BoE Preview (Feb 1): Inflation Risks Shift From the Upside to More Balanced?

Bottom Line: As is widely expected, the BoE is likely to keep policy on hold for a fourth successive meeting when it delivers its next verdict on Feb 1. But as with other DM central banks the interest is less on what is done, but more on what is said, especially given the manner in which market interest rates have fallen. Admittedly, some of this fall has reversed of late. But this still implies rate cuts arriving earlier and more sizeably than the BoE may be comfortable with. As a result, the BoE is likely to repeat is assertion that policy ‘will need to be sufficiently restrictive for sufficiently long to return inflation to target’ and there may still be 1-2 MPC dissents in favor of even tighter policy. But the tightening bias may disappear amid weak economic data and very clear signs of easing price and costs pressures (Figure 1). Indeed, and despite the softer interest rate assumption, the updated Monetary Policy Report may see the inflation outlook even softer, possibly embracing our view of the headline rate falling below target by mid-year. Indeed, as the downside risks to growth and prices we envisage materialize, the BoE will be forced to start easing from Q2, with 100 bp of rate cuts on the card for this year.

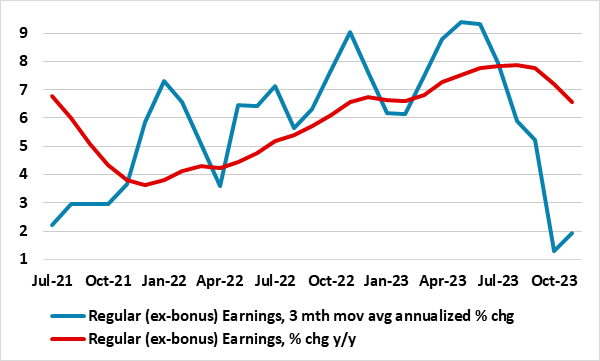

Figure 1: Wage Pressures Clearly Easing

Source: ONS, CE

Data Undershooting as Price Pressure Persistence Dissipates

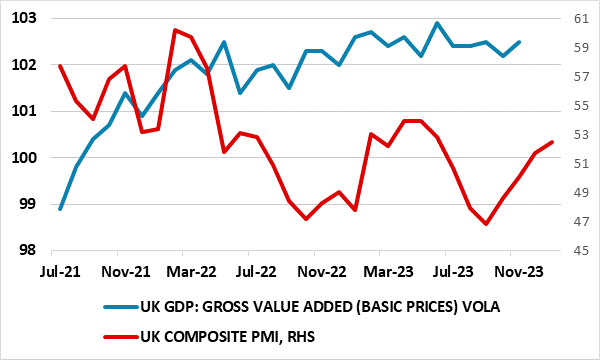

It does look as if a whole array of data has undershot BoE expectations, especially those laid out in the last (November) Monetary Policy Report (MPR). Most notably, headline CPI is 4.0%, 0.6 ppt below what was assumed while wages are likely to be over a ppt below what the MPC projected for Q4 private sector regular earnings, with recent m/m data (Figure 2) actually suggesting an even weaker backdrop, thereby chiming with a marked slowing in PAYE tax receipts. And with core CPI also having fallen clearly of late too, this should calm worries about persistent inflation threats that have dominated BoE thinking through the last year and which forced a clear tightening bias to continue even after formal rate hikes stopped after last August. In addition, it now looks as if the real economy may have undershot expectations too, with GDP last quarter like to have fallen in contrast to the flat picture the BoE projected. Admittedly PMI data have perked up lately but these numbers have been very poor indicators of actual GDP swings in recent years.

Updated Projections

These developments will feed into the updated MPR, where the circa -0.5 ppt added fall in markets interest rates may have marginal boost to the existing GDP projections of zero growth this year and a little more to the bare 0.25% envisaged for 2025. This will have little impact on the inflation outlook, even if the BoE were to make a further downgrade to its supply-side assumption as is possible. There may be some fiscal effects, encompassing broadly neutral recent Autumn Statement developments, but where possible further tax cuts due in coming months cannot be included.

Figure 2: PMI Survey A Poor Guide to GDP Swings?

S

S

Source: Markit, ONS

Instead, the combination of downside surprises to CPI and wage figures, alongside much weaker energy price developments, should ensure a material downward revisions to the CPI inflation profile. Notably in the MPC’s November MPR, conditioned on a market-implied path for Bank Rate that declined gradually to 4¼% by the end of 2026, there was clear falls in inflation projected. In the most likely, or modal, projection, CPI inflation returned to the 2% target by end-2025 and fell below the target thereafter. The Committee judges then that the risks to its modal inflation projection were skewed to the upside, so that it put more weight on the mean projection. But even for the mean this saw CPI inflation at 2.2% and 1.9% at the two and three-year horizons. And the likelihood is that these projections may be revised down markedly – we see the headline rate slipping below target next quarter and moving down below more durably through 2025 and with downside risks as policy bites ever harder.

All of which will make it difficult for the MPC to talk tough in order to either dampen, let alone reverse, market rate speculation as markets continue to react more to the downside risks to the economy and inflation we have been stressing of late. By May these downside should be clear and we feel that this will prompt the BOE to cut rates by 25 bp in Q2 2024. This may be rationalised by the BoE that sufficiently restrictive policy can be consistent with some rate cuts and still achieve the inflation target sustainably. We look for a total of 100 bp of cuts in 2024.

Grappling With Uncertainty

We remain puzzled why the BoE has not followed the lead of the ECB in both providing seasonally adjusted CPI inflation data which gives it the potential to assess up-to-date inflation developments that are not dominated by base effects from a year before and/or by producing measures of what are considered to be persistent inflation pressures. After all, the ONS has. What we may see is a Monetary Policy Report with more discussion on the monetary side of the economy, this to address (or refute) recent criticism that the Bank must do more to foster a diversity of views and strengthen a culture that encourages challenge. Indeed, a lack of emphasis on the monetary side has been a criticism we have made of the BoE for some time, all the more notable given the weakness and possible cause of such marked weakness in bank deposit and lending, the latter being a key factor behind our persistent below consensus thinking.