U.S. GDP: Historical revisions mostly positive and significantly so for income

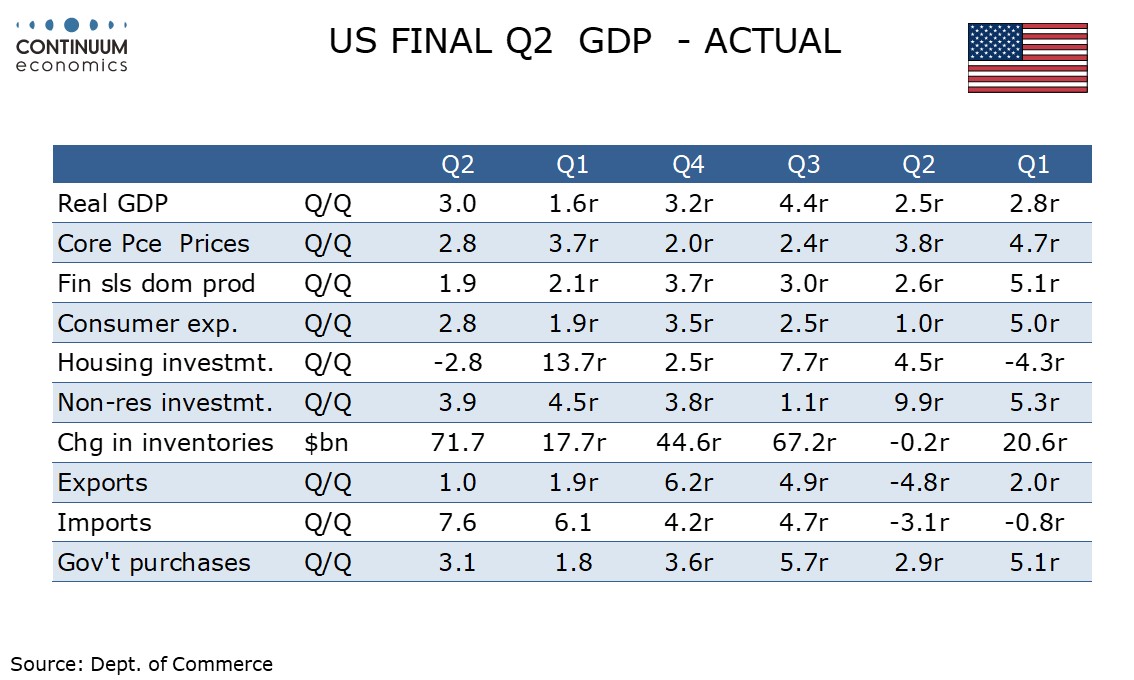

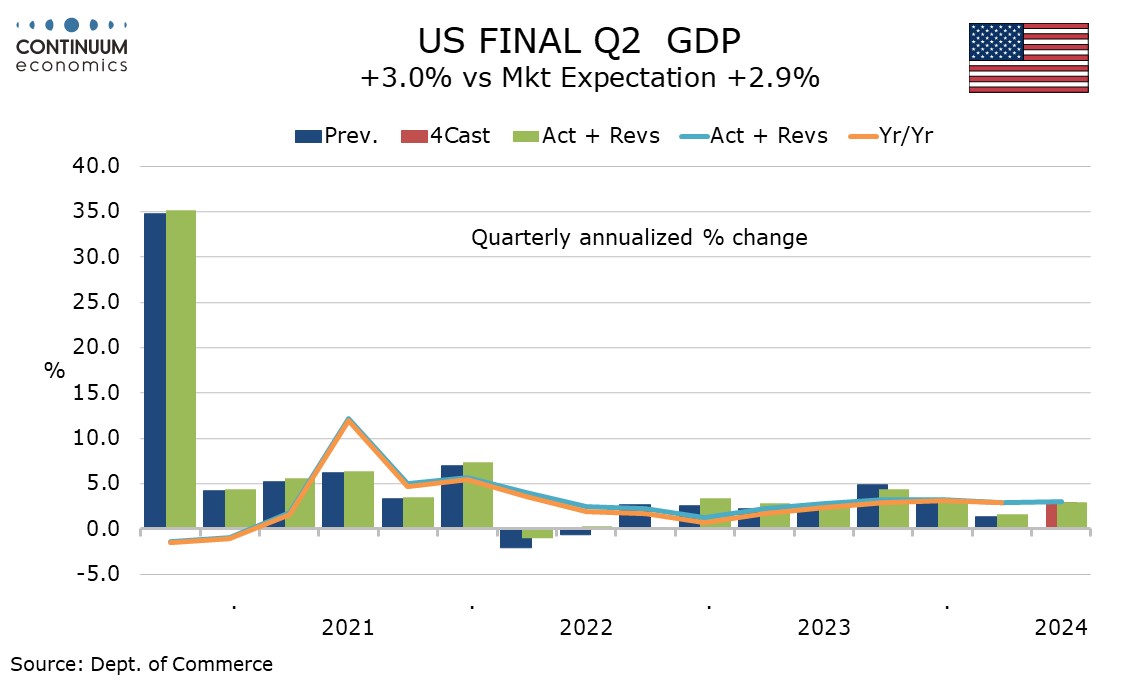

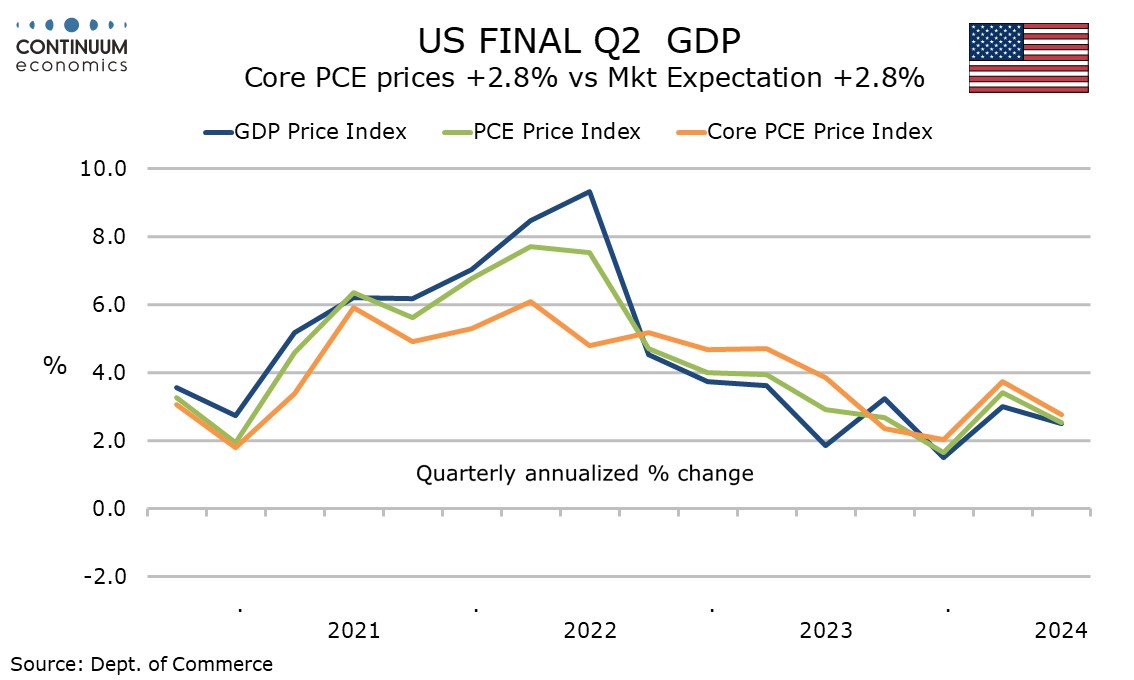

While Final Q2 GDP was unrevised at a strong 3.0% pace and the core PCE price index was also unrevised at 2.8%, Gross Domestic Income saw a strong upward revision to 3.4% from 1.3%. More significantly, the release included historical revisions for the past five years, and these were generally positive and particularly so for income. The stronger income data reduces downside economic risks, in particular for consumer spending, going forward.

Real disposable income is now up by 3.1% yr/yr compared with only 0.9% in the preliminary data, and is now running ahead of consumer spending which is up by 2.7% yr/yr, unrevised from the preliminary. The savings rate has been revised up sharply to 5.2% from 3.3%, showing consumers on a much more solid footing than previously thought. The upward revisions to income come as a surprise given that employment is set to be revised down, hinting that there may be more strength in wages than was previously realized.

