DM FX Outlook: 2024 - The Year of the Yen

· Bottom Line: JPY weakness has been the main trend in DM FX markets in the last three years, with the JPY falling 30% in real trade weighted terms since the end of 2020 to reach its lowest level in the floating era. This has been driven by rising inflation and monetary policy tightening in the U.S. and Europe, and the consequent rise in yield spreads, but as this reverses in 2024/5, JPY weakness should also reverse. We forecast USD/JPY at 125 end 2024 and 115 end 2025.

· On EUR/USD, we expect a 120bp decline in U.S. 2 year yields by the end of 2024, compared to just 50 bps in German 2 year yields, so even though we would expect the 10 year US/Germany yield spread to remain fairly steady, this should support some further gains in EUR/USD. We forecast 1.15 end 2024 and 1.20 for end 2025.

· Forecast changes: We have made only modest changes to our forecasts since September. Our GBP forecasts are slightly higher as the UK data has improved a little, while CAD forecasts are a little lower, reflecting a lower oil price. We still look for general USD declines as the Fed ease through 2024/25.

· Risks to our views: A resurgence of U.S. inflation would undermine our expectations of USD weakness. An increase in geopolitical tension could restrict the decline in global inflation. Election uncertainties in the U.S. could also have a significant impact.

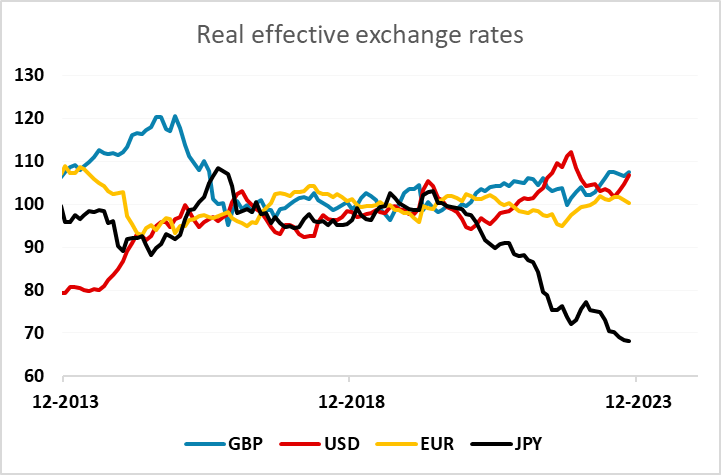

Figure 1: Real effective exchange rates

Source: BIS

JPY weakness has been dramatic

The JPY has fallen more than 30% in real effective terms against other major currencies in the last 3 years, as a result of the rise in inflation seen in the U.S. and Europe and the consequent rise in interest rates in the rest of the developed world. The rising nominal yield spreads in favour of other developed currencies have driven the JPY lower, but relatively low Japanese inflation has meant that the JPY has fallen even further in real terms than it has in nominal terms. USD/JPY has risen around 13% more in real terms than in nominal terms in the last 3 years.

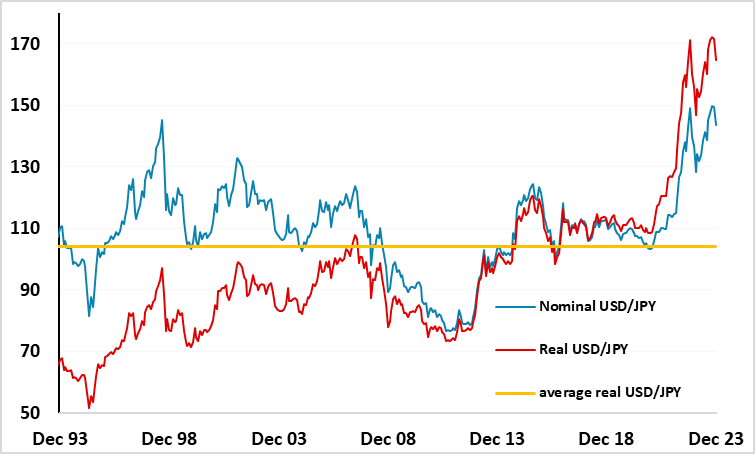

Figure 2: Real and nominal USD/JPY

Source: Continuum Economics/Datastream

Of course, the main driver of JPY weakness has been the rise in nominal yields in the U.S. and Europe in response to the rise in inflation, but we would expect this to start to reverse in 2024 and extend into 2025. This is already priced into the market, but yields will nevertheless decline further as policy rates are cut in the next couple of years. Meanwhile, the BoJ have stuck to their ultra-easy monetary policy, but tightening is likely to begin in 2024. BoJ governor Ueda has indicated as much in his recent speeches, and most forecasters now see the policy rate rising in H1 2024. 10 year JGB yields are likely to rise significantly above the 1% reference rate (which is no longer a formal ceiling) as the yield curve control (YCC) policy is eased and eventually abandoned.

