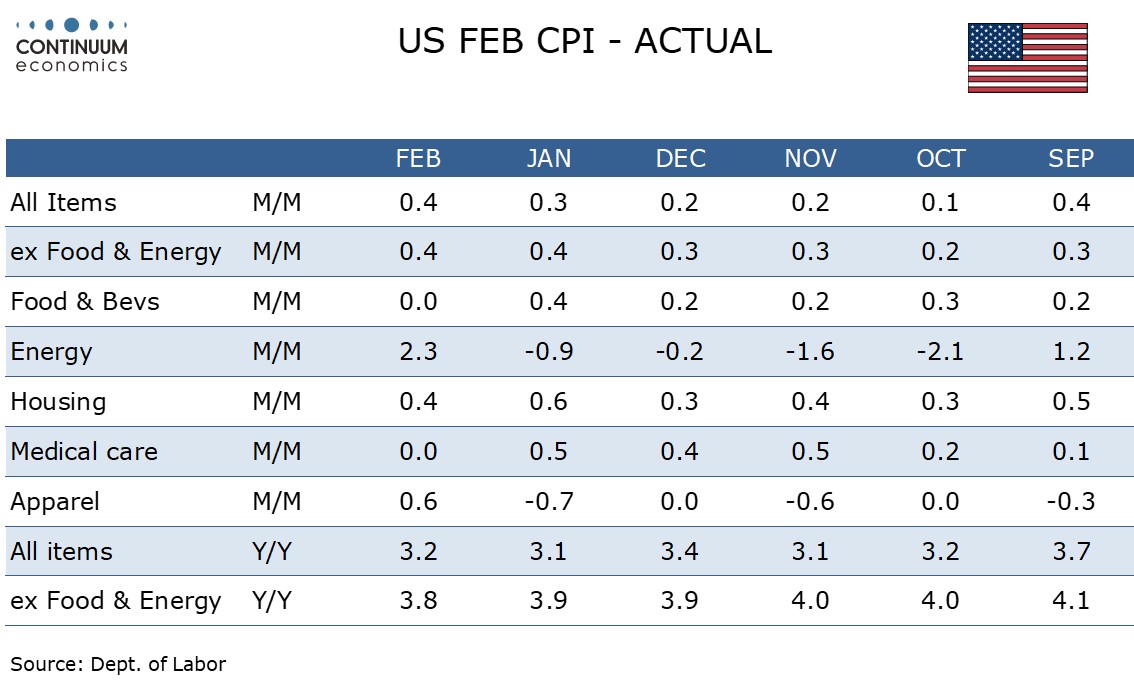

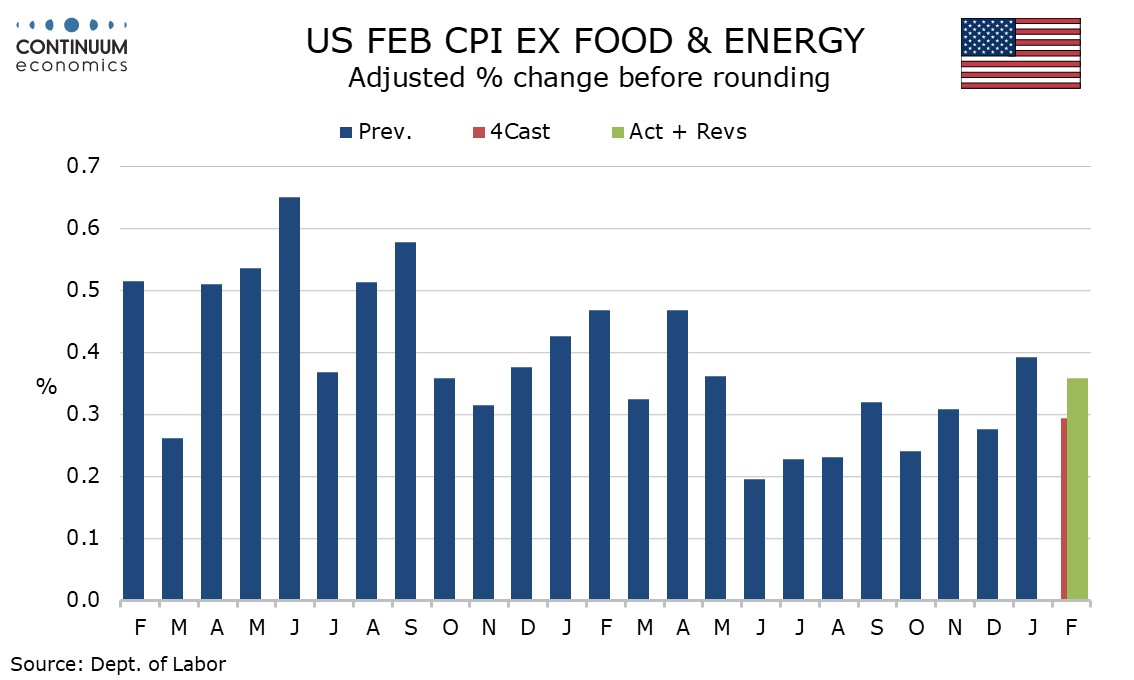

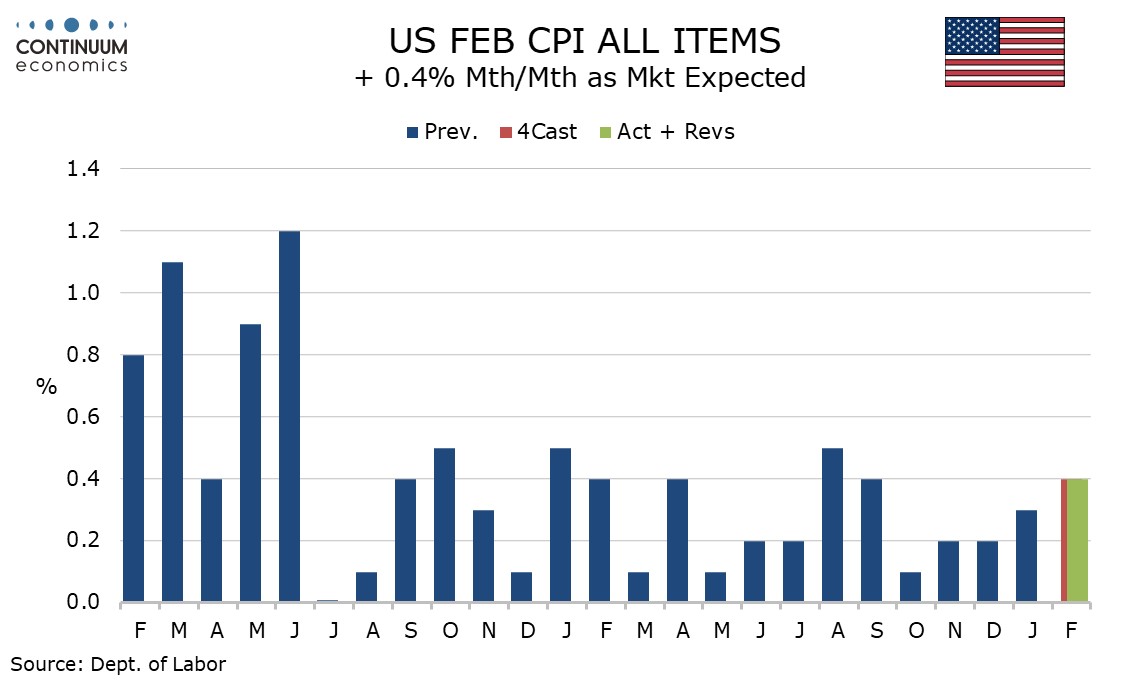

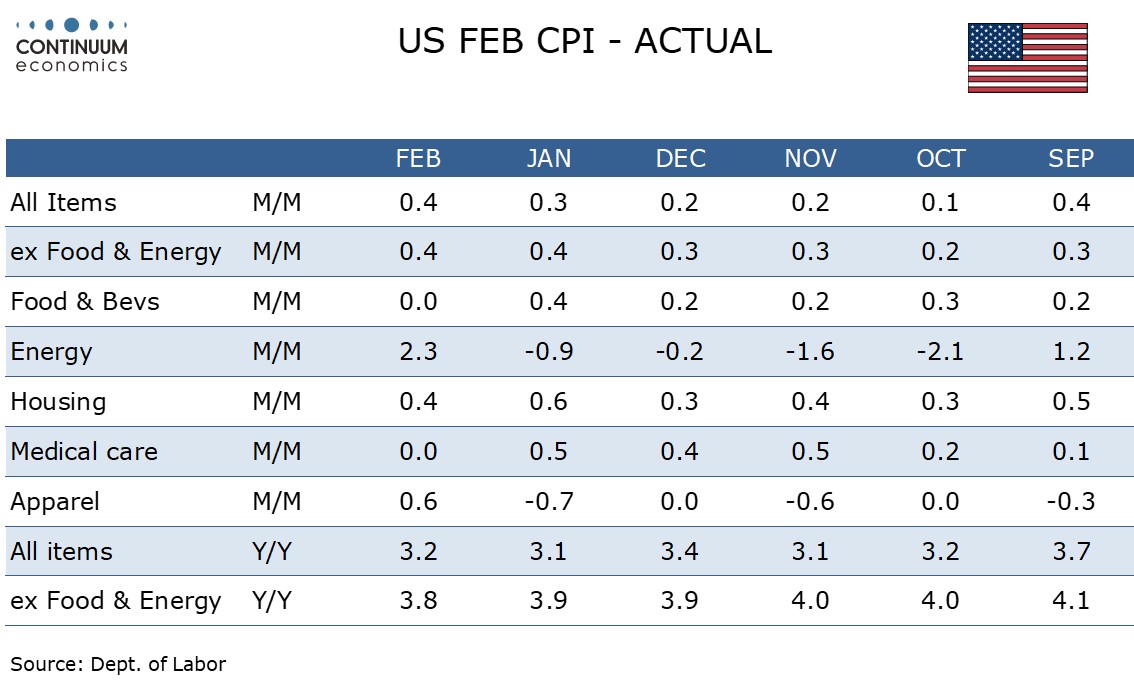

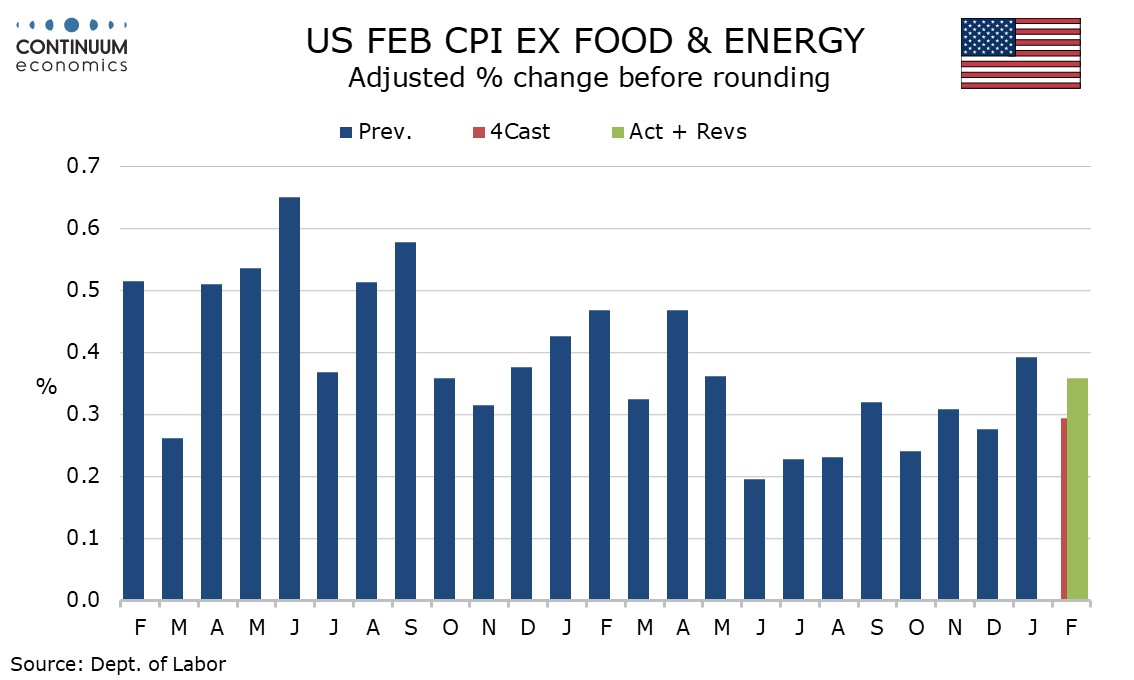

