This week's five highlights

Trump's latest Tariffs

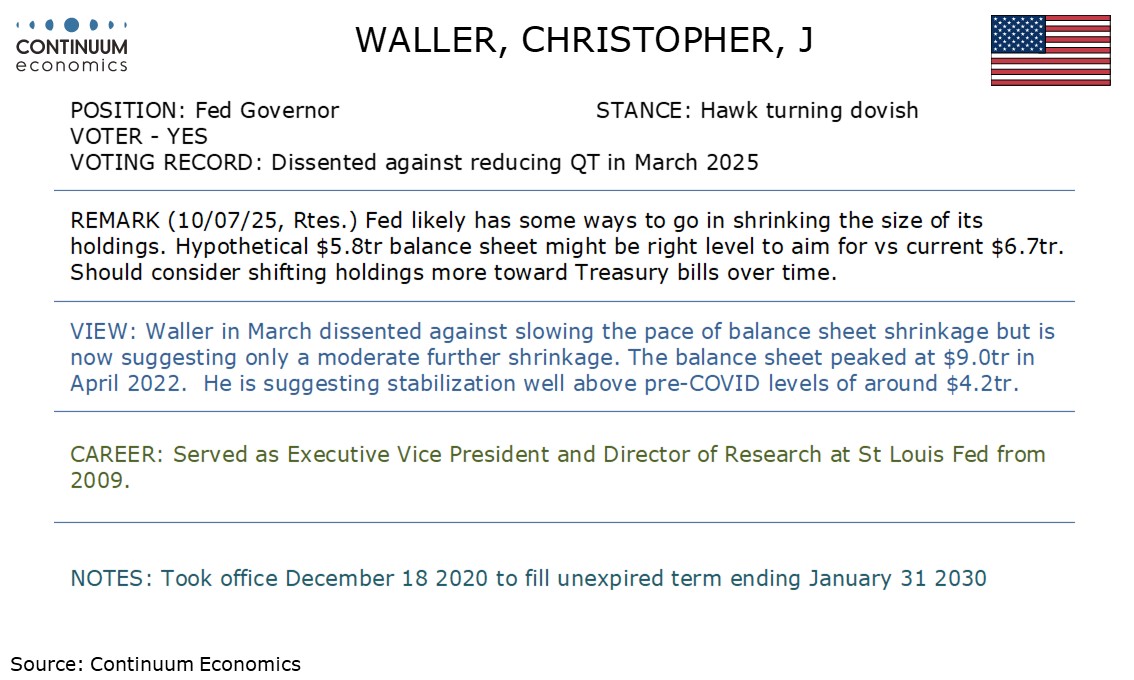

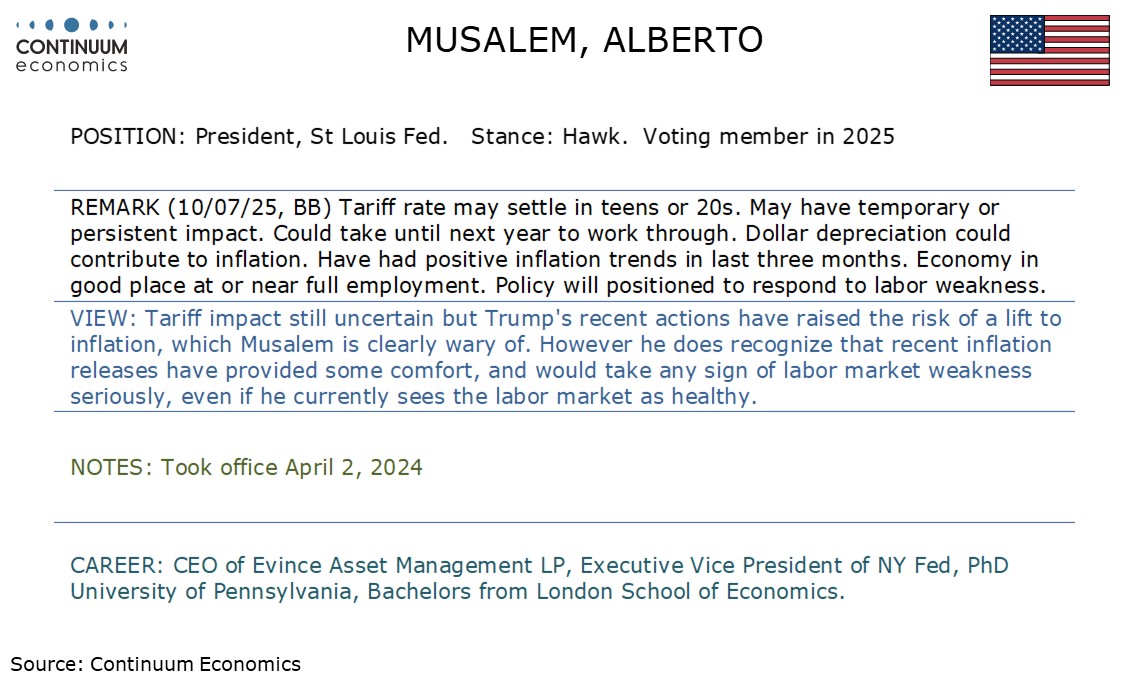

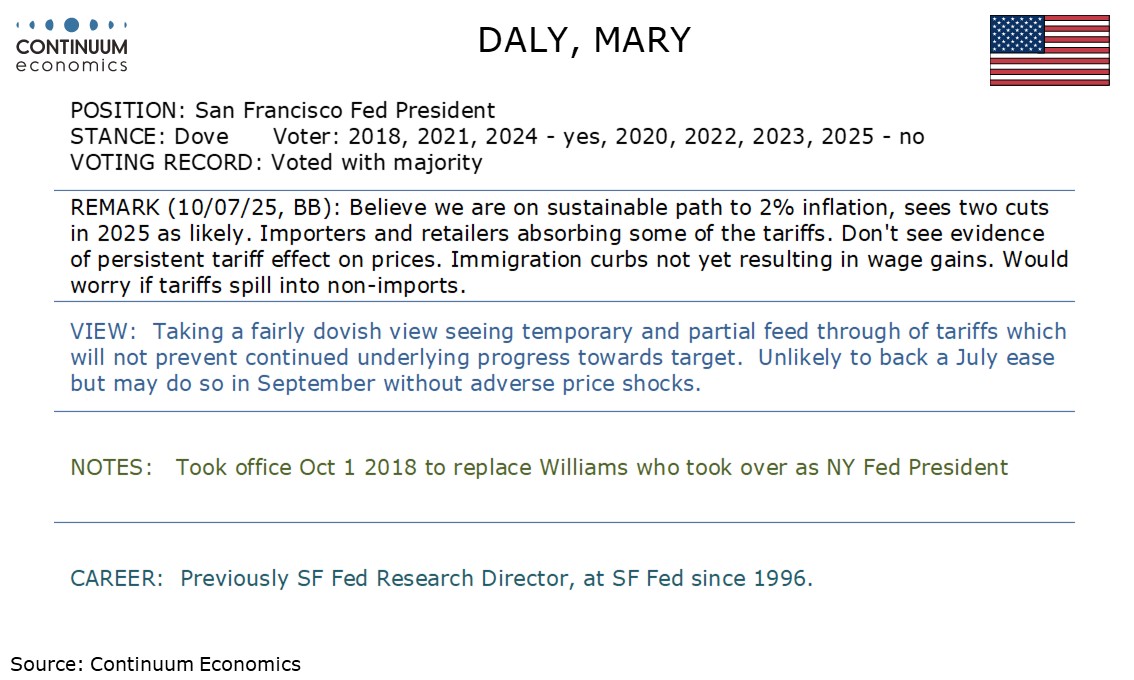

This Week's Fed Speakers

RBA Does not Cut to Market's Surprise

RBNZ Holding on to Their Last Cut

Another Downside Surprise for UK GDP

Trump has announced his latest round of tariffs by sending trading partners letters. The latest ones being 50% for Brazil and 35% for Canada. He also raised the tariff for copper import to 50%. While there is still time to "TACO" after the August 1 start, one can believe the time interval will become shorter and shorter. Another area to be closely watched is Trump floating the idea of baseline tariffs to be increased to 15-20%, including those countries that did not receive any tariff letters. So far, there has not been any retaliation from these countries.

The RBA has held the cash rate at 3.85% in the July 8th meeting as they are cautiously waiting for for another round of quarterly CPI before the next cut. The combination of lagged effect of easing and uncertainty in inflationary dynamics seem to be the trigger for the decision to hold, suggesting no urgency to cut. The forward guidance shows RBA being cautious toward global uncertainty. Yet, "The Board is focused on its mandate to deliver price stability and full employment and will do what it considers necessary to achieve that outcome.", says they remain committed to further cuts.

