FX Weekly Strategy: July 14th-18th

US CPI could see some impact from US tariffs

Higher CPI could see the USD gain against the EUR but JPY might outperform

GBP vulnerable to any weakness in labour market or CPI data

Market still focused on tariffs but FX impact unclear

Strategy for the week ahead

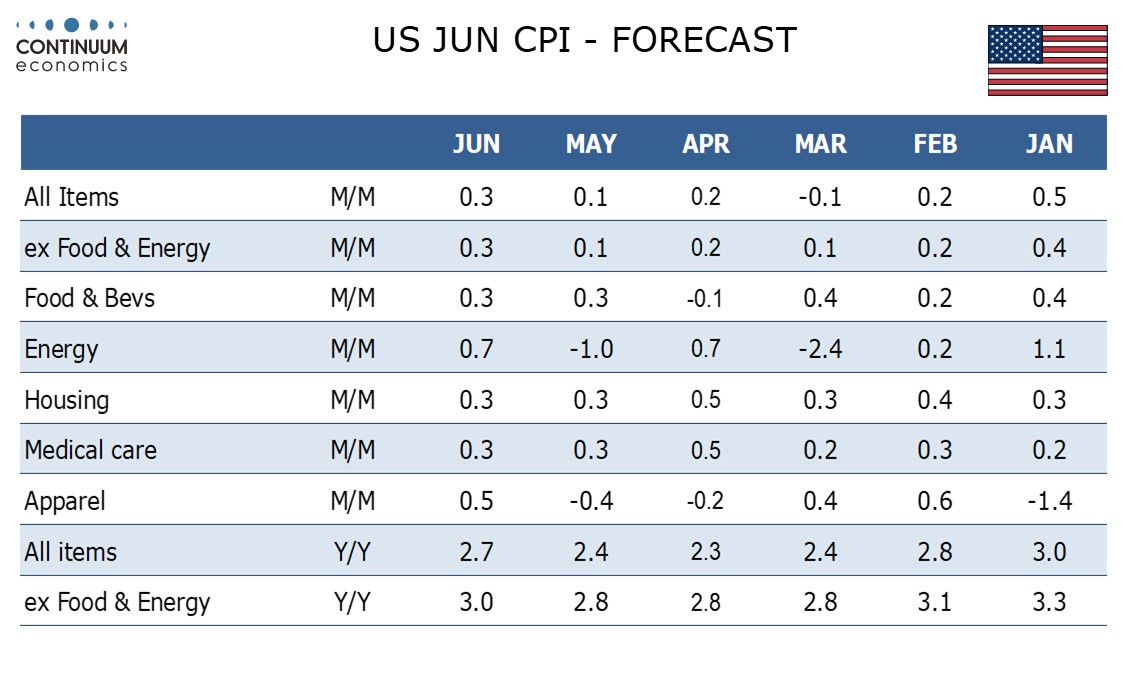

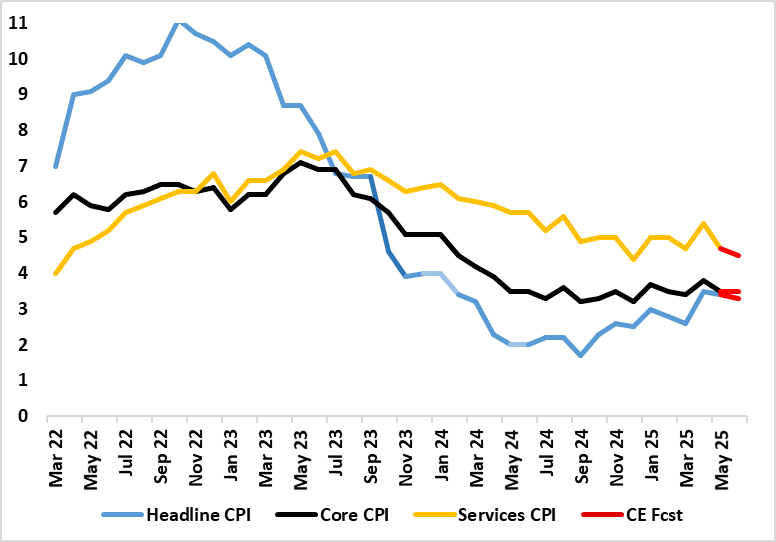

This is CPI week, with the June data for the US, UK, Japan, Canada and Sweden (final) all released. The US numbers will be the biggest focus, as the market looks to see if there is any evidence of an impact from tariffs. Our forecast is in line with the market consensus of a 0.3% rise, and the market could be expected to take this sort of number in its stride, even though this would be the strongest rise since January. As it stands, the market is still pricing in two Fed cuts by the end of the year. If we see inflation rising, this becomes less likely, unless it is accompanied by significant weakness in growth. Tariff related price rises might well also mean lower real consumer spending, but in the initial stages it is the price rises that are certain rather than the weaker growth, so higher inflation numbers could be expected to produce higher US front end yields, but a flattening of the curve.