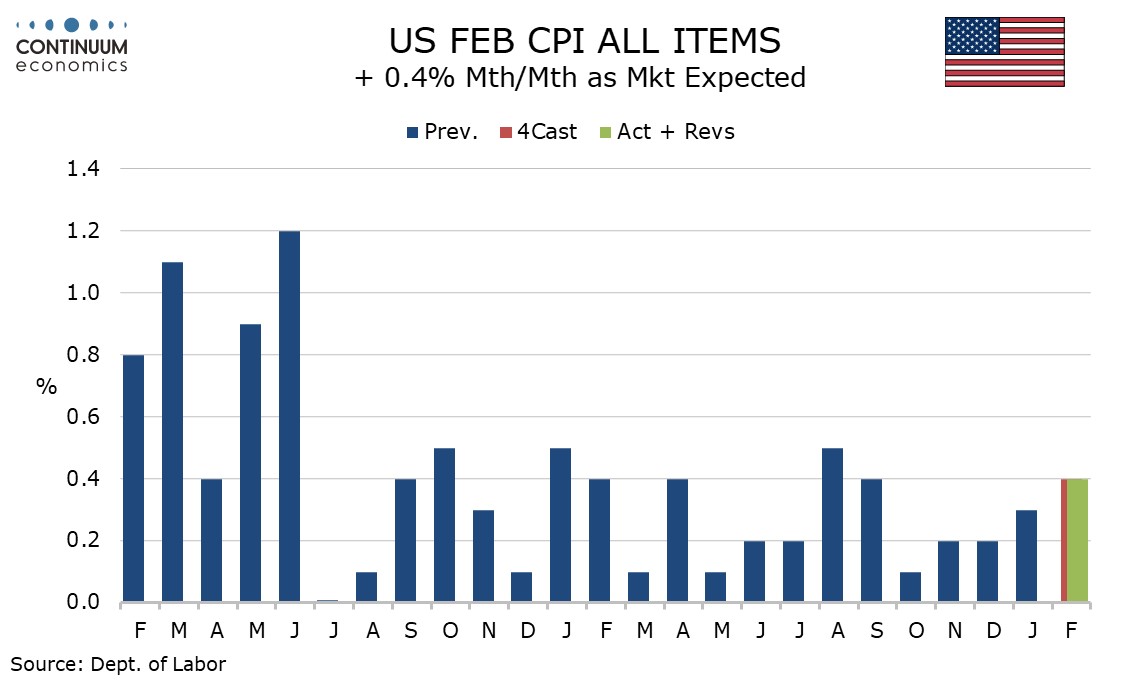

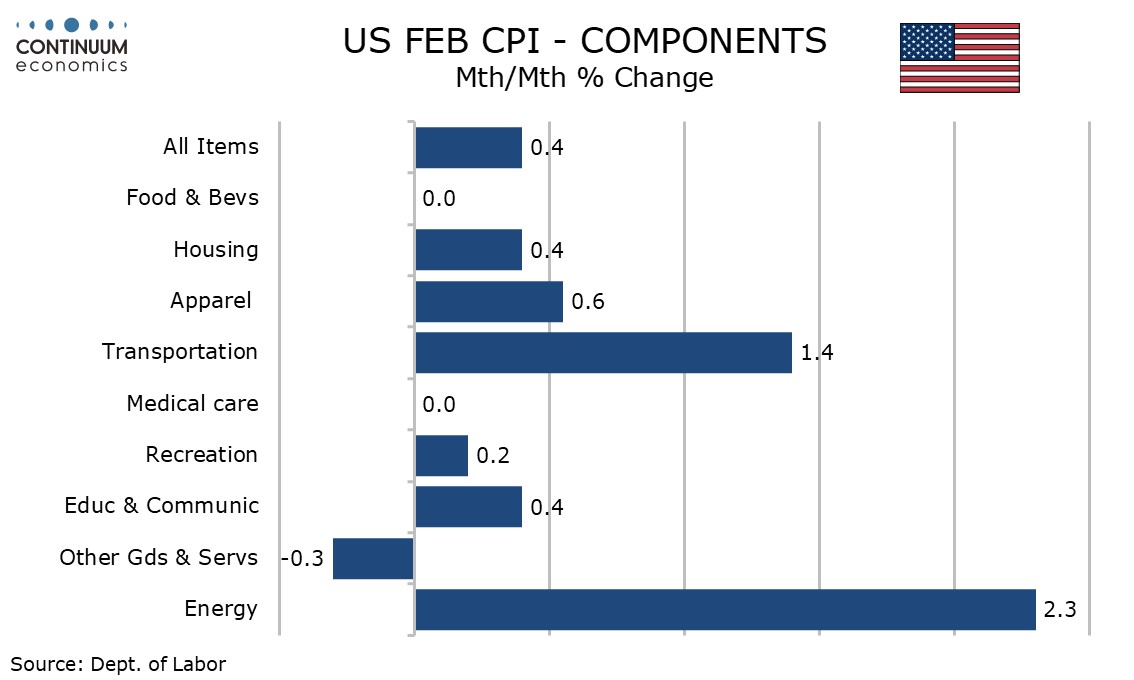

February CPI has produced a second straight rise of 0.4% in the core rate ex food and energy, showing that with