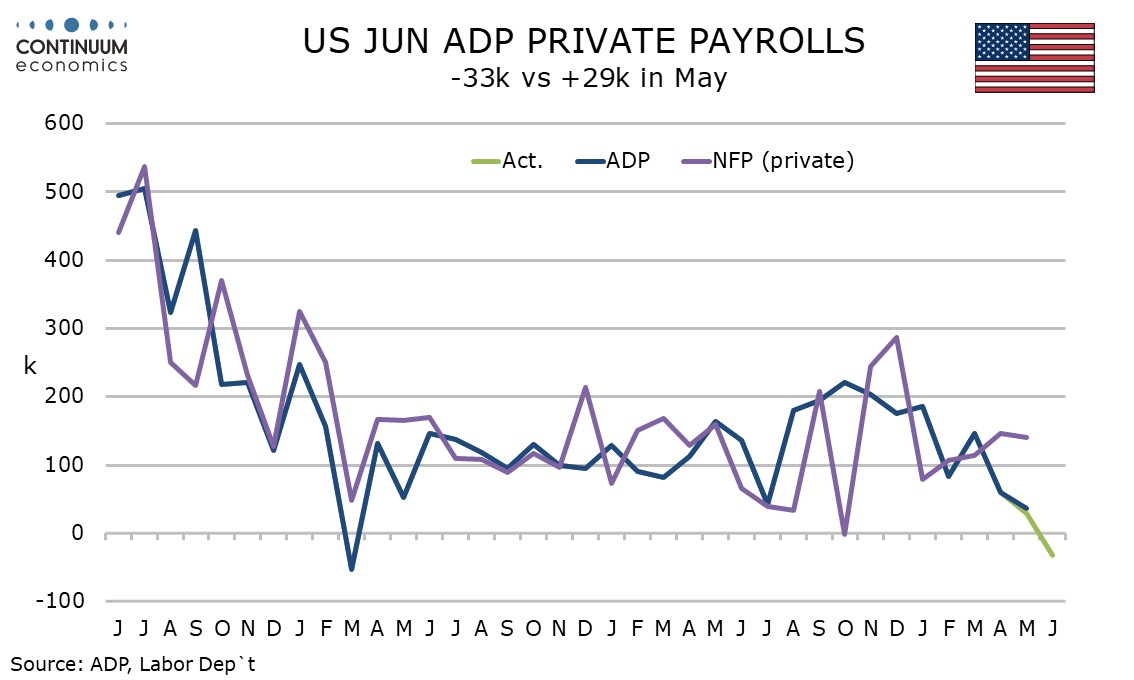

USD, GBP flows: USD softer after weak ADP, GBP falling on fiscal concerns

USD lower on negative ADP report, GBP declines while UK yields rise on fiscal concerns and talk that Chancellor Reeves may resign

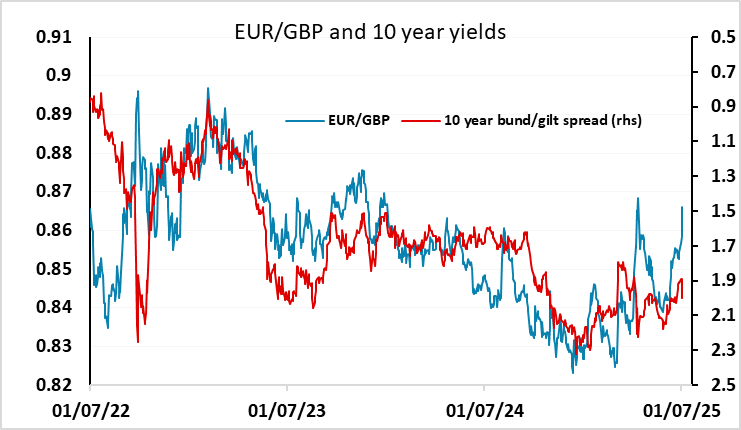

The weaker than expected ADP number has sent the USD generally lower, but particularly against the JPY and CHF as risk sentiment dips. However, the most significant move today is in GBP, which has fallen across the board at the same time as UK yields have risen, once again reflecting a loss of confidence in the UK fiscal position. The sharp rise in UK yields reflects both disappointment at the failure of the government to get their spending cuts through parliament and talk that Finance minister (Chancellor of the Exchequer) Rachel Reeves may resign. We saw a similar move after Reeves’ first UK budget, which itself was a smaller scale version of the reaction to the Truss/Kwarteng budget in 2022. On the previous occasions the spike in UK yields and the decline in GBP have been relatively short-lived, and it is likely to be similar this time around. But EUR/GBP may in any case have upside scope with expectations of policy turning more dovish, so although the rise in yields looks unlikely to persist for long, the decline in GBP may endure.