FX Weekly Strategy: November 25th-29th

CAD may benefit from position squaring in holiday shortened week

USD remains generally well supported by data and geopolitics

EUR looks vulnerable after weak PMIs

JPY preferred to CHF as a safe haven

Strategy for the week ahead

CAD may benefit from position squaring in holiday shortened week

USD remains generally well supported by data and geopolitics

EUR looks vulnerable after weak PMIs

JPY preferred to CHF as a safe haven

In a week effectively shortened by the US Thanksgiving holiday, there is relatively little US data of note and the main data of global interest is likely to be the November Eurozone and Japanese Tokyo CPI data, both coming on Friday. There is also Canadian Q3 GDP data on Friday and the Australian CPI data on Wednesday. Wednesday also sees the RBNZ monetary policy decision. However, while the CPI data at the end of the week may be significant, most of the week’s activity may be driven by a combination of geopolitics and position adjustment ahead of the US Thanksgiving holiday.

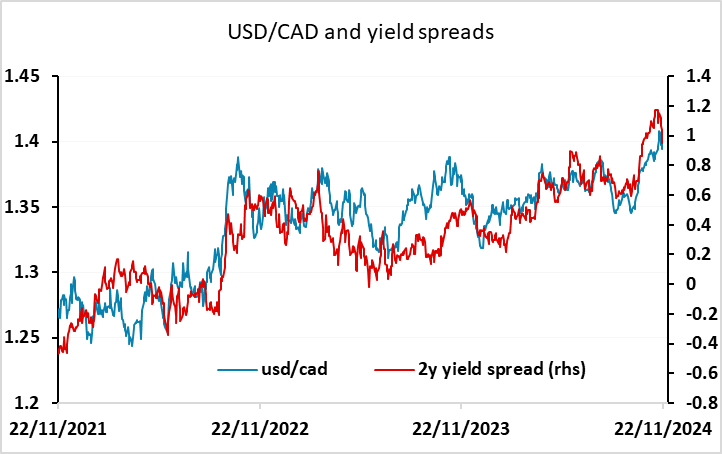

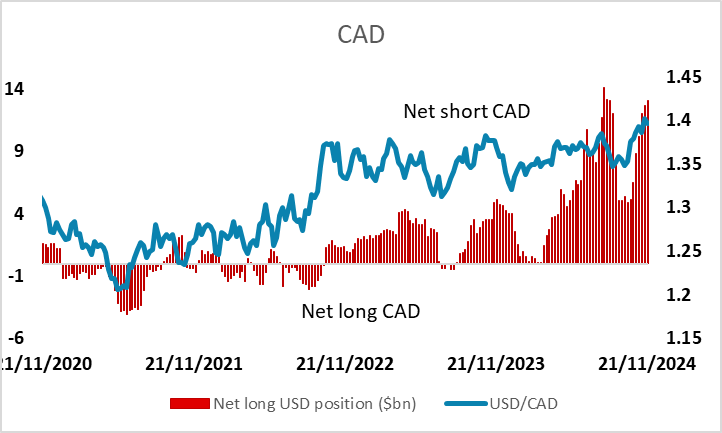

From a positioning perspective, the CFTC data shows the speculative market to be generally long USD, but primarily against the CAD, with other positions comparatively modest. There may be some upward pressure on the CAD as a result, especially since yield spreads have moved in the CAD’s favour in the last few days, and no longer point to further USD/CAD gains. The Canadian GDP data on Friday could potentially trigger significant CAD gains if the data comes in above expectations.

