Preview: Due October 31 - U.S. September Personal Income and Spending - Core PCE prices may match Core CPI this month

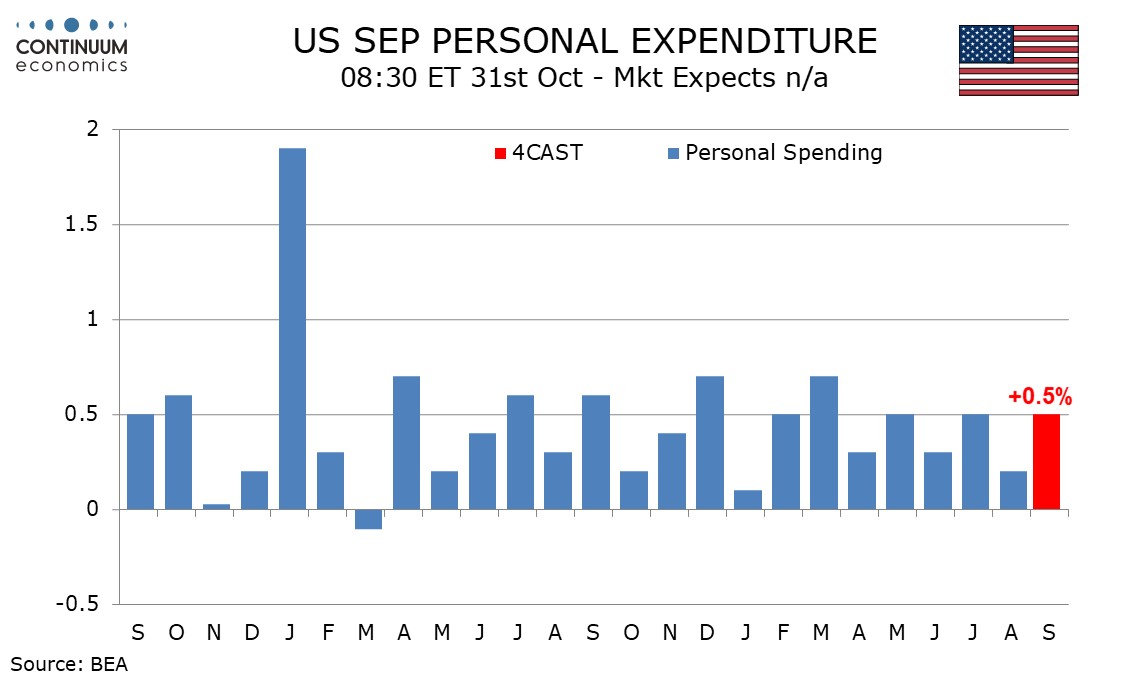

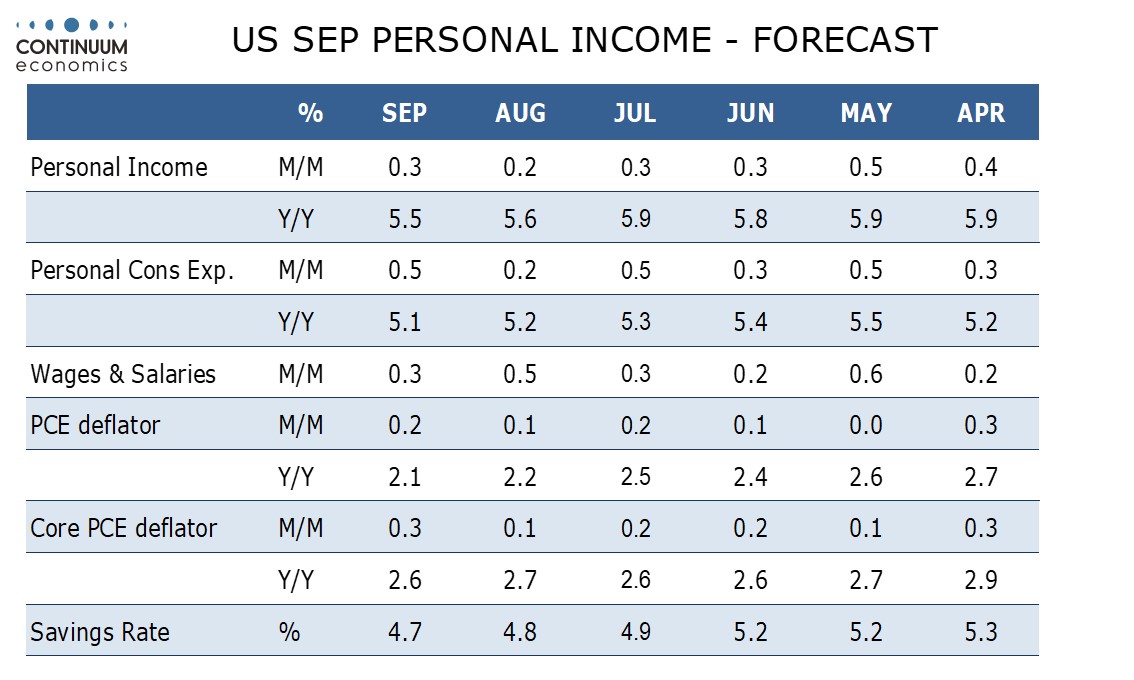

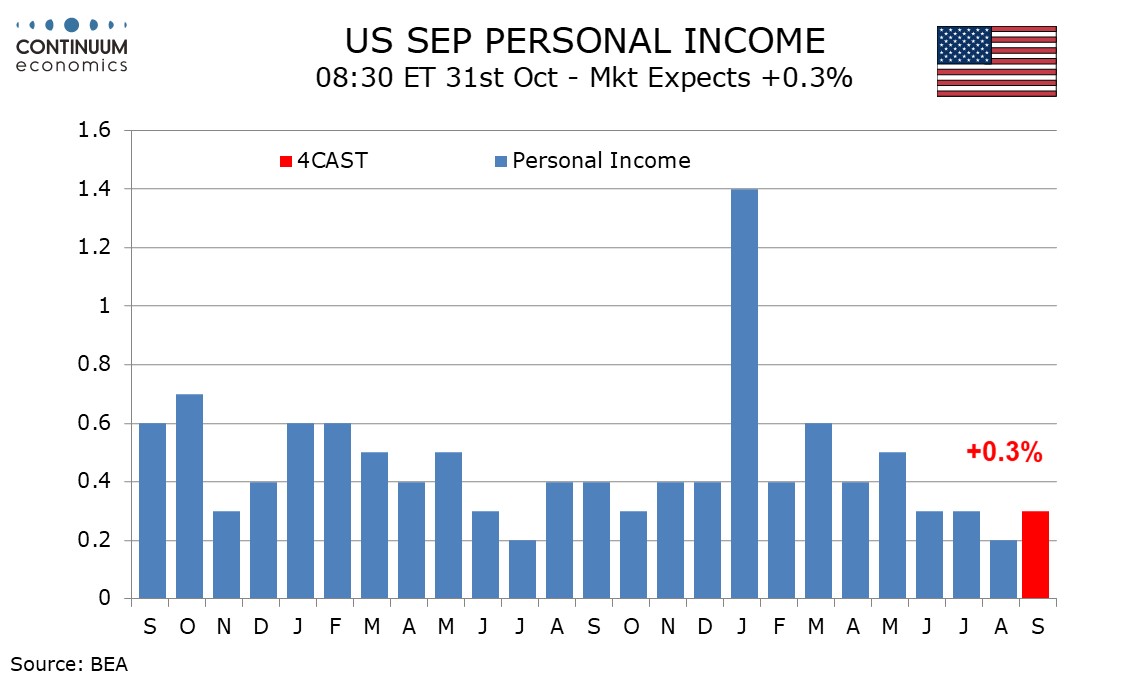

September personal income and spending data will be largely old news at the time of the release, with Q3 totals due with the GDP release the day before. Ahead of the GDP release we look for a stronger 0.3% increase in core PCE prices, and a moderate 0.3% rise in personal income which we expect will be outperformed by a 0.5% increase in personal spending.

