Preview: Due February 19 - U.S. December Trade Balance - Despite volatility, 2025 will average similar to 2024

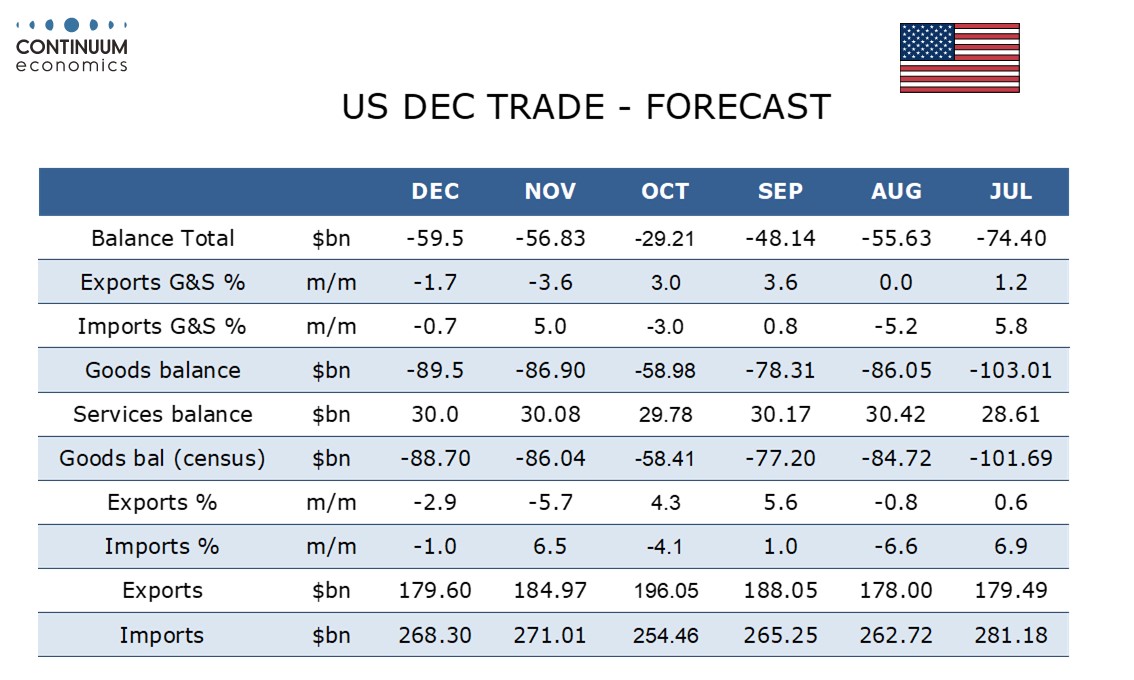

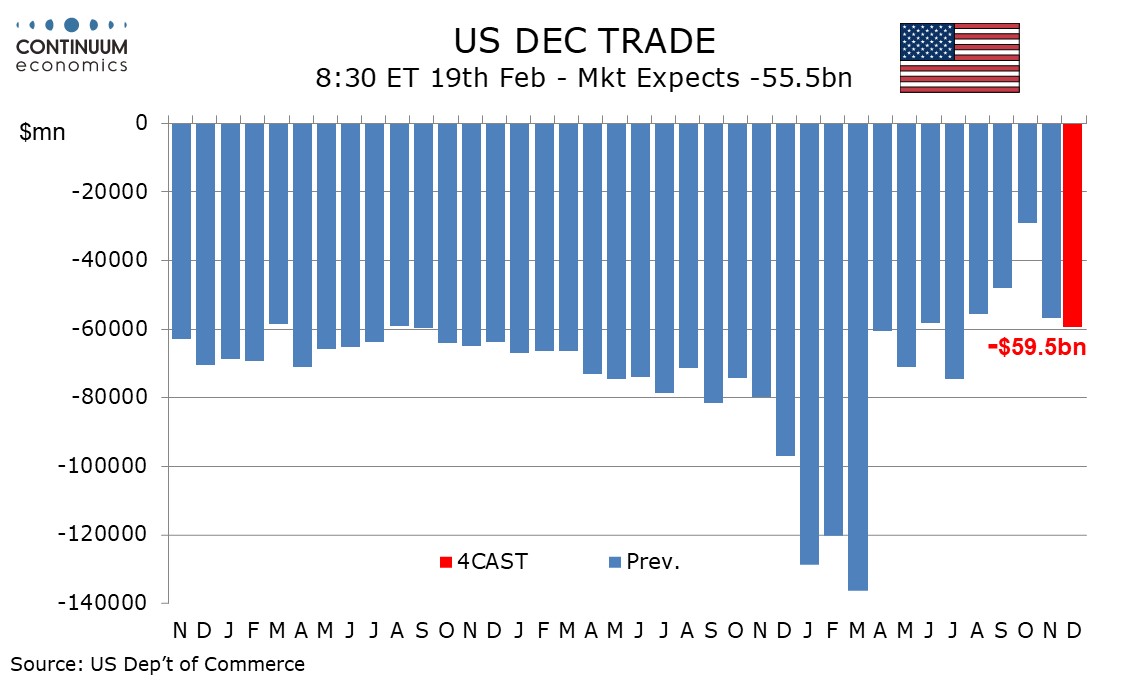

We expect a December trade deficit of $59.5bn, which would be the widest since August and up moderately from November’s $56.8bn. It would be up sharply from October’s $29.2bn which was the lowest since June 2009 but heavily influenced by temporary factors. The data may bring some fine tuning to expectations for Q4 GDP which is due on February 20.

Goods exports surged in September and October largely on strength in nonmonetary gold. Nonmonetary gold exports slipped back in November and further slippage is likely in December, leaving goods exports down by 2.9% in a second straight fall, but still above August’s level. Imports fell sharply in October led by a plunge in pharmaceutical preparations which rebounded in November and now seem to be at a sustainable level. November’s imports rise, which more than fully erased October’s decline, was further fueled by a surge in computers which will be difficult to sustain. We expect goods imports to fall by 1.0% to a level slightly above that seen in September.

We expect the service surplus to be little changed at $30.0bn with exports up by 0.4% and imports up by 0.6%, leaving overall exports down by 1.7% and overall imports down by 0.7%. The deficit will remain below a trend seen through 2024 of around $70bn per month, but can still be seen as in a correction from a record pre-tariff deficit of $136.5bn in March. Under our December forecast the 2025 deficit will total $899bn, close to 2024’s $903.5bn, suggesting underlying changes have been modest despite the heightened volatility caused by policy changes.