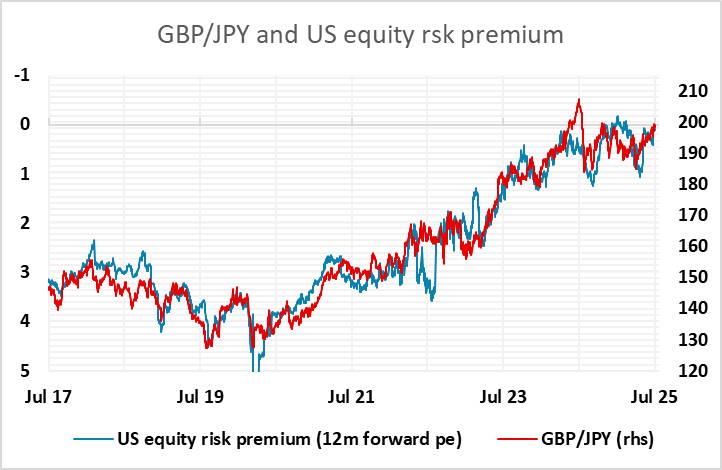

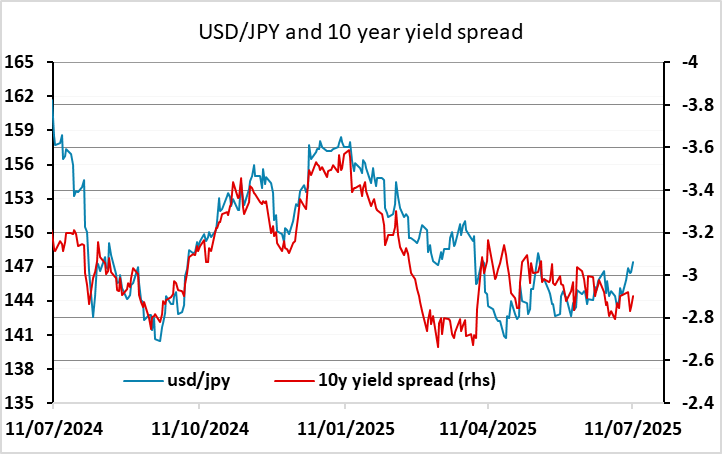

From an FX perspective this might be supportive for the US against the EUR and the riskier currencies which tend to be more focused on front end yields, but might be less positive against the JPY which tends to be driven more by back end yields and risk premia. While the JPY has generally remained under pressure in the last few weeks, we may be reaching the limits of weakness on the crosses, with EUR/JPY having seen seven consecutive weeks of gains. This has been based on improving growth sentiment and declining equity risk premia, but this could be challenged if the market starts to anticipate less Fed easing and real growth weakening due to higher inflation. Of course, if the inflation numbers come out weaker than expected, the riskier currencies are likely to outperform, but we see the risks as being on the upside for inflation and the JPY. The US inflation data will be more important for the JPY than the Japanese inflation data on Friday, which is likely to be broadly in line with the Tokyo data already released.

The UK CPI data will also be of interest as the latest real data out of the UK suggests a need for some easing of policy, with GDP declines in both April and May and employment declining in the latest numbers. The UK labour market data will also be important in this regard, with many on the BoE MPC seeing strong wage growth as a key factor limiting the scope to ease. There has been some evidence of weaker wage growth in the last couple of months, and more weakness in wages and/or prices might be enough to increase market expectations of BoE easing. As it stands, a BoE rate cut in August is priced as an 80% chance, with 50bps expected by year end. But with major tax increases likely to be announced in the autumn Budget, the risks remain towards lower rates, particularly in 2026, so we see GBP as vulnerable on any signs of weakness in wages or prices.

