JPY flows: Extreme JPY weakness; what can turn it?

The JPY is at record weak levels and continued to make new lows despite narrowing yield spreads and FX intervention. Will the trend ever turn? Risk aversion looks liek the most likely candidate to trigger a recovery which could be huge when it comes

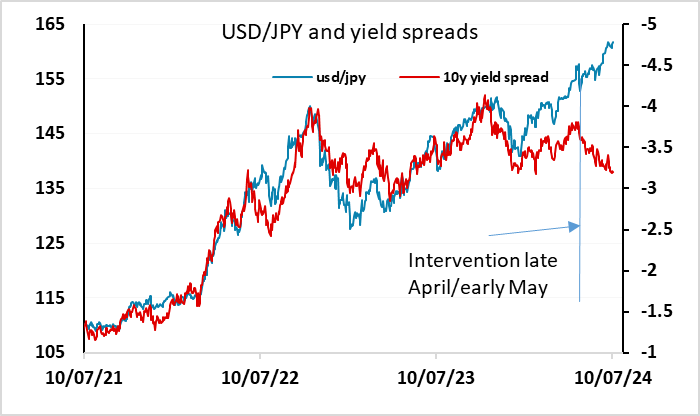

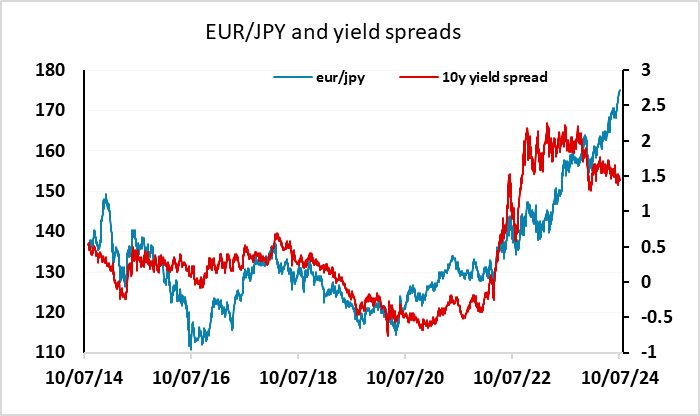

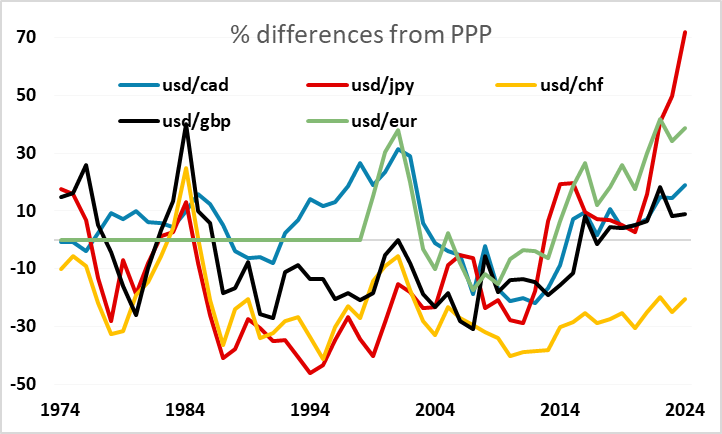

JPY weakness remains the main FX theme. While it was once a story about rising yields in the US and Europe and stable yields in Japan, it has no transformed into a momentum and carry story. Yield spreads are no longer moving against the JPY – indeed, they have moved in its favour in the last couple of months. But the JPY continues to make new lows against a range of currencies. While USD/JPY is (just) holding below the early July 38 year high at 161.95, EUR/JPY has made a new all-time high today at 175.31, GBP/JPY has made a 16 year high at 208.08, and AUD/JPY has made a new 34 year high at 109.36. This of course understates JPY weakness, as in real terms all of these are all time highs. The trend is extremely strong and prolonged. GBP/JPY, EUR/JPY and AUD/JPY are all in their seventh consecutive month of gains, a run that has never before been seen in any of these crosses.

