Bank of Canada Preview for December 11: Another 50bps easing with tariffs threatened

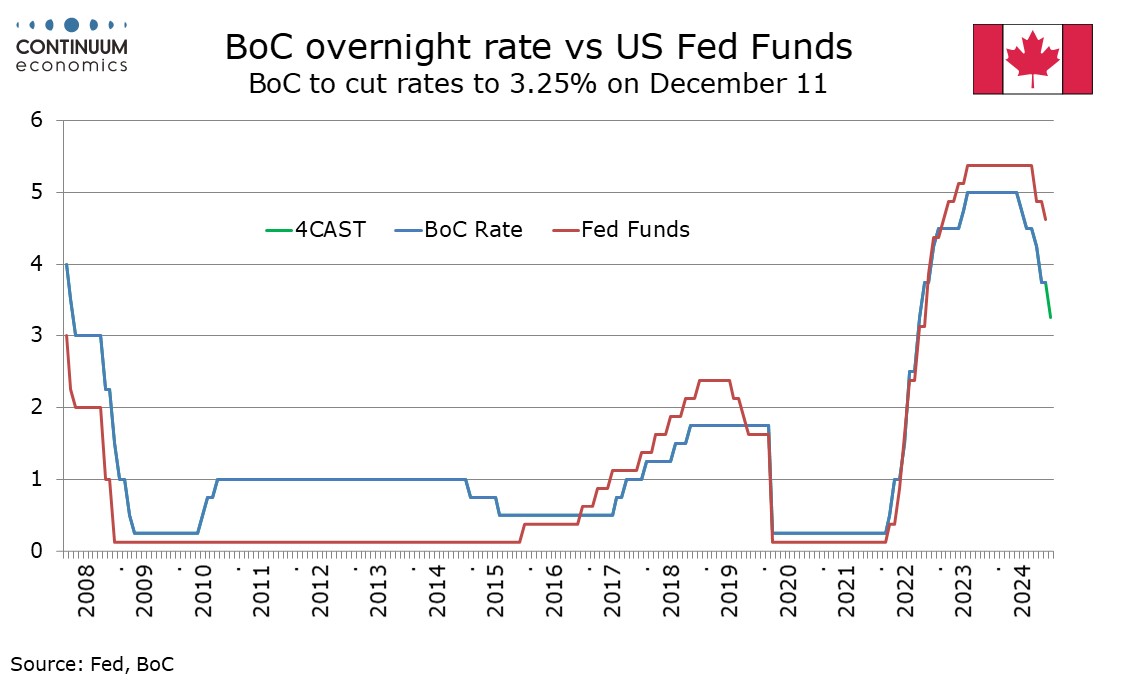

The Bank of Canada meets on December 11, and we expect a second straight 50bps easing, to 3.25%. While October’s inflation data was a mild disappointment the underlying picture looks subdued. While there are some signs the economy is starting to respond to lower rates, with Q3 GDP having disappointed and tariff threats meaning significant risks in 2025 the BoC is likely to sustain an aggressive pace of easing.

This meeting will not see a quarterly Monetary Policy Report, meaning that the BoC will not be updating its economic forecasts. The BoC is probably glad it does not have to do so at this meeting given the extra uncertainty generated by Trump’s threat to impose a 25% tariff on Canadian imports on day one of his term (January 20). Whether Trump follows through with this threat will be clearer by the time of the next BoC meeting on January 29, when the next MPR is due. The weakness of the CAD increases inflationary risks, but should the tariffs be implemented Canada would likely face a recession in 2025. Trump’s threat on balance strengthens the case for a dovish BoC.

