Indonesia CPI Review: Cooling Inflation Signals More Rate Cuts Ahead for Indonesia

In September, Indonesia experienced its slowest inflation in nearly three years, driven by a drop in food and transport costs. Core inflation edged up, reflecting price increases in non-essential goods. The ongoing deflationary trend since May, influenced by supply-side factors like strong harvests, raises concerns about weakening consumer demand and economic activity, reinforcing our view of another rate cut in Q4.

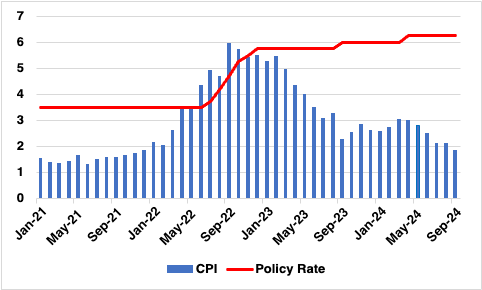

Figure 1: Indonesia Consumer Price Inflation and Main Policy Rate (%)

Source: Continuum Economics

Indonesia’s consumer price inflation eased to 1.84% yr/yr in September, down from 2.12% in August, marking the lowest inflation rate since November 2021, according to data from BPS. The deceleration was largely driven by falling food prices, although other categories also contributed to the overall disinflationary trend. Food price growth dropped to 2.57% yr/yr in September, down from 3.39% in August, shaving 0.23 percentage points (pps) off the headline inflation rate. Transport prices also slowed, reducing the inflation figure by another 0.07pps. However, personal care and education costs exerted mild inflationary pressure, continuing to rise.

On an annual basis, food prices remained the primary contributor to inflation, adding 0.73pps to the headline figure. This was followed by personal care prices at 0.39pps, along with restaurant prices. Notably, core inflation—excluding volatile food and energy prices—rose to 2.09% yr/yr in September, surpassing the headline inflation rate. The monthly deflation was largely supply-driven, as the harvest season boosted supplies of commodities like chilli and tomatoes, while prices for non-subsidised fuels, poultry, and school fees also declined.

For the third consecutive month, CPI inflation has stayed below Bank Indonesia’s target midpoint of 2.5% (±1%). This consistent slowdown in inflation opens the door for additional rate cuts by the central bank in Q4, particularly as inflation cools further and concerns over sluggish consumer demand mount. This rapid cooling of inflation has raised concerns about weakening consumer demand in Indonesia, where a shrinking middle class has been accompanied by contracting manufacturing activity since July, along with factory closures and layoffs.