USD, JPY, EUR flows: Quiet overnight but some corrective pressure

Current yield spreads suggest further USD losses but risk of short term USD upside correction if FOMC only cuts 25bps

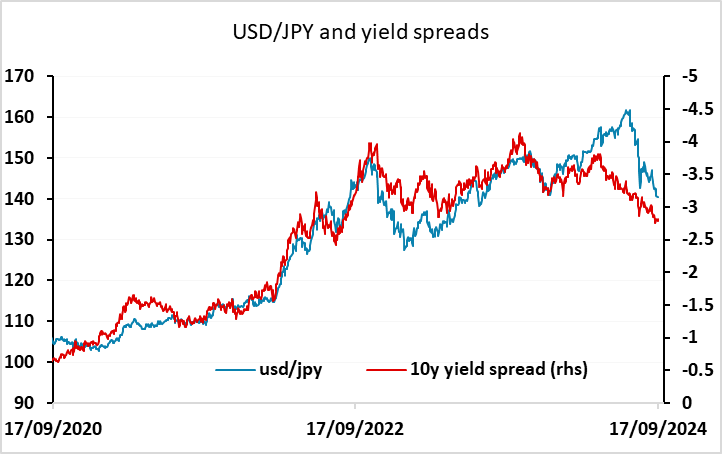

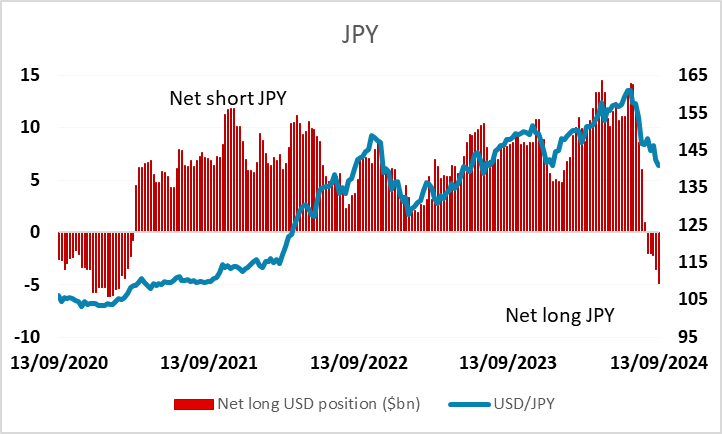

A quiet overnight session has seen little change in the majors, although there was an early spike higher in USD/JPY seemingly triggered by comments from Japanese finance minister Suzuki who said he was analysing the impact of the strengthening JPY. This may have been intended to stall recent gains, rather than reflecting any genuine analysis, since in reality USD/JPY is near enough unchanged on the year. It’s consequently hard to argue the recent recovery is having significant economic effects, with the sharp losses in the previous three years still likely to be the dominant factor for Japanese businesses. In any case, the spike in USD/JPY was brief, and it soon returned to US closing levels. Even so, USD/JPY has seen a significant rally after making new lows for the year at 139.58 on Monday, and if the Fed were only to cut rates 25bps, this could extend further in the short term. CFTC data shows net speculative positioning is now shorter USD/JPY than at any time since 2021, so there is some corrective risk. Even so, current yield spreads still suggest there is downside scope, so we would see any rally as corrective. But we do think the market is overpricing the likelihood of a 50bp Fed cut, so the short term risks may be on the USD upside.

Net speculative positioning in the CFTC futures data

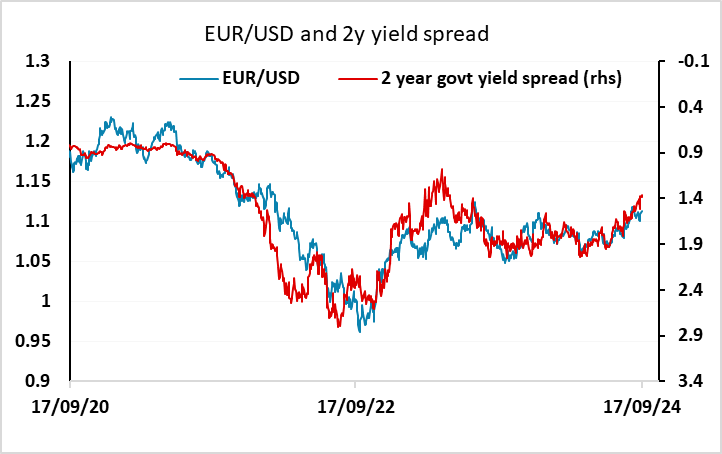

This is also true for other USD pairs. Typically, we have seen the JPY suffer more on rising US yields than the higher yielders, because yields outside Japan have tended to follow US yields higher, and because higher yields have usually meant lower equity risk premia, as equities have generally proved resilient. But this may not be the case this time around, with equities potentially sensitive to a less dovish than expected Fed, while the correlation between US and European yields has declined in recent weeks. However, like USD/JPY, EUR/USD looks well supported by current yield spreads, so any move lower should be seen as corrective.