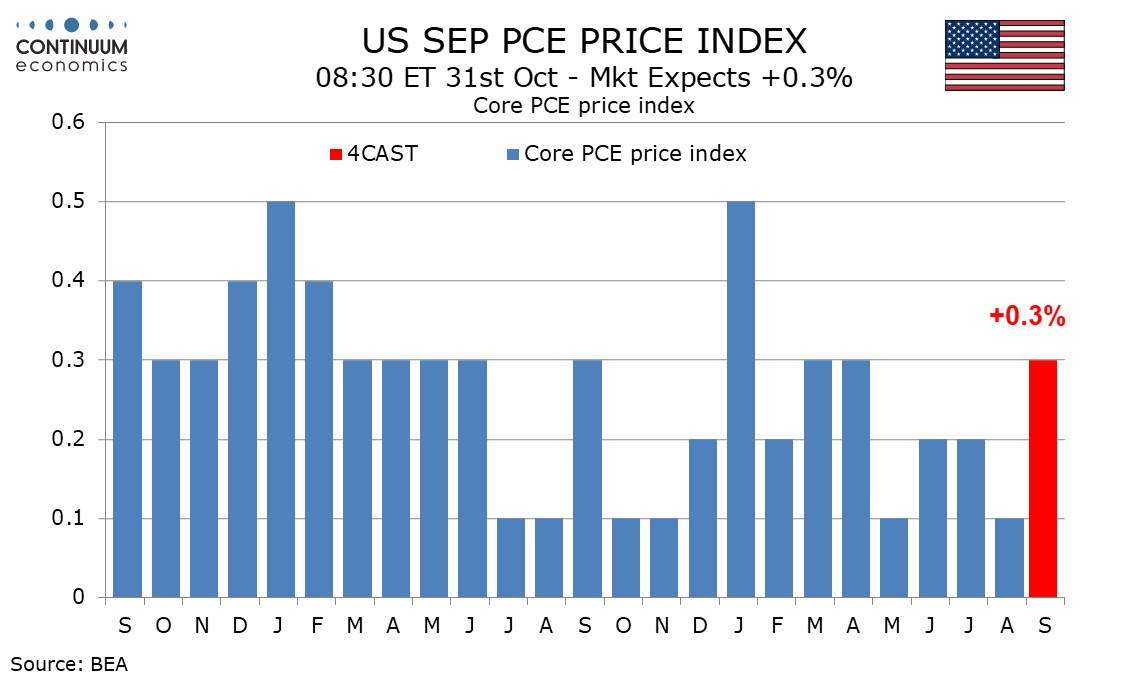

September’s CPI increased by 0.2% with a 0.3% rise ex food and energy, matching the gains of August. August core PCE prices significantly underperformed the core CPI with a rise of only 0.1% but we do not expect such a sharp discrepancy this time, with September’s core CPI gains being broader based than those of August, which were led by housing. We do expect core PCE prices to be on the low side of 0.3% before rounding, while core CPI was slightly above 0.3% before rounding.

Strong data a year ago will still allow yr/yr growth to fall, core PCE prices to 2.6% from 2.7% and overall PCE prices to 2.1% from 2.2%. There does appear to be some residual seasonality in inflation data even after seasonal adjustment so the fact September 2023 was above trend adds to the case for an above trend month in September 2024.

While September saw strong gains in the non-farm payroll and average hourly earnings, a dip in the workweek implies the gain in wages and salaries will be modest, we expect by 0.3%. We expect the other components of personal income to unusually match the rise in wages and salaries, correcting from an unusually sharp underperformance in August.

Retail sales rose by 0.4% in September, led by non-durables excluding gasoline which fell on lower prices. We expect a 0.5% increase in services, slightly stronger than in the preceding three months, largely due to stronger gains in prices.