EZ HICP Review: Disinflation Resumes Amid Services Resilience?

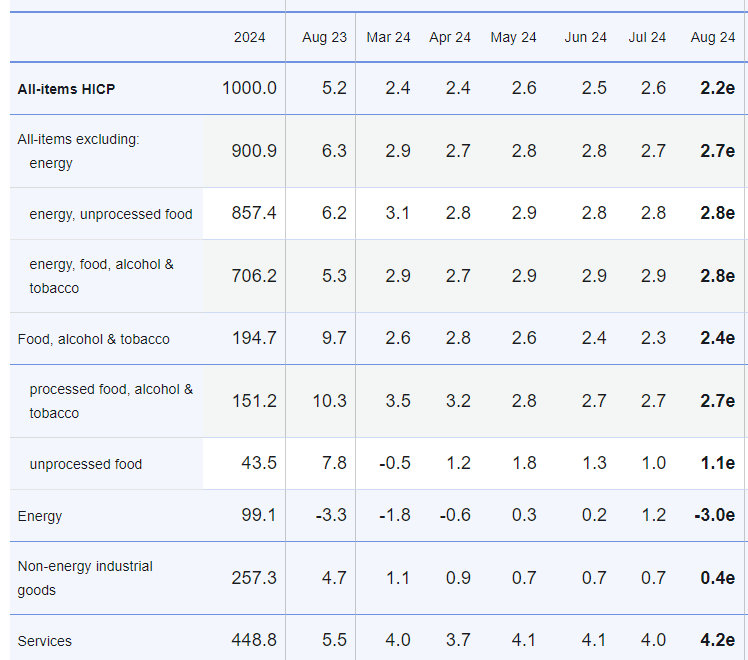

Prior to these latest HICP numbers, it could be argued that the EZ disinflation process has stalled given that no further drop beyond that to 2.4% in April had occurred. Indeed, somewhat unexpectedly, headline HICP inflation rose a notch to 2.6% in July, reversing the slide seen in June. This is even the case regarding the core rate which stayed at 2.9%, thereby still 0.2 ppt above the April low, with services inflation still showing apparent resilience after slipping a mere notch to 4.0%. But we see abundant signs of the disinflation process in survey data and with the ECB’s own measures of persistent inflation pointing very much to already below-target inflation. These considerations are all the more important as the ECB hierarchy have made clear policy will be shaped by an array of data rather than particular data points! Thus it will be important that the August HICP flash saw the headline rate resume its fall with a drop to 2.2% ahead of what may be a rate back at target in September, this paving the way for what we expect will be a further rate cut next month.

Figure 1: Headline and Core Fall Afresh?

Source: Eurostat, % chg y/y

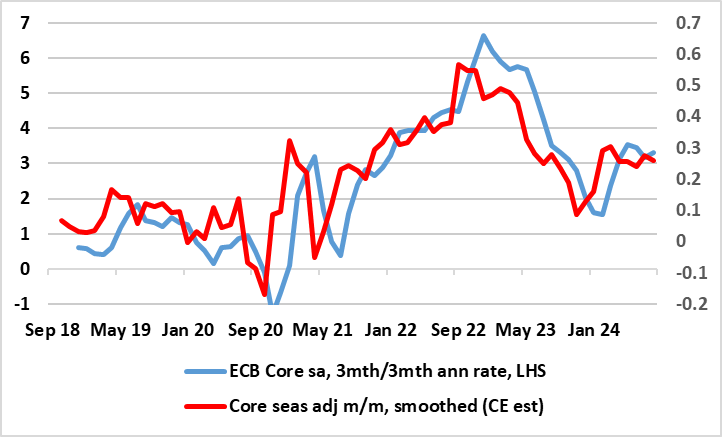

Indeed, we see the headline rate dropping to the 2% target next month, a full year earlier than ECB projections suggest, albeit where this near-term outlook is actually chiming with the ECB's projection of an average rate if 2.3% for the current quarter. Regardless, perhaps the last mile for inflation is not the hardest after all. Indeed, for middle distance runners and most other experienced athletes the last mile is often the quickest, involving a sprint! Admittedly, the drop was very much energy biased, with services actually ticking higher to a 10 month high of 4.2%, this partly explaining what seems to be somewhat resilient core inflation measures, most notably on a more short-term basis (Figure 2).

Figure 2: Core Inflation Resilience Continues?

Source: Eurostat, European Commission

This rate though is still well below that seen in many other DM environments and in August was probably boosted by the impact that the Olympics had in France, implying some softening back down hereafter. Even so, while headline inflation may slip to 2% next month, it may perk back towards 2.5% by end-year due to energy base effects. The ECB will have to take note although the hawks on the Council will point to still apparently resilient services inflation, but where the doves may counter by pointing to recent much softer wage inflation news which suggest that services inflation will soon buckle.

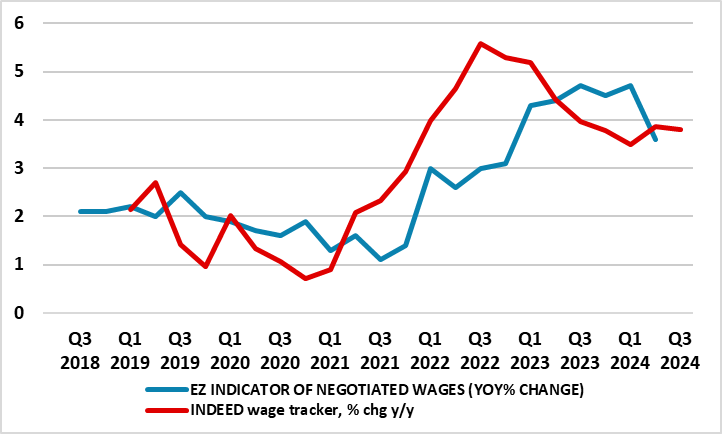

Figure 3: Wage Pressures Easing?

Source: Eurostat, ECB,

Wages Pressures in Context

Indeed, amid those worries about price resilience, more signs of softer wage pressures will act as some foil – Indeed-compiled wage tracker data is well below 4% as is the rate for negotiated wages, the latter the lowest in over two years and these are numbers recently cited by Chief Economist Lane as suggesting they ‘signal that wage dynamics will remain elevated in 2024 but will decelerate in 2025’. Even so, inflation uncertainty continues and remains concentrated enough around wages that explains the ECB Council being unwilling to offer firm(er) policy guidance for H2, let alone into next year. It is notable that this explicit data dependency has attracted surprising and open criticism, not least from ex World Bank Chief Economist Robert Zoellick who suggested that being data dependent means effectively that central bankers don’t know what to do!