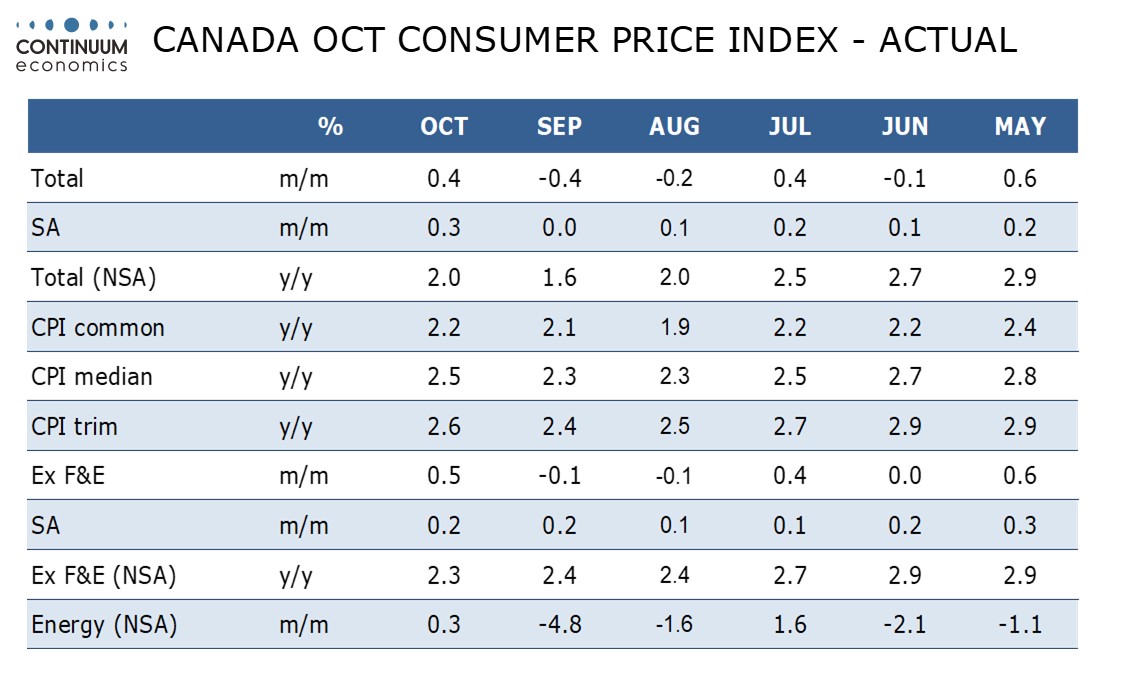

October’s Canadian CPI disappointed with a rise to 2.0% from 1.6% but remains below a 2.1% BoC projection for Q4 made in October, while the BoC’s three core rates all picked up too, to an average of 2.43% from 2.27% in September. However, the seasonally adjusted ex food and energy rate, while not one of the BoC’s core rates, shows a subdued underlying picture, with a second straight gain of 0.2% on the month, following two straight gains of 0.1%. This looks consistent with inflation heading back to the 2% target, and will allow the BoC to focus on the growth picture.

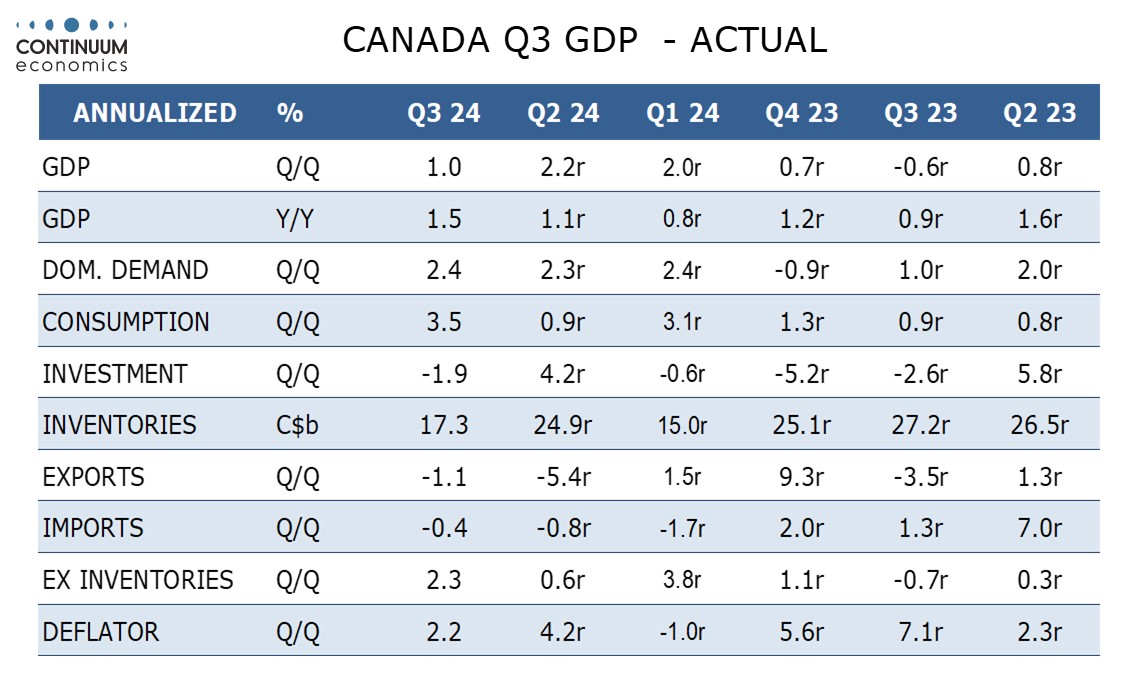

Q3 GDP with a 1.0% annualized gain fell short of a 1.5% October BoC projection. With September below expectations at only 0.1% month/month, and preliminary estimates for October being for a similar gain, there does not appear to be much momentum entering Q4. The Q3 details were a little stronger than the headline, with domestic demand up by over 2.0% for a third straight quarter, led by a revival in consumer spending, but the economy will still be seen as operating with excesss supply and with significant downside risks going forward.

Going forward, a lot will depend on the decisions of incoming US President Donald Trump. We suspect there is a higher probability that he does not follow through with his threats, at least towards Canada, but given the state of the Canadian economy we would still expect the BoC to continue to lower rates to 2.5% by mid-2025, in the low end of the 2.25-3.25% range the BoC sees as neutral. Should tariffs be implemented, the BoC would probably move rates lower still, particularly if Canada does not respond with matching tariffs of its own, which would lift prices in Canada.