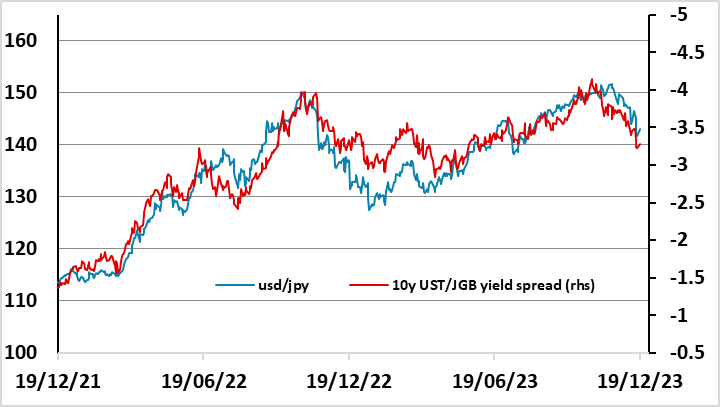

Figure 3: Nominal yield spreads have dominated the move in USD/JPY

Source: Continuum Economics/Datastream

All of this means we can expect a substantial rise in 10 year JGB yields through 2024, and an even more substantial decline in the 10 year spread with the U.S. (and Europe), as yields elsewhere decline. By the end of 2024 we expect to see the 10 year UST/JGB spread down to 2.1% from the current 3.25%. Based on the recent correlation between nominal yield spreads and USD/JPY (see Figure 3), this suggests scope for USD/JPY to decline to at least 125. However, this is a nominal correlation, and as we note above, USD/JPY has risen 13% more in real terms in the last few years than in nominal terms. In the longer run, real values are what matter, so at some point, the JPY is likely to regain this ground, which may mean we see USD/JPY extend declines through 2025 even though we don’t expect any further decline in yield spreads after the end of 2024.

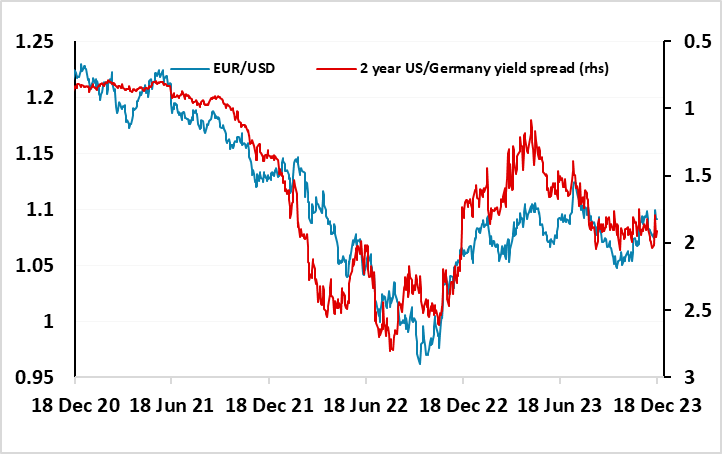

USD to see modest decline elsewhere

As can be seen from Figure 1, moves in other currencies have been quite modest compared to moves in the JPY. However, the USD and GBP have made some gains against the EUR in the last couple of years, and we do see scope for some modest reversal of these moves, with the Fed leading the easing cycle. We expect a 120bp decline in U.S. 2 year yields by the end of 2024, compared to just 50 bps in German 2 year yields, so even though we would expect the 10 year US/Germany yield spread to remain fairly steady, this should support some further gains in EUR/USD. However, EUR/USD is also sensitive to risk sentiment, so to some extent will depend on how the equity market responds to Fed easing. We see some downside risks for the U.S. equity market due to the current high valuation, but European markets are much more fairly valued, so while there might be some USD support in periods of equity weakness, this should be largely offset by relatively reasonable [M2] European equity market performance.