the economy remaining firm, inflationary pressures still persist. Overall CPI also rose by 0.4%, this in line with consensus. Before rounding the gains were 0.358% in the core and 0.442% overall.

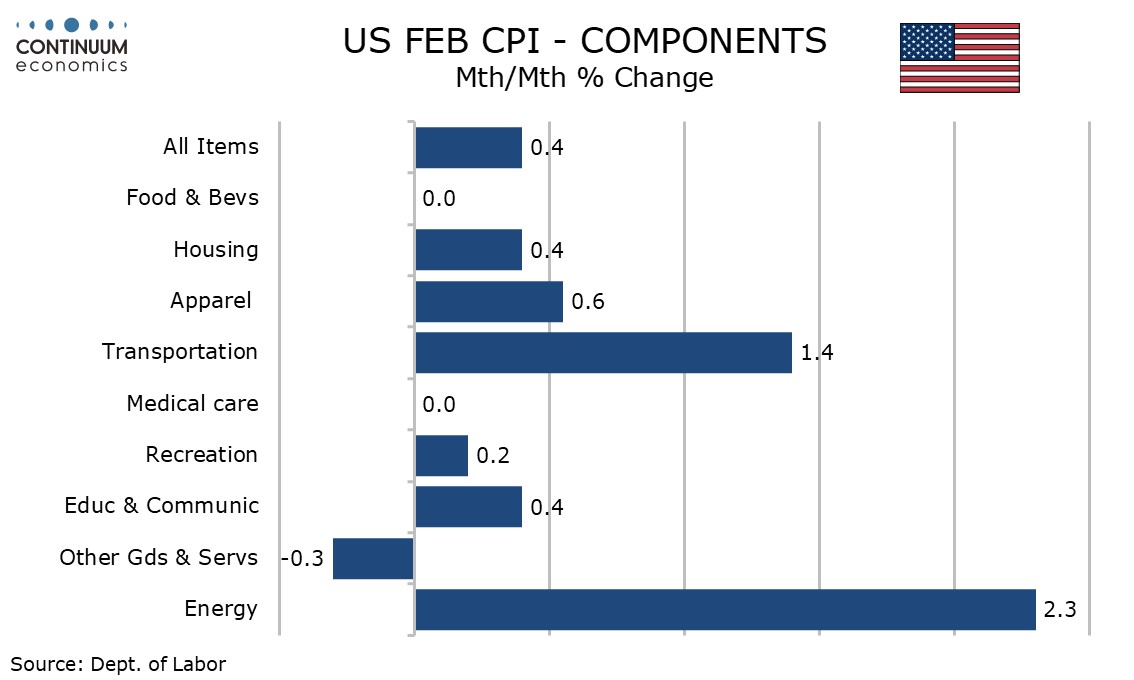

The data was a little more balanced than in January, with commodities ex food and energy rising by 0.1% after falling by 0.3% in January, while services less energy slowed to a still quite firm 0.5% pace from January’s 0.7%. Energy with a 2.3% rise provided an expected boost led by gasoline that is visible in the data before rounding though food was unchanged.

