Preview: Due January 31 - U.S. December Personal Income and Spending - Core PCE Prices to match Core CPI

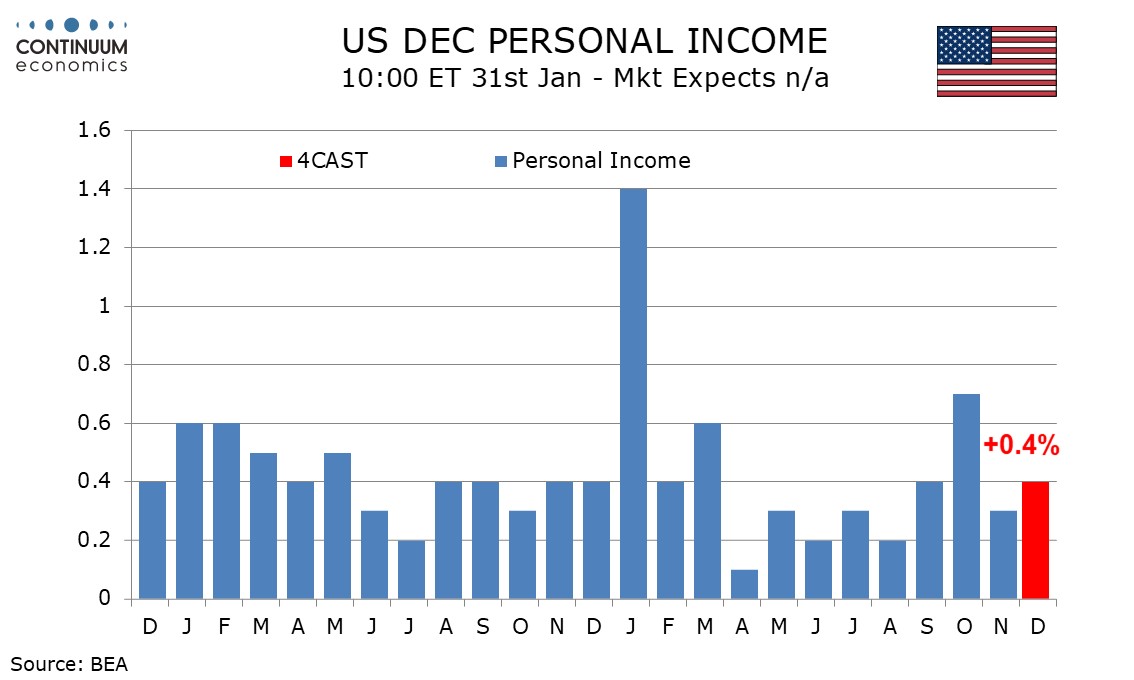

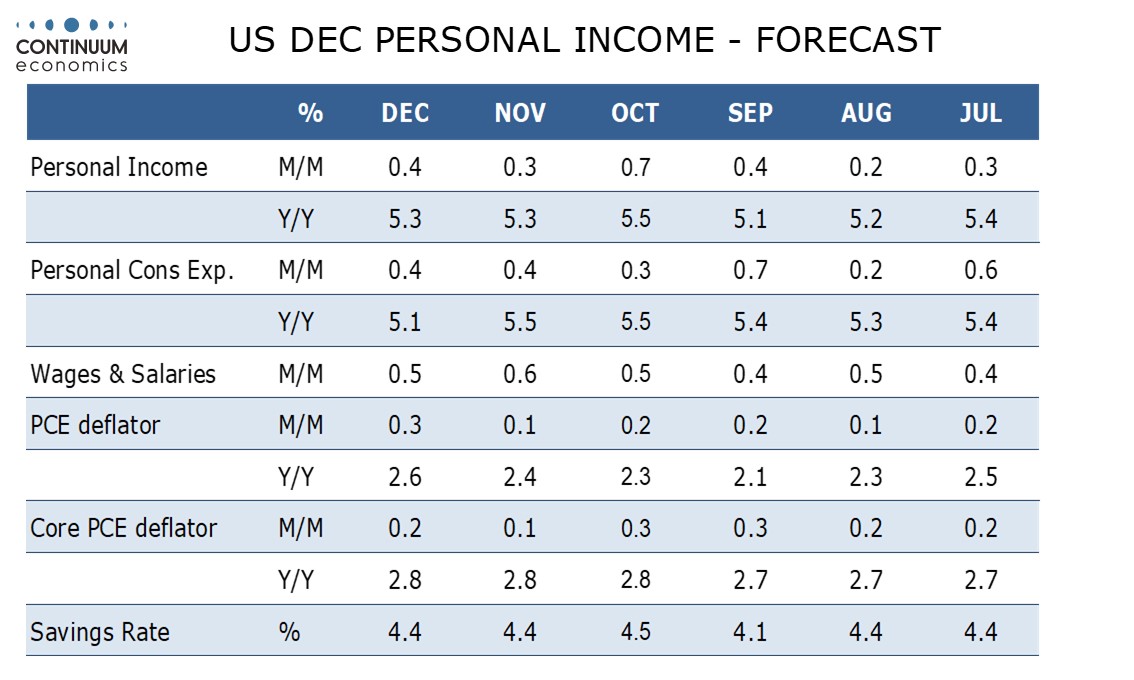

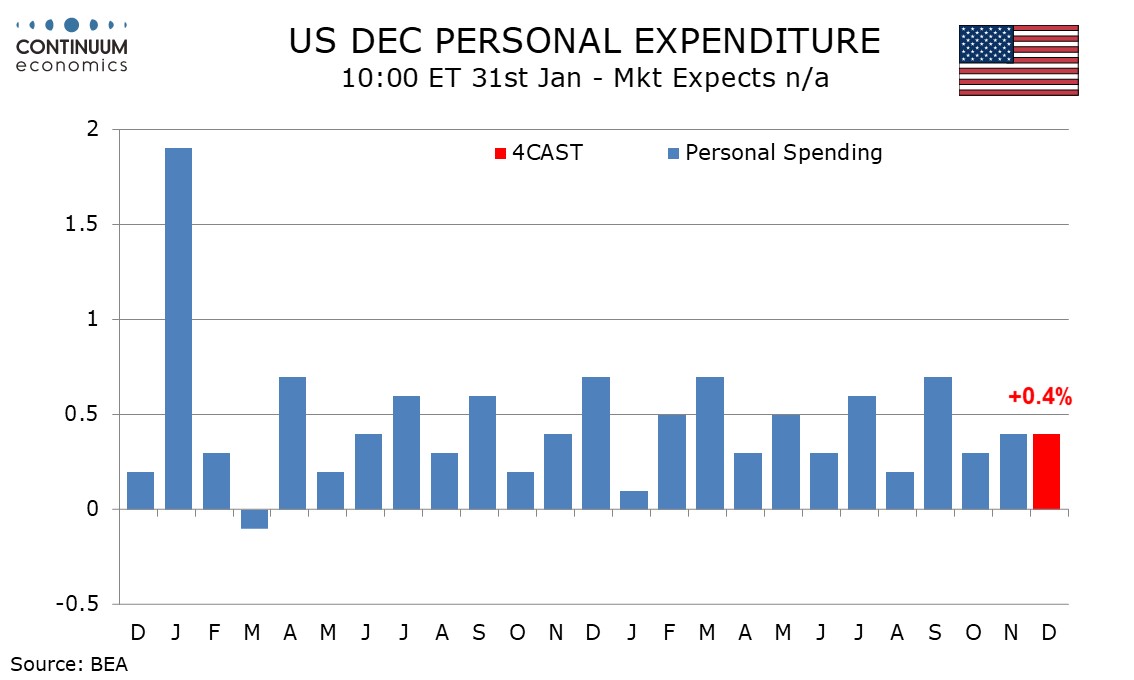

December’s personal income and spending report will be largely old news at the time of the release, with Q4 totals due with the GDP report on January 30. Ahead of the GDP data we expect a 0.2% increase in core PCE prices, and 0.4% gains in both personal income and spending.

