U.S. Q3 and Q2 Unit Labor Costs revised lower

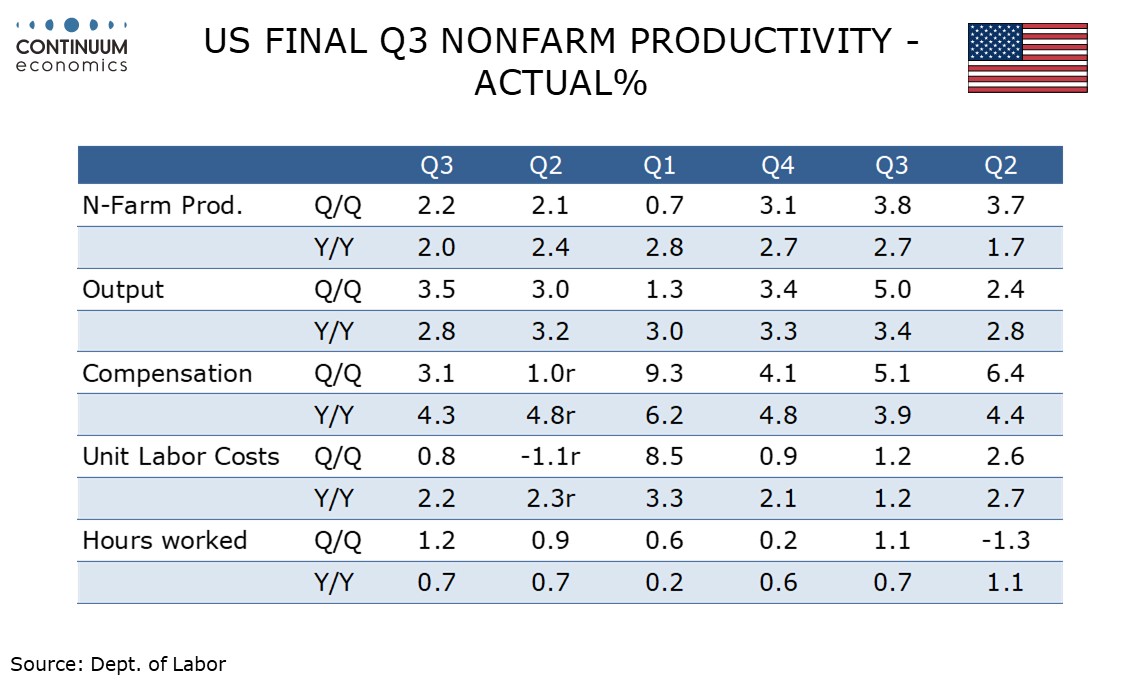

While Q3 non-farm productivity was unrevised at a respectable 2.2% unit labor costs saw a steeper than expected downward revision to 0.8% from 1.9%, with Q2 revised even more significantly lower, to -1.1% from a positive 2.4%.

The revisions to unit labor costs came from downward revisions to compensation, Q3 to 1.8% from 4.2% and Q1 to -1.8% from 4.6%, These soft figures do follow a very strong, and unrevised, Q1 gain of 9.3%, so yr/yr compensation is still quite solid at 4.3% and yr/yr unit labor costs moderate at 2.2%.

Downward revisions to unit labor costs were offset by upward revisions to non-labor costs, meaning the Q3 overall deflater was actually revised up to 1.1% from 0.9%, while Q2 was unrevised at 2.3%. The yr/yr deflator is however still quite subdued at 1.8%, which appears consistent with on target inflation.