U.S. January CPI Shows Strength in Services to Start the New Year

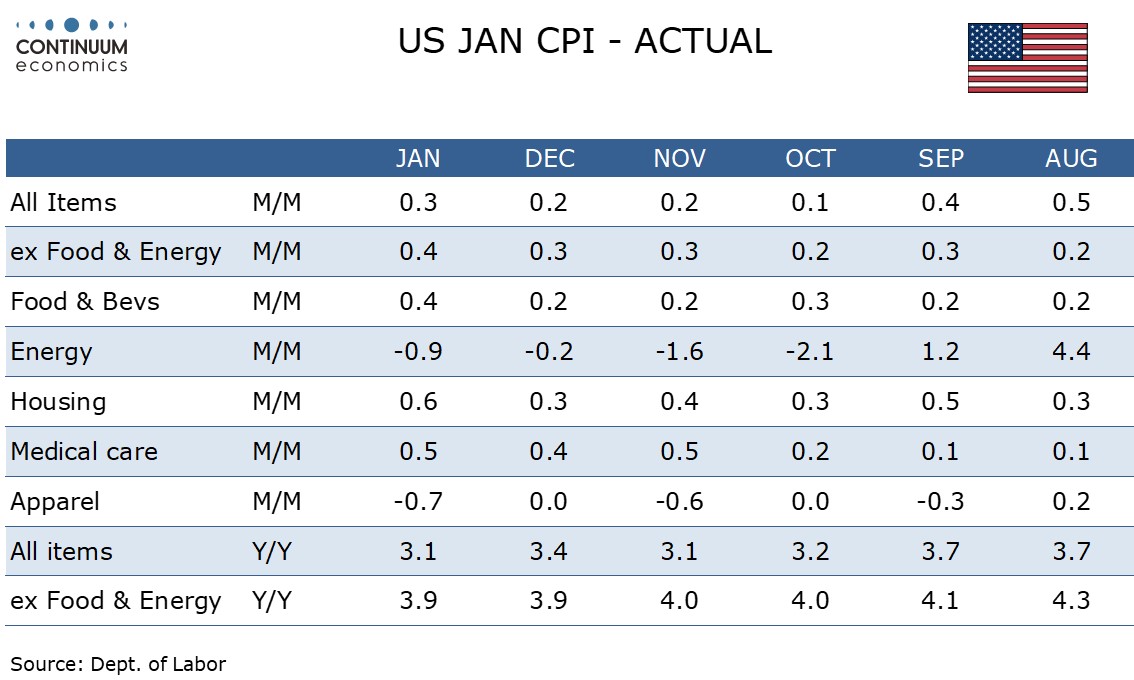

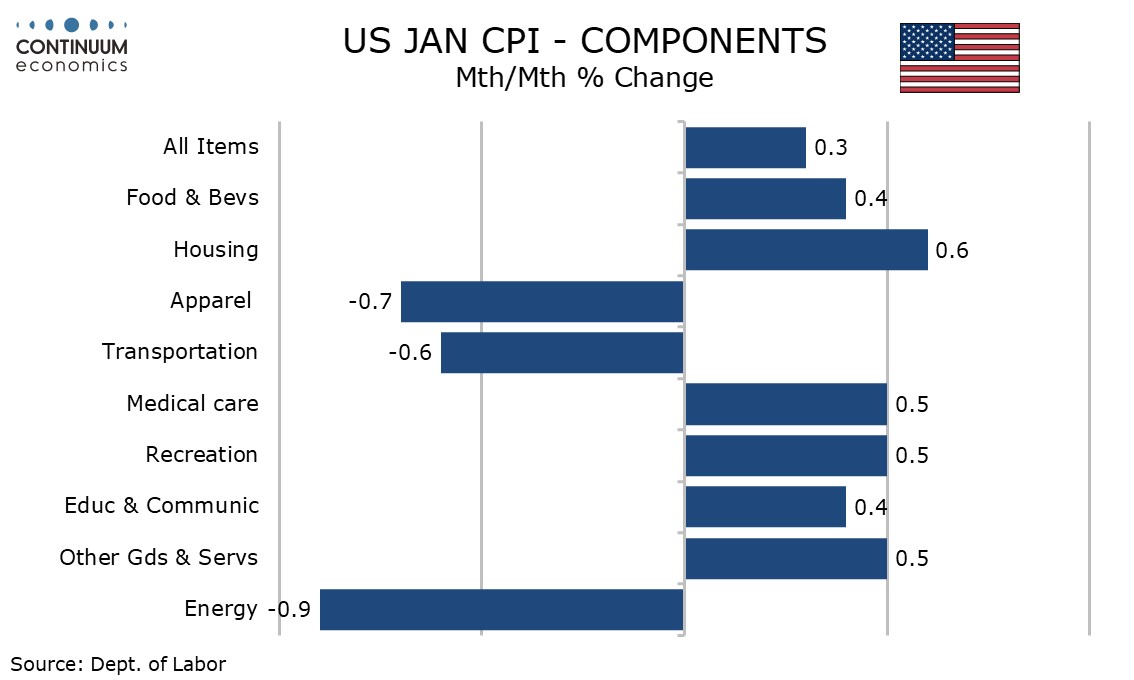

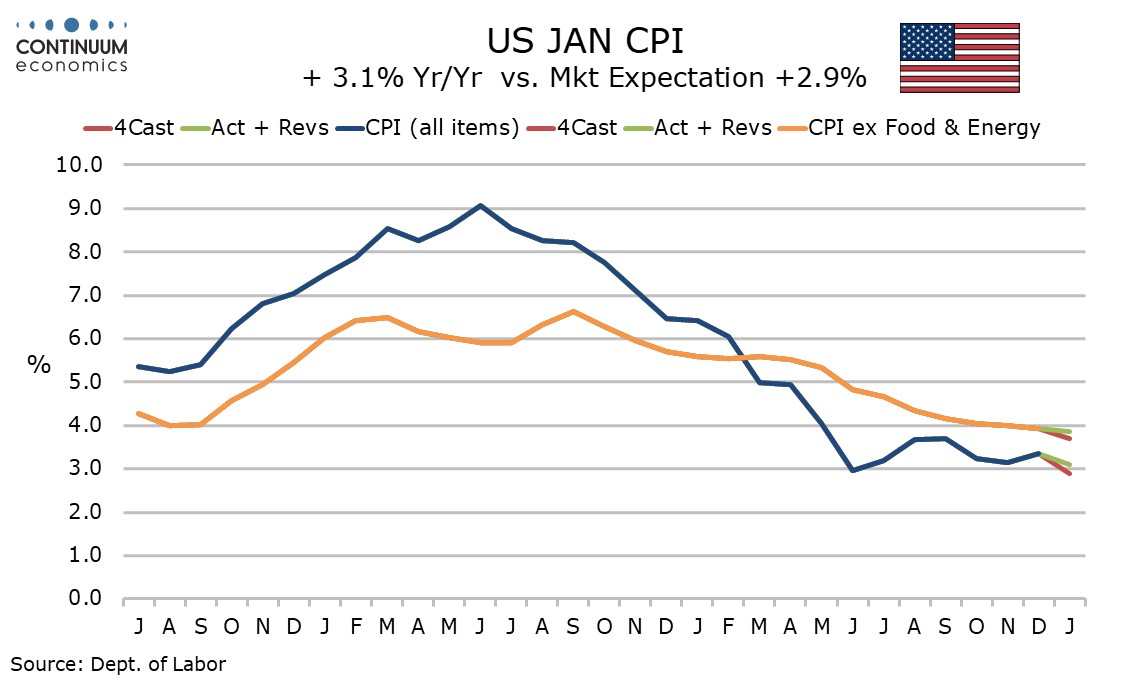

January CPI has come in higher than expected, rising by 0.3% overall and 0.4% ex food and energy, suggesting inflationary pressures still persist at the start of 2024, though whether the recent tendency of core PCE prices to underperform core CPI will persist is unclear. Core CPI rose by 0.392% before rounding.

