This week's five highlights

Japan's LDP Likely Lose Control of the Japan Upper House

Mission Accomplished for Japan?

Trump Deals with Japan, Philippines and Indonesia

USD/JPY Consolidating

ECB Policy ‘On Hold’ Leaves Easing Door Open

On the 20th July, half of the seats for Japan's Upper House are up for election. The LDP and its coalition were originally holding 141 seats as a ruling majority but as early exit polls are suggesting, they are set to lose that majority. 75 out of the 141 seats are not contested in this election and the LDP coalition will need to win at least 50 seats to remain in majority. Moreover, there seems to be little interest for smaller parties to work with the LDP for their concern on difference in political agenda and credibility from the ruling parties.

Rising living cost & rising foreign workers are key reason for voters' change of heart, driving a historic 21.5 million voters to cast their ballot. The latest surge in rice price from 2024-2025 have been a big blow to the ruling LDP coalition, despite their effort to steady prices by releasing the emergency rice reserve. To deal with the pressure of living, the current government is suggest a cash handout while the opposition's idea of consumption tax cut seems to have gained more traction among voters.

U.S.-Japan reached a trade deal with 15% reciprocal tariff. While details are to be finalized, it seems steel/aluminum tariffs and military spending are not included in this deal. The deal came as a surprise as Japan seems to have been solid on requesting 0% auto tariffs but should be welcome by the BoJ. If approved by the parliament, the uncertainty surrounding the trade front will be largely dismissed, freeing BoJ's hand to change monetary policy and achieve their inflation target. However, after the Upper House election last week, the current ruling LDP coalition has become a lame duck government with no majority control over both the Upper and Lower house. It maybe complicated for the Japanese government if smaller parties decided to collectively vote against the deal.

The main obstacle in previous negotiation is on auto an agriculture. The deal has lowered the 25% tariffs on auto and auto parts to 15%, without a quota. However, Trump also mentioned Japan will open their market towards U.S. agricultural product which did not seem to have faced steep obstacle before. The deal also included a joint venture between U.S. and Japan to develop LNG projects in Alaska. 550 billion USD will be invested into multiple sectors by Japan, including those of national security and AI, further tightens the bilateral tie. Yet, stick points on military spending remains. A previous suggested 3.5% GDP military spending has led to a negotiation collapse and it will be tight for Japan to spend 3% of GDP for military, given the current fiscal space.

This deal came after LDP loses their majority and could be potentially viewed as a political attempt by Japanese PM Ishiba to keep his chair. While it is hard to say whether the deal would face more obstacle in the Diet, it seems inevitable for the Japanese government to make some compromise to gain the political support needed to avoid a renegotiation of deal with Trump. PM Ishiba will remain on the chopping board despite his intention to stay, for the tough words on protecting the agricultural sector were proven empty.

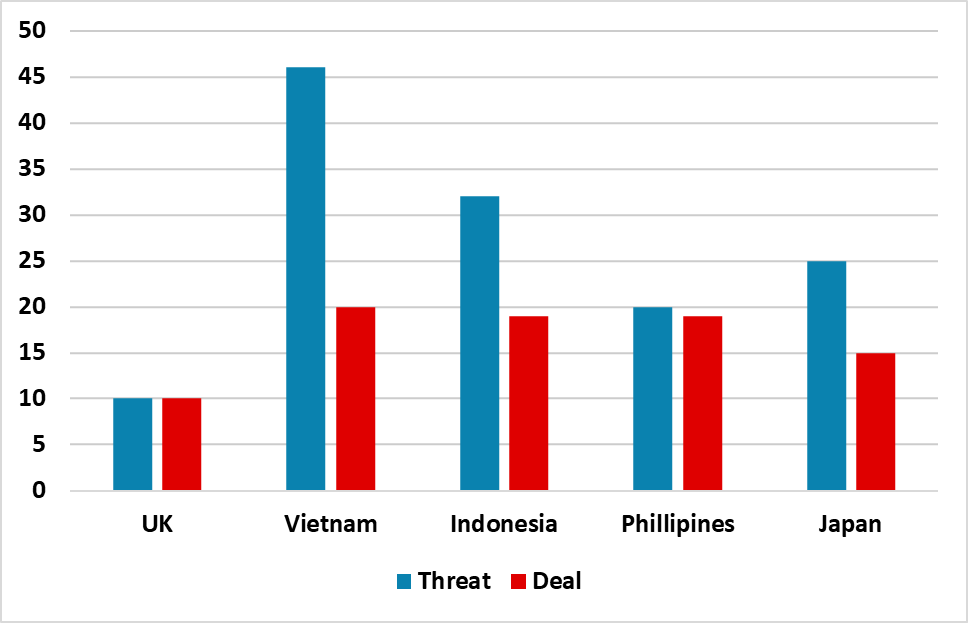

Figure: Reciprocal Tariff Threats and Outline Deals (%)