Figure 4: EUR/USD to rise as 2 year yield spreads fall

Source: Continuum Economics/Datastream

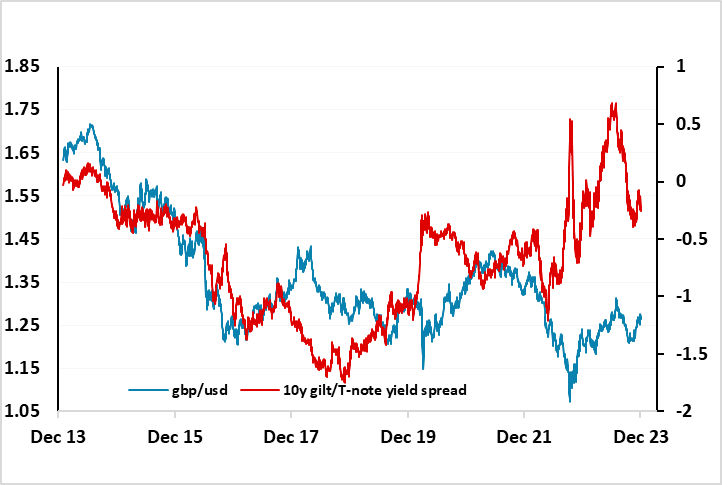

GBP may manage some outperformance near term

Relatively high and persistent UK inflation has meant that the Bank of England has been one of the more hawkish of the major central banks of late, and for the moment there are still three members of the UK MPC that are calling for a further rate hike. Recent outperformance of UK PMI data has also helped support UK yields, and there is less easing priced in from the BoE than there is from the Fed or ECB in the coming year. This may provide some near term support for GBP, with UK inflation declines lagging a little and discouraging early BoE rate cuts. But as with the JPY, real values also have to be considered, and relatively high UK inflation has also mean real appreciation for GBP. We are also sceptical that the BoE can retain relatively tight policy for long. While it may take a little longer for UK inflation to fall, we doubt this will prevent UK yields declining in line with US yields over the next couple of years. Even so, there remains something of a risk premium priced into GBP, and if the BoE are a little slower to cut than other central banks, this could be unwound, allowing some short term GBP strength in the early part of the year.

Figure 5: Some risk premium in GBP/USD?

Source: Continuum Economics/Datastream

Nevertheless, we don’t see any persistent UK growth outperformance relative to Europe, and there is still upward pressure on EUR/GBP from a real valuation perspective, so we wouldn’t expect any persistent GBP outperformance of the EUR. We forecast 0.88 on EUR/GBP by end 2024.

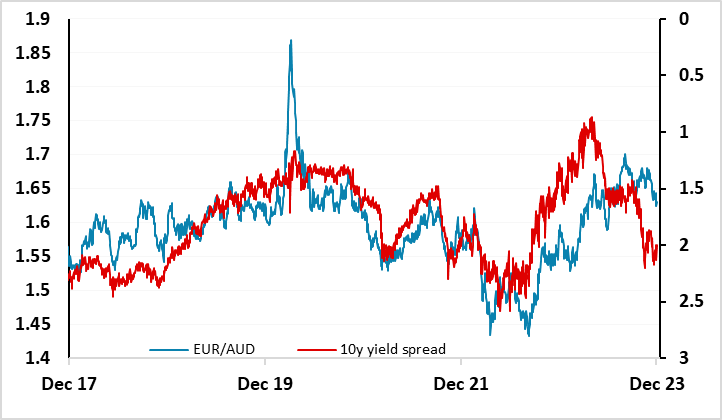

Scope for AUD to outperform

The AUD has been undermined in recent months by concerns about China slowdown, but we see scope for the AUD to outperform other risky currencies in the coming year. While there are still likely to be some concerns surrounding Chinese growth and Chinese debt levels, and we do expect Chinese growth to be relatively subdued, this shouldn’t be a persistent negative for the AUD. While weak growth in Europe limits the upside for the EUR and should mean a fairly rapid decline in European yields, the growth picture for Australia is a little stronger and the RBA may not be inclined to cut rates quite as rapidly. Yield spreads with the EUR suggest significant EUR/AUD downside, and we would expect this to materialize through 2024. However, any periods of weakness in U.S. or Chinese equities could be expected to limit the AUD upside.

Figure 6: Scope for AUD gains against the EUR (EUR/AUD (LHS) v 10yr bond yield spreads (RHS))

Source: Continuum Economics/Datastream