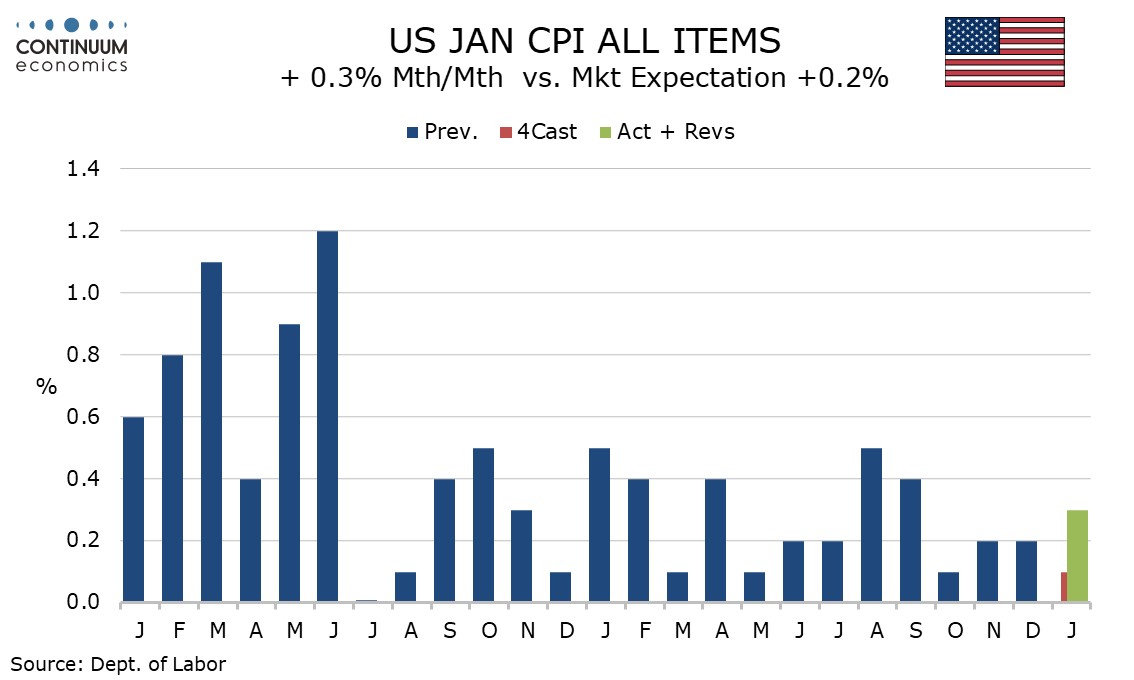

Food was quite firm with a 0.4% increase but outweighed by a 0.9% decline in energy led by 3.2% fall in gasoline. Energy services were firm with a 1.4% increase.

Commodities less food and energy saw a negative trend deepen with a 0.3% decline meaning that services explain the upside surprise, with services less energy up a strong 0.7%. Used autos at -3.4% and apparel at -0.7% were notably weak in the commodities detail.

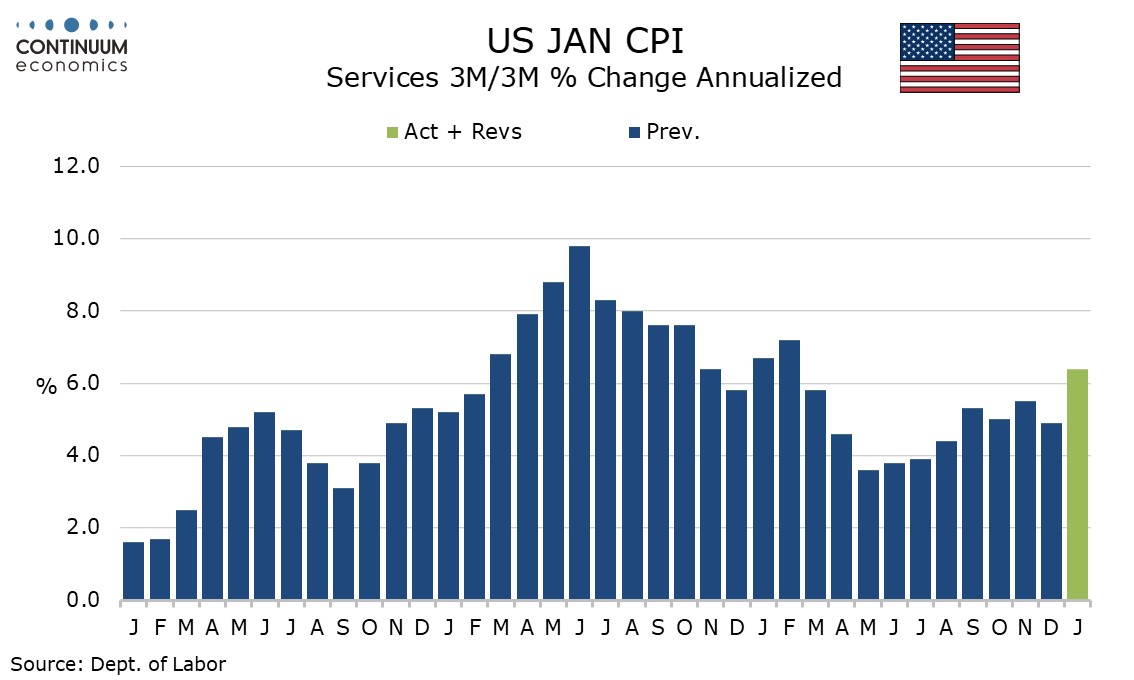

Shelter was strong at 0.6% with owners’ equivalent rent rising by the same amount, its strongest increase since April while lodging away from home rose by 1.8%. Medical care services rose by 0.7% with medical care overall up by 0.5%, and have seen a significant acceleration in the last three months, partly on methodology changes. Transportation services rose by 1.0% with auto services and air fares both stronger. Service strength was however broad based with recreation and education/communication services both up by 0.4% and other personal services up by 1.2%, led by a 2.4% rise in financial.

The broad based strength in services will be of concern to the Fed as it implies that demand and wage pressures persist in generating services inflation despite the decline in goods inflation generated by improving supply. The negative picture in goods is not going to persist for ever so sustaining a fall in inflation will require a decline in services inflation.

Should core PCE prices come in significantly softer than the core CPI, and there has been an increasing tendency for that to be the case in recent months, it will present the Fed with a dilemma, but if the economy remains healthy we doubt they will dismiss the CPI, even if it is core PCE prices that they are targeting.

Yr/yr growth ex food and energy was unchanged at 3.9%, though a marginal slowing before rounding leaves the pace as the lowest since May 2021. Yr/yr overall CPI fell to 3.1% from 3.4%, but was lower as recently as June 2023.