Brazil CPI Review: Inflation Below Expectations in June

The IBGE's June CPI figures show a 0.21% monthly increase, below market expectations. The Y/Y index rose to 4.2%, driven by increases in potatoes, milk, and coffee. The floods in the South had a minimal impact. Health and Housing saw modest rises, while core CPI remained stable. Despite potential risks from exchange rates and oil prices, we expect the BRL to stabilize, possibly allowing the BCB to cut rates, ending 2024 at 10.0%.

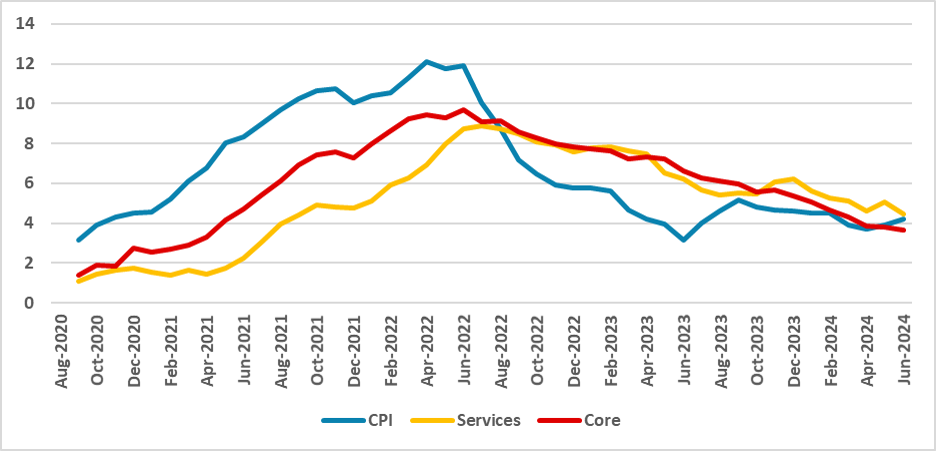

Figure 1: Brazil’s CPI (Y/Y, %)

Source: IBGE and BCB

The Brazilian National Statistics Institute (IBGE) has released the CPI figures for June. The data show that the CPI increased by 0.21% (m/m) during June, below market expectations (0.30%) according to the Bloomberg Survey. However, the Y/Y index rose to 4.2% from 3.9% in May. The biggest rise came in the Food and Beverages group, influenced specifically by increases in potatoes (14.5%), milk (7.5%), and coffee (7.4%). It seems that the overall effect of the floods in the South of the country will be marginal on the Food and Beverages group.

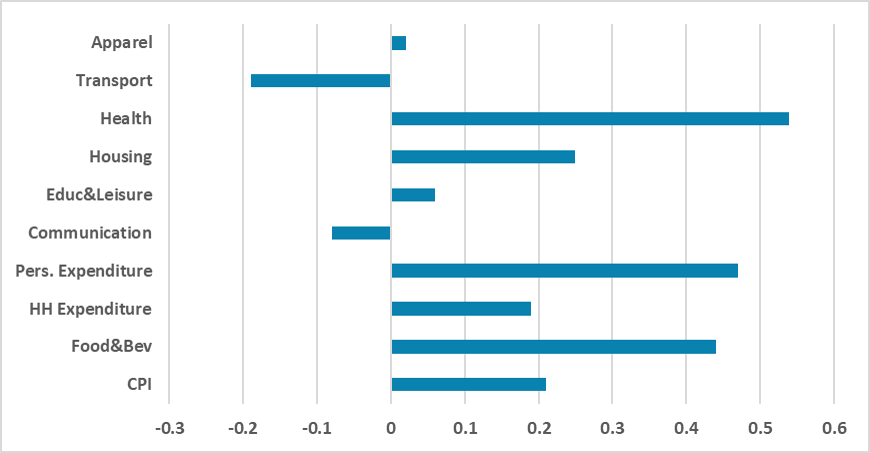

Figure 2: Brazil’s CPI by Group (%, m/m)

Source: IBGE

The Health group rose by 0.5%, mainly influenced by healthcare insurance, which adjusted their premium prices in accordance with the National Health Agency's approval in June. Personal expenditures rose by 0.5%, while Housing rose by 0.6% due to adjustments in sewer services. The good news came from analyzing the core groups. The Services CPI was stable in June, growing 0%. The average of the Brazilian Central Bank (BCB) core rose only by 0.2%, and its Y/Y index dropped to 3.6%.

The CPI results for June were positive and indicate that demand pressures from wage hikes are tending to pass. However, the risks now come from expectations and the exchange rate. We believe most of the depreciation seen in the BRL will eventually fade away, and the BRL will end the year closer to 5 BRL/USD, especially once the Fed starts cutting rates. However, oil prices will slightly increase Transport CPI in the short term. Due to base effects from the food and beverage CPI drop in the second half of last year, we see the CPI staying above 4% until December.

We believe the CPI will generate more doubts than certainty for the BCB. The BCB board has made it clear that they have stopped the cuts and will likely not resume considering cuts in their next meetings. Most market participants believe the Brazilian policy rate will be at 10.5% until the end of the year, but some even think there could be a hike. We diverge from most market views. We believe that once the BRL comes close to 5 and fears of unsustainable fiscal policy pass, there will be room for the BCB to apply two 25bps cuts to the policy rate, meaning it will finish 2024 at 10.0%.