FX Daily Strategy: N America, July 25th

Focus on US Q2 GDP

Growth to stay sub-trend, but limited impact seen

European surveys may weigh on EUR

Focus on US Q2 GDP

Growth to stay sub-trend, but limited impact seen

European surveys may weigh on EUR

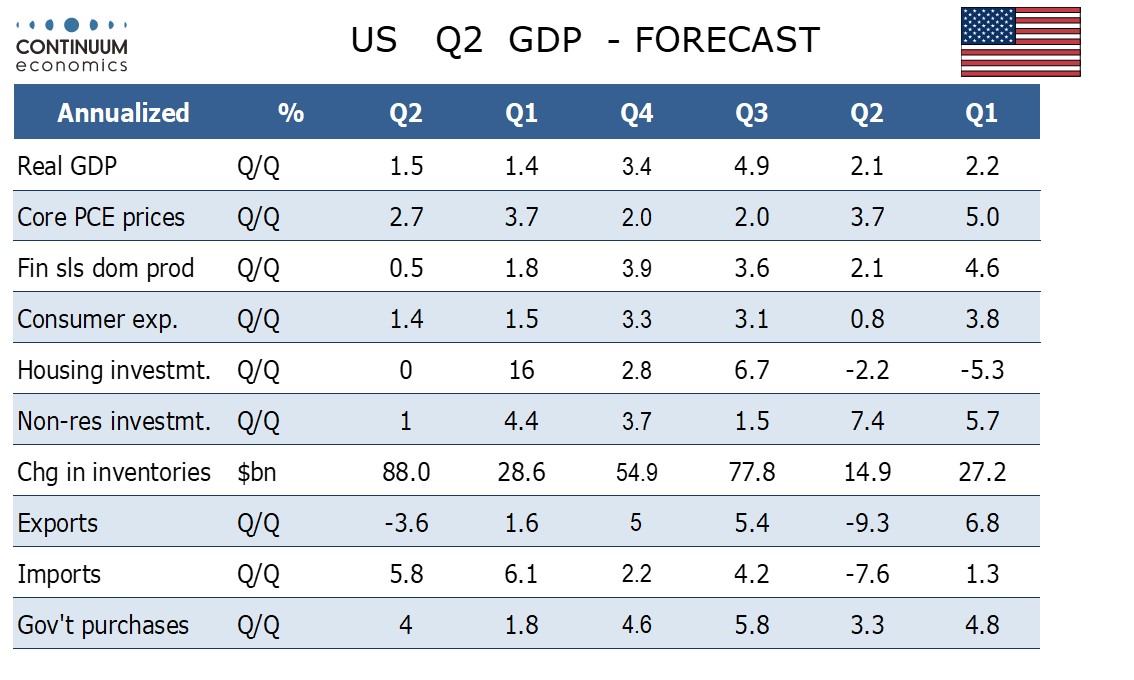

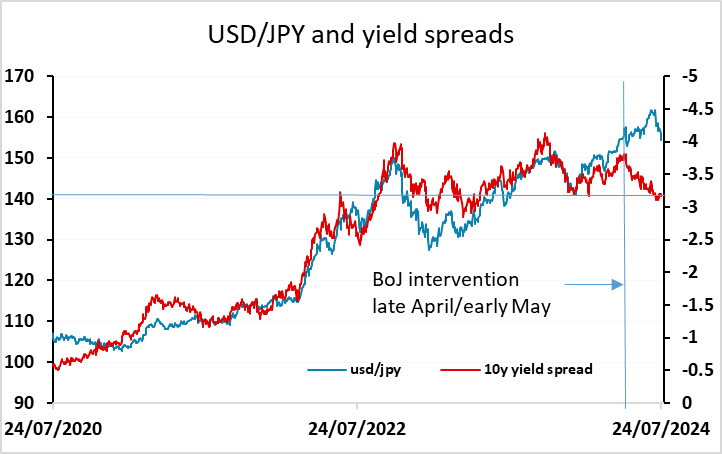

US Q2 GDP will be the main focus on Thursday. Our forecast is slightly below market consensus at 1.8% q/q annualised (consensus 2.0%), but in line with the consensus for the core PCE deflator at 2.7% annualised. The first two quarters of 2024 are set to be the weakest since the first two quarters of 2022 recorded modest declines. Q1’s weaker growth was downplayed due to the slowdown coming mostly from inventories and net exports, with final sales to domestic buyers (GDP less inventories and net exports) rising by a respectable 2.4%. In Q2 we expect a modest slowing in final sales to domestic buyers, to 2.0%. All in all, our forecast is similar enough to consensus to suggest there won’t be much of a USD reaction. The softer USD tone on Wednesday against the European currencies looks a little overdone given the relative strength of the US S&P PMIs, so there may be scope for a USD recovery in those pairs. There is less reason to expect a USD recovery against the JPY with yield spreads still pointing substantially lower and USD/JPY valuation still extremely high.

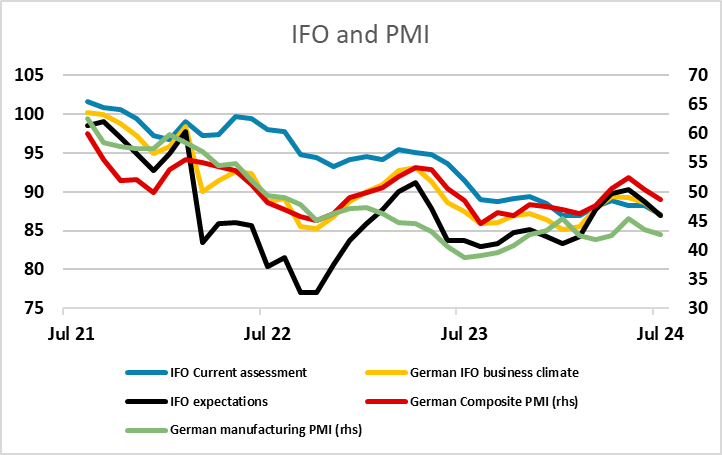

The French INSEE survey and the German IFO survey were both disappointing, with the INSEE survey particularly weak showing the weakest reading since 2013. This may relate to the recent political turmoil and the concerns about the fiscal position, but don’t really chime with the PMI data. The Eurozone money data, on the other hand, was on the strong side of expectations, with the 2.2% rise in M3 the largest since April 2023. However, loans to households remained weak at 0.3% y/y, so the European data retains a soft tone in general.

Nevertheless, EUR/USD is holding up reasonably well in a generally risk negative market, standing little changed from opening levels, despite some fairly sharp declines in equities and yields. EUR/JPY remains under some pressure, as does EUR/CHF, but we don’t see a great deal more CHF upside here. The JPY continues to represent much the best value of the safe haven.