USD flows: USD lower on CPI

USD generally lower, AUD outperforming

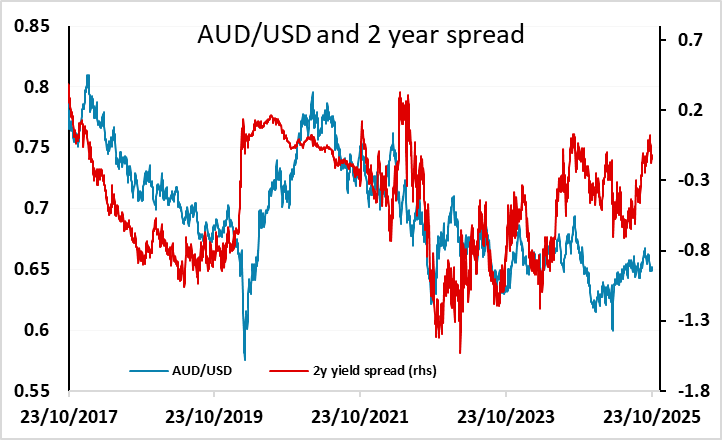

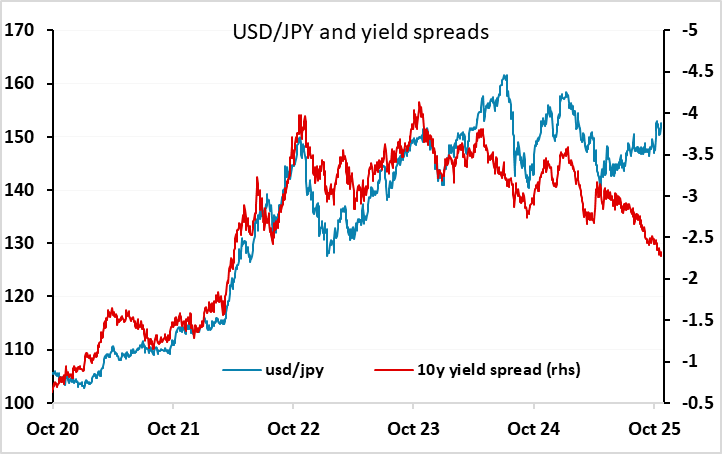

The USD is generally lower on clearly weaker than expected US CPI data, with both the headline and the core 0.1% below consensus. US yields are a few bps lower, propelling S&P 500 futures to new all time highs. USD losses have been seen across the board, with the AUD the best performer, but despite the positive equity impact, the JPY has slightly outperformed European currencies. Yield spreads have had limited influence on the USD of late, with the EUR outperforming spreads and the AUD, and particularly the JPY, underperforming, but the latter two consequently may have the most potential for gains. In practice the data doesn’t change the risks for the upcoming FOMC meeting next week. A 25bp rate cut was fully priced in already and remains so, so there is unlikely to be major followthrough.