U.S. June Retail Sales show surprising underlying resilience

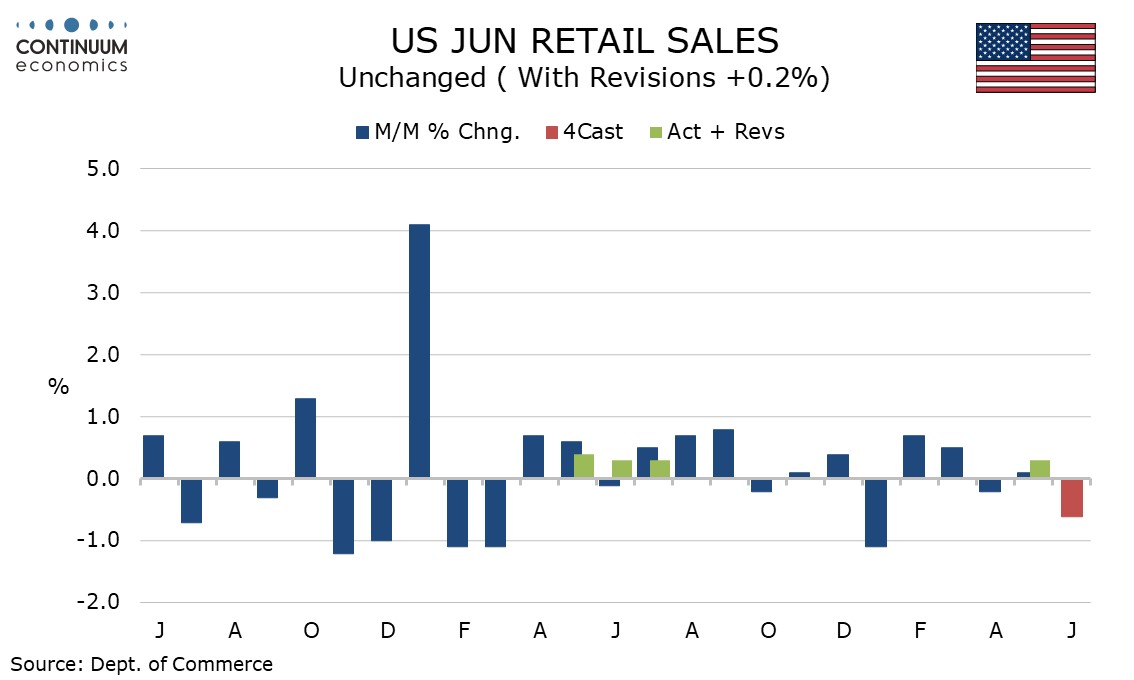

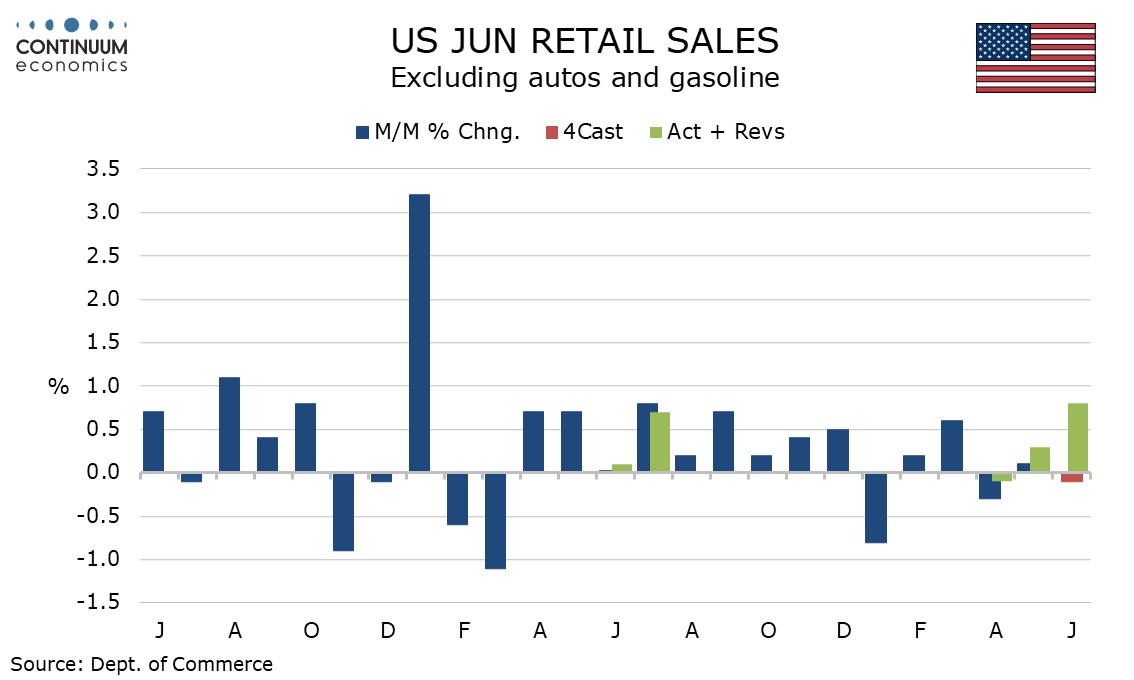

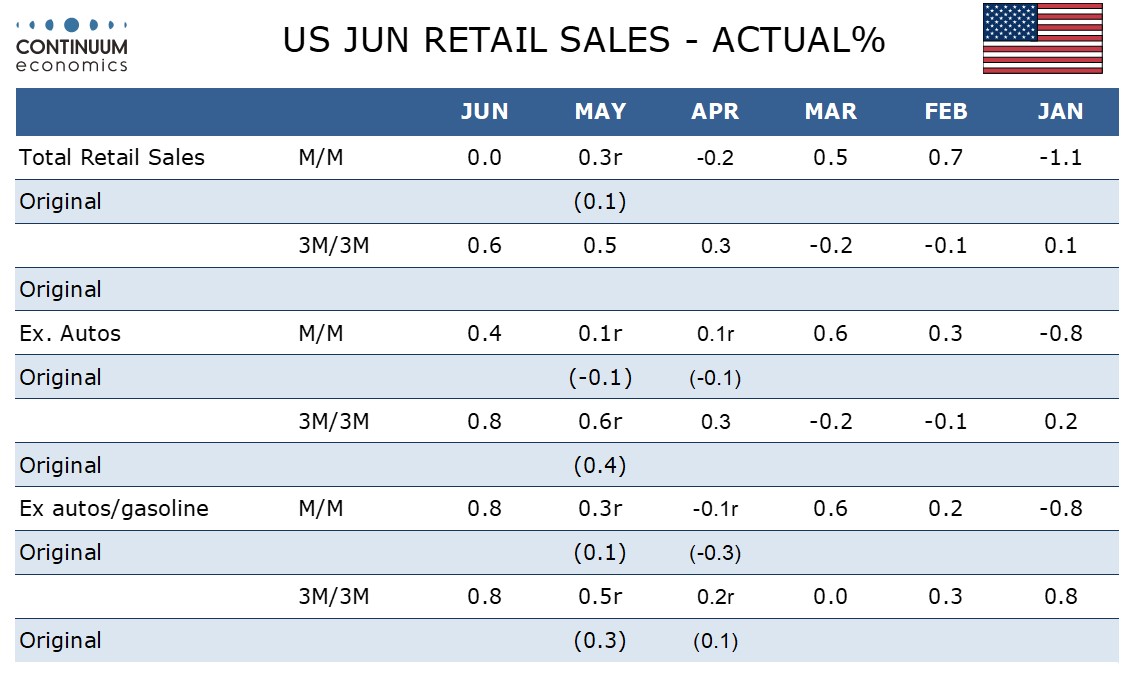

June retail sales show the consumer still resilient even if unchanged overall on a dip in autos and weaker gasoline prices which restrained the ex auto data to a 0.4% increase. Ex autos and gasoline sales rose by a strong 0.8% while the control group which contributes to GDP was stronger still at 0.9%.

