This week's five highlights

Geopolitical tension flares up

Thoughts of Trump Policy

UK Inflation Back Above Target & Core Pressures Higher

ECB Stability Review Broadens the Case for Easier Policy

Choppy USD/JPY

After the west authorized Ukraine to strike target within Russia with their provided weapon, geopolitical tension once again flares up. So far, it is reported that British Shadow Storm were used and Russia has retaliated by launching intercontinental ballistic missile against critical infrastructure in Ukraine. While Russian nuclear threat ramped up by suggesting the indirect involvement of foreign countries will be considered a potential target for nuclear strike, they seems to have tried to restrain from escalating by limiting their comment on the ICBM strike. It is worth to keep a vey close eye to as the market does not to have priced in anything of a potential escalation.

Much uncertainty still exists on policy but in 2025 the EU will likely be under pressure from targeted new tariffs by the Trump administration, while also being asked to spend more on defense spending. Purchasing extra LNG and military hardware from the U.S. is one way towards a potential trade deal by H2 2025/H1 2026 – though the complexity of dealing with the EU will ensure that this is not quick. The UK and Australia will likely be treated differently due to defense commitments alongside the U.S. in Asia. Meanwhile, Japan/Canada will be under pressure as well to speed up planned military spending increases and fine tune the 2019 trade deals.

We have some initial thoughts on how key DM countries could be approached by the incoming Trump administration. However, uncertainty exists on these initial baselines, due to differences of opinion on the pace and breadth of tariff increases and how much geopolitical threat exists from certain countries. Even so, the focus will shift to bilateral discussions rather than multilateralism. We shall regularly update our baseline views on new information from the Trump administration in late 2024 and H1 2025. Our December Outlook will also include analysis on the economic and market impact of likely Trump administration policies. However, it is worth noting that even if bilateral trade deal were to reduce U.S. deficits with one country, that the overall trade deficit is a function of aggregate demand and supply and tax cuts could fuel demand more than tariffs prompt import substitution.

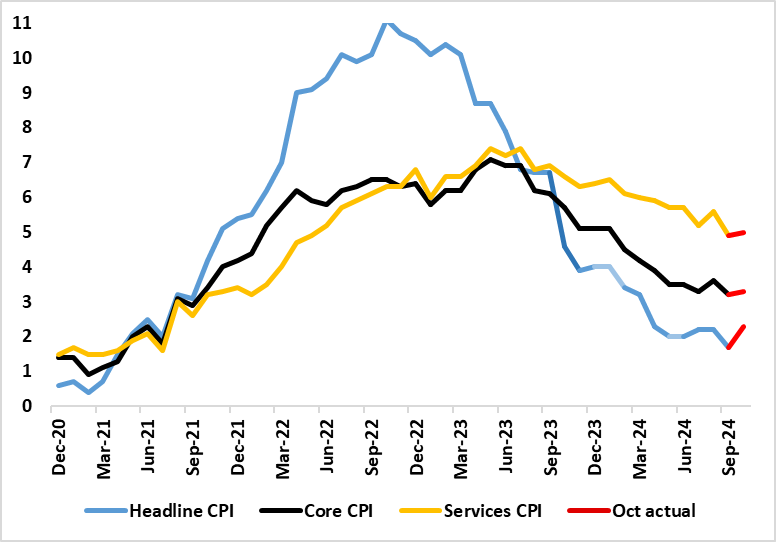

Figure: Core Inflation Drop Reverses?

Coming in higher than expected and a notch above BoE thinking, CPI inflation jumped to 2.3% in October. Helped by a fall in fuel prices and airfares, amplified by base effects, alongside some belated broader softening in services costs, UK inflation had dropped to 1.7% in the September CPI (from 2.2%), thus falling below target for the first time since April 2021. However, this drop proved to be both short-lived and with the latest data showing a fresh rise (of 0.1 ppt) in both the core and services inflation to 3.3% and 5.0% respectively (Figure), the latter up from a 28-mth low. Regardless, a rise in the headline was almost inevitable as last month’s rise in the energy price cap (partly dampened by a drop in fuel prices) was always going to pull the headline rate back and with the prospect of a further rise by a notch or two higher for the whole of Q4 – the BoE sees a 2.4% rate. Nevertheless, the data backdrop is consistent with underlying inflation still having fallen, especially when assessed in shorter-term dynamics and where supply side factors still suggest disinflation to continue.

The last CPI picture was weaker than BoE thinking by almost 0.5 ppt, and broadly so and made the much-vaunted Bank Rate cut at this month’s MPC meeting almost a given. But despite clear signs of abating price pressures, the MPC stuck to a gradualist easing outlook approach, partly based on what we think are optimistic assumptions about the Budget measures impact on growth and perhaps an unwillingness to consider how much weak demand may yet add to a disinflation process driven by supply factors.

Figure: Stretched Debt Servicing Capacity Signs More Visible?

It seems that worries about weaker growth are reverberating more discernibly and more broadly within the ECB. Indeed, the worries may now be at least twofold. Clearly, weaker growth risks possible (added) downside risks to inflation, with BoI Governor Panetta yesterday warning that restrictive monetary conditions are no longer necessary given the risk of inflation falling well below target. But the ECB is now also flagging elevated financial stability vulnerabilities according to its just-released Financial Stability Review (FSR). It notes risks to economic growth that have shifted to the downside and where growth fears have resurfaced as a key source of uncertainty particularly to firms where debt servicing is possibly more of an issue (Figure). All of which chimes with our long-standing concern of downside risks that may be materialising to what we still see is a below-consensus growth outlook. It could be argued therefore that ECB easing is needed not only to minimise downside inflation risks but also help repair debt servicing capacity and persuade households to run down elevated savings!

What the FSR underscores is that there signs of stretched debt servicing capacity are becoming more visible as corporate bankruptcies rise and deleveraging continues (Figure). The Report highlights that high borrowing costs and weak growth prospects continue to weigh on corporate balance sheets, with EZ firms reporting a decline in profits due to high interest payments. This adds to already clear evidence that the corporate world is under pressure. Indeed, the recent ECB Bank Lending Survey (BLS) highlighted that growth in lending to firms and demand for bank loans by firms remained weak while credit standards for loans to firms had remained at the restrictive levels reached after more than two years of progressive tightening. This is backed up by firms themselves.

USD/JPY remain choppy after the post Trump rally. Both the U.S. and JGB yields have crept higher yet the lack of commitment from BoJ to further tighten, has kept JPY gains at bay. The strength in broad equity market also limited the attractiveness of haven currency like the JPY. Looking at a medium run, the weakness in JPY is overdone but correction will only occur when yield differential significantly narrows or a major correction in the equity drove bids in haven asset. There next leg in JPY could be BoJ hike in December as per our forecast.

On the chart, the consolidation beneath congestion resistance at 156.00 has given way to renewed selling interest, as overbought intraday studies unwind, with the break back below 155.00 adding weight to sentiment. Focus is turning to support at the 154.00 break level, but daily readings are turning down once again and overbought weekly stochastics are flat, suggesting potential for a later break. Focus will then turn to the 152.50 break level, where by-then oversold daily stochastics could prompt fresh consolidation. Meanwhile, a close back above congestion resistance at 155.00, if seen, will help to stabilise price action and prompt consolidation beneath 156.00.