USD, JPY, EUR, CHF flows: USD lower against riskier currencies after CPI, FOMC

Despite the FOMC dots showing a median expectation of only one rate cut this year, US yields and the USD are lower, except against the JPY, and JPY weakness looks anomalous. Widening France/Germany spreads may maintain downard pressure on EUR/CHF.

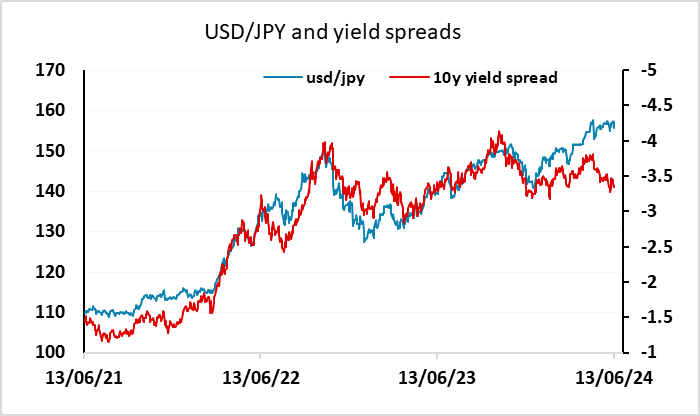

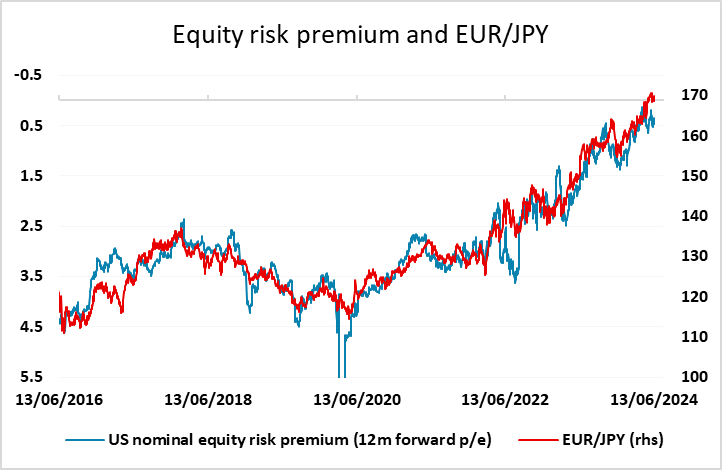

The net impact of the US CPI and the FOMC meeting has been to reduce US yields along the curve. Even at the very short end of the curve, despite the FOMC dots indicating a median expectation of only one rate cut this year, the market is now pricing 44bps of cuts rather than the 38bps before the meeting. The USD has weakened against the EUR and the other riskier currencies in response, but is little changed against the JPY despite an initial sharp dip. This may partially reflect somewhat lower JGB yields over the last couple of days, but still looks out of line with the movements in yield spreads and equity risk premia. EUR/JPY and other cross JPY pairs are typically negatively correlated with equity risk premia, and equity risk premia are generally slightly higher this morning due to the decline in US yields not being fully offset by stronger equities. JPY weakness consequently looks anomalous, but may relate to expectations of tomorrow’s BoJ meeting. Few expect any change in the policy rate, and there is only around a 10% chance of a move priced in, but the BoJ has been prone to surprising the market under Ueda’s governorship, and we see a greater chance of a rate hike than the market.

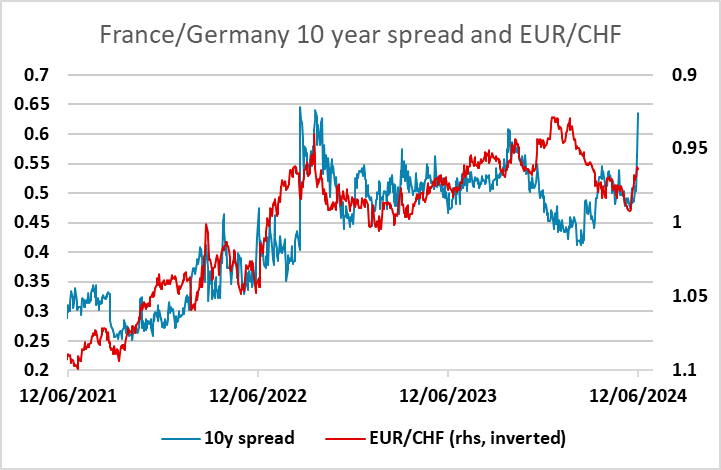

For EUR/USD, the gains back above 1.08 may also reflect some fading of concerns around European politics that were awakened by Macron’s calling of French parliamentary elections. While EU politics is showing a shift to the right, there is no real reason to suppose this will change fiscal or monetary policy any time soon. However, the widening of intra-Eurozone spreads, particularly France/Germany, has historically tended to be correlated with a weakening in EUR/CHF to reflect increased Eurozone political uncertainty, and with the France/Germany 10 year spread up to 2 year highs, this may mean that downward pressure on EUR/CHF continues.