USD flows: USD slips lower on softer PCE price data

USD generally softer after PCE price index rises only 0.1% in August. AUD and JPY favoured

A softer than expected core PCE price index at 0.1% has helped the USD slip lower through early North American trading, although the y/y rate rose slightly to 2.7%, which was in line with expectations, so we wouldn’t see the data as particularly significant for the Fed. Personal income and spending were also slightly weaker than expected, and we have seen front end US yields a little lower and the USD lower across the board, losing around 0.3%. Canadian July GDP came in a little stronger than expected at 0.2%, but with the provisional August number flat the CAD hasn’t outperformed. In fact, it has slightly underperformed on the crosses as it tends to in weaker USD scenarios.

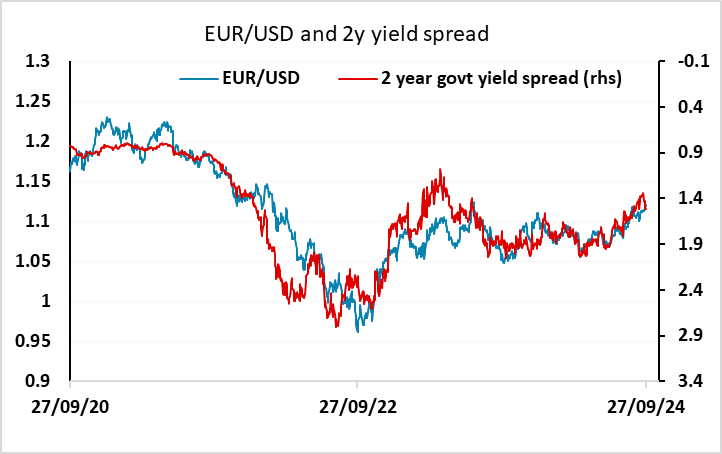

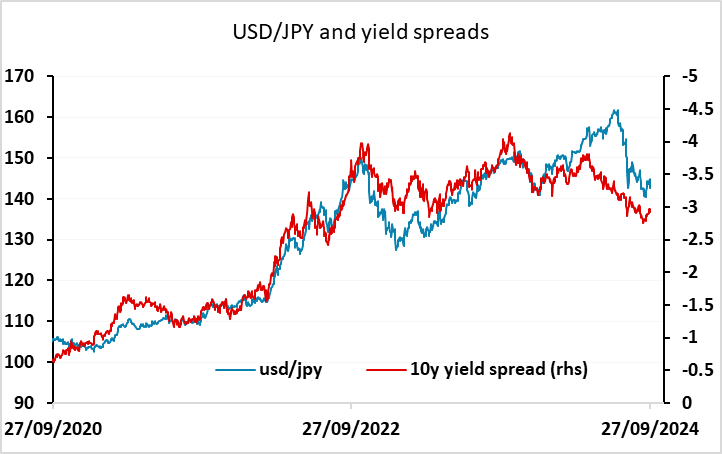

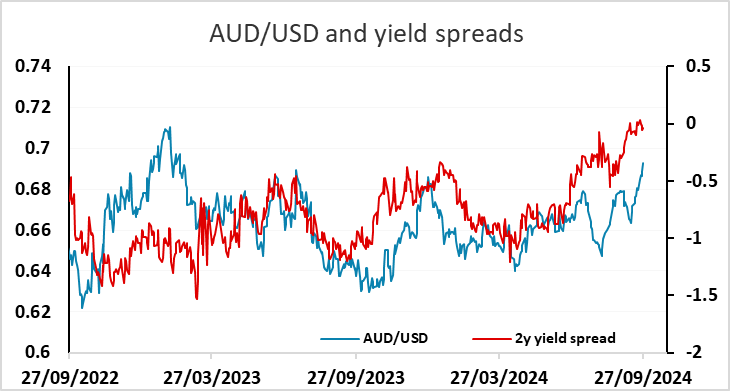

After the weak French and Spanish inflation numbers earlier, we would see the EUR as perhaps the least likely to benefit from this USD dip, with the AUD looking attractive helped by the stronger China picture, while the JPY is also supported by narrowing yield spreads. The CHF looks a little expensive having gained against the EUR this morning, helped by the JPY rally, but offering little value in what is still a risk positive world.