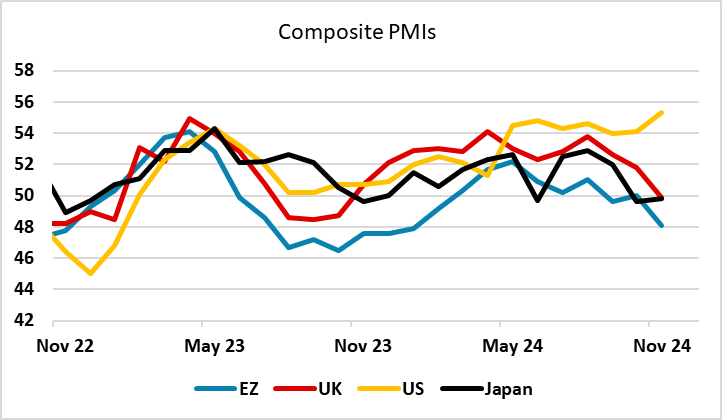

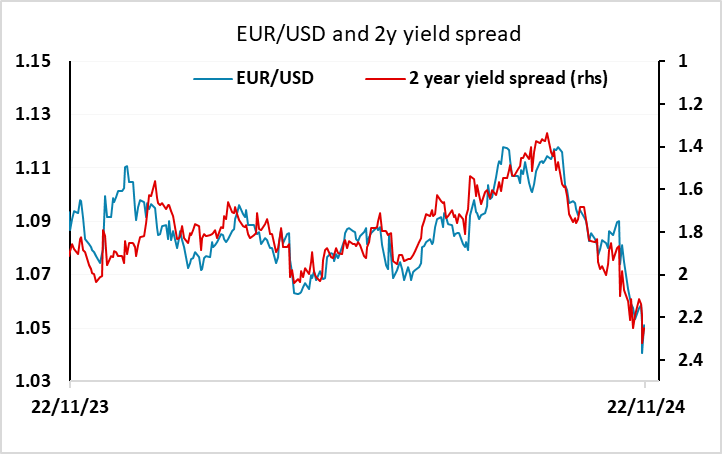

However, the bigger picture remains generally USD positive. The USD gained support in the last week from the combination of geopolitical concerns related to escalation in the Russia/Ukraine conflict, and the relatively strong US PMI data, more because of the weakness in Europe than the strength in the US. It will be hard to oppose this general USD strength, particularly against the EUR, in the absence of significant news. The market is currently pricing both the ECB decision on December 12 and the Fed decision on December 18 as essentially 50-50 calls, the former between a 25bp and a 50bp cut and the latter between a 25bp cut and no change. The direction of EUR/USD looks likely to depend on how the market moves on both of these views. The momentum suggests EUR/USD downside risks are greater, at least until the Eurozone CPI data on Friday, and some probing below 1.04 in EUR/USD looks likely.

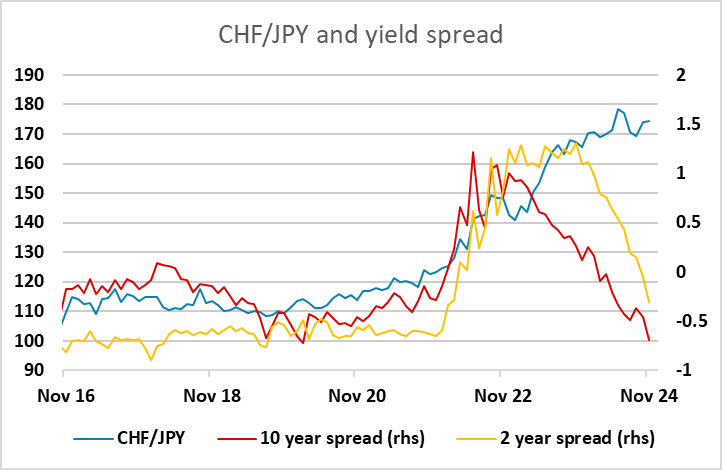

The USD/JPY picture is more uncertain, as the slightly higher than expected Japanese CPI last week increases the chance of a BoJ rate hike on December 19. This was also priced as close to a 50-50 call between a 25bp hike and no change, but has move fractionally in favor of a hike after the data. Yield spreads also if anything still suggest some downside risks for USD/JPY, and geopolitical uncertainty tends to favour the JPY against the riskier currencies. However, the resilience of equity markets in the face of the recent deterioration in the Ukraine war to some extent limits the JPY upside. Even so, we continue to favour JPY gains, particularly against the CHF. The CHF has benefited against the EUR from the rise in geopolitical tension, but SNB chair Sclegel warned last week of the possibility of a return of negative rates in Switzerland, and the current high level of the CHF combined with a strong possibility of a 50bp rate cut in December makes the JPY and USD more attractive safe havens.

Data and events for the week ahead

USA

The US sees no significant data on Monday. Tuesday sees November consumer confidence, which will be watched for early signals of post-election sentiment, and October new home sales, where we expect a 1.6% increase to 750k, which would be the highest level since February 2022. The afternoon sees FOMC minutes from November 7, which is likely to show a cautious approach, seeing the pace of future easing dependent on data, and no clear signals for December’s decision.

