JPY flows: Another new 16 year high in EUR/JPY. Don't blame the BoJ

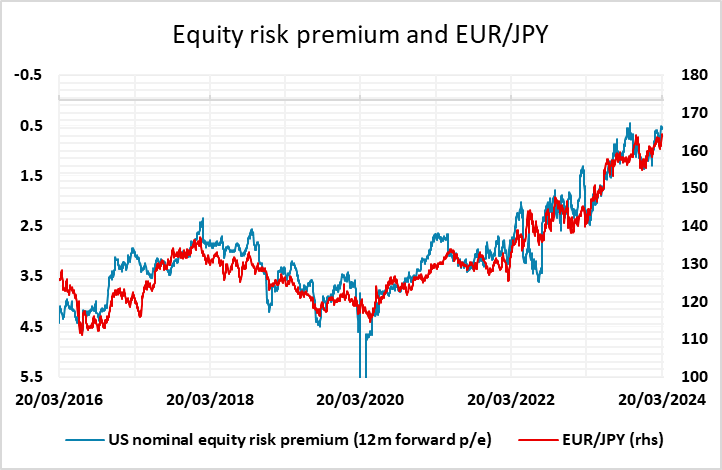

EUR/JPY made another new 16 year high this morning, as JPY weakness extended. But we see the JPY weakness as related to low equity risk premia rather than the latest BoJ decision and guidance.

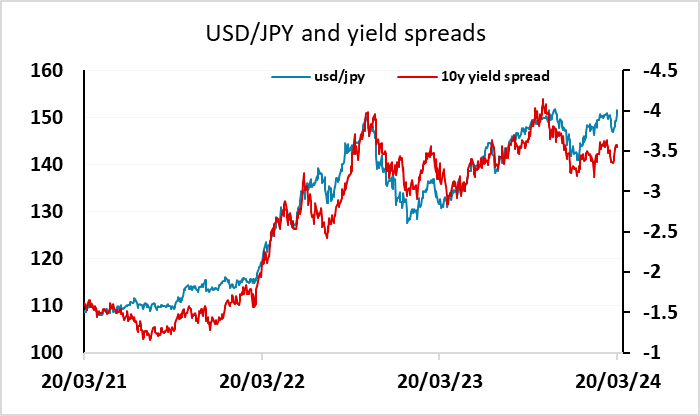

EUR/JPY has hit another post-2008 high this morning as the JPY sell off that started yesterday after the BoJ meeting continues. A lot of commentators are putting forward the argument that JPY weakness is due to the lack of prospect of further tightening from the BoJ, but in our view this does not hold water. While Japanese yields are a tad lower since the meeting, the move is very modest compared to the rise in front end yields seen this year, and the market is still pricing another 20bps of tightening this year, essentially little changed since the meeting. Yield spread correlations still suggest that the JPY is too weak, even looking just at nominal values. (The JPY is a lot weaker when looked at in real terms).

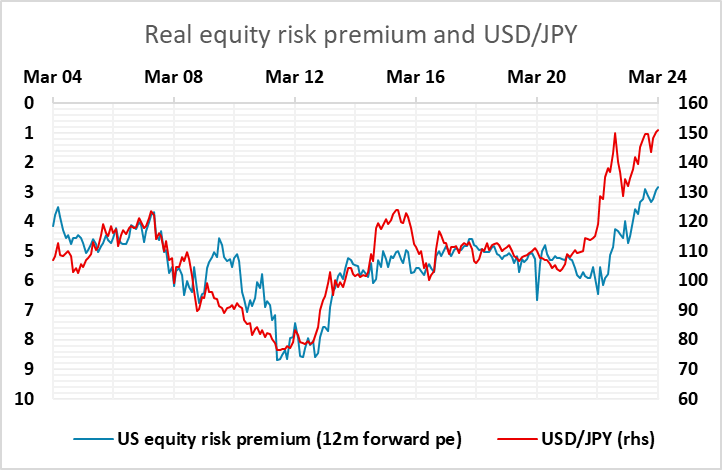

So we don’t really see JPY weakness as a consequence of the BoJ decision. Rather, JPY weakness on the crosses reflects to continued decline in equity risk premia we have seen this year. Ahead of the BoJ meeting, EUR/JPY had failed to rise in line with the usual correlation with equity risk premia, and now appears to be playing some catch-up. This negative correlation between EUR/JPY and the nominal US equity risk premium has held strongly for the last eight years, so is hard to oppose, even though it has little fundamental basis to justify it. There is also a strong long term correlation between USD/JPY and the real US equity risk premium, but USD/JPY already looks somewhat extended on this basis. The most likely way for equity risk premia to rise is by a decline in US bond yields that is not fully matched by a decline in equity yields. The alternative is that there is some derating of equities due to weaker growth or earnings expectations. The correlation could simply break if Japanese yields rise enough, but this looks unlikely in the near term.