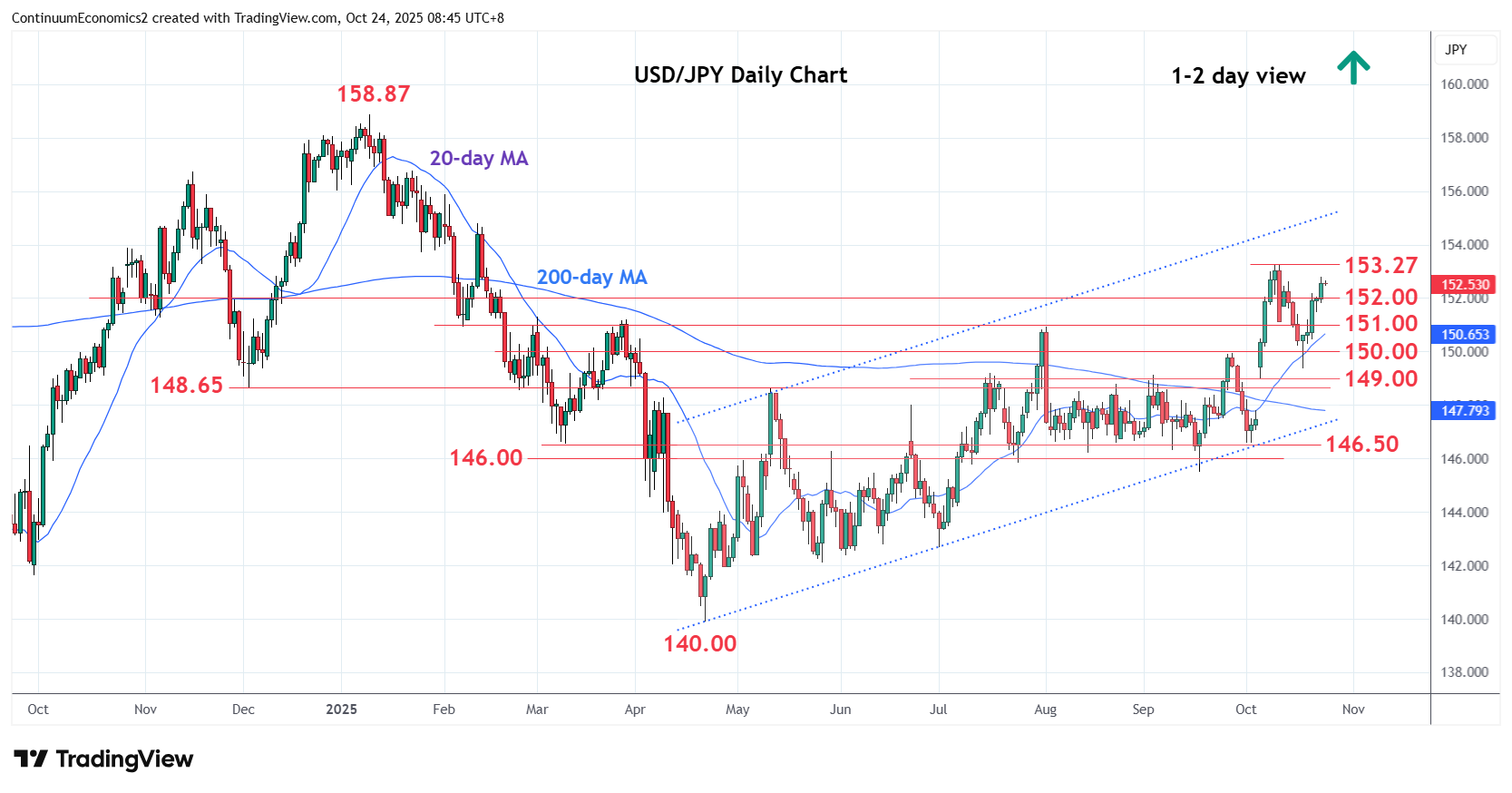

The LDP and Japan Innovation Party have reached a broad agreement to form a coalition government and is expected to announce their co-operation soon. The LDP has also reached out to the DPP but their difference seems to be too large for an imminent alliance. The Japan Innovation Party, Ishin, is only asking for a reduction of seats in the Diet, Osaka to be considered as second capital and social security reform, which seems to be more acceptable for the LDP.

Contrary to most beliefs, while we still consider Takaichi a believer of "Abenomics", the Japanese economy is different than the 2010s. The change in business price/wage setting behavior has begun and echoes with the last stage of "Abenomics" reform, thus the first two stages of massive stimulus are not necessarily to be repeated. If such reformative behavior accelerates, they could potentially be no fraction between the BoJ and new PM. Realistically, it is only fair to assume the change of price/wage setting behavior to be gradual because consumption behavior at higher prices is required for the transformation and we are only seeing moderate process in that aspect.