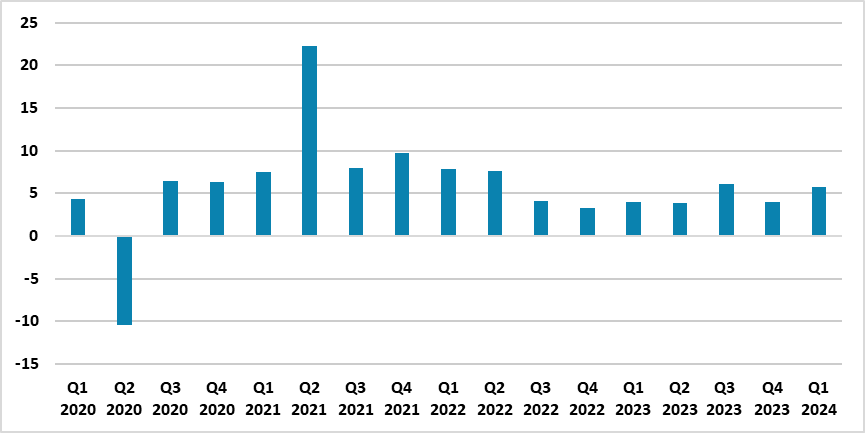

Turkish Economy Grew by a Strong 5.7% in Q1

Bottom Line: Turkish Statistical Institute (TUIK) announced on May 31 that Turkish economy expanded by 5.7% in Q1 driven by the buoyant demand, invigorated private consumption and government spending. Despite strong Q1 figure, we expect the pace of the GDP growth to decelerate in the rest of 2024 due to lagged impacts of strong monetary tightening by the Central Bank of Turkiye (CBRT) coupled with tighter fiscal stance. We now foresee the Turkish economy to grow by 3.3% in 2024.

Figure 1: GDP (%, YoY), Q1 2020 – Q1 2024

Source: Continuum Economics

When the activities which constitute GDP are analyzed, it appears household spending played a key role in propelling the economy forward in Q1, as household consumption grew 7.3% in annual terms. Government spending was up 3.9% from Q1 of last year while exports increased by 4% and imports plummeted by 3.1% in the mentioned period.

One reason why household consumption surged substantially in Q1 was the government took measures such as increasing the minimum wage by 50% before the local elections on March 31 to counterbalance the expensive cost of living. Furthermore, households decided to bring purchases forward in expectation of higher inflation likely lead to a hike in the consumer spending.

Following the GDP growth announcement, the Treasury and Finance minister Mehmet Simsek stated that the country is heading toward more balanced and sustainable growth this year, and added that "Indicators for Q2 indicate that the balancing of the economy continues. We see balanced growth in 2024, with a positive contribution from net foreign demand." Trade Minister Omer Bolat indicated that Turkiye has become the fastest-growing economy compared to EU and G-20 countries that have announced their first-quarter data.

Despite CBRT lifted the benchmark one-week repo rate from 45% to 50% on March 21 to establish the disinflation course as soon as possible and to control the deterioration in pricing behavior and to squeeze demand, lagged impacts of the aggressive tightening cycle are still feeding through. We feel the pace of the GDP growth will decelerate in H2 2024 due to CBRT’s hawkish bias, contractionary fiscal actions targeting to slow down demand and lending coupled with elevated inflation. We are also of the view that household spending will likely decrease in H2 of 2024 if the government will not increase minimum wage in July, as it previously announced. Taking these into account, we now foresee the Turkish economy to grow by 3.3% in 2024.