So how long can it go on, and what can halt it? We have seen narrower yields spreads, BoJ tightening, ECB easing and BoJ intervention in the last few months, but none have been sufficient to halt the rise. More committed BoJ intervention might be effective, but without support from the Fed and other central banks might require a lot of activity. There has been no intervention since the appointment of the new “FX diplomat” Mimura on June 28, replacing Kanda, so at this stage intervention looks to have been benched for the time being.

The first Fed easing could be a trigger, but that won’t be until September at the earliest and there is no guarantee either that it will come or that it will turn the JPY trend. Underneath all this is the uncertainty about whether the Japanese authorities are really that concerned about JPY weakness. It adds to inflation in the short term, and they may see this as desirable after years of trying and failing to get inflation up to target. But their bigger concern should perhaps be that the lower the JPY goes, the faster and further it will rise in the future, potentially leading to renewed deflation problems.

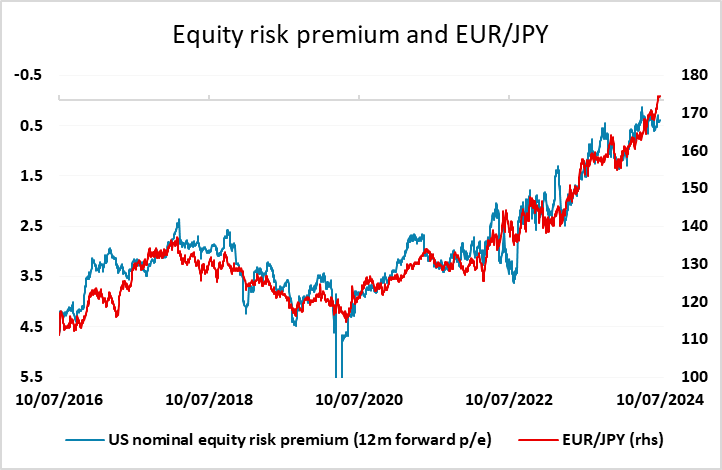

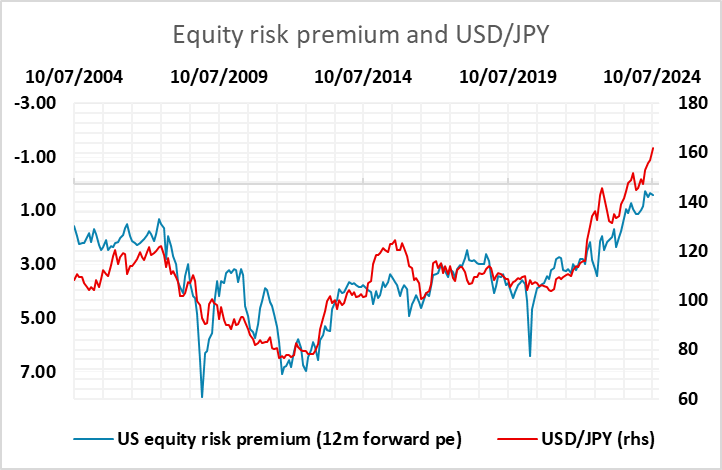

Typically, JPY gains come in periods of risk aversion – most memorably in the GFC and the Asian/LTCM crisis in 1998. In both cases the JPY gains were huge and rapid. In 1998 USD/JPY fell 25 figures in 3 days. In 2008 EUR/JPY fell 60 figures in 2 months. These were from starting points where the JPY was a lot higher than it is now. We are certainly in a situation where the US equity market valuation is extended and vulnerable to bad news. A turn lower in risk appetite consequently looks like the most likely trigger for a JPY recovery, and the recovery could be extremely large and rapid. Given the low starting point, it could be even larger and faster than 1998 or 2008.

By their nature, such turns in risk appetite are hard to forecast, particularly in their timing. But the US economy is slowing and political risk is increasing in both the US and Europe. The (northern hemisphere) autumn is typically the period when risk sentiment is vulnerable, and the previous collapses in USD/JPY have been seen in the August to October period. We would be wary of short JPY positions in the coming few months.