EZ: Misleading Signals in Record Low Jobless Rates

While HICP inflation continues to subside amid an economy backdrop which is flat at best, and shrinking on a domestic basis, the labor market still looks apparently unmoved. Indeed, the EZ jobless rate has just returned to a record-low of 6.4%, hinting at labor market tightness that will perturb ECB hawks wary of higher ensuing wage pressures. But this apparent record-low may exaggerates the tightness in the labor market as it masks not only a situation where labor supply is not only rising but actually far faster than pre-pandemic (Figure 1), but where this has resulted in higher unemployment for younger workers (Figure 2). This may curtail what would otherwise be a relatively greater predisposition by the young to consider changing employment in search of higher remuneration. This will surely diminish any wage pressures, especially given that these younger potential works also seem to have a much lower perception and expectation of overall inflation.

Figure 1: Labor Supply on Firmer Upward Trend

Source: Eurostat, Continuum Economics, dashed lines are pre-COVID trends

Friendly Labor Signals

The latest (November) jobless data point to a record-low in the level of unemployment with the rate back down to 6.4%. But this masks something unique to the EZ, at least amid the DM world, that is not only an increase in labor supply continues but at a pace exceeding pre-pandemic rates Figure 1). As a result, there has not only been much actual fall in the unemployment level but also a clear rise in the jobless rate for young, they more likely than older workers to consider looking for better paid work (ie labour churning). Indeed, the rate has risen almost a full ppt in the last year, albeit with clear volatility into the latest release.

Figure 2: Youth Jobless Swings Dictate Wages?

Source: Eurostat, ECB

What is driving this divergence between older workers (ie over 25) and younger (under 25) is unclear over and beyond what is a weak economic backdrop. It may be that companies want to retain experienced workers amid what have been clear labor shortages signaled by business survey data, albeit the latter still suggesting an ever-clearer wariness about taking on new staff. It may also be the case that after the sharp fall in youth unemployment seen prior to mid-2023, more such workers were tempted back into the workforce with the prospect of actually finding employment, this possibly accentuated both by the relative and absolute costs of alternatives (such as further education) and a need to support family incomes hit by the surge in inflation.

Added Supply Dampening Wages?

Regardless the added supply of mainly younger potential workers is likely to affect the overall ability to strike for higher wages. Meanwhile, the demand for higher wages may be sapped both a decreased incentive to find alternative work with higher remuneration and by younger works having much lower perceptions and expectations of inflation – at least according to the latest ECB Consumer Expectations Survey. And history highlights how important turning points in youth unemployment have been is pre-dating turning points in wage pressures (Figure 2).

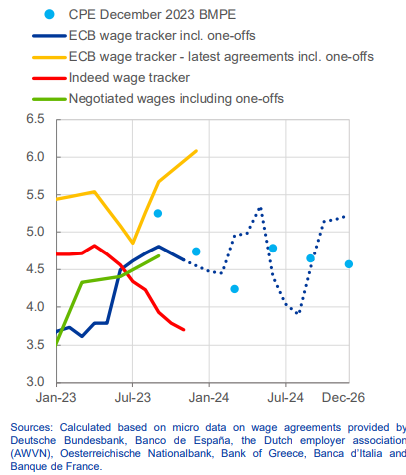

Figure 3: Some Signs of Softer Wage Pressures Already Evident

Source: ECB, CPE = Compensation per employee

For the ECB, there has been much attention placed on the still low jobless rare but little about the details behind it. For the hawks there is still the concern that wage pressures will persist at the recent higher pace. But even here the question is what is the recent pace, as varying measures offer starkly contrasting signals (Figure 3). In this regard, perhaps the softer signals in both the Indeed and ECB compiled wage tracker can be understood given what is really happening in terms of actual dynamics of the EZ labor market!