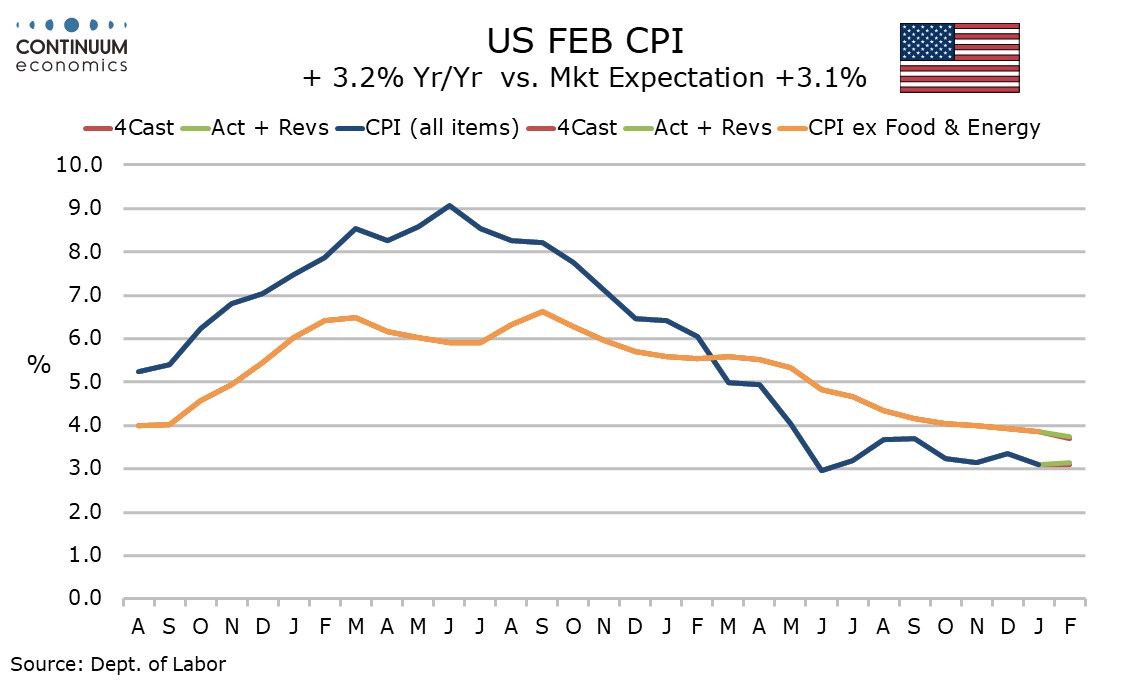

The 0.358% rise in the core rate before rounding was only a modest surprise and slower than January’s 0.392%, though the first two months of 2024 are stronger than the final seven months of 2023, which suggests that the acceleration in the economy in the second half of 2023 is having some feed through into underlying inflationary pressures.

The 0.358% rise in the core rate before rounding was only a modest surprise and slower than January’s 0.392%, though the first two months of 2024 are stronger than the final seven months of 2023, which suggests that the acceleration in the economy in the second half of 2023 is having some feed through into underlying inflationary pressures.

Many had seen January’s strength as likely to be one-time price gains for the New Year and unlikely to signal a trend, with many Fed speakers downplaying January’s data. This is harder to do after today’s data.Stronger core commodities data came as used autos corrected higher by 0.5% after a 3.4% plunge in January while apparel rose by 0.6% after a 0.7% January decline.

Many had seen January’s strength as likely to be one-time price gains for the New Year and unlikely to signal a trend, with many Fed speakers downplaying January’s data. This is harder to do after today’s data.Stronger core commodities data came as used autos corrected higher by 0.5% after a 3.4% plunge in January while apparel rose by 0.6% after a 0.7% January decline.