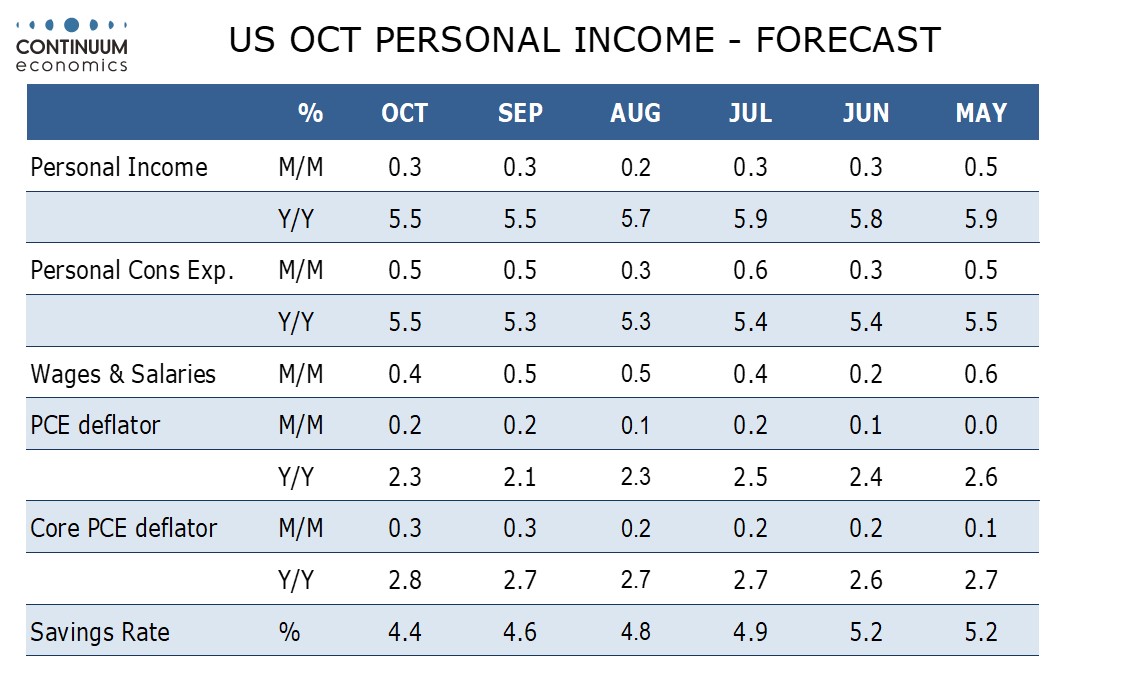

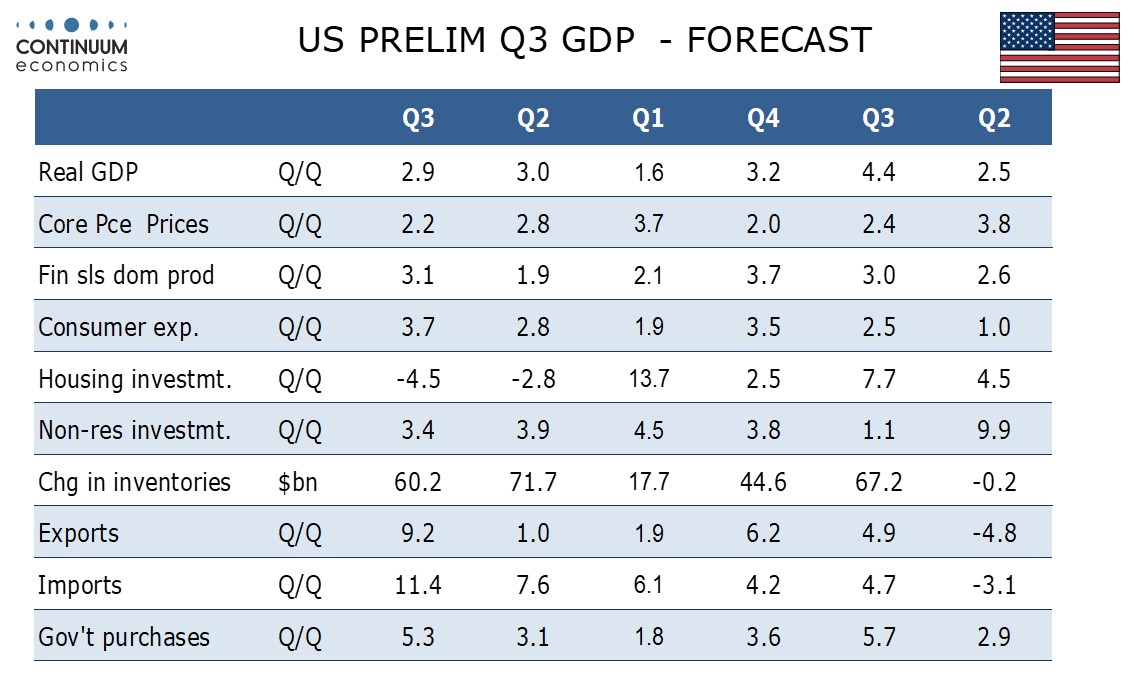

Wednesday sees a heavy data schedule, including weekly initial claims given the Thursday’s Thanksgiving holiday. We expect a 1.0% increase in October durable goods orders, with a 0.4% increase ex transport, and a correction lower in October’s advance goods trade deficit to $104.5bn from $108.7bn. We expect Q3 GDP to be revised up marginally to 2.9% from 2.8%. October personal income and spending data follow, where we expect income to rise by 0.3%, spending to rise by 0.5%, and most importantly a second straight 0.3% increase in core PCE prices, which will be a little too high for comfort. US markets are closed on Thursday and Friday’s calendar is quiet.

Canada

Canada releases Q3 current account data on Thursday and Q3 GDP on Friday. We expect a 1.3% annualized increase in GDP, below a 1.5% October estimate from the Bank of Canada, though we expect the quarter to end on a positive note with a 0.3% increase in September’s monthly data.

UK

The BoE book-ends the week. Monday sees Deputy Governor Lombardelli speak at the 3rd Bank of England Watchers’ Conference and is likely to discuss how the Bank has started to address the Bernanke Report recommendations. Friday sees whether risks to UK financial stability remain broadly unchanged in the updated Financial Stability Report. Significant financial market and global vulnerabilities are likely to remain, however, if not having intensified. Friday also sees fresh BoE-compiled money and credit data that may be of increasing importance. Firstly, they will show the extent to which cash-strapped households are still turning to borrowing to fund everyday spending, this important given some MPC views suggesting consumers are building up savings. Secondly, they will highlight how BoE balance sheet reduction is having a wider impact, given the drop in bank deposits that has occurred until at least recently.