There has been little changes in inflationary trajectory, thus the surprise only came from market participants misreading previous RBA comment. In governor Bullock's press conference, she openly suggest the market has put too much emphasis on the consideration of 50bps cut in May and that idea was quickly dismissed in the May meeting. She also kicked the can down the road by suggesting a cautious and gradual stance on further easing, which could come as early as after the next quarterly CPI release by end of July.

The global uncertainty has kept RBA from frontloading their cuts to 3.2% terminal. We continue to see two 25bps cut in 2025 before a final cut in Q1 2026. The timing of the two cuts will likely be the August and November meeting, to give RBA sufficient time to assess the impact of easing and Trump's tariff policy. Inflation data remains critical and a trimmed mean CPI below 2.5% for the next quarter will almost seal an imminent cut.

The RBNZ also decide to hold rates unchanged at 3.25%. While both the RBA and RBNZ choose to hold, they are of different grounds as RBNZ is near the end of their easing cycle. Their OCR forecast is only seeing one more 25bps cut. The RBNZ is forecasting inflationary pressure to return and could potentially bring the headline figure closing to the upper band of target range, thus they choose to hold for now. We will have to wait and see fore the next quarterly CPI figure before knowing the timing of the next rate cut but the RBNZ does not seem to be urgent about that.

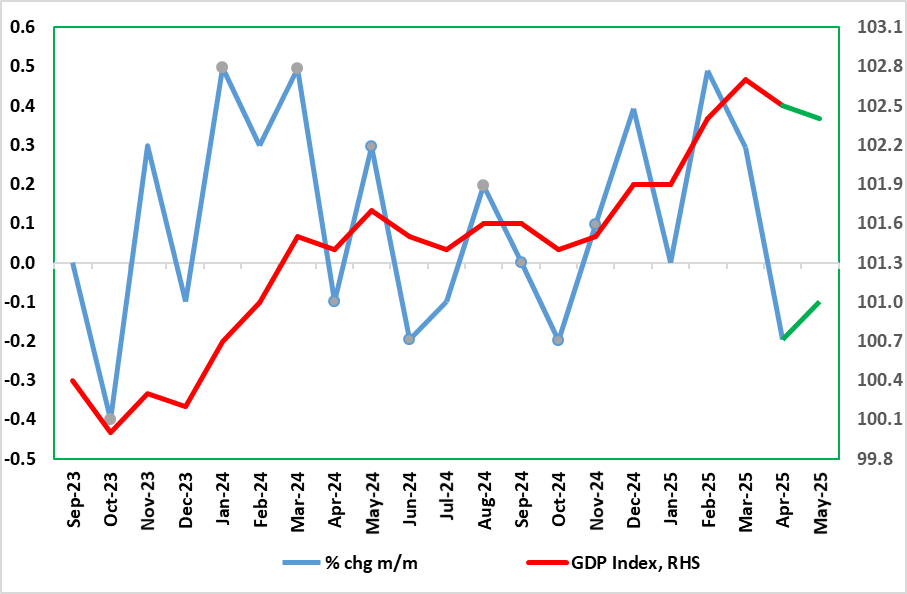

Figure: GDP Falls Again?

After two successive upside surprises, a correction back in monthly GDP was not entirely a wholesale surprise for April GDP. But that 0.3% m/m drop was almost repeated in the May numbers (Figure), where a further albeit smaller (ie 0.1%) fall occurred, but very much below consensus. Admittedly there were some upward revisions to data before April, which have created base effects that may (now) prevent Q2 seeing a q/q fall. Regardless, especially given private sector softness, the latest GDP outcomes thereby add to a gloomier economic backdrop most recently highlighted by growing signs of labor market weakness. As a result, we think that Q2 GDP will be flat in q/q terms and may be as weak in Q3, the former undershooting BoE thinking of a rise of around 0.25%. The weakness we envisage chimes with business surveys, payrolls and tax outcomes. If this pattern persists (let alone if it is even worse, then the BoE’s relative complacency regarding the economy is likely to shift and possibly rapidly.

Indeed, it seems even more to be the case that Q1 numbers may have been boosted by added production destined for the U.S in anticipation of tariffs, this evident in an industry reported slump in car production for the month of some 25% m/m (ie enough to knock GDP by 0.2 ppt itself. In addition, real estate activity seems to have dropped after the raising of effective stamp duty. Moreover, we already know that retail sales dropped clearly in May, this alone also potentially knocking m/m GDP down by over 0.2 ppt. Against this backdrop, the May GDP numbers could have been much worse and would have been had it not been for some fresh rises in public services, without which the May drop would have been twice as large and where recent GDP rises would have been minimal!