Looking into the personal income detail, 2023’s upward revision was led by components other than wages and salaries, but in early 2024 wages and salaries led the upward revision. Q2 real disposable income was revised up to 2.4% from 1.0%, with Q1 revised sharply higher to 5.8% from 1.3%. 2023 real disposable income was revised up to 5.1% from 4.1%, still not fully reversing a 2022 decline as stimulus payments ended, that was revised to -5.5% from -5.9%. 2021 was revised modestly higher to 3.4% from 3.1%. 2020, which saw the largest stimulus payments, now stands at 6.3% rather than 6.4%.

Q2 GDP was unrevised at 3.0% and Q1 revised only modestly to 1.6% from 1.4%. However there were upward revisions to 2023 to 2.9% from 2.6%, 2022 to 2.5% from 1.9%, and 2021 to 6.1% from 5.8%. 2020 GDP was unrevised at -2.2%.

The Core PCE price index has not seen significant revisions, though they are marginally higher. 2023 is unrevised at 4.1%, 2022 was revised up to 5.4% from 5.2% and 2021 unrevised at 3.6%, as was 2020 at 1.3%. Q2 2024 is now up by 2.7% yr/yr versus 2.6% in the preliminary release with Q1 at 3.0% yr/yr versus 2.9% in the preliminary. However the last three quarters are unrevised, Q2 at 2.8% annualized, Q1 at 3.7% and Q4 2023 at 2.0%. The lift to the yr/yr pace is due to Q3 2023 being revised up to 2.4% from 2.0%. A downward revision to Q1 2023 to 4.7% from 5.0% saw 2023 as a whole unrevised.