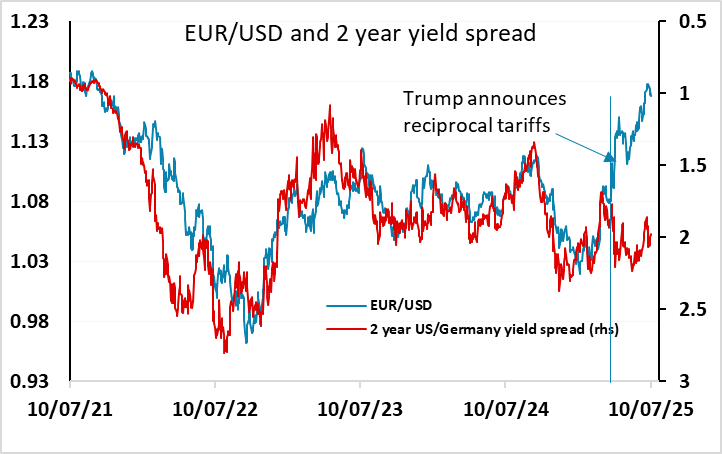

The market is still waiting for more tariff news, with the EU still the main region that has now been covered by recent announcements, and this could prove to be the main market mover this week despite all the CPI data. The USD declined after the reciprocal tariff announcements in April, largely because the market saw them as representing significant risks to US growth, and international investors shifted away from the USD both because of these growth concerns and because of the uncertainty about US policy. The concerns about US growth have faded a little since, but the shift away from the USD towards the EUR has so far broadly held. It is unclear what the reaction would be to, say, an announcement of a 25% tariff on the EU. Based on the reaction earlier in the year, it could be USD negative, but we suspect much of the initial portfolio shift has occurred, and if such a tariff was seen as damaging European growth, we could see some retracement of the EUR/USD gains seen since April.

Data and events for the week ahead

USA

After a quiet Monday it is a busy week for US data, with June CPI on Tuesday likely to be the key release. We expect gains of 0.3% overall and ex food and energy, both the strongest gains since January, as tariffs start to have some impact. The July Empire State manufacturing survey is also due on Tuesday, while Fed’s Collins. Logan and Barkin will speak.

June PPI follows on Wednesday, where we expect a 0.3% rise overall, but a 0.2% ruse ex food and energy. Also on Wednesday we expect a 0.1% rise in June industrial production, with manufacturing unchanged. The Fed’s Beige Book is due on Wednesday, while Fed’s Hammack, Williams and Barkin again will speak.

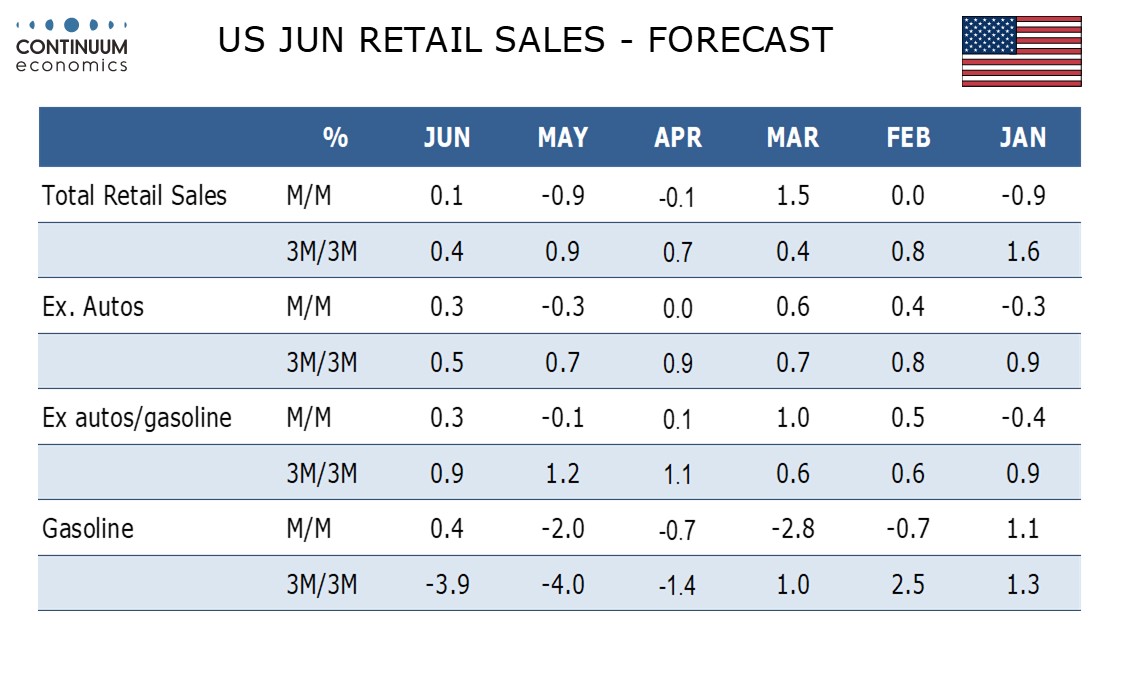

On Thursday we expect June retail sales to rise by a modest 0.1%, with a 0.3% incase ex autos. Weekly initial claims, July’s Philly Fed manufacturing survey and June import prices are due at the same time. July’s NAHB homebuilders’ survey and May business inventories, which existing data suggest will be unchanged, follow. On Friday we expect June housing starts to correct higher by 3.5% to 1300k but a 1,0% fall in permits to 1380k. The preliminary July Michigan CSI follows.