Japan deal with the U.S. is better than Philippines/Indonesia or Vietnam’s. Japan has agreed 15% for reciprocal tariffs, but crucially a reduction in auto and auto parts tariffs from 25% to 15% (without any UK style quota). Though the deal includes USD550bln investment by Japan in the U.S., this is likely to include existing commitments and new money will likely be much smaller – Trump reports that a JV will be set up for an Alaska gas project with Japan, which suits Japan’s needs. Finally, the deal does not include any extra commitments to Japan’s military spending, which the U.S. had been pushing for.

Indonesia and Philippines managed to agree 20%, while Vietnam was 20% reciprocal tariffs with 40% for transshipments (from China). Does this mean a two tier target for the U.S. on reciprocal tariffs, given that the UK managed to agree 10%? Japan is certainly a strategic ally in geopolitical terms, as the Pentagon sees Japan Okinawa bases as being the most important military asset if a conflict were to occur over Taiwan between China and the U.S. This could have helped Japan reach a better deal than its Asian neighbors. However, the U.S./Philippines relationship is the most crucial in the South China sea, given China grey warfare in that region (here). The specific rates that are agreed could also be the U.S. wanting to reach some deals to pressure China/EU/Canada and Mexico but also other countries wanting to avoid higher threatened reciprocal tariffs (Figure). Trump is also keen to shift the news cycle to trade deals from Epstein. These are also only high level outline terms in some cases and trade framework deals in others, with detail lacking. Thus the Japan deal does not mean that other countries can agree 15% reciprocal and for autos.