Eurozone

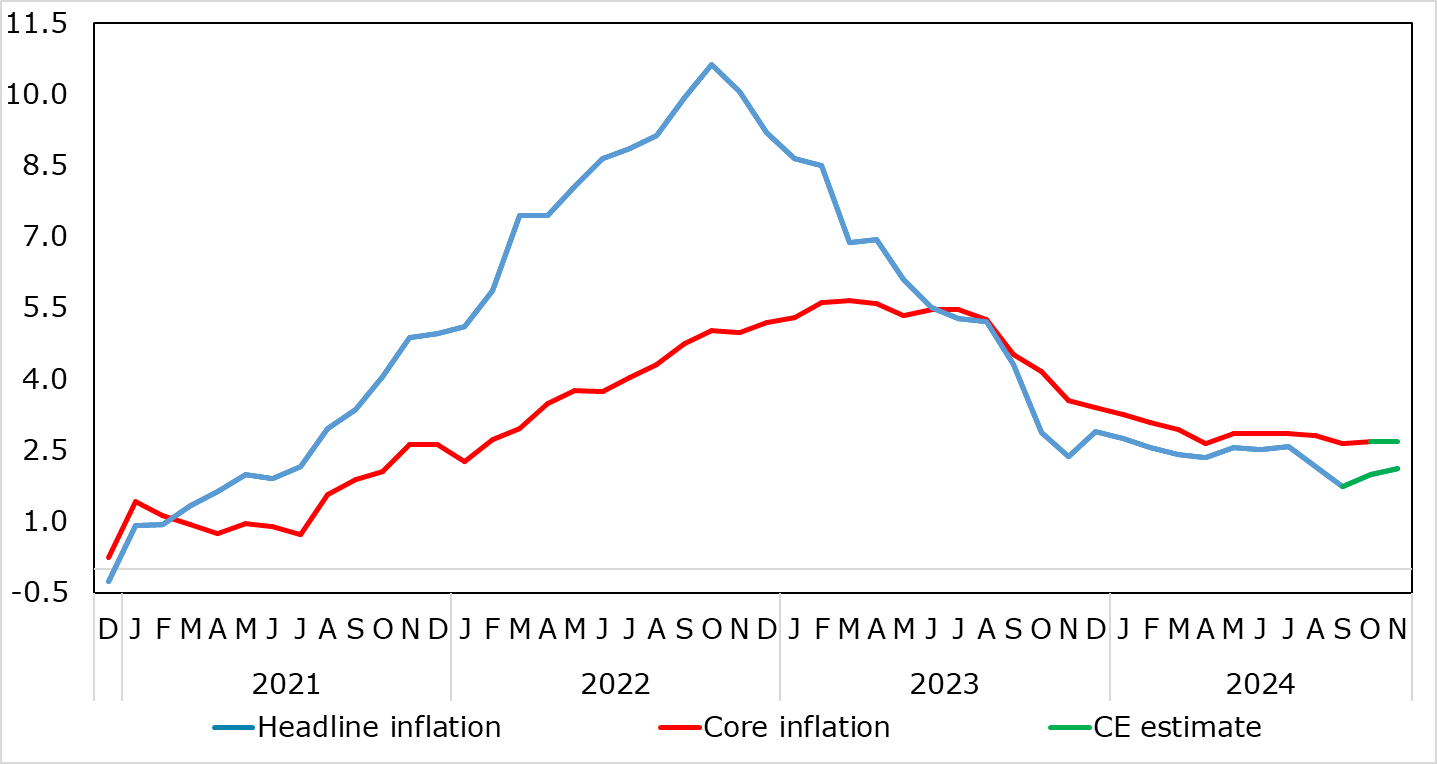

Inflation news may dominate the week. As for Germany, CPI/HICP arrives on Thursday. A further, but more modest (i.e. 0.1 ppt to 2.5%), rise is in store for November’s headline, again largely based around energy base effects but where services inflation (which rose afresh in October) may abate somewhat. As a result, the core may remain at 3.3% at least on a CPI basis but still with friendly short-term price dynamics! The EZ HICP comes the day after. The headline HICP rate may edge up a notch or two in November – most likely to 2.1%, but with the core staying put. Adverse energy base effects will be the cause, making it all the more important to look at shorter term price dynamics, (ie adjusted m/m data), which suggest on target core inflation even on the ECB’s preferred measure.

Headline Rises Back - Modestly

Source: Eurostat, CE

But the ECB may be more interested in the other key data due in the week. European Commission survey data (Thu) will offer more insights into how downside growth and inflation risks may be faring, as well as offering an alternative insight to the more volatile PMIs. The ECB release money and credit data (Thu) where the focus may be on the extent to which corporate credit growth is faring, especially after a slightly better reading in the last (September) numbers.

Rest of Western Europe

In Sweden, new Deputy Governor Seim on Tuesday will discuss the concept of a neutral interest rate and how the Riksbank views it. The next day sees Deputy Governor Jansson talks about current monetary policy and the economic situation. In Norway, Wednesday sees the publication of Financial Stability Report, and where any decision on the countercyclical capital buffer rate will be published at the same time.

Japan

Following the hotter National CPI in October, the Tokyo CPI for November on Friday is likely to linger around 2% with ex fresh food and energy likely higher than headline. It would be favourable for the BoJ to tighten in December, especially after Ueda suggest current inflation has been tilted towards wage driven. On the same day, we also have retail trade and housing start.

Australia

Monthly CPI on Wednesday would be the only critical data for Australia. The monthly CPI has gone closer towards the upper band of target range but has been downplayed by RBA as government subsidy on energy took a chunk out of the figure. If there is steady moderation in CPI after energy subsidies expire, it could prompt the RBA to ease earlier.

NZ

RBNZ’s interest rate decision will be on Wednesday and it is widely expected there will be another 25bps easing. Another 50bps cannot be ruled out but there were no early cues of such to occur, given the current inflationary dynamics. It would be a surprise to the market if there is no cut or there is a 50bps cut. Earlier in the week, we have trade and retail sales on Monday and Business confidence and outlook on Thursday.