Canada

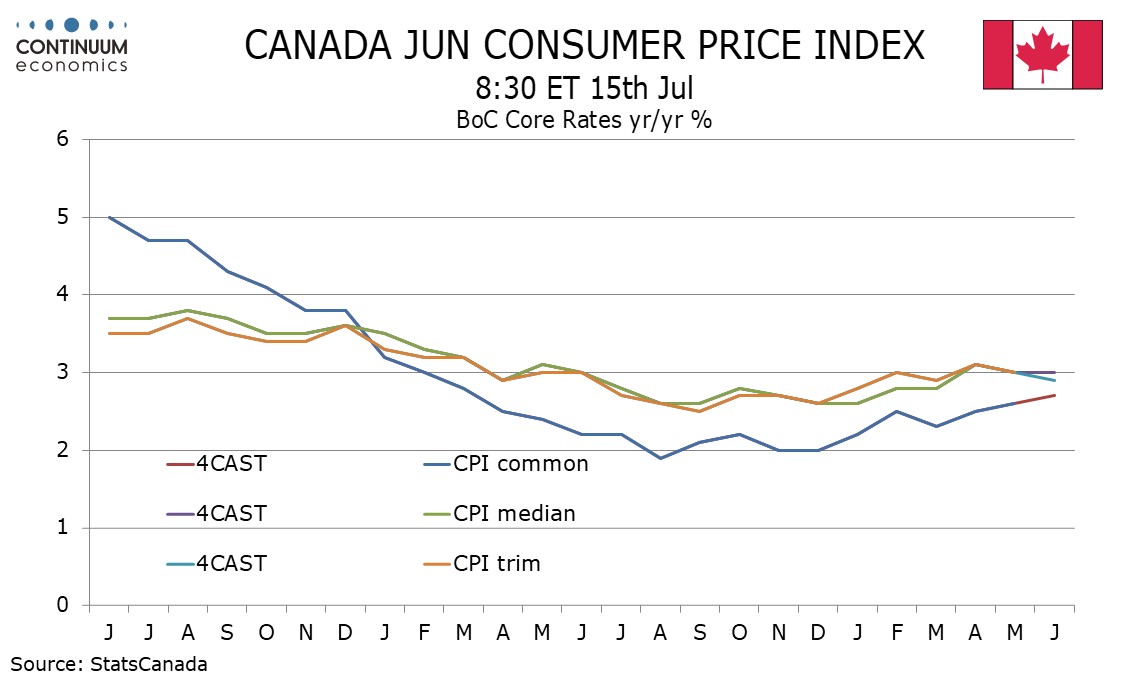

Canada’s key release will be June CPI on Tuesday, where we expect yr/yr growth to pick up to 1.9% from 1.7% with little net change in the BoC’s core rates which remain above the 2.0% target. Also due are May wholesale sales on Monday, where a preliminary estimate was for a 0.4% decline, and May manufacturing shipments on Tuesday, where the preliminary estimate saw a 1.3% fall. June housing starts and existing home sales are also due on Tuesday.

UK

Wednesday sees the next set of CPI data. Calendar effects have been accentuating swings in UK CPI data of late. But we see only a small 0.1 ppt drop in the June headline CPI (to 3.3%) and where a slightly larger fall in services may be offset by still elevated food inflation at over 4.5%, adverse energy base effects and a stable core reading stuck at 3.5%. Thursday sees labor market numbers where apparent wage resilience has perturbed some MPC members. But this data release, now encompassing updates not just from the long-standing ONS but also real time figures from the HMRC (which we suggest are more authoritative data) is likely to see clear drops in the official earnings data of up to 0.3 ppt at least for regular pay. Otherwise, the HMRC numbers are likely to show that employment is continuing to contract and maybe more broadly so, such data possibly taking greater precedence than CPI numbers for most MPC members. Indeed, a keynote speech from BoE Governor Bailey (Tue) may acknowledge this!

June Inflation to Slip Only Slightly

Source: ONS, Continuum Economics, % chg y/y

Eurozone

More ECB updates arrive via an array of Council member speeches. Datawise, after Thursday’s final HICP numbers there is an important update on construction (Fri) preceded by what may be flat industrial production reading (Tue). Otherwise German ZEW data (Tue) may move improve further.

Rest of Western Europe

There are key events in Sweden, including Monday’s final CPI data that help explain the upside surprise seen in the flash numbers.

Japan

Another National CPI will be released on Friday. While it likely shows moderation but around 3% for the headline figure, the inflationary pressure will remain a pressure for the BoJ to hike as transitory inflation factor fades. It will be alarming to see core CPI rises. Industrial production on Monday will be the other relevant data.

Australia

The employment data will be released on Thursday and likely points towards a healthy Australian labor market. The RBA seems confident in the strength of labor market and thus we are unlikely to see a strong negative surprise. We also have consumer inflation expectation on the same day and consumer confidence on Tuesday.

NZ

Only Business index on Monday, unlikely to be market moving.