The dip in autos had already been signaled by industry sales data and the dip in gasoline prices was visible in the CPI. The strength ex autos and gasoline is a surprise and with CPI goods prices subdued most of the gain appears to be on volumes, leaving the consumer with renewed momentum at the end of Q2.

May saw a marginal upward revision to a 0.3% increase from 0.1% while April was unrevised at -0.2%, though April did see upward revisions ex autos and ex autos and gasoline.

June data showed broad based moderate gains outside dips in autos and gasoline, with gains of 1.4% in building materials and 0.9% in health and personal care being particularly firm, if not striking as stand-outs.

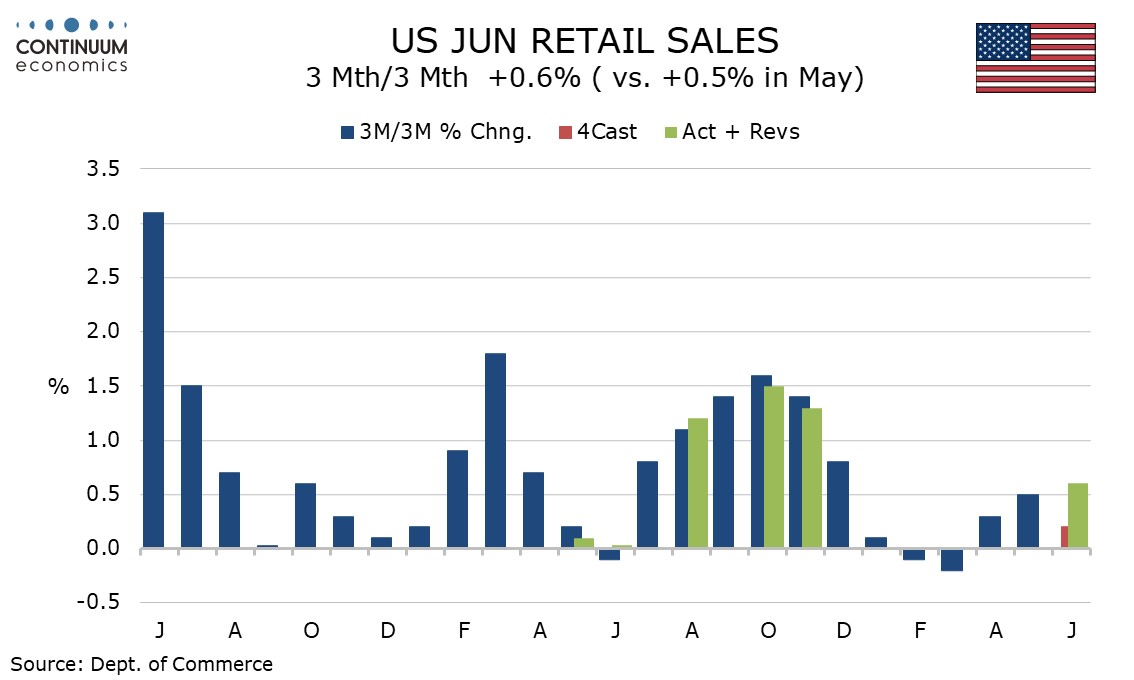

Despite each month being quite subdued overall Q3 shows a healthy gain (not annualized) of 0.6% after a 0.2% decline in Q1, though Q1 was depressed by bad weather in January which flatters the Q2 comparison. Q2 saw gains of 0.8% ex auto and ex autos and gasoline, after Q1 saw ex auto sales fall by 0.2% and ex auto and gasoline sales unchanged.

This latest report will give support to Q2 GDP estimates and the strength of June provides a stronger foundation for Q3 than was previously expected.