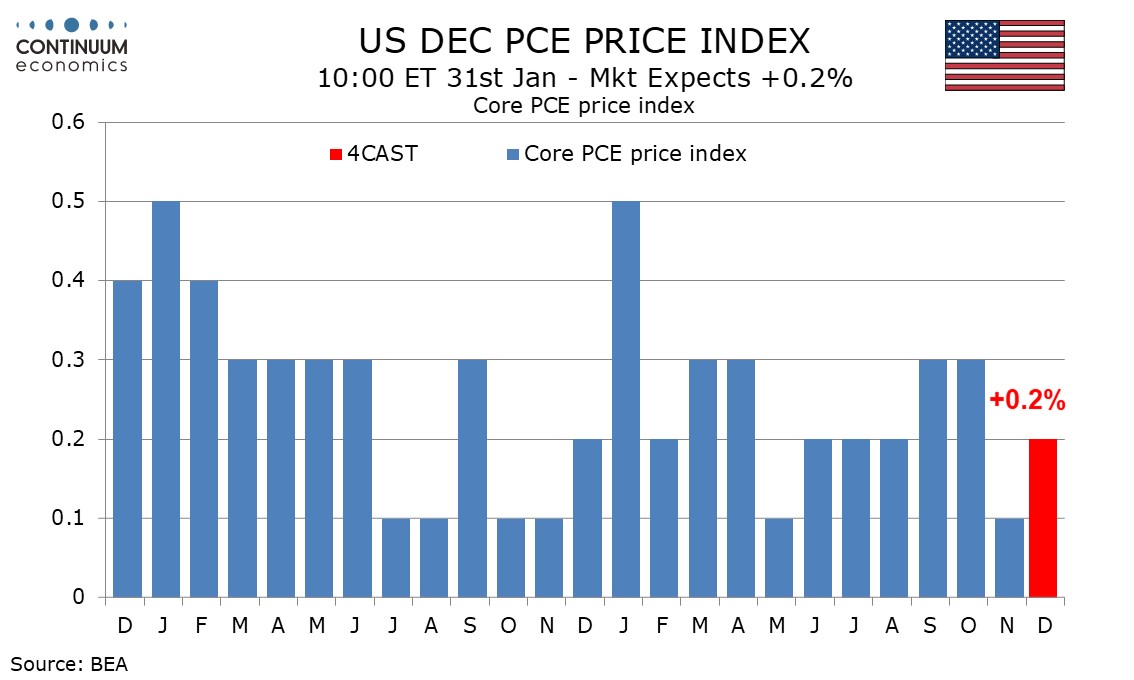

PCE prices trend a little lower than the CPI but after a significant November underperformance, when core CPI rose by 0.3% but core PCE prices rise by only 0.1%, we expect December’s core PCE price index to match a 0.2% core CPI increase. This would leave core PCE prices at 2.8% yr/yr for a third straight month.

PCE prices are less sensitive to gasoline then CPI, and we expect overall PCE prices to rise by 0.3% in December, slightly less than a 0.4% increase in overall CPI. This would see yr/yr growth in overall PCE prices rising to 2.6% from 2.4%, a third straight acceleration from September’s 2.1% but still lower than the core rate.

Retail sales rose by in December 0.4% but industry auto sales suggest autos may outperform the retail auto data. We expect a 0.3% increase in services, up from 0.2% in November but well below October’s 0.6%. Eating and drinking places, counted as services but included in the retail sales report, slipped in December. This would leave overall personal spending up by 0.4%, the same pace we expect for personal income.

A strong non-farm payroll but more subdued average hourly earnings imply a 0.5% rise in wages and salaries. We expect the other components of personal income to moderately underperform, as is trend, though this follows a more substantial underperformance in November that corrected a rare outperformance in October.