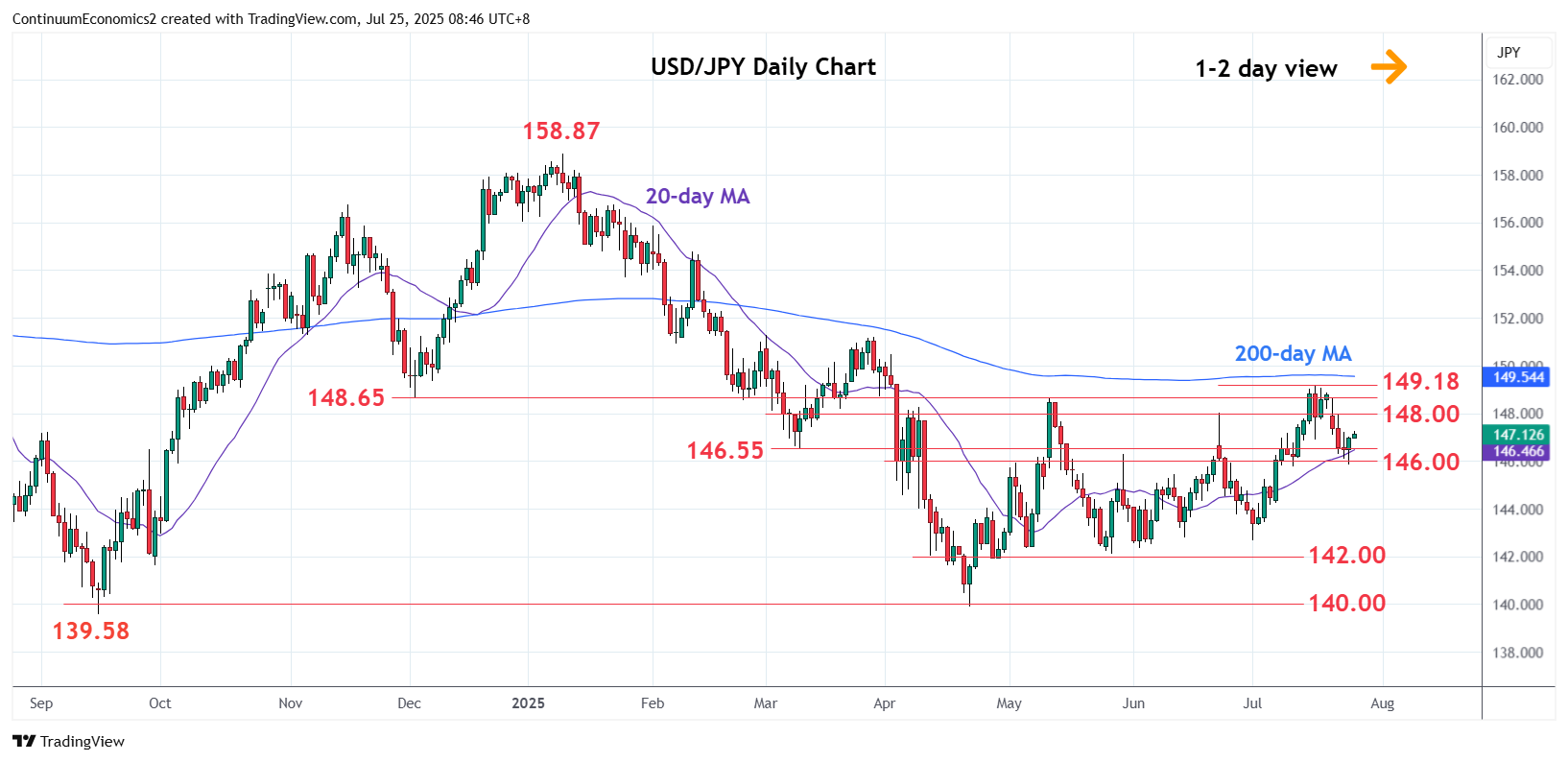

The JPY yo-yoed after the announcement of U.S. Japan trade deal, mostly because there has been little commitment from the BoJ on further hiking rates. In a medium run, we forecast the BoJ to hike once in 2025 and bring rates to 1% in 2026, thus supporting the JPY. Furthermore, the reduction in bond purchase could see yields rising freely and provide more support for the JPY.

On the chart, the pair is extending bounce from test of the 146.00 level as prices unwind oversold intraday studies. Clearing the 147.00/08 resistance opens up room for stronger bounce to retest the June high at 148.00, which is expected to cap. Break, if seen, will open up room for retest of the 148.65 resistance then 149.18 high. Lower high sought for pullback to retest the 146.55/146.00 support and where break is needed to open up room for deeper pullback to the 145.20/00 area. Below this will turn focus to 144.00 level and the 142.68, 1st July low.

Figure: The ECB Tariff Scenario - Severe More Likely than Baseline?

Given the uncertainty overhanging policy makers worldwide, let alone in the EZ, the ECB was always likely to revert to stable policy after seven consecutive cuts which have taken the discount rate to its current 2%. In a much shortened statement, but which was more willing to highlight disinflation in labor costs, we still think this is a policy pause rather than a protracted hold, with rate cut likely to resume in September and probably once more again by end year. To us this reflects the added damage to both real activity and inflation that the rumoured circa-15% reciprocal U.S tariff will bring (Figure) but also because we think the ECB is under-estimating a disinflation picture reflecting still-tight financial conditions which is seeing slowing credit growth and a softer labor market. As for this month’s ECB message, it is a clear wait and see, with the easing door left open as, after all, President Lagarde underlined policy now being on hold.

The EU, it seems, is willing to accept a deal that would see 15% tariffs on its exports to the U.S and possibly keep 50% on European steel but with other sectoral concessions for the likes of aircraft, spirits and medical devices. Possibly to save face, but also persuade Trump not to accentuate tariffs further, the Commission, is moving ahead with a possible arsenal of countermeasures, worth some EUR 93 bn (about 20% of EU exports to the U.S.). But this is posturing.

Regardless, a circa-15% deal will be seen by most as damage limitation in order to avoid an even more punitive 30% tariff that has been threatened. But in what may turn out to be more than 15% effectively, any such tariff would be more than the 10% rate the EU thought it would get just a few weeks ago and which forms the baseline for the ECB’s existing forecasts - something the latter clings to for the time being. But, although it is uncertain what the impact will be, we think that according to its recent scenario pictures, when the ECB updates its forecasts at the Sep 11 decision, it should be reining in both its inflation and growth outlooks more in line with its severe scenario (Figure). Indeed, the ECB largely sees tariffs as being disinflationary for the EZ and even if a trade deal is reached it may merely reduce current uncertainty not end it nor repair the damage it will cause. Albeit with likely Council divisions and possible dissents, this we envisage, should trigger a 25 bp cut on Sep 11, not least as the core 2026 and 2027 HICP readings are already down to 1.9%.