In the services breakdown air fares surged by 3.6% after a 1.4% January increase though medical care services slipped back by 0.1% after rising by 0.7% in January. Shelter saw a more typical 0.4% rise after a 0.6% bounce in January, with owners’ equivalent rent matching both those gains and lodging away from home subdued with a 0.1% increase after bouncing by 1.8% in January.

In the services breakdown air fares surged by 3.6% after a 1.4% January increase though medical care services slipped back by 0.1% after rising by 0.7% in January. Shelter saw a more typical 0.4% rise after a 0.6% bounce in January, with owners’ equivalent rent matching both those gains and lodging away from home subdued with a 0.1% increase after bouncing by 1.8% in January.

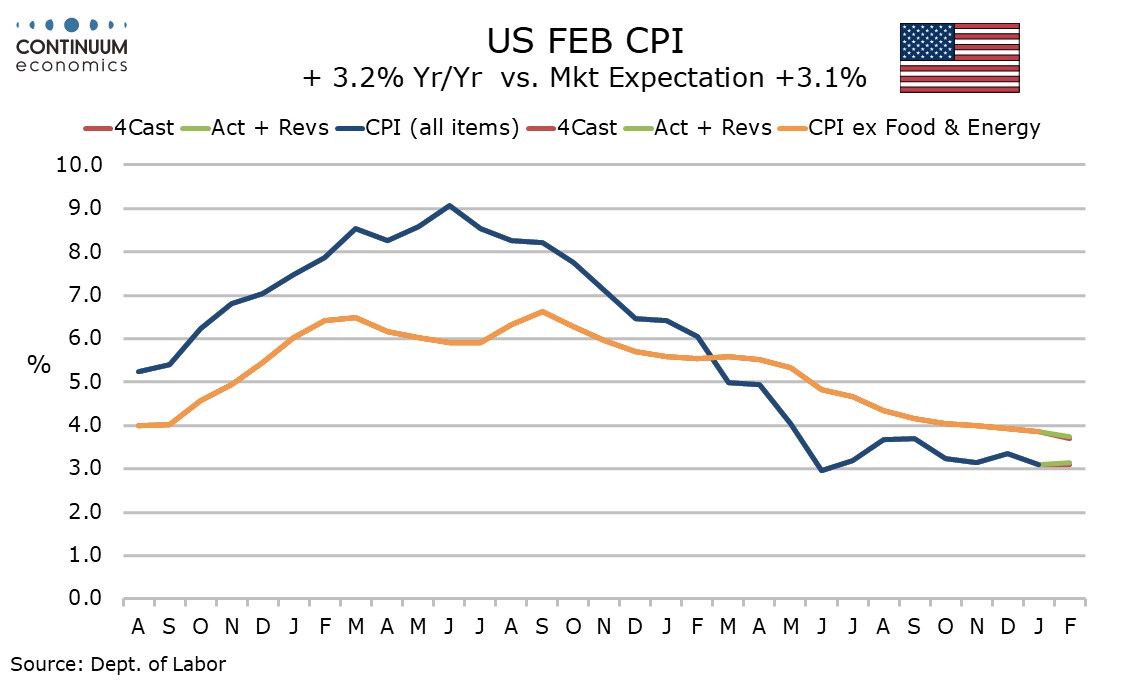

Yr/yr data rose to 3.2% from 3.1% overall but the core rate slowed to 3.8% from 3.9%, reaching its slowest since April 2021, though the data remains too high to be consistent with the Fed’s 2.0% target for core PCE prices. With the data showing signs of acceleration in early 2024, we do not appear to be on track to return to target, and that suggests the Fed is unlikely to provide any hints of easing at its March 20 meeting.

Yr/yr data rose to 3.2% from 3.1% overall but the core rate slowed to 3.8% from 3.9%, reaching its slowest since April 2021, though the data remains too high to be consistent with the Fed’s 2.0% target for core PCE prices. With the data showing signs of acceleration in early 2024, we do not appear to be on track to return to target, and that suggests the Fed is unlikely to provide any hints of easing at its March 20 meeting.