USD, EUR,JPY, CAD, NOK flows: USD firm, CAD vulnerable, EUR money data in focus

The USD is still mostly yield spread driven, but the CAD looks overcooked. Eurozone money data may pressure the EUR.

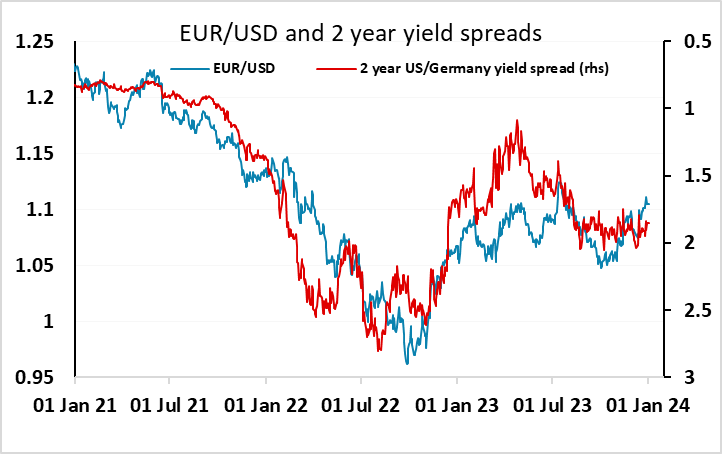

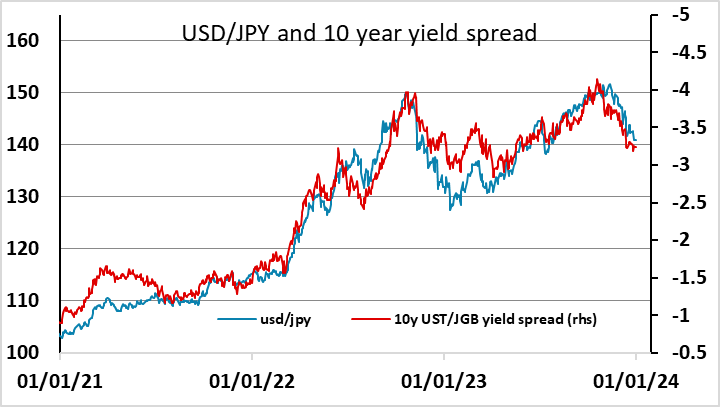

The USD is starting the year slightly firm, but is still essentially following the playbook from last year and moving in line with yield spreads against the EUR and JPY. EUR/USD continues to be most closely correlated with 2 year spreads, while USD/JPY is moving more consistently with 10 year spreads. Rising US yields this morning across the curve provide general USD support.

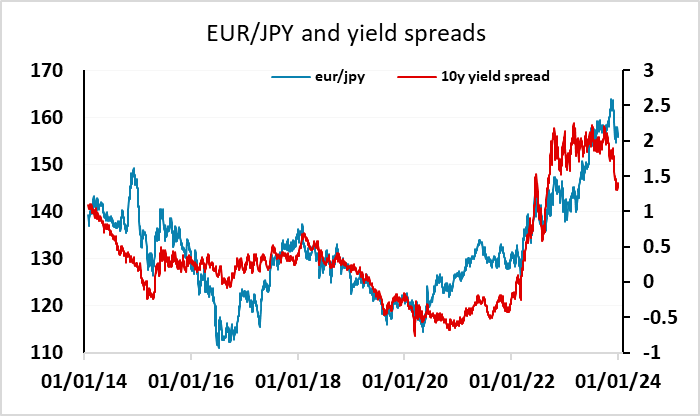

The experience from last year is that rising yields tend to be more favourable for USD/JPY than the USD against European currencies, but this may change this year with there likely being more upside potential for Japanese yields than European yields. Also, while USD/JPY is moving in line with yields spreads, there is still a strong yield based case for a lower EUR/JPY.

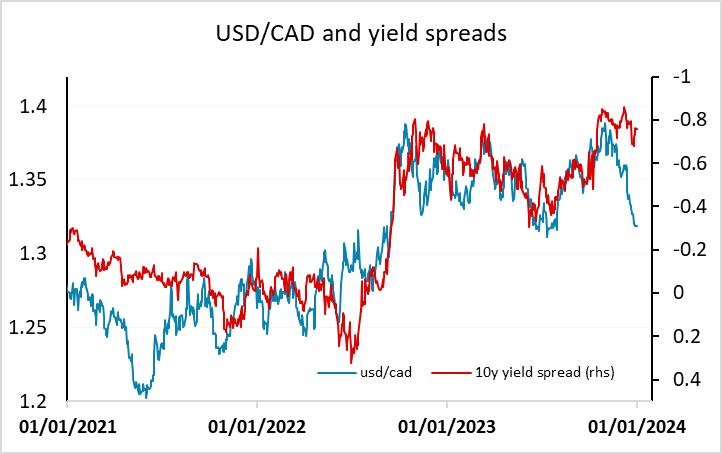

While the USD is still in line with yield spreads against the EUR and JPY, USD/CAD has clearly dipped away from the recent spread relationship in the last month. This has come in spite of quite a soft oil price over the period, and we would be a little wary of the prospects for further CAD gains as a result. The NOK, by contrast, looks somewhat cheap relative to the SEK based on the usual NOK/SEK yield spread correlation.

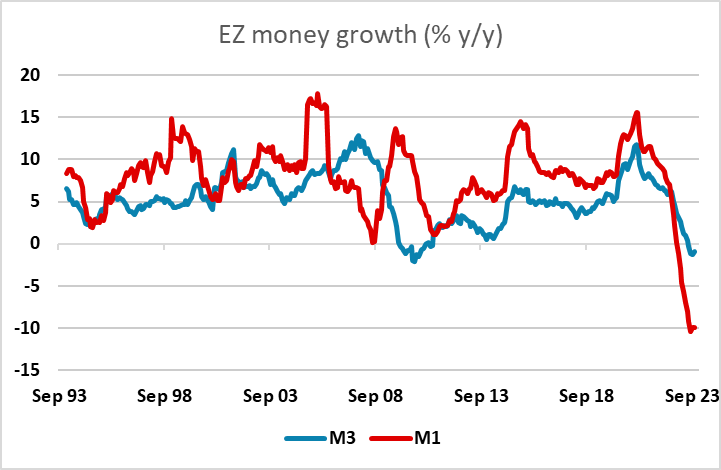

For today, the Eurozone money data may be the prime focus, with little else of significance on the calendar. We expect this to provide a reminder that the monetary tightening from the ECB has had a huge impact on money growth, and that the real effects of this are yet to be felt. This may mean the EUR suffers some downside pressure both against the USD and on the crosses.