Published: 2024-02-14T13:16:46.000Z

Preview: Due February 15 - U.S. January Retail Sales - A below trend month restrained by weather

Senior Economist , North America

-

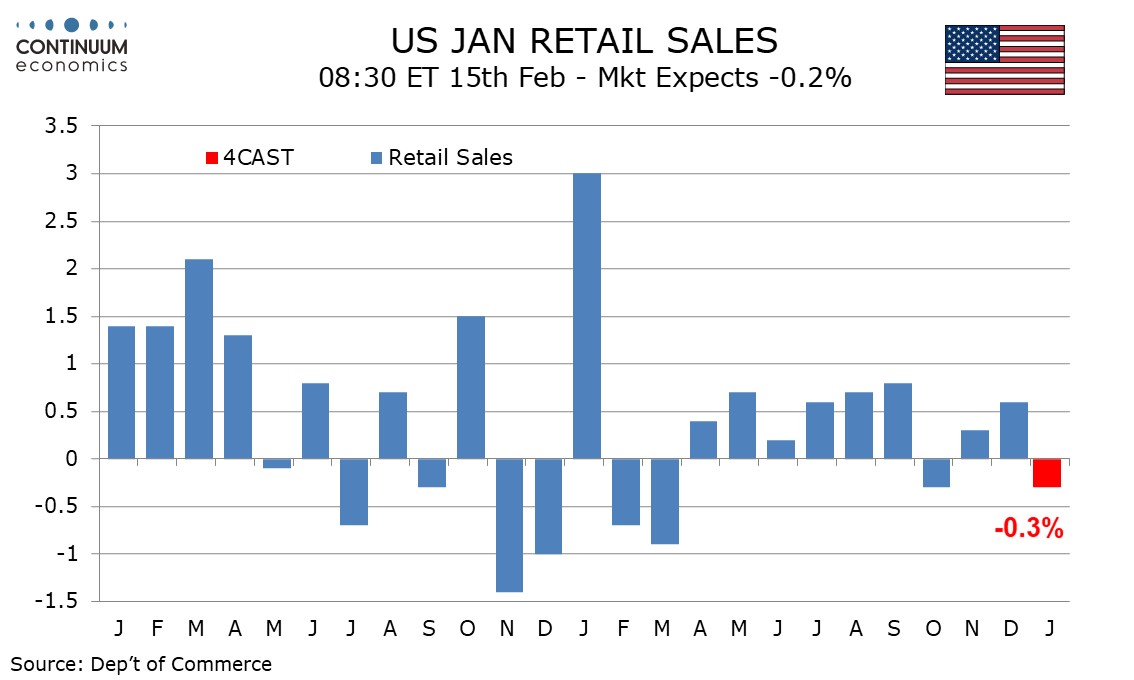

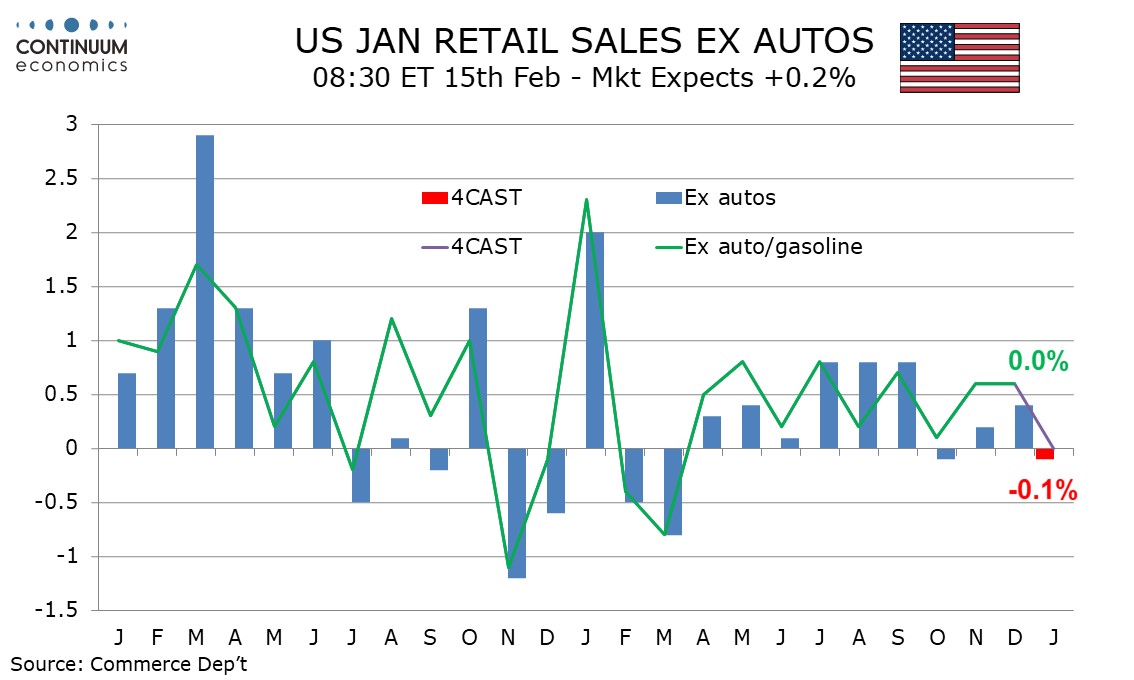

We expect a 0.3% decline in January retail sales, with a 0.1% decline ex autos and an unchanged outcome ex autos and gasoline. The data should be seen alongside a strong December with weather probably providing some restraint in January.

A decline would be the first since October and the steepest since March when a second straight decline followed a very strong January.

The January 2023 strength was probably flattered by mild weather. This January weather is likely to be a negative as suggested by a significant dip in the workweek in January’s non-farm payroll, which was particularly sharp in retail. Strong employment growth however suggests any weather-induced weakness in January 2024 retail sales will prove temporary.

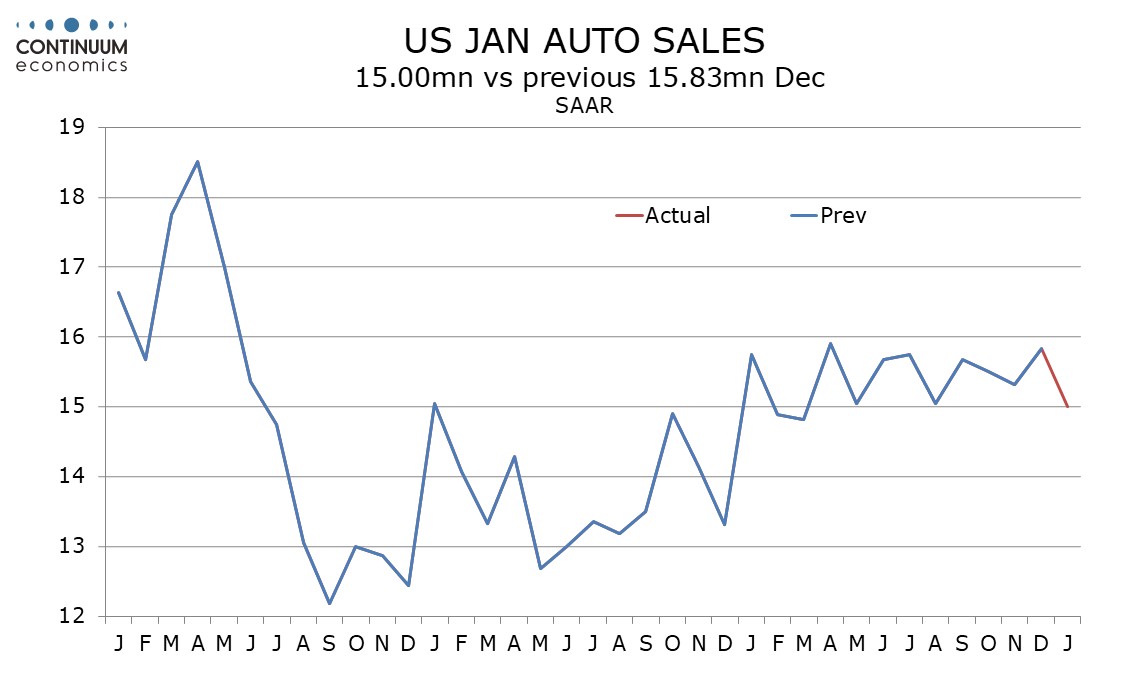

Industry data shows auto sales slipping to near the bottom of what remains tight range after rising to near the top of the range in December. Gasoline also looks set to be a modest negative.

Ex auto and gasoline we expect sales to be unchanged after two straight above trend gains of 0.6%. December’s above trend gain broke a string of monthly data alternating between above trend and below trend that lasted from May through November. A flat month from sales ex autos and gasoline would not be a clear signal of a weakening in trend, particularly if restrained by weather.