CHF, AUD, JPY flows: CHF lower after CPI

Another big downside miss in Swiss CPI weighs on the CHF

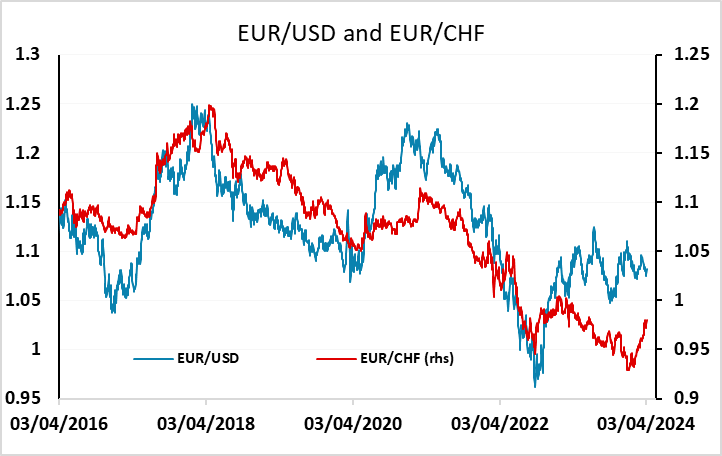

Another much weaker than expected Swiss CPI number has sent the CHF lower this morning. March saw a flat m/m change and a decline in the y/y rate to 1.0%, well below the market consensus of 1.0%. This will make the SNB comfortable with further easing and with some further weakening of the CHF. Given the low starting point of 1.5% for the policy rate, the scope for SNB easing is less substantial than elsewhere, but the yield spread has never been a good guide to the CHF, and SNB policy will likely be focused just as much on the exchange rate. The CHF already looked like the most attractive funding currency given the SNB’s preference for some weakness, the low rates and the high valuation – this will cement that perception. The 0.9842 high from June 2023 will represent initial resistance for EUR/CHF, but there is scope to move back to parity.

The general risk positive tone continued overnight in FX, with AUD/USD hitting its highest since March 21, and EUR/USD and GBP/USD at their highest since March 26. JPY crosses are similarly threatening the recent highs seen in mid-March. But other markets are more neutral, with yields unchanged to lower, and equities also mixed. There may now be some risk of corrective pressure on the riskier currencies ahead of tomorrow’s US employment report.