JPY, CHF, EUR flows: USD back to near pre-employment levels, JPY still soft

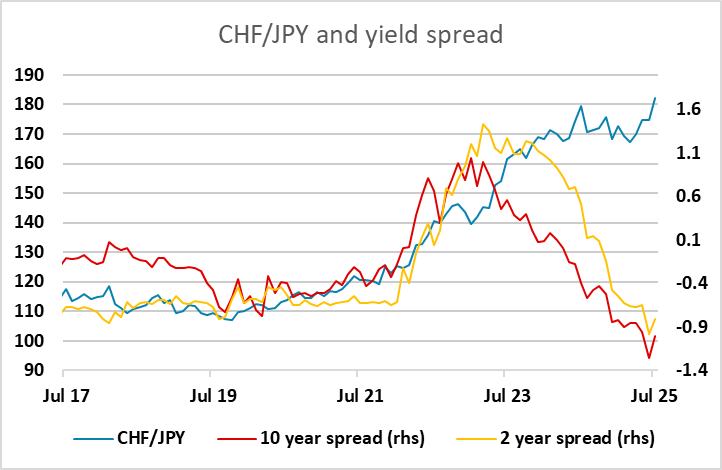

USD has slipped back overnight and the JPY has recovered, but remains weak, especially versus CHF

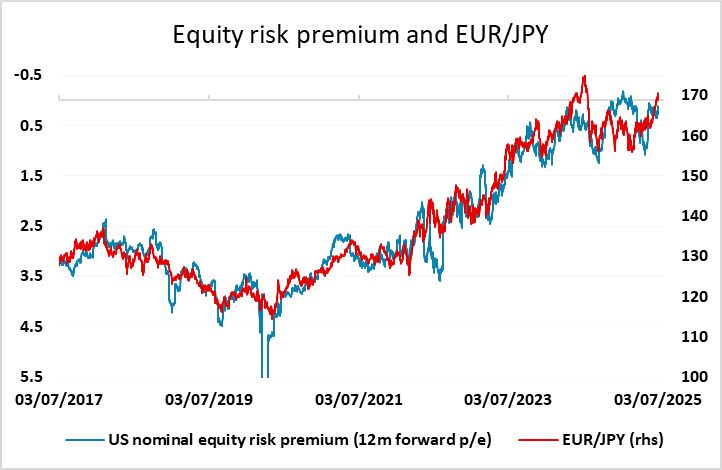

The US holiday means we will have a relatively quiet day in the markets. Overnight we have seen most of the reaction to the US employment report reversed, with USD/JPY back down to near pre-employment report levels helped by a very strong 4.6% rise in household spending in May – the largest rise since 2021. The JPY remains at very low levels on the crosses, particularly against the CHF, where it has only slightly backed away from the all time high at 182.46 seen around European close on Thursday. A major reversal is unlikely to be seen without some turn in equities, and at this stage, without some weaker US data or new tariff news, this doesn’t seem imminent. But valuation is a long way out of line with longer term fundamentals.

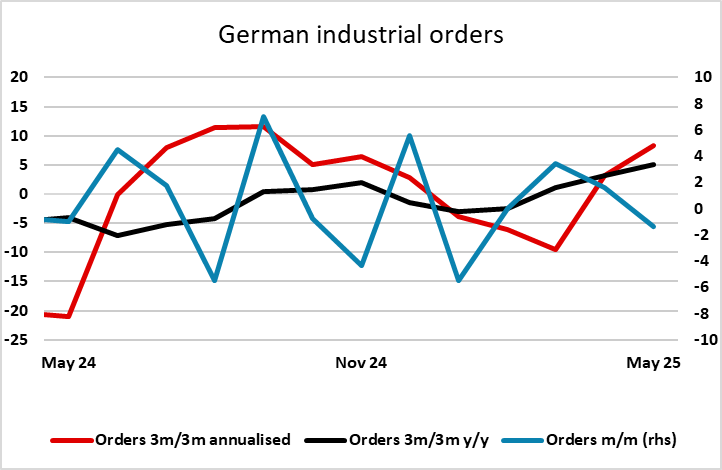

This morning’s May German factory orders data was on the weak side of consensus, but April was revised higher so the underlying trend still looks strong and there has been no FX reaction. Even so, we do anticipate some slowing in the economy in the